Written by Nick Ackerman, co-produced by Stanford Chemist.

We last covered CBRE Global Real Estate Income Fund (NYSE:IGR) in May of this year. I ultimately came away with a neutral to negative outlook on the closed-end fund, or CEF. I noted that Cohen & Steers Real Estate Opportunities and Income Fund (RLTY) could be a better opportunity for investors looking for real estate and real estate investment trust exposure.

That ended up being the right call; though real estate investment trusts, or REITs, have continued to remain pressured throughout most of 2023, RLTY would have offered significantly reduced losses, coming in essentially flat since our last update. On a total share price return basis, we even have positive results, as the fund had seen its discount narrow.

Today, despite IGR having the larger discount, I would continue to favor RLTY. Cohen & Steers Quality Income Realty Fund (RQI) is also offering a tempting discount these days as well that investors could consider. The risk of a distribution cut remains, and that continues to be an overhang for this fund.

The Basics

- 1-Year Z-score: -1.32

- Discount: -13.96%

- Distribution Yield: 16%

- Expense Ratio: 1.41%

- Leverage: 31.10%

- Managed Assets: $946 billion

- Structure: Perpetual.

IGR invests with an objective of “high current income, and its secondary objective is capital appreciation.” They do this by investing “globally with an emphasis on the income-producing common equity and preferred stocks of real estate companies.” They mention that “up to 25% of its assets in preferred shares of global real estate companies.”

The fund is leveraged, and that can create more volatility for shareholders. The upside is that if the fund were performing well, it would increase that positive performance. Unfortunately, the fund is performing poorly in the current rate environment. However, it isn’t necessarily just a rising rate environment; this fund has performed quite poorly in most years.

Performance Comparison

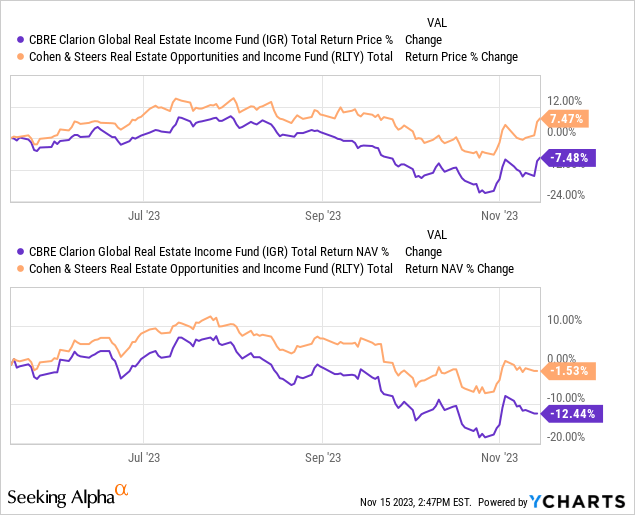

Since our previous update, neither fund has done particularly well. They both started to pull themselves out of the banking crisis at that time but then started to take a dive on the back of increasing Treasury Rates. More recently, they started to rebound as those rates eased off. However, both still produced negative total NAV returns, but clearly, IGR fared significantly worse.

Ycharts

While I certainly wouldn’t hold anyone back from incorporating more diversification through global exposure that IGR can offer, it just doesn’t seem like the right play in the REIT space. Not just because performance is terrible but also because the fund wasn’t managed as well compared to the Cohen & Steer, Inc. (CNS) REIT funds.

All funds with REIT exposure certainly have taken massive hits, but as an example, IGR did not hedge for rising interest rates on their leverage. CNS, on the other hand, hedged all their funds. It’s true that if rates stay high for the next few years, CNS REIT CEFs will start to face some pressures from rates, but at least this initial blast has been postponed. That just put CNS funds in a much better position. However, RLTY does carry a significant amount of leverage, with the leverage ratio pushing to just over 38%.

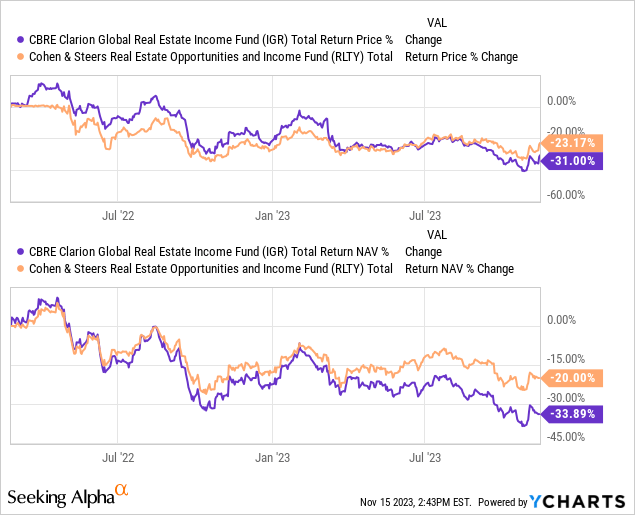

Being hedged was probably a factor in performance if we look at the total returns since RLTY’s inception. RLTY only launched at the beginning of 2022, so it has only experienced a rising rate environment. It also means that we don’t have a significant period of time to look back at the performance of the fund for comparison.

Ycharts

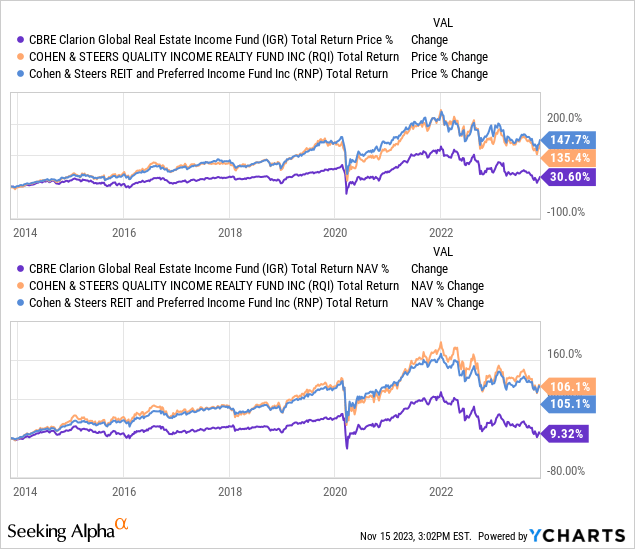

Instead, if we give a comparison between RQI and IGR, we can get a better idea of a track record. RQI tends to favor equity REIT exposure more heavily than RLTY and IGR, at least historically. With that in mind, we can look at the Cohen & Steers REIT and Preferred and Income Fund (RNP), which holds a portfolio that’s fairly split between equity and REITs. RLTY is about in the middle at a weighting of around 67% in equity REITs and 33% in preferred.

With that being the case, we can’t just say that RQI’s equity sleeve helped drive most of the results that we saw for RQI compared to IGR. RNP performed almost identically to RQI in the last decade despite the significantly larger preferred sleeve.

Ycharts

Distribution Cut Possible

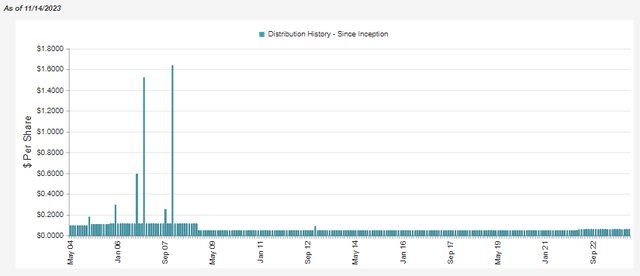

Predicting when or if a fund will cut its distribution is extremely difficult. Closed-end funds can essentially pay out what they’d like for as long as they’d like – assuming NAV doesn’t go to $0. That said, one of the red flags here would be the fund’s NAV distribution rate, which is pushing around 13.77%. That’s what the underlying portfolio would have to earn to continue to pay out the current distribution, plus the fund’s expenses to operate. When including that, the portfolio would need to generate closer to a 15% return.

IGR Distribution History (CEFConnect)

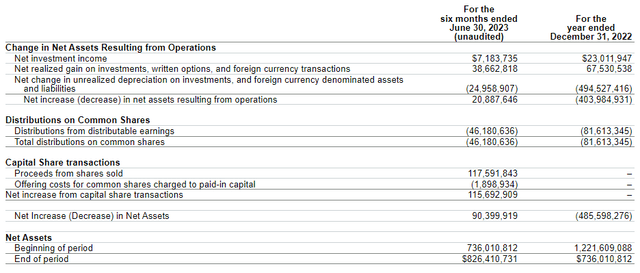

Some funds can support high distribution rates and are benefiting from rising rates, but given the deteriorating coverage from the IGR’s last semi-annual report, that isn’t the case for this fund.

IGR Semi-Annual Report (CBRE)

As a fund that invests fairly heavily in equities, it will require capital gains to fund its payout. That isn’t anything new. RLTY and RQI are in the same boat of needing capital gains, though their NAV rates are at more manageable levels. Seeing IGR’s NII per share go from $0.20 last year to what would be $0.12 on an annualized basis will make it more difficult going forward. RLTY and RQI have seen their NII drop as well, but thanks to their interest rate swap hedges, also took in significant realized and unrealized gains from those contracts.

Of course, the fund’s distribution rate on a share price basis comes out to a tempting 16%, but that’s also one of its biggest risks now. CEFs that cut their distributions are generally met with a pretty swift drop. That can even be the case when the fund is trading at a deep discount, though the reaction is much more muted, as we’d expect.

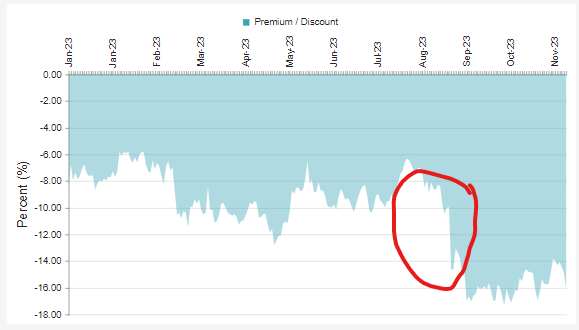

One example of that would be when Virtus Total Return Fund Inc. (ZTR) cut their payout earlier this year. The fund had a fairly attractive discount that got even more attractive. Since then, it has clawed back some of the discount, but clearly, the market move lower was substantial and pretty easy to see. Here’s a look at the move that ZTR saw in its discount/premium at that time.

ZTR Discount Widening After Distribution Cut (CEFConnect)

I believe that if IGR delivered a cut to its distribution, it could probably offer an even better opportunity to take a position in the fund, at least if one is looking for global diversification in the real estate space.

IGR’s Portfolio

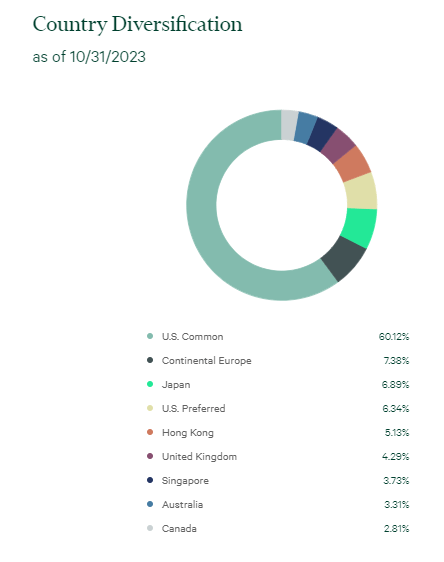

Besides the fund’s discount, I do believe another appealing feature would be its more global diversification. The fund has more flexibility to invest where it feels it has the most opportunity. Unfortunately, as we saw with the track record up to this point, the choices made haven’t really delivered.

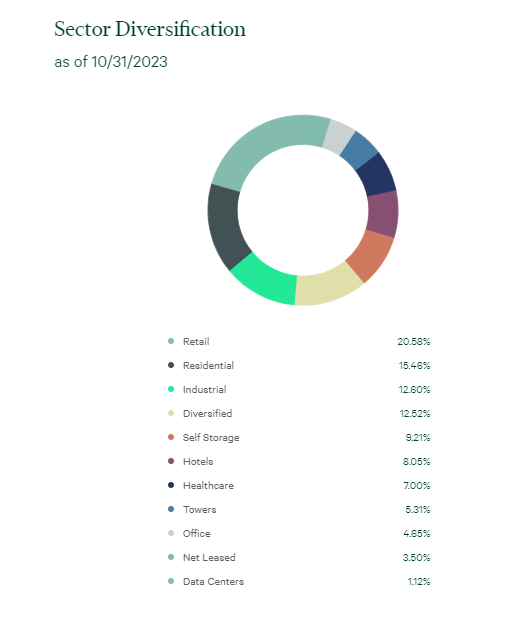

The fund holds about 66% of its assets in the U.S. positions, but that also isn’t too uncommon for global funds to hold a sizeable weight in U.S. positions. The fund has focused primarily on retail exposure as of the latest update. Residential, industrial and diversified REITs also make up a fairly meaningful sleeve of the portfolio as well.

IGR Geographic Allocation (CBRE)

On a positive note, it would seem that office exposure here is quite small. This was the case earlier in the year as well when office exposure came in at around 5.5%. Retail exposure at that time was closer to 16.6%, so that has seen its weight climb, too.

IGR Sector Allocation (CBRE)

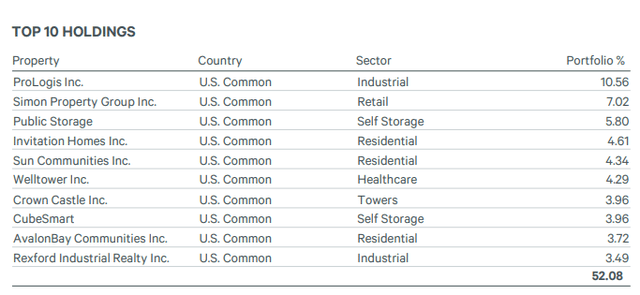

Compared to the Cohen & Steer CEFs, IGR does take a more concentrated approach to investing in portfolio names. They hold 83 total holdings as of their last fact sheet. RLTY is pushing closer to ~180 for some context. RQI is similarly around the same number of holdings, but that said, RQI also has a few positions that are fairly significant in terms of weighting relative to the rest of their holdings. That is the case for IGR, too, but even more so, with the top three holdings at around 23.4% or nearly a quarter of the fund.

IGR Top Ten Holdings (CBRE)

Generally speaking, the larger the number of holdings for a fund and the more concentration, the easier it is to outperform. That is, assuming that you are taking the right bets. The opposite is also true, that it is much easier to underperform when you are making the wrong bets. Given the track record, it does appear to be, at least historically, that IGR has placed the wrong bets. Of course, the usual caveat is that past performance is no indicator of future success. That’s just as much true for good results as it is equally true for poor results.

The future could always be brighter for IGR, and I don’t see any specific top ten holdings that look particularly terrible. A little heavy in residential, and that could be a problem during a recession where unemployment rises materially. Though everything is likely to take a hit during recessions, just some areas could be particularly sensitive.

Conclusion

While I’d like to believe that CBRE Global Real Estate Income Fund can turn its success around, it doesn’t seem on the path to do that as long as the distribution remains this elevated. At this point, it does almost seem like it is at the point of no return, or alternatively, it would need a massive rally in REITs for any chance to potentially recover. A doubling of most REITs held by IGR could likely do it, as it would bump up the needed gains for the payout.

Cutting the distribution and getting the move out of the way would likely be beneficial to the fund in the medium to longer term after a good bit of initial volatility. However, they also don’t seem interested in going that route and don’t seem to mind continuing to overpay their distribution. That can make it harder to recover in the future, and with RLTY and RQI trading at attractive discounts as well, I’d continue to lean toward those funds instead.

Read the full article here