A lot of small-cap companies have faced recessionary pressures over the last year, and now the related stocks are falling again due to fears of an actual recession in 2024. iHeartMedia (NASDAQ:IHRT) falls into this category of stocks crushed due to the weak advertising market in the last year, yet the stock is now getting crushed again despite knowledge the business will see the 2024 Presidential election windfall next year. My investment thesis remains Ultra Bullish on the media stock, though risks exist due to the high debt level.

Better Than Feared

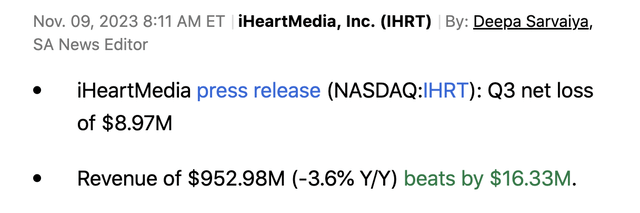

iHeartMedia just reported another solid quarter for Q3’23, though revenues fell YoY as follows:

Seeking Alpha

The company guided to Q3 revenues of ~$940 million, based on a decline of mid-single digits. Arguably, iHeartMedia revenues did fall mid-single digits rounding up to a 4% dip while analysts were actually expecting revenues to dip to $937 million.

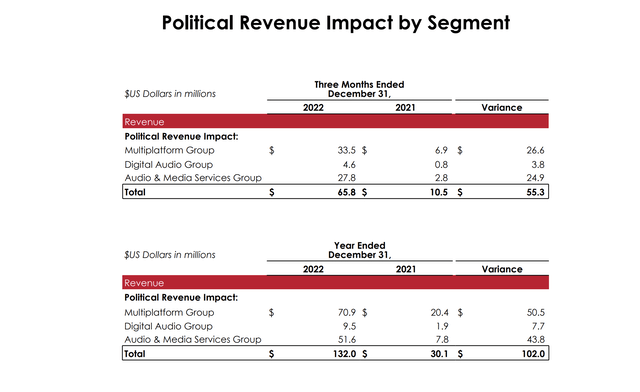

Revenues were only down fractionally when stripping out the $26 net million benefit from back in Q3’22 due to political advertising. iHeartMedia saw a $102 million benefit boost back during the 2022 mid-term elections, with $55 million during the December quarter.

iHeartMedia Q4’22 presentation

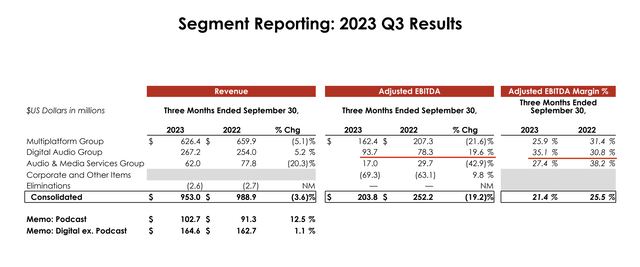

The media company continues to see the Digital Audio group grow revenues in a tough environment. The segment is now generating 35.1% adjusted EBITDA margins, up from 30.8% last year, producing $94 million in EBITDA last quarter.

iHeartMedia Q3’23 presentation

Unfortunately, iHeartMedia only generates $267 million in quarterly revenues from the Digital Audio group, growing EBITDA nearly 20% YoY. The struggling Multiplatform group saw revenues fall 5.1% weighing on the overall results, though this segment was hit the hardest by comparable political ad spending.

An economic rebound in 2024 and the political revenues from the Presidential election provide iHeartMedia with the potential to return back to previous goals for record adjusted EBITDA topping $1.1 billion, leading to annual free cash flow in the $250+ million range.

The game changer is when management is able to dramatically cut net debt via paying down high interest-bearing debt. Unfortunately, though, the stock dipped following earnings due to the company not being aggressive on Q4 guidance on the Q3’23 earnings call as follows:

As we talked about on previous calls, we expected Q4 to be the strongest quarter of the year for the Company, although it is still on track for that, it will be weaker than we originally anticipated due to some dampening of advertising demand, which coincided with the uncertainty caused by the recent geopolitical events.

Having said that, in some years, we do see significant last minute advertising spend come in late November and December indeed it has in the last two years. However, since we can’t predict it’s not included in our guidance.

In essence, the stock is down due to management being unwilling to predict the unpredictable, though the last-minute advertising flush appears an annual event now.

Fear Benefits

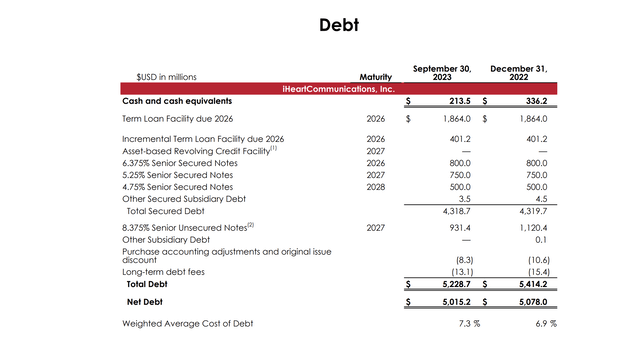

The market is so fearful iHeartMedia is going to run into financial trouble that the company keeps purchasing debt below par value. The company bought $89 million in principal balance of 8.375% Senior Unsecured Notes (at a discount to par) for $65 million in cash, saving the business ~$7 million in annual interest expenses.

iHeartMedia has now bought $519 million worth of debt at par at a discount of $82 million. The company is now saving $43 million in annualized interest savings.

The company has mostly used available cash to repay debt, with the net debt only down $63 million YTD. iHeartMedia produced $68 million in free cash flow in Q3 and should add more in Q4.

iHeartMedia Q3’23 presentation

Interest expenses are actually up nearly $12 million YoY to $100 million in Q3. iHeartMedia faces higher costs due to the average weighted cost of debt rising 400 basis points YTD to 7.3%, even with total debt down $185 million.

The stock is interesting due to the high leverage offset by solid adjusted EBITDA and free cash flows. iHeartMedia has a limited market cap below $300 million currently due to debt fears and the weak ad market.

The upside opportunity only requires a 2024 EV/S multiple jumping to 2.5x in order to reward shareholders with a stock price closer to the mid-2021 highs near $30. As highlighted in the previous research, the Base case has iHeartMedia rallying above $6 and the Bullish case includes a rally to nearly $40. Neither case factors in debt repayment that would further boost the stock price from a reduced EV.

Takeaway

The key investor takeaway is that iHeartMedia has now been beaten down to a pulp. The stock trades at only $2 due to debt fears on panic over a potential recession, though the advertising market has already been through a recession.

Investors should only load up on iHeartMedia here knowing the risk of capital loss, though the prospects for a strong 2024 due to the Presidential cycle are currently being ignored.

Read the full article here