Introduction

I have been keeping an eye on some European cement producers, as the decreasing interest rates may spark renewed enthusiasm in the real estate and construction sector. And of course, when the war in Ukraine ends, Eastern Europe will need a lot of construction materials for the reconstruction of the eastern side of the country. That’s why I was predominantly looking at cement producers with exposure to Eastern and Southeastern Europe. Titan Cement (OTC:TTCIF) fits that bill. Although the company has a Belgian ISIN-code and is listed on Euronext Brussels, it actually is a Greek company.

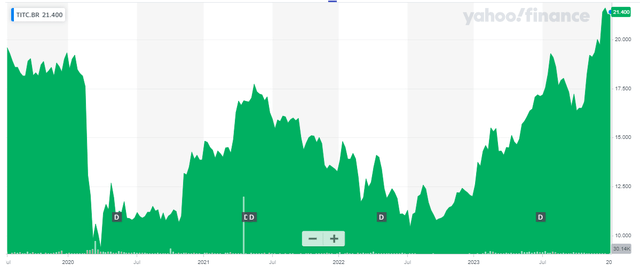

Yahoo Finance

Although the Greek listing is the most liquid, with an average daily volume of 45,000 shares per day versus the Belgian listing of just 9,000 shares per day, I think most brokerage firms offer easier access to Euronext Brussels rather than the Athens stock exchange. The ticker symbol for Titan Cement on both exchanges is the same: TITC. The current share price is 21.40 EUR, and as there are approximately 74.3M shares outstanding (taking the most recent share buyback update into account), the market capitalization is approximately 1.6B EUR.

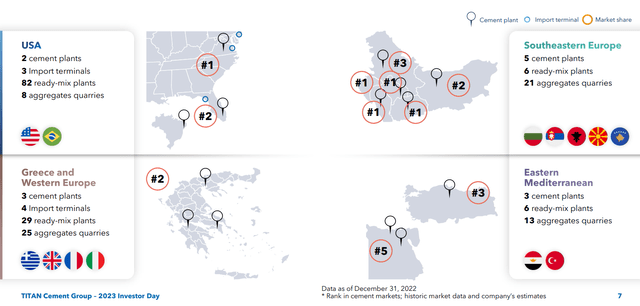

The company was founded in 1902 and has grown into an important European player in the cement industry. Titan Cement also expanded into the US, where it owns and operates eight quarries and two cement plants.

Titan Cement Investor Relations

The financial results are surprisingly strong this year

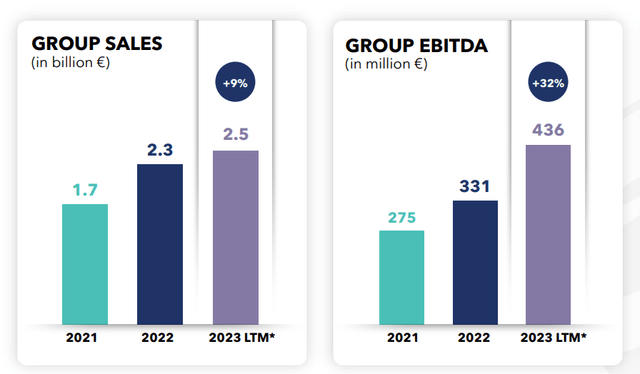

While I started tracking cement producers in the first quarter of this year, I didn’t want to pull the trigger as I was expecting a bigger impact of the slow-down of construction and real estate activities on the cement producers. I was completely wrong about that, as not only did the entire sector perform well from a financial perspective, the share prices moved up accordingly. Titan Cement was even able to publish record earnings on the back of a substantial improvement of the margins.

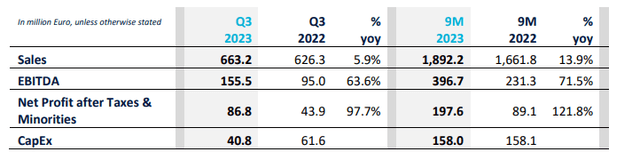

Titan Cement Investor Relations

The table above shows how the EBITDA increased by almost 64% despite reporting a revenue growth of just 5.9%. This means the Q3 EBITDA margin jumped from just over 15% to in excess of 23% and this obviously also had a very positive impact on Titan’s earnings.

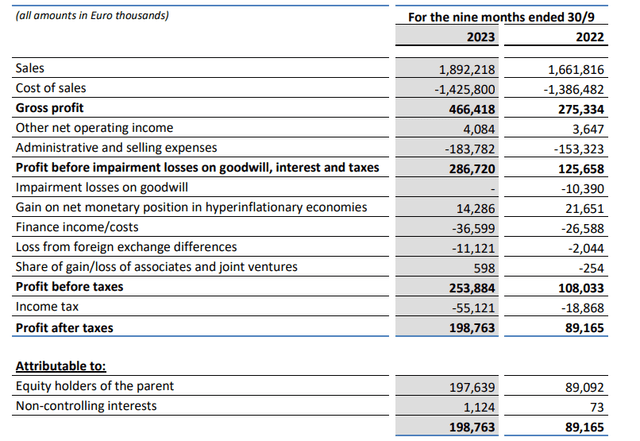

Looking at the financial results for the first nine months of the year, Titan Cement reported a total revenue of 1.9B EUR, resulting in a gross profit of 466M EUR. That’s an increase of in excess of 190M EUR compared to the first nine months of 2022. Additionally, while the G&A expenses also increased by a double-digit percentage, the EBIT came in at 286M EUR, which is more than twice the 125.7M EUR reported in the first nine months of last year.

Titan Cement Investor Relations

Sure, the net interest expenses continued to weigh on the result, but the higher interest expenses were more than fully compensated by the stronger operating performance. And as you can see below, the net profit came in at almost 199M EUR. After deducting the portion of the net profit attributable to non-controlling interests, the net income attributable to the common shareholders of Titan was 197.6M EUR for an EPS of 2.64 EUR per share. Definitely not a bad result for just the first three quarters of the current financial year.

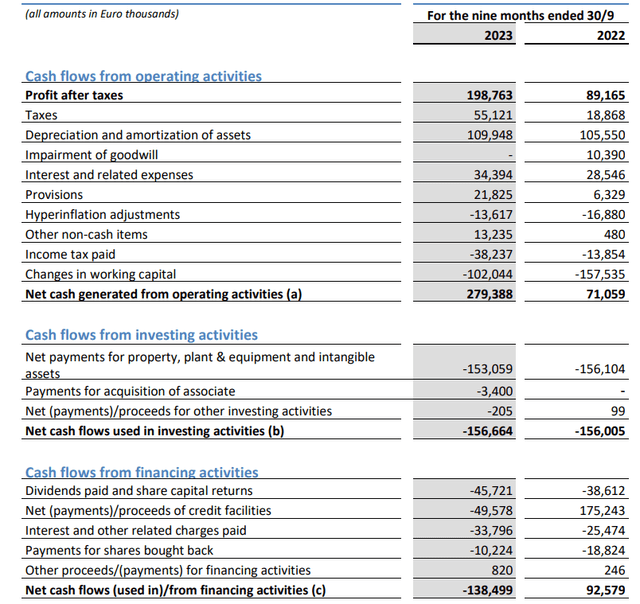

And the strong earnings aren’t just a “paper profit.” The cash flow statement confirms the company is printing cash. As you can see below, the total operating cash flow was 279.4M EUR, but this includes a 102M EUR investment in working capital changes while we should also deduct an additional 17M EUR in taxes as well as 33.8M EUR in interest payments. Additionally, and this is not shown in the cash flow statement below, there were some lease payments. A look at the more detailed annual report shows there were 17M EUR in short-term lease liabilities at the end of last year. This translates into an average quarterly lease payment of 4.25M EUR, so I will use a 13M EUR lease payment in the first nine months of the current financial year.

Titan Cement Investor Relations

This means the adjusted operating cash flow in the first nine months of 2023 was approximately 317.6M EUR. We see there was a total capex of 153M EUR (excluding acquisitions) and that’s relatively high as Titan Cement continues to invest in itself. The 9M 2023 capex of 153M EUR and the 13M EUR in lease payments represent approximately 155% of the depreciation and amortization expenses. And those investments will pay off, as the company has unveiled its plans for 2026 at a recent investor day.

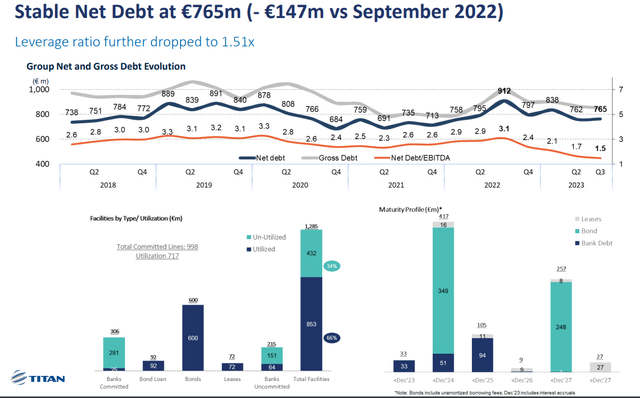

The strong cash flow result obviously also helped the balance sheet. At the end of September, Titan Cement had 86M EUR in cash on the balance sheet and approximately 850M EUR in financial debt and finance liabilities, for a net debt of 765M EUR.

Titan Cement Investor Relations

After filtering out the lease liabilities, the net financial debt is approximately 700M EUR, which compares very favorable to the 383M EUR EBITDA generated in 9M 2023, adjusted for lease amortization. Also, worth mentioning is the company’s most recent debt issue. Last month, it issued 150M EUR of 6 year notes with a coupon of just 4.25%. And that is actually lower than the current average cost of debt.

The 2026 targets are ambitious but appear achievable

We should perhaps be a little bit conservative when it comes to the Q4 earnings result, as Titan Cement’s final quarter of the year can be pretty volatile. It generated a net profit of just 20M EUR in Q4 2022 and Titan Cement has been warning for an uncertain year-end period, and it expects the uncertainty to continue into the first part of 2024.

Some of the targets appear to be relatively “easy” to achieve. The annual EPS of 3 EUR per share appears to be a given, especially if the company wants to grow its EBITDA at a double-digit percentage on an annual basis.

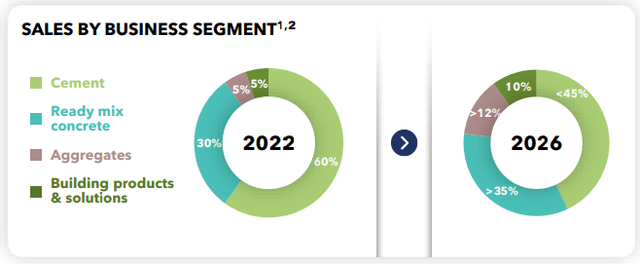

Titan Cement Investor Relations

Interestingly, the company also would like to reduce its exposure to just cement as it will increase its exposure to all other divisions. The ready mix concrete weighing in the revenue should increase, but it also wants to more than double the revenue from aggregates sales.

Titan Cement Investor Relations

Investment thesis

2023 is shaping up to be a surprisingly strong year for Titan Cement, and I hope the company can repeat this performance in 2024. I think Titan’s projections for 2026 are achievable and while it moves toward a full-year EPS of 3 EUR per share, it should be able to further reduce its net debt position which in turn will have a positive impact on the free cash flow thanks to lower interest payments.

I have a small long position in Titan Cement as I only got a partial fill on an order, but I will be looking to further increase my exposure to Titan Cement in 2024.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here