Eagle Point Credit Co LLC (ECC) is a closed-end investment fund with rather similar dynamics to BDCs, which seek loan-type investments across the private capital markets and invests in them (or originates) with the help of external leverage to maximize the spread between cost of capital and the loan portfolios.

In ECC’s case, the difference lies in the investment policy, which focuses on investments in equity and junior debt tranches of CLOs.

There are many people, who would disagree with this, but this fact alone that ECC allocates into the most speculative CLO structures renders the fund risky and more volatile than most of the BDCs or other yield-seeking CEFs out there.

The current dividend yield of ~17% serves as clear proof of that, where high risk per definition requires higher returns, which come in the form of elevated yield here.

However, this high yield or bias towards inherently unprotected CLO structures does not automatically turn ECC into a subpar investment (or a seemingly attractive one, if some investors tend to think that almost 20% yield implies a great opportunity).

Let’s now explore the underlying details of ECC and determine whether yield-seeking investors should view this as a decent investment and consider going long.

Portfolio structure

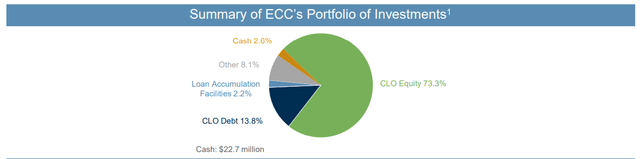

As stated a bit earlier in the article, ECC is heavily skewed toward CLO equity and junior debt tranches, which together make up ~87% of the total portfolio.

ECC Investor Presentation

The tricky thing is that the lion’s share of this goes to CLO equity, which entails even higher risk than CLO debt as equity holders (i.e., CLO equity tranche) act as the first line of defense when the dominoes start to fall. Namely, in the case of even a single loan default, CLO equity holders would be forced to recognize either a loss or receive lower returns, while CLO debt holders could still enjoy their cash flow streams as planned. The CLO equity component has to be (theoretically) fully wiped out before the debt tranche would become subject to some downward revisions.

This aspect is the key driver behind ECC’s risk and dividend yield of 17%. All the remaining aspects of the portfolio are well-structured and give no meaningful reason for additional concerns.

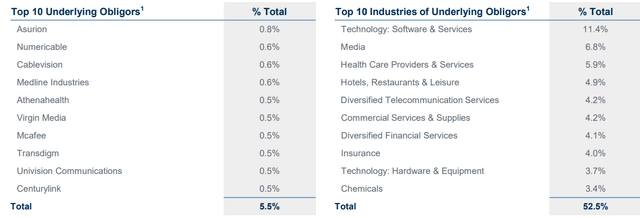

For example, if we look at the diversification aspect, ECC carries a very tiny concentration in the Top 10 holdings, which account for just ~5.5% of the total AUM. Industry-wise, ECC is also greatly diversified where the Top 10 constitutes ca. 52% of the exposure. It is not that often when we see this level of diversification among high yielding CEFs and especially BDCs.

ECC Investor Presentation

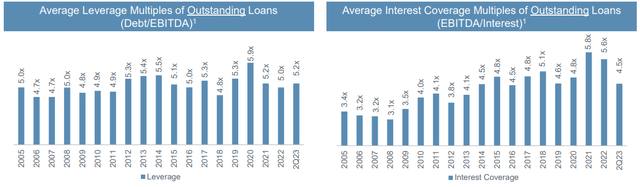

On top of that, we currently see some very positive dynamics in the CLO outstanding loan space, where the average outstanding loan seems rather protected by acceptable leverage and coverage profiles.

ECC Investor Presentation

Risk areas

Now, as mentioned above, the aspect of almost pure-play exposure toward the most speculative classes of CLOs, makes me uncomfortable with ECC. The notion of diversification and even overall sound loan coverage ratios do not neutralize the risk of a sudden and painful correction in the NAV base, which could happen if loan defaults start to increase.

If we start to experience rising corporate defaults and struggles in the economy, it is clear that this will bring systematic consequences of the CLO funds irrespective of how diversified they are.

And the current metrics we see on the loan coverage end, all are averages and obviously include much weaker loans that fall into the riskier buckets of the CLO universe that could introduce serious difficulties for CLO equity and junior tranches in the case of economic distress.

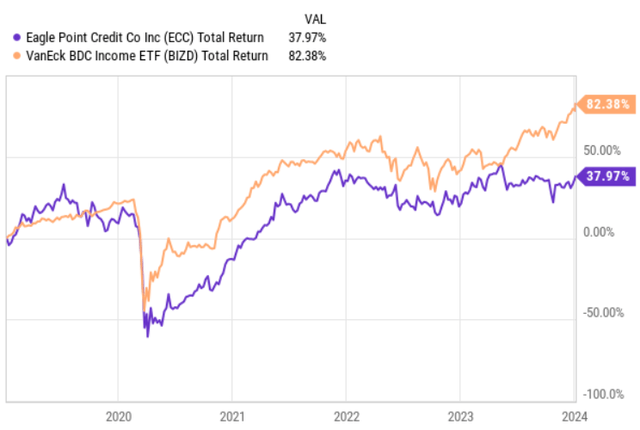

Furthermore, the total returns over the past three years have not been that great for ECC (i.e., the fund has underperformed the BDC average) even though we currently live in a period of almost non-existent or very immaterial corporate defaults.

YCharts

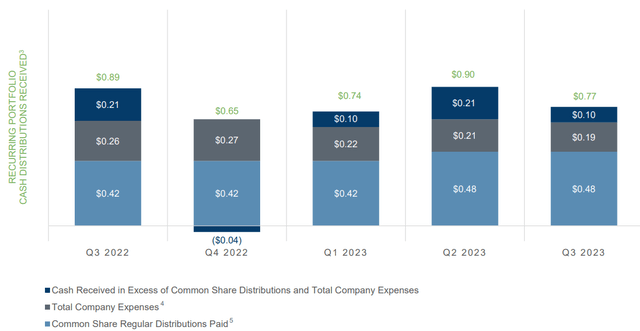

Plus, over the same time period, the cash generation profile of ECC has been rather volatile, where in Q4, 2022 it was forced to tap into its NAV base to accommodate the existing dividend (which in turn was significantly decreased in early 2020 because of the pandemic).

ECC Investor Presentation

Preferred shares as a solution

As a result of the aforementioned, ECC’s equity exposure is just too risky for my taste. While the current yield of ~17% is indeed high and currently seems attractive also from the coverage perspective, the notion of CLO equity (and slight junior debt) coupled with subpar total return performance despite one of the calmest times in terms of the loan defaults, renders ECC’s equity story unattractive.

However, in contrast to ECC’s equity, the Eagle Point Credit Company Inc. 6.75% PFD SR D (NYSE:ECC.PR.D) seems a more appealing deal to me that is still offering a relatively attractive yield of ~8.5%. Granted the yield is much lower in relative terms, but on an absolute level having an ~8.5% dividend could be easily deemed attractive.

These preferred shares were issued back in late 2021 at a par value of $25 per share and a call date of November 2026 (where the call strike is based on the par value, i.e., $25 per share).

Assuming that ECC exercises its call option, investors would immediately benefit from price appreciation (or convergence back to par) that would translate to ~27% in just price return alone. On top of that the preferred provides an attractive yield that makes the holding process acceptable for current income investors as well.

Now, the key reason why I strongly prefer ECC’s preferred shares over equity is because it would really take a major economic shock to completely wipe out the surplus cash that ECC currently generates and distributes to its equity holders. And only once this surplus cash is gone, the preferred shareholders would be in a position to start worrying about their dividend proceeds.

Otherwise, slight changes in the CLO sector or several write-downs in the ECC’s portfolio really do not move the needle in the context of ECC’s preferred shareholder ability to safely capture the distributions.

Even in one of the worst financial conditions we had during the pandemic period, ECC was not forced to cut the entire chunk of its dividend and instead was in a position to keep a notable part unchanged and later revert back to a dividend growth trajectory.

The bottom line

ECC is a well-structured CEF, but the fact that it invests in the most speculative tranches of CLOs coupled with inferior returns to the overall BDC market despite having such strong tailwinds in terms of extremely muted corporate defaults renders the equity story unattractive.

Nevertheless, given that ECC has indeed introduced a decent diversification component and has strong cash generation to support a ~17% yielding dividend (thus implying a huge margin of safety for ECC’s preferred investors), investing in preferred shares offers a better mix of returns and risks. This is especially true considering that the current yield of ECC’s preferreds stands at 8.5%, which comes on top of the underlying discount to par, which if called by 2026 would generate an additional ~27% return.

Read the full article here