Thesis

In my previous article, I assigned a “strong buy” rating to Advanced Micro Devices, Inc. (NASDAQ:AMD), projecting a near-term upside of 28% based on my estimates, which would have placed the stock at $129.9. However, upon closer examination of my models, I realized that I did not accurately utilize analysts’ estimates or their net income margin projections. The estimates I provided earlier were excessively conservative.

After a thorough revision and adjustment of the estimates, it appears that AMD’s fair value is significantly higher than initially anticipated. According to my slightly more conservative estimates, which still align closely with analysts’, the fair value could be up to 96.3% higher than the current stock price of $139.20. Consequently, I am reaffirming my “strong buy” rating on AMD.

Seeking Alpha

Overview

FQ3 2023

Despite a bleak fourth quarter projection attributed to slowdowns in embedded and gaming segments, AMD experienced a notable uptick, with shares rising over 6% as Wall Street rallied in defense of the chipmaker. The surge in confidence followed encouraging indicators provided by AMD regarding its upcoming AI chip. CEO Lisa Su stated:

“We expect data center GPU revenue to hit approximately $400 million in Q4 and exceed $2 billion in 2024, with revenue steadily increasing throughout the year.”

In terms of financial performance, Advanced Micro Devices reported Non-GAAP EPS of $0.70, surpassing expectations by $0.02. Additionally, the company posted revenue of $5.8 billion, exceeding estimates by $110 million. This positive financial outcome, coupled with the optimistic outlook for the AI chip division, contributed to the rebound in AMD’s stock.

Market

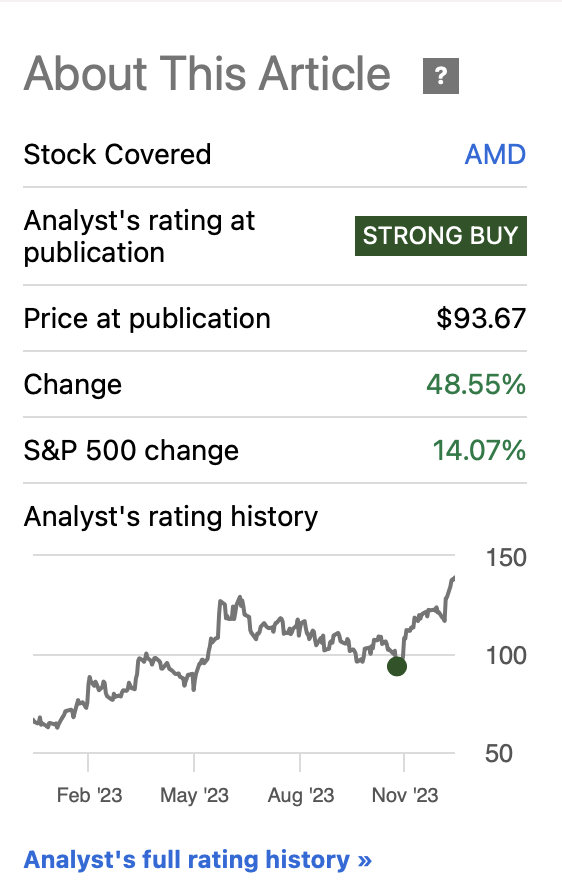

Data Center Market

The Data Center Market is poised for consistent revenue growth, with a projected CAGR of 4.66% from 2023 to 2027. However, inside this data center market is the “AI Market,” which has been delivering huge returns so far.

Statista

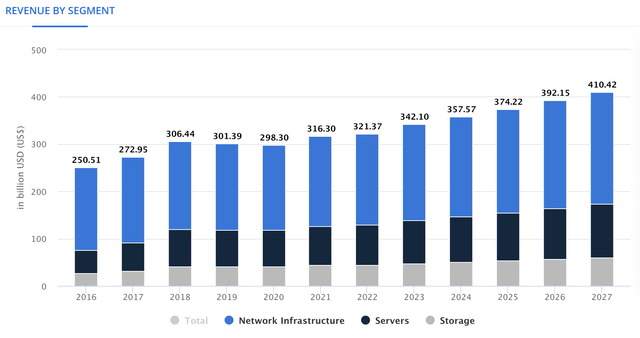

The AI market is set to undergo robust expansion, with an expected CAGR of 17.30% from 2023 to 2030. It’s noteworthy that by 2030, an estimated 70% of companies will integrate AI into their operations, representing a substantial 35% increase from the 35% observed in 2023.

Statista

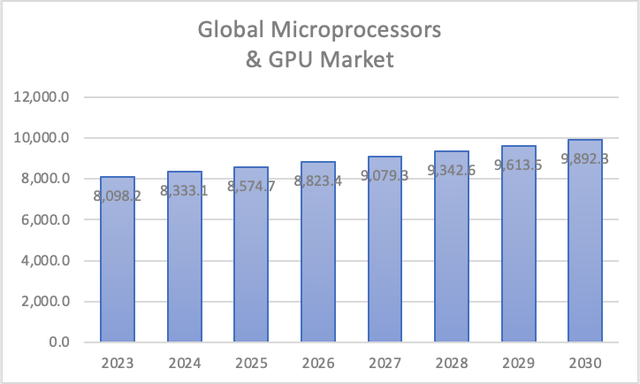

Client & Embedded processors

This segment encompasses AMD’s sales of CPUs and GPUs to individuals and PC brands. The microprocessor and GPU market is anticipated to grow at a rate of 2.9% through 2030.

Author’s Calculations with base on Yahoo Finance

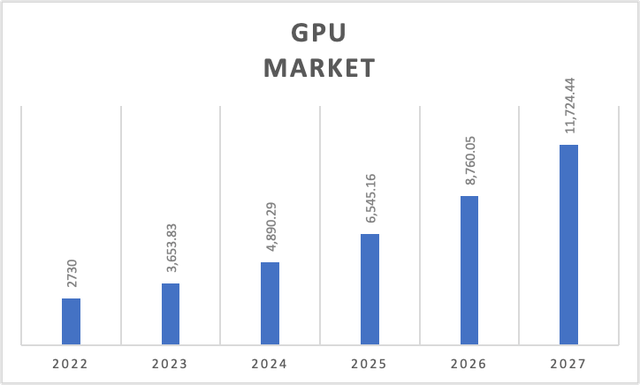

Gaming GPU Market

In the gaming market, AMD offers GPUs, and this market is expected to experience a growth rate of 33.8% through 2027. This growth rate is supported by various sources, including Mordor Intelligence, Allied Market, and Yahoo.

Author’s Calculations with base on many sources

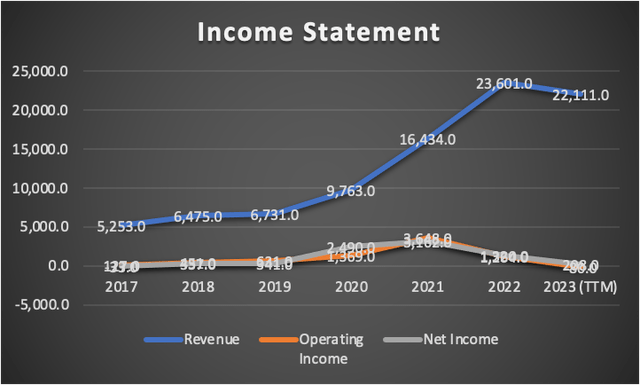

Financials

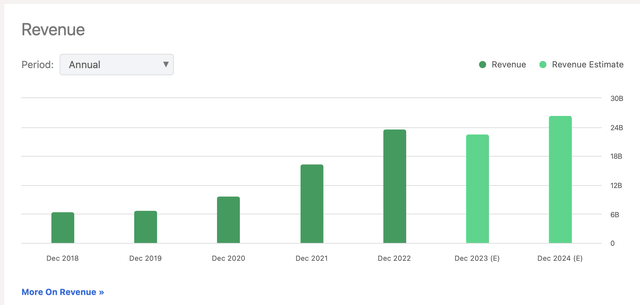

AMD’s revenue has demonstrated robust annual growth, reaching 53.5% from 2017 to 2023. However, from Q2 2023, the trailing twelve-month [TTM] revenue has increased by a modest 1.07%.

Despite a concerning annual operating income decline of 27.2%, it’s crucial to note a peculiar trend. In 2022, AMD’s operating income stood at $1.2B, but in 2023, it dropped to $-80M. This apparent setback stems from increased expenses, evident in the subsequent quarter where operating income rebounded by approximately 78%, settling at -$378M.

Net income has shown remarkable growth, boasting a rate of 121.7% since 2017. However, this metric is subject to manipulation by AMD, likely for financing development or other purposes. From Q2 2023, net income surged by an impressive 900%, rising from Q2’s -$25M.

Author’s Calculations

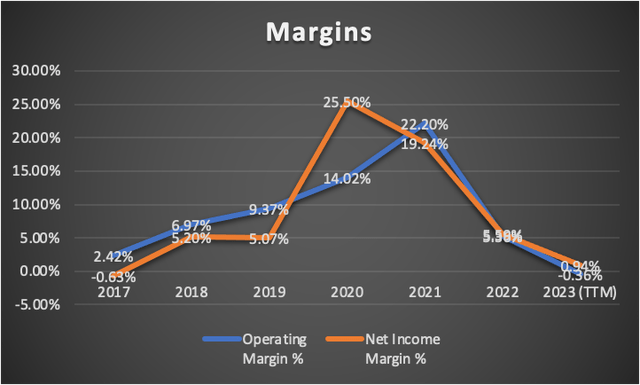

Current margins hover around the 1% mark, with operating margin at -0.36% and net income margin at 0.94%. Notably, Q2 2023 witnessed a positive shift with these metrics improving from -1.73% to -0.11%.

Author’s Calculations

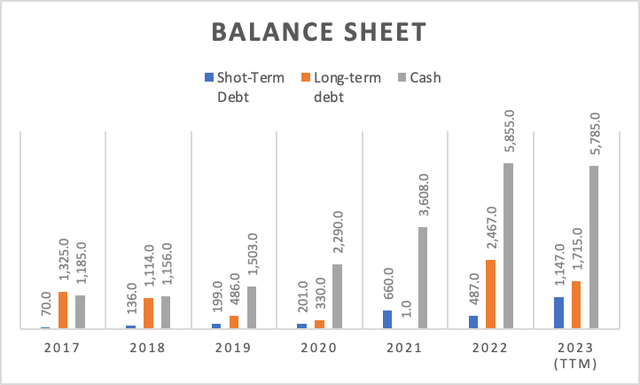

AMD’s balance sheet remains robust, holding $5.7B in cash reserves. While this marks a reduction from Q2 2023’s $6.28B, the company maintains stability. Long-term debt remains at $1.7B, mirroring Q2 figures, as does short-term debt at $1.14B.

Author’s Calculations

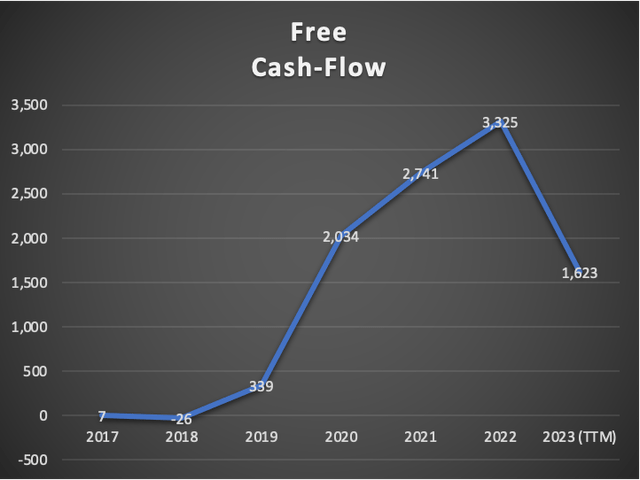

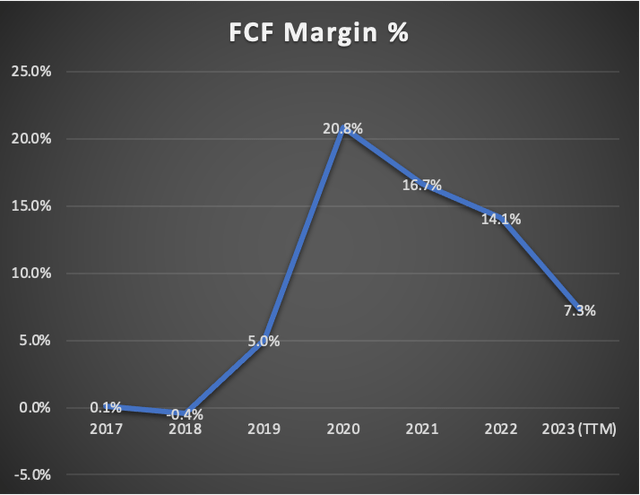

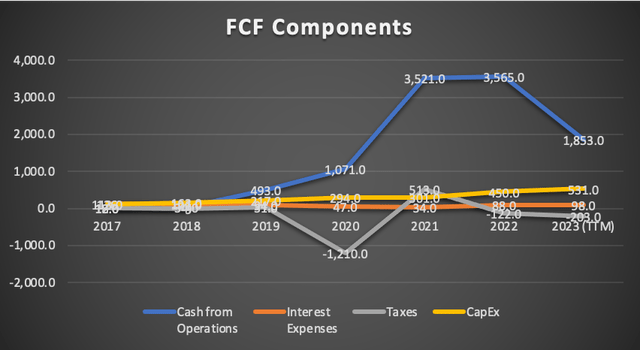

However, free cash flow has experienced a significant downturn, currently standing at $1.62B, reflecting a 28.6% reduction from Q2’s $2.36B. Consequently, the free cash flow margin has decreased to 7.3%, down from Q2’s 10.4%, largely attributed to a decline in cash from operations, evident in the “Free Cash Flow Components” graph.

Author’s Calculations

Author’s Calculations

Author’s Calculations

In summary, AMD has made slight improvements in its income statement, maintaining a stable balance sheet. Nevertheless, the noticeable dip in cash flows doesn’t negate the company’s overall solidity, as evidenced by its resilient balance sheet.

Valuation

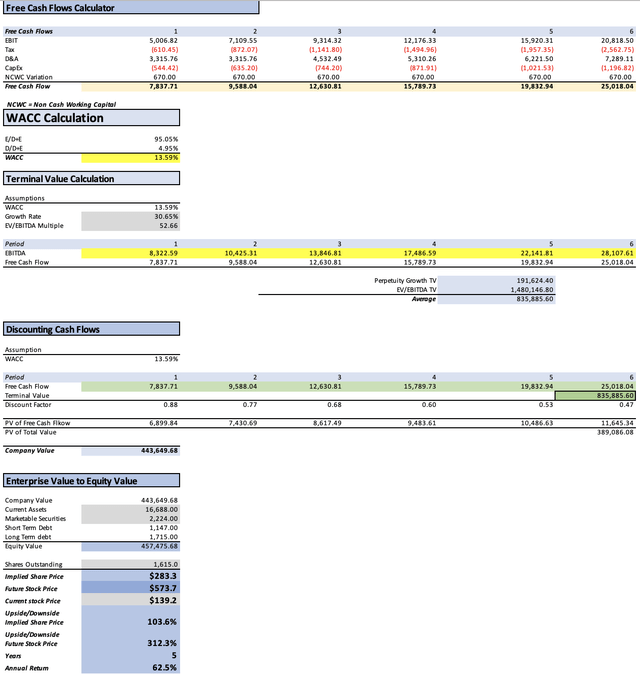

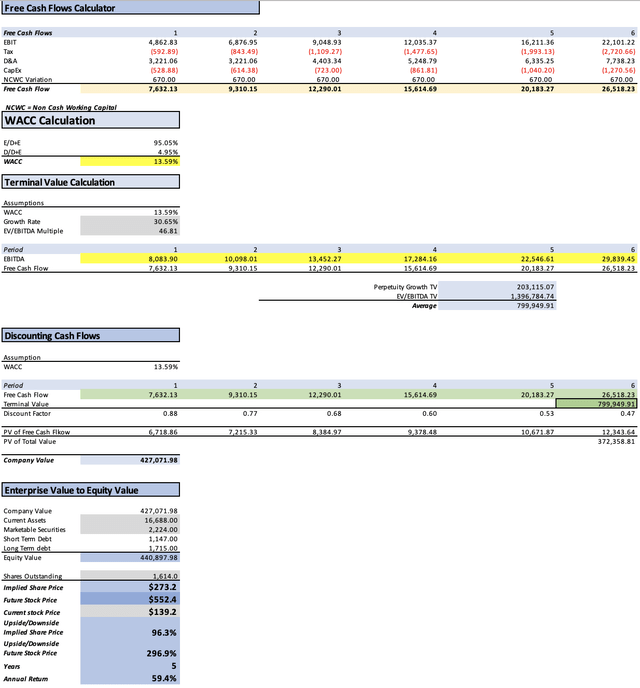

In this valuation, I will introduce two models: one grounded in analysts’ estimates, as accessible on Seeking Alpha, and the other rooted in my own projections.

In the ensuing table, I will compute depreciation and amortization (D&A), interest expenses, and CapEx, aligning them with revenue margins. Furthermore, I will ascertain the Weighted Average Cost of Capital [WACC] employing the well-established formula.

| TABLE OF ASSUMPTIONS | |

| (Current data) | |

| Assumptions Part 1 | |

| Equity Value | 54,970.00 |

| Debt Value | 2,862.00 |

| Cost of Debt | 3.42% |

| Tax Rate | 14.21% |

| 10y Treasury | 4.45% |

| Beta | 1.6 |

| Market Return | 10.50% |

| Cost of Equity | 14.13% |

| Assumptions Part 2 | |

| EBIT | |

| Tax | (203.00) |

| D&A | 3,234.00 |

| CapEx | 531.00 |

| Capex Margin | 2.40% |

| Assumption Part 3 | |

| Net Income | 208.00 |

| Interest | 98.00 |

| Tax | -203.00 |

| D&A | 3,234.00 |

| EBITDA | 3,337.00 |

| D&A Margin | 14.63% |

| Interest Expense Margin | 0.44% |

| Revenue |

22,111.0 |

Analysts’ Estimates

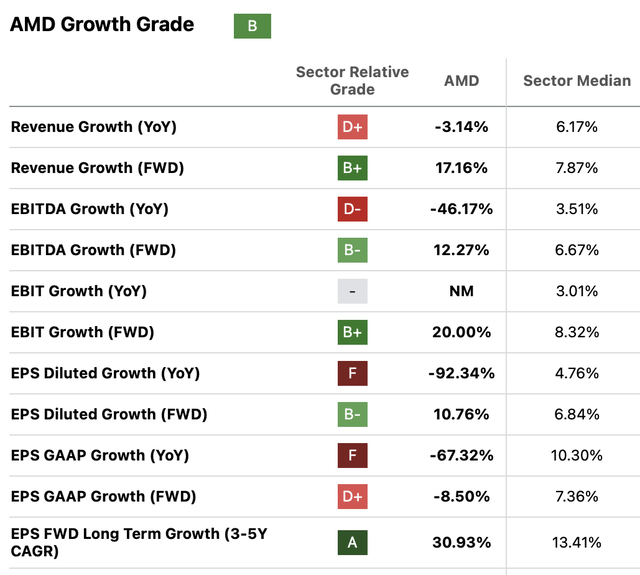

For the initial model, I will assess AMD’s valuation based on current analysts’ estimates for revenue and EPS, as well as incorporate the anticipated forward revenue growth and the 3-5-year long-term EPS growth.

Presently, analysts’ estimates project AMD’s revenues to reach $22.67B for FY2023 and $26.45B for FY2024.

Seeking Alpha

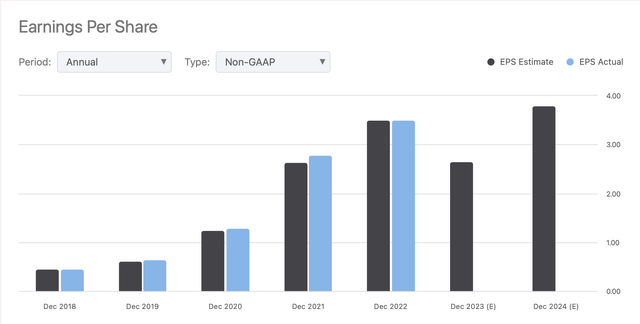

In terms of EPS, analysts anticipate $2.66 for FY2023 and $3.80 for FY2024, corresponding to net incomes of $4.29B and $6.13B, respectively.

Seeking Alpha

Additionally, analysts project a forward revenue growth rate of 17.16%, and for the long-term EPS growth, an expectation of 30.93%. As depicted in the table below, these figures surpass the sector median.

Seeking Alpha

| Revenue | Net Income | Plus Taxes | Plus D&A | Plus Interest | |

| 2023 | $22,670.0 | $4,295.90 | $4,906.35 | $8,222.11 | $8,322.59 |

| 2024 | $26,450.0 | $6,137.00 | $7,009.07 | $10,324.83 | $10,425.31 |

| 2025 | $30,988.8 | $8,035.17 | $9,176.97 | $13,709.46 | $13,846.81 |

| 2026 | $36,306.5 | $10,520.45 | $12,015.41 | $17,325.67 | $17,486.59 |

| 2027 | $42,536.7 | $13,774.43 | $15,731.78 | $21,953.28 | $22,141.81 |

| 2028 | $49,836.0 | $18,034.86 | $20,597.61 | $27,886.73 | $28,107.61 |

| ^Final EBITA^ |

Author’s Calculations

Analysts’ expectations imply that AMD’s fair price is $283.3, indicating an astronomical 103.6% upside from the current stock price of $139.2. Moreover, the model suggests that by 2028, AMD will attain a stock price of $573.7, translating to annual returns in the realm of 62.5% over the five years of this projection.

My Updated Estimates

This second model will be made by projecting the revenue of each f AMD’s segment by the expected market growth of the market in which each segment operates. That means that data center will be growing at a rate of 17.30%, , gaming at 33.8%, and client & embedded at 2.9%.

| Data Center | Client | Gaming | Embedded | |

| 2023 | 5,395.1 | 3,537.8 | 6,854.4 | 6,235.3 |

| 2024 | 6,355.4 | 3,640.4 | 9,171.2 | 6,416.1 |

| 2025 | 7,486.7 | 3,745.9 | 12,271.1 | 6,602.2 |

| 2026 | 8,819.3 | 3,854.6 | 16,418.7 | 6,793.7 |

| 2027 | 10,389.1 | 3,966.3 | 21,968.2 | 6,990.7 |

| 2028 | 12,238.4 | 4,081.4 | 29,393.5 | 7,193.4 |

Then I will be adjusting my net income margin estimates to those that analysts are expecting which are the following:

| Net income Margin | |

| 2023 | 18.9% |

| 2024 | 23.2% |

| 2025 | 25.9% |

| 2026 | 29.0% |

| 2027 | 32.4% |

| 2028 | 36.2% |

| Revenue | Net Income | Plus Taxes | Plus D&A | Plus Interest | |

| 2023 | $22,022.6 | $4,172.34 | $4,765.23 | $7,986.29 | $8,083.90 |

| 2024 | $25,583.1 | $5,935.86 | $6,779.34 | $10,000.41 | $10,098.01 |

| 2025 | $30,105.9 | $7,806.23 | $8,915.49 | $13,318.84 | $13,452.27 |

| 2026 | $35,886.2 | $10,398.66 | $11,876.31 | $17,125.10 | $17,284.16 |

| 2027 | $43,314.3 | $14,026.25 | $16,019.38 | $22,354.63 | $22,546.61 |

| 2028 | $52,906.6 | $19,146.07 | $21,866.73 | $29,604.96 | $29,839.45 |

| ^Final EBITA^ |

Author’s Calculations

This concluding model indicates a marginally lower fair price of $283.3, suggesting an upside of 96.3%. According to the model, by 2028, the projected stock price should reach $552.4, translating into annual returns of 59.4%.

Risks to Thesis

The first risk to this thesis lies in the reliance on non-GAAP EPS metrics as the foundation for analysts’ estimates, recognizing that AMD’s non-GAAP metrics can differ from GAAP metrics. While there has been previous acknowledgment that non-GAAP metrics were considered more reliable than AMD’s GAAP metrics, it’s crucial to recognize that during an economic downturn, investors are likely to pivot towards GAAP metrics for added security.

The second risk pertains to the potential abrupt slowdown in demand for AI chips, which could significantly impact revenue forecasts. While I may have underestimated the potential of AI chips and other segments in my estimates, it might not be sufficient to counteract the emotional response of investors in the event of such a scenario.

Lastly, it’s important to note that market sentiment could exert a downward influence on this growth stock. However, as outlined in my article on the S&P 500 (SP500) for 2024, where I suggested a possible flat trend with a maximal upside of 8%, this scenario might still provide AMD the opportunity to sustain its growth trajectory even in a market characterized by stagnation.

Conclusion

In conclusion, a comprehensive analysis of Advanced Micro Devices, Inc.’s financial landscape and growth prospects reveals a compelling investment opportunity. Two distinct valuation models have been meticulously examined, with the first relying on current analysts’ estimates and the second projecting revenue growth across AMD’s key segments. Notably, the initial model, incorporating analysts’ forecasts, points towards a fair price of $283.3, reflecting a remarkable upside of 103.6% from the present stock price of $139.2.

The second model, adjusted to align with analysts’ net income margin estimates, suggests a slightly lower fair price of $283.3, still indicating a noteworthy upside of 96.3%. Emphasizing the consistency of these models, both anticipate robust annual returns, projecting a stock price of $573.7 by 2028 and $552.4, translating to returns of 62.5% and 59.4%, respectively.

Amidst these optimistic projections, the convergence of these models underscores the strength of the “strong buy” rating, affirming the potential for substantial gains for Advanced Micro Devices, Inc. investors, with a target price of $283.3 standing out as a testament to AMD’s promising future.

Read the full article here