Introduction

With 2023 now behind us, hopefully, 2024 will shape up to be a better year for us dividend investors. Some stocks were up during the year, but there were also some that didn’t do too well and were in the red. To be honest, though it was rocky for some, specifically the REIT sector (VNQ). That’s because interest rates were raised at a rapid pace until recently. But with at least three cuts expected this year, I think investors in the sector will see some nice capital appreciation to go along with those dividends.

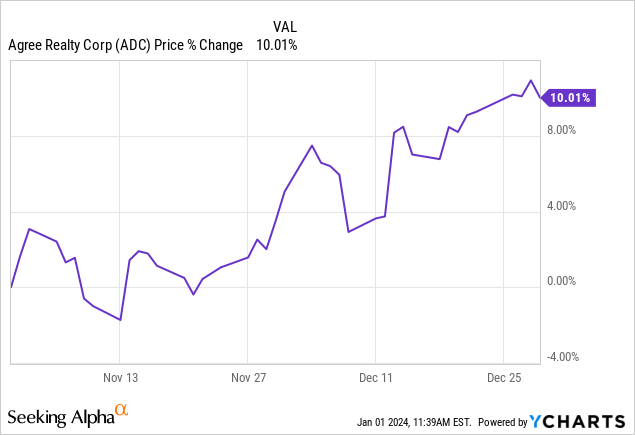

Furthermore, one of the stocks, Agree Realty, I covered this past November. I rated the stock a strong buy as it was trading at well below its 5-year average P/AFFO ratio, and had recently hit a new 52-week low. Since then, the share price has rebounded but still trades around 16x FWD P/AFFO, below their 19x average. But still remains a buy because of their upside potential, which I discuss later in the article.

Agree Realty also delivered a beat on its Q3 earnings, had minimum amount of lease expirations remaining in 2023, and is well-positioned for a strong 2024. In this article, I list two stocks for 2024, one to buy, and one to avoid. Let’s get into my recommendations.

Avoid: Tyson Foods (NYSE:TSN)

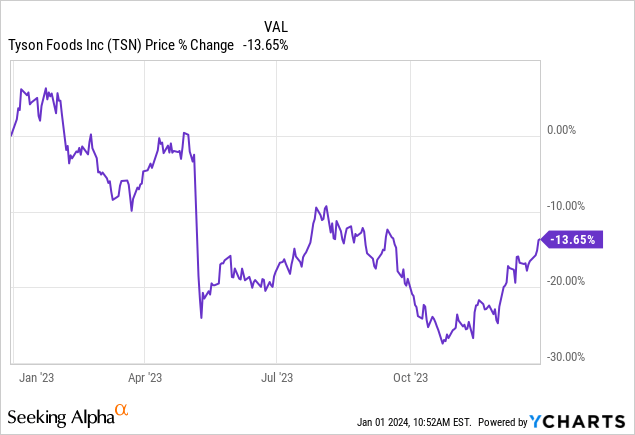

You know how you tell someone you have some good news and bad news? Which one do they usually want to hear first? Most of the time they want the bad news first. So, I decided to give dividend investors the stock I think they should avoid in 2024, Tyson Foods. The company is down double-digits in the last year. 2023 was rough for them as they struggled financially.

The company faced lawsuits over worker’s compensation, child labor issues, and had a meat recall on 30,000 chicken nuggets. Additionally, they also had protests at some of their plants and were forced to close some, and will actually be closing another four facilities this year. However, on a positive note, they did close on an acquisition of the William Sausage Company.

Sales and cash flows were down year-over-year. This led to the business being forced to trim its sales guidance and cut CAPEX forecasts. Sales were previously expected to be in the range of $55 to $56 billion while capital expenditures were expected to be $2.5 billion.

Sales volumes decreased because of lower availability of live cattle. Operating income of $889 million was also impacted by higher fed cattle costs and a $333 million goodwill impairment charge. For 2024 management expects this to be in the range of $800 million to $1 billion.

Medium Rare Dividend

Despite the lower sales volumes and financial issues, TSN did manage to increase its dividend by a penny to $0.49. Additionally, the company has a solid dividend streak of more than 30 years without a reduction, so technically they’re a dividend aristocrat. But with their cash flow issues that I discuss later in the article, right now the stock is a pretender because of the risk of a cut.

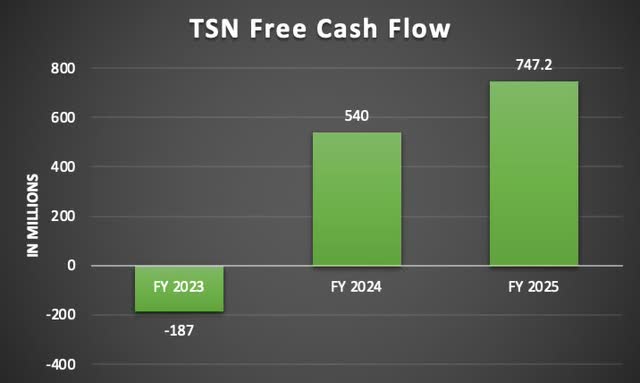

As a dividend investor, I wouldn’t invest my money into this stock currently. For 2023, the company’s FCF was a negative $187 million while they paid out a total of $670 million in dividends. In my opinion, management should have chosen to hold the dividend steady at $0.48 instead of the penny increase. But seeing as they are a dividend aristocrat and their staying power, I understand the move of electing to raise it.

Author creation

And while free cash flow is expected to improve over the next two years, the company is still expected to have negative free cash flows in 2024 with only $540 million expected for the year and almost $700 million in dividends. Over the last 2 years, Tyson has paid an average of $661.5 million in dividends. Even with cash flows expected to improve more than 38% to $747 million in 2025, this would still give the company a payout ratio of more than 90%, way above what is considered a safe range.

The company did buy back more than 193,000 worth of shares in 2023 at an average price of $53.57 according to their 10-K. So they have been decreasing their share count rather steadily. This totaled to $354 million worth of shares, roughly half of what they bought in 2022. Even with the decreasing share count, it will take some time for the company to become cash flow positive. This means the dividend is at risk of a potential cut for the foreseeable future.

BUY: Agree Realty (NYSE:ADC)

Most know the REIT sector experienced a volatile year in 2023 but I think the sector is poised for a nice rebound this year. Some stocks have already seen their prices recover nicely in the last few months. Since hitting a new 52-week low, Agree Realty’s share price is up more than 10%. The stock is now trading near $63 a share at the time of writing.

With rates expected to decline significantly this year, several REITs will reward shareholders with some nice capital gains. During the downturn in the sector, ADC was the stock in my portfolio I was adding to the most. I also added to some of my other REIT positions but Agree Realty was my preference.

Growing Monthly Dividend

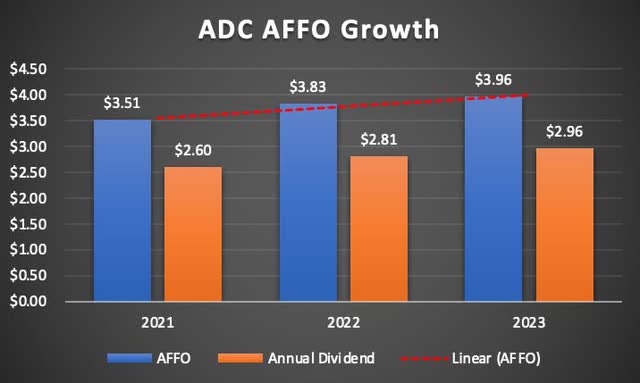

Despite all the volatility within the sector, I still got two dividend raises in 2023. With more than a decade of dividend increases and a conservative payout ratio of just 74%, the monthly payer has ample room to continue growing the dividend for the foreseeable future. Over the last 10 years, the REIT has maintained an average AFFO payout ratio of 76%, well below the sector average.

In the chart below you can see Agree Realty has continued increasing its dividend while growing AFFO nearly 13% in the last two years. The REIT is set to report earnings later this month and has earned a total of $2.96 in AFFO. I expect the company to bring in at least $1.00 in AFFO in Q4 for a total of $3.96 for the fiscal year. This would give them a payout ratio of less than 75%.

Author creation

During their Q3 earnings call, their CEO stated that he expects ADC to deliver at least 3% AFFO growth in 2024 on a per share basis. That’s in the absence of external growth, which is impressive. Including the dividend yield of nearly 5%, investors get almost 8% in yield & growth to hold ADC. Not bad if you ask me, especially from a monthly paying company of this caliber.

Further Strengthening The Portfolio

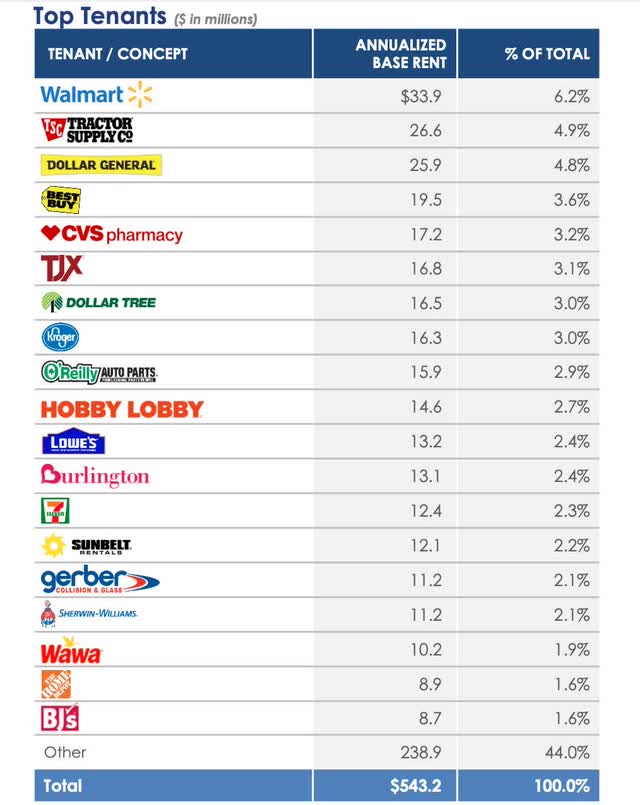

In 2023 the REIT further strengthened its portfolio by upping its exposure to investment-grade tenants. Furthermore, they also increased their ground leases and these now account for more than 11% of annualized base rent.

ADC December presentation

This segment included 88% investment-grade tenants like Walmart (WMT), Lowe’s (LOW), and Home Depot (HD). These had a weighted average lease term of nearly 11 years. They also have one of the best balance sheets in the sector with no significant amount of debt maturing until 2028. As the company continues on its path to growth in the coming years, I expect them to receive an upgrade in credit rating. Their CEO stated the current rating of BBB was sheerly due to size and I agree. So, as the company continues making acquisitions in the foreseeable future, I expect an upgrade to BBB+.

Furthermore, they also maintain one of the best leverage ratios in the sector at just 4.5x net-debt-to EBITDA. This is in comparison to Realty Income’s (O) 5.2x and NNN REIT’s (NNN) 5.4x. With no debt maturing to worry about and available liquidity, ADC doesn’t have to worry about refinancing headwinds in the coming months or years for that matter.

Risks

Although rates are expected to decline significantly this year, a risk both companies face is the threat of the mild recession expected sometime in the foreseeable future. With Tyson already facing downward pressures on their financials, a recession would likely cause further damage to the company. Tyson faced significant challenges this year due to market dynamics in beef & pork.

I also expect 2024 to continue placing pressure on the business because of the limited cattle supply. Management stated they also expect challenging supply conditions to remain. During the last recession in ’08-’09, the company faced similar headwinds. Chicken sales were up while beef & pork sales faced pressure.

This caused management to lower the value of its beef segment and annual sales dipped in ’09. Similar to the GFC when high feed & fuel prices and the economic slowdown made it difficult for the business, I expect similar headwinds. Although, the looming recession is expected to be mild compared to the GFC.

For Agree Realty although the share price experienced some volatility, the REIT continued to outperform. If a recession does come to fruition, ADC could see its financials affected due to a drop in occupancy ratings. The company has maintained a stellar rating of over 99% the last few years, but a slowdown in the economy could impede financials going forward.

A slowing economy could also affect development projects the REIT has in the works, similar to the pandemic when the slowdown caused projects to be delayed for several businesses. This could hurt ADC as portfolio growth could be slowed for the foreseeable future. The company was forced to cut its dividend during the GFC, but to be fair they were a much smaller company back then.

Valuation

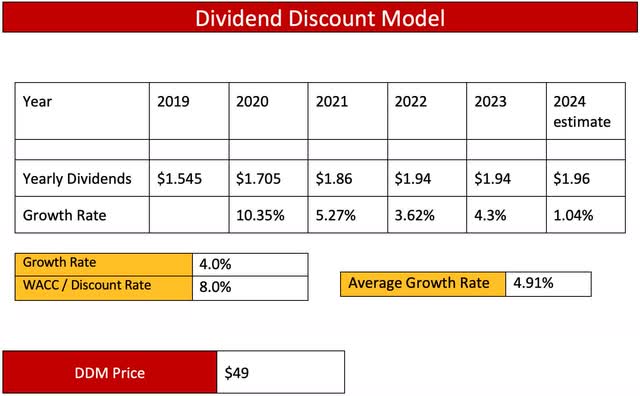

In regard to Tyson, if you believe in the long-term growth outlook of the company and their track record & brand, then the stock is very attractive at the current price. The company experienced more institutions buying than selling, more so in the third quarter last year. Furthermore, the stock offers little upside to its price target of $54.50. Using the Dividend Discount Model I have a price target of $49 for the stock, roughly 8% downside from the current price of $53.40.

Author creation

This is roughly in line with TipRanks price target of $48.17 for Tyson. Because of the cash flow issues, expected economic downturn, and downside risk, I think the stock is a pass and sell at the current price.

TipRanks

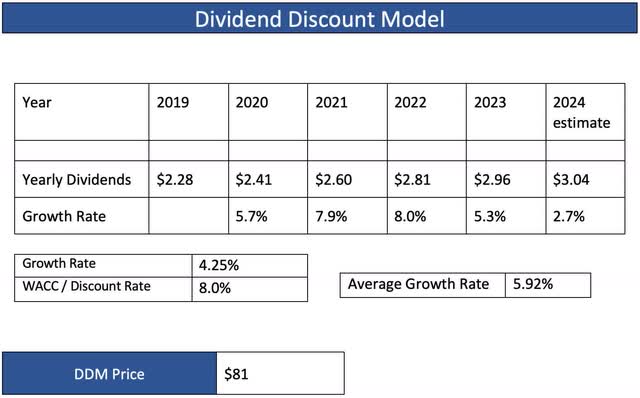

In regard to Agree Realty, using the DDM model, the REIT offers investors double-digit upside to the price target of $81. This is more than 26% higher than the average price. But with REITs typically posting higher returns after the rate hike cycle, I could see ADC reaching new highs in the not-so-distant future.

Author creation

Analysts currently have the stock rated as a strong buy. At its current price of roughly $63, the stock offers little to no upside. But as I previously mentioned, I expect the sector to outperform in 2024 as rates decline. And I expect Mr. Market to reward the higher-quality ones in the sector like ADC accordingly.

TipRanks

Bottom Line

As investors expect market conditions to ease as rates decline in 2024, I think Agree Realty is one of the best quality REITs your money can buy. A monthly dividend that’s well-covered by growing FFO & AFFO, along with a strong, growing portfolio. On the other hand, Tyson Foods is still expected to face cash flow issues, which puts the dividend at risk of a cut. To be fair, I think the company will do everything they can to keep their dividend streak intact.

Because of the economic slowdown, and market conditions expected to continue impacting cash flows going forward, I think TSN is too risky. If you believe in the business and think management can right the ship, then the stock is great for a potential turnaround story and may reward investors with some capital appreciation down the line. But for now, ADC is a buy with rates expected to decline and Tyson Foods is a sell.

Read the full article here