From Hold to Buy

Elbit Systems Ltd. (NASDAQ:ESLT) will be reporting Q3 ’23 earnings on November 28, 2023. We believe the company will outperform expectations. We are upgrading our Hold assessment of the stock shared in our January ’23 article for Seeking Alpha to a Buy opportunity.

In January, we anticipated weak revenue and earnings for FY ’23. The share price had tumbled to ~$162, though we pointed to positive signs that “the stock will likely recover over the long term, but there are risks, and patience will be rewarded.” The stock climbed to $225.22 mid-year then pulled back to about $197 at too close of September. In October, all broke loose when 3,000 Hamas terrorists unleashed a firestorm kidnapping and killing Israeli civilians. Elbit shares shot up to +$211 but faded over the next few weeks; investors became skittish about a widening war and production interruptions. Shares slipped to ~$190.

Opportunity Knocking

Seeking Alpha posted on October 9 that “War between Israel and Hamas pushes U.S.-traded Israeli stocks lower.” It has been our position since the invasion that investing in Israel-based companies trading on an American stock exchange will best assist our American ally’s economy and job security for 300K reservists called up for duty. Meanwhile, investors can take advantage of dips in the share prices of solid publicly traded businesses. These are companies we wrote about and see as worthwhile investment opportunities:

Oct 1 ’23 Oct 31 ’23 Nov 10 ’23 YTD

Global-e Online Ltd. $39 $34 $37. +78%

NICE Ltd $170 $152 $170. -11%

Mobileye Global $41 $36 $36 +12%

Check Point $133 $136 $137 +7%

G Willi Food Intl $10 $8 $9 -31%

Elbit Systems $202 $189 $190 +13%

Teva Pharma Ltd $10 $9 $9 -4%

Radcom Ltd $8 $8 $8 -21%

Healthy Industry, High Earnings Potential

Elbit Systems designs and manufactures military aircraft, drones, helicopters, and land vehicles for military and commercial sales. The company is a leader in electro-optic, night vision, and air, land, and sea countermeasure systems for command control, communications, computer, and intelligence missions involving electronic warfare and signal intelligence.

Elbit Product Segments (Elbit Systems Ltd)

Charity is pouring into Israel in the way of money and essential goods worldwide. There has been a “massive surge” in the sale and purchase of Israel Bonds, a mainstay of investment in the vibrant and resilient economy of the start-up nation. Military assistance to Israel exceeds all expectations from the U.S. and U.K.

The assistance complements the “excellent health” of the Israeli $12.5B defense industry. The industry had about a 20% increase in revenue in 2022, while Elbit reported FY ’22 revenue of $5.511B, an increase from $5.278B in FY ’21. Elbit’s market cap is $8.57B putting it in the top 100 Israel-based companies traded on an American exchange. Its Q2 ’23 revenue was reported in August +12% over Q2 ’22 “with growth across all business segments.”

32% of company revenue is generated from sales to European nations, 23% in North America, 22% are from Asia Pacific nations, and 17% of revenue is from sales to Israel. Ending in June ’23, the gross profit totaled $372.2M compared to $339.7M in June ’22.

When the economy was humming before the war, Elbit had been negotiating contracts that were announced in just the last 2 months: $170M to the Swedish Army, $115M to a NATO country, another $95M munitions contract, and on October 29 the CEO announced Elbit “was awarded a $135M contract to establish an artillery ammunition factory.”

Production interruptions are nothing new for Elbit whether from wars causing labor shortages, supply chain issues, or anti-Israel activists picketing and storming Elbit facilities. The company seems to cope well. In addition to Elbit operating in a healthy defense industry, we see positivity in the forecast earnings. NASDAQ maintains that Elbit

has a “high” Earnings Quality Ranking (‘EQR’) for the 13th consecutive week. Earnings quality refers to the extent to which current earnings predict future earnings. “High-quality” earnings are expected to persist, while “low-quality” earnings do not. EQR is a weekly ranking of relative earnings quality for a large universe of publicly traded US equities. Companies are compared to peers in their industry.

Their yearly earnings forecast is $6.69 per share ending FY ’23, $7.75 ending FY ’24, and $8.75 per share ending FY ’25. EPS in FY ’23 is expected to be $1.71 in Q3 and $1.93 in Q4. There is a low yield (~1%) dividend paid and few analysts cover the stock.

Risks

The risks we foresee to investors in Elbit Systems stem from conditions not related to the war, per se. Elbit filed a two-year effective shelf prospectus in September with the Israel Securities Authority to raise funds through stock offerings and sales of debt and equity securities in Israel. This has the potential to dilute shareholders but the money is most likely to be used to fulfill a slew of contracts.

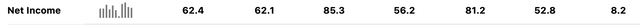

Net income ups and downs might make some investors uneasy by making comparisons quarter-to-quarter; they reflect inconsistencies for defense contractors from both the obstacles of countries planning-to-placing orders and paying for them. Elbit is no different per the quarterly net income reported chart that runs from December ’21 ($8.2M) through June ’23 ($62.4M).

June ’23 Dec ’21

Net Quarterly Income (Seeking Alpha)

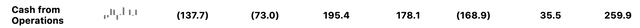

Likewise, cash from operations at Elbit can be inconsistent:

Cash from Operations (Seeking Alpha)

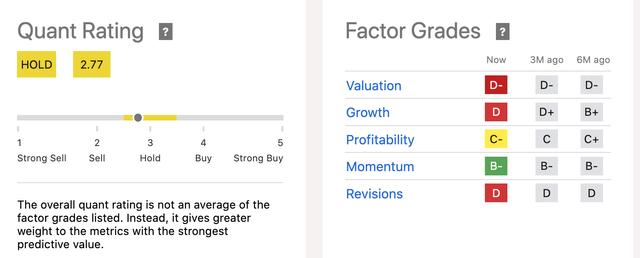

The risk from Elbit’s last reported net debt is not worrisome; it was ~2xs EBITDA. But interest payments can be a stretch going forward with higher rates holding longer and the war raging. The risk is compounded by the company’s cash outflow. Elbit’s debt increased in part because the company bought 3 businesses in the last 5 years in the aerospace and defense industries. Increasing dilution or adding more debt per the shelf prospectus raises cause for concern investors need to consider, especially highlighted by S A’s faltering Factor Grades and Quant Rating:

Quant Rating & Factor Grades (Seeking Alpha)

Valuation and growth grades are set low. Short interest is negligible. The PE is at a high 32.7 and with the price-to-cash flow getting an F grade. Price-to-sales and to-book with C grades are not enough to lift the overall low valuation scores.

Another risk stems from the actions of hedge funds. They have been selling throughout the last 2 years when the share price rose above $175. Funds decreased their holdings by 16.6K shares during the last quarter.

Takeaway

While funds have decreased their Elbit holdings on share price highs, Elbit shares are up higher YTD, even more than the 9% of the SPDR S&P Aerospace & Defense ETF (XAR). Despite the debt load, the company’s cash and market cap levels suggest to us there is little chance for financial distress. Moreover, Elbit Systems is an essential defense contractor for Israel, so what is vital for Israel could be good for investors.

The most vigorous incentive for investors is momentum. Not long ago, the share price topped $225 under the same conditions; with anticipated earnings expected to grow, in our opinion, the shares can move back up into that price range over the next 2 quarters representing what can be an 11% increase. A conservative assessment suggests retail value investors ought to consider Elbit worth at least a Hold but considering its position in defense and Israel’s reliance on native defense contractors like Elbit, we believe a Buy assessment is worth the risk.

Read the full article here