In a macro-focused article earlier this year, I noted that Walmart (NYSE:WMT) was one retailer that stood to gain the most in an era of inflation-induced consumer trade down. Shares in WMT have since gained just under 13%, almost double the gain in the broader S&P (SPY) over the same period.

The momentum has carried WMT to new all-time highs due in large part to the value proposition of its products. The company has gained market share over its competitors and has steadily built up its eCommerce business. Most recently released results are a continued reflection of the strength of their operating model.

Though WMT’s Q3 results were positive, markets still sent shares lower by about 7% in the pre-market hours immediately following the release. One factor behind this may have been the lower guide for full-year EPS. While WMT did raise their earnings guidance, it fell short of the consensus mark. In addition, shares could have very well been priced to perfection yesterday at their all-time highs.

A holiday season with lower prices, fueled in part by the overall disinflationary trend, particularly in fuel costs, and the consumer’s continued desire for value bode well for WMT. But at this juncture in the cycle, I see it fit to remain on “hold” on any new or further positioning in the stock.

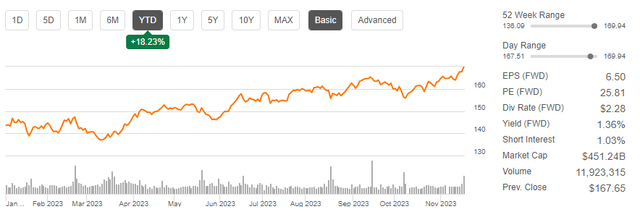

WMT Key Stock Metrics

Shares in WMT recently traded up to new all-time high prices. This follows YTD performance of 18%, which handily surpasses the S&P’s (SPY) approximately 12% gain over the same period. WMT’s performance also significantly outflanks its Dow (DJIA) counterparts, which collectively are up just over 5.5% YTD.

Seeking Alpha – YTD Performance Of WMT

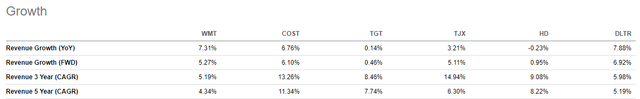

One aspect of WMT’s stellar run thus far is their sales track record in the more challenging operating environment. Retail peers such as Home Depot (HD) and Target (TGT) both reported Q3 results this week that showed declining YOY comparable sales. HD, for example, reported a YOY decline of 3.1%, while TGT reported a 4.9% decline. The TJX Companies is one exception, but WMT is still reported generally stronger growth rates.

Seeking Alpha – Growth Metrics Of WMT Compared To Peers

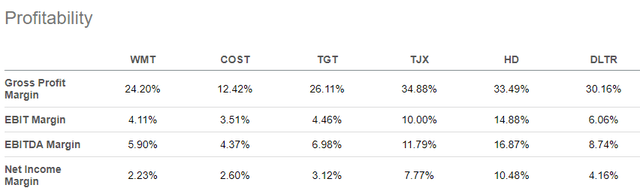

Granted, investors weren’t overly concerned with the declining sales at both HD and TGT, as evidenced by the bid-up in the respective share prices immediately following the releases. It was an improved profit outlook for TGT that particularly grabbed investors’ attention. This is one area in which WMT trails. But this is due in part to their sales mix.

Seeking Alpha – Profitability Metrics Of WMT Compared To Peers

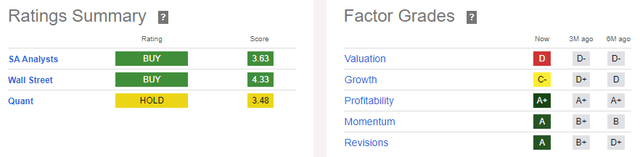

The combination of the higher trading multiple and weaker growth prospects, as measured by Seeking Alpha’s (“SA”) quant rating system, is the primary factor shares have been rated as a “hold.” The analyst community and Wall Street, on the other hand, feel more bullish, with Wall Street seeing approximately 6% more upside in WMT.

Seeking Alpha – Rating Summary Of WMT

What Did WMT Expect Heading Into Earnings?

In Q2, WMT reported comparable sales growth of 6.4%. Though this represented a slower pace of growth than in the same period last year, it was comfortably above expectations for 4.1% growth. Driving the increase were grocery sales, as well as sales of their health and wellness products, due in part to tailwinds from the popularity of GLP-1 drugs.

Earnings commentary indicated these drivers would continue to grow as a percentage of total sales in the back half of the year. While certainly a positive, the categories do carry a lower margin profile than WMT’s offerings of general merchandise. Recognizing this, WMT emphasized that cost control would be a focus in an effort to improve the sales mix.

Despite the heightened attention to product costs and mix, profitability was still materially up in Q2 compared to last year. Net income broached nearly +$8.0B compared to +$5.1B last year. The increase was due in a large part to a more favorable comparable environment with less product discounting.

The expectation-beating results through Q2 enabled an increase in WMT’s full-year guidance. Full-year constant currency sales were seen growing in a range of 4% to 4.5%, with net constant currency sales growth in Q3 of approximately 3%.

At the bottom line, full-year adjusted EPS was seen at a midpoint of $6.41/share and at a midpoint of $1.475/share for Q3. This was reflective of an expected increase in full-year operating income of between 7% and 7.5% and a quarterly increase of approximately 1%.

WMT Q3 Results Recap

WMT reported continued sales and profit growth in Q3, further supporting the notion that Americans remain attracted to the value proposition of WMT’s offerings.

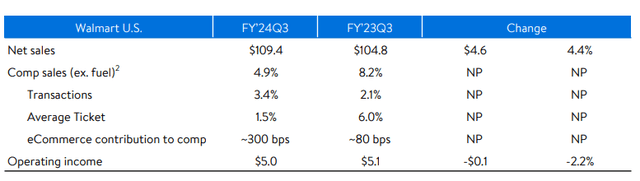

WMT once again raised its full-year outlook, due in part to another expectation-beating quarter. YOY U.S. comparable sales rose 4.9% during the quarter. While this represents a slowdown from prior periods, it was still a healthy trend, given declines seen elsewhere in the retail sector.

WMT Q3 Earnings Release – Summary Of WMT U.S. Sales & Operating Performance

Driving the sales increase was continued strength in groceries and health/wellness products, consistent with strength reported in the first three quarters. In addition, WMT reported further growth in market share in groceries, the mainstay of their overall U.S. business.

Falling inflation has provided some much-needed relief to the American consumer. Ahead of the holiday season, WMT CEO Doug McMillon cited the lower cost of a Thanksgiving meal as one tailwind for its consumers.

In addition to sales, profits continued to increase. Adjusted operating income hit +$6.2B in the most recent quarter. Sales of nongrocery items, however, have held back profitability and margins. In Q3, WMT’s gross profit rate was unchanged from Q2 at 24%. Nevertheless, overall adjusted EPS landed at $1.53/share, ahead of the $1.52/share expected.

Accompanying the release was an upward revision in full-year EPS and expectations for full-year net sales growth. WMT now expects full-year EPS to land at a midpoint of $6.44/share, up a few cents from their previously estimated midpoint of $6.41/share. Net sales were bumped up to a range of between 5% and 5.5%, up from 4% to 4.5% previously.

Is WMT Stock A Buy, Sell, Or Hold?

In contrast to other retailers that have reported thus far this week, such as Home Depot and Target, WMT is reporting continued growth in comparable store sales. One major attributing factor is the value proposition of their products, which is still paramount to consumers despite falling inflation rates. Further evidence of the appeal in discount shopping could be seen in the results of the TJX Companies, who also reported growth in comparable store sales.

In an interview with CNBC, CFO John David Rainey noted that consumers are leaning more heavily on promotional-type periods and are continuing to put off larger purchases until they see a deal. This suggests groceries and other necessities will remain WMT’s primary point of strength through at least the remainder of the calendar year.

WMT is also benefiting from a successful build-out of their eCommerce model. The model’s sales grew 24% in the U.S. during Q3. In addition, complementary add-ons to their core business are providing another leg-up to total revenues. Total revenue in Connect, WMT’s ad business, for instance, grew 26% YOY.

After reaching an all-time high on Wednesday, some investors may have been selling the positive figures immediately following the release. Shares were down about 7% in pre-market trading. Consensus Wall Street estimates also see less than 10% remaining upside in the stock. Forward guidance on the EPS target may have disappointed further, as the range fell short of the consensus mark of $6.50/share.

In my view, I see WMT continuing to gain market share in the months ahead. Lower fuel costs and a relatively cheaper holiday season than last year should provide a tailwind for consumers in the immediate term. And their continued desire for value in spite of this should retain WMT as the “go-to” location for groceries and other necessities.

At 26x forward earnings, however, shares aren’t cheap. And it’s likely the stock was valued to perfection yesterday at its all-time highs. While I am positive on the outlook, I view the present as a suitable time to “hold” on any new or further initiation.

Read the full article here