Investment Thesis

Zillow Group, Inc.’s (NASDAQ:Z) outlook ahead doesn’t inspire a lot of hope. There are ample blemishes to this investment, as we’ll soon discuss. However, I remain bullish on Zillow stock, as I believe that this online real estate platform has a strong moat and ample potential to turn around its prospects.

In fact, I believe that although shares look expensive right now at 30x forward free cash flows, this strong brand has the capacity to enter 2024 with a much stronger footing.

What’s more, keep in mind that Zillow has about $1.5 billion of net cash on its balance sheet. Meaning that this business clearly has the wherewithal to invest in its growth prospects. Simply put, Zillow’s story hasn’t ended yet, even as its stock continues to languish.

Rapid Recap

Back in September, I wrote a bullish analysis on Zillow where I said:

Zillow’s mission is now just two things.

One, can it rebuild trust with investors? And two, can Zillow stabilize its revenue growth rates?

Here, I argue that these are the only two missions that Zillow must deliver upon.

And that in time, investors will flock back to this name, when Zillow’s prospect look more “certain”, and Zillow’s stock carries a multiple that is reflective of a more “certain” business.

Accordingly, I argue that the time to get involved with Zillow is now. Before investors unanimously decide, this moat has staying power.

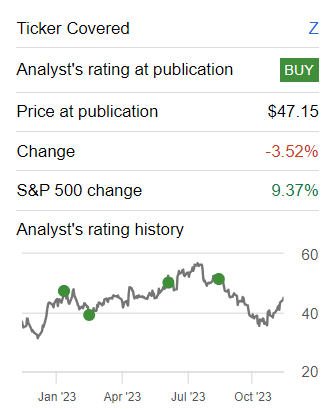

Despite my bullish outlook, Zillow’s share price has been a solid laggard in 2023. Case in point, this is my performance on Zillow since I’ve been recommending the stock earlier in 2023.

Author’s work on Z

This is a very poor performance on my part. And yet, I am still bullish on Zillow’s prospects. Here’s why.

Zillow’s Near-Term Prospects

In the near term, Zillow’s prospects appear promising, as Zillow’s unwavering focus on delivering a housing Super App, an end-to-end platform facilitating seamless real estate transactions, reflects its innovation.

Its recent acquisition of Follow Up Boss, a CRM system, demonstrates Zillow’s intent to enhance its ecosystem, providing real estate professionals with valuable tools. The diversified revenue streams, including robust growth in the Rentals marketplace and significant progress in mortgages, underscore Zillow’s resilience and its ability to weather industry shifts.

The company’s continuous efforts to optimize the customer funnel, capitalize on organic traffic, and invest in growth pillars like touring and financing signal a proactive approach to maintaining its market position.

Despite these positive indicators, Zillow faces challenges in the near term. The uncertainties surrounding potential shifts in industry practices, particularly related to buyer agency commissions, introduce a level of unpredictability.

The legal complexities and the potential for a prolonged resolution process could pose challenges to Zillow’s strategic plans. Furthermore, as the company seeks to scale its enhanced markets and roll out new products, it must contend with the broader macroeconomic environment, including housing affordability.

While Zillow has consistently outperformed industry transaction volumes, the headwinds from a challenging housing market could once again affect transaction dynamics.

Given this background, let’s now delve deeper into its financials.

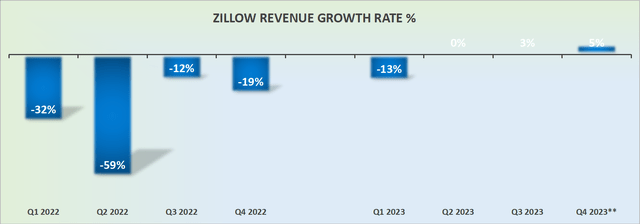

Revenue Growth Rates Are Unattractive

Z revenue growth rates

Zillow’s growth prospects right now look thoroughly uninteresting. It’s difficult to imagine just how unimpressive last year’s revenue growth rates were in Q4, although Zillow had already exited its iBuying venture, and that this time around, Q4 also looks so mundane, as its top line is only expected to be up in the single digits.

That being said, I believe that in 2024 the business will be a better place to reap a lot of the investments it has made this year as well as to benefit from its increase in headcount.

On top of that, note that its comparables in 2024 will also be relatively easy. Therefore, altogether, I believe that this is not the time to give up on Zillow.

Given this context, let’s turn our attention to discussing Zillow’s valuation.

Z Stock Valuation — 30x Forward Free Cash Flow

If the investment thesis wasn’t complicated enough, we now have to consider this. Looking ahead to Q4, Zillow guides for approximately $60 million in EBITDA. This figure is down slightly from the $73 million in the same period a year ago. Thus, even if the ultimate figure ends up as flat y/y EBITDA growth, this is still a tough pill to slow.

Why should investors continue to pay a premium on Zillow’s stock, when the business has no growth in intrinsic value to speak of?

Here’s why:

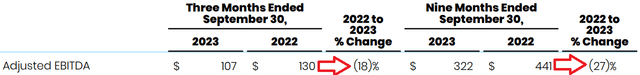

Z Q3 2023

As you can see above, Zillow’s EBITDA profile for the first 9 months of 2023 was down 27% compared with the same period in the prior year. While Q4’s guidance points to the business being expected to arrive at close to flat y/y EBITDA growth.

Consequently, this demonstrates that Zillow is very much on the recovery path. At long last. This business can in 2024 be appraised as a profitably growing enterprise.

Admittedly, this is not a blemish-free investment, as I’ve already noted. It’s difficult to argue that investing in Zillow right now is particularly exciting. But at the same time, this isn’t where Zillow’s story ends.

Zillow will enter 2024 having done a lot of heavy lifting in 2022 and 2023, and if we assume there are stable interest rates and a stable real estate market, this business will be better placed to start to deliver increasing profitability. On that basis, this is a business with a significant moat that can continue to press ahead and grow its underlying profitability.

According to my estimates, Zillow will make approximately $310 million of free cash flow in 2023. If we presume that next year Zillow’s free cash flow grows by 10% this leaves the stock priced at 30x forward free cash flow.

The Bottom Line

In conclusion, while Zillow Group’s current valuation at 30x forward free cash flow may seem steep, it is crucial to view this investment through a longer-term lens.

The company’s strategic initiatives, such as the focus on a housing Super App and recent acquisitions, reflect its commitment to innovation and growth.

Despite facing challenges in the near term, including uncertainties in industry practices and legal complexities, Zillow’s resilience and diversified revenue streams indicate its ability to navigate industry shifts.

Although the stock has lagged in performance, the anticipation of increased profitability in 2024, supported by a recovering free cash flow profile, suggests that now is not the time to give up on Zillow Group, Inc.

Read the full article here