Editor’s note: Seeking Alpha is proud to welcome Akim Guerreiro as a new contributor. It’s easy to become a Seeking Alpha contributor and earn money for your best investment ideas. Active contributors also get free access to SA Premium. Click here to find out more »

Business Overview And Recent Changes

Tripadvisor, Inc. (NASDAQ:TRIP) is an American online travel company that operates in the entire spectrum of travel guidance: accommodations, restaurants, experiences, airlines, cruises along with hosting hundreds of millions of travellers’ reviews and thousands of discussion blogs on its platform. The company is implemented in 48 countries and 28 languages, and continues expanding every year. The company was founded in 2000, with the rise of the internet, giving it an important first-mover advantage.

And yet, I am not overly bullish in the short-term on the stock. Indeed, Tripadvisor has been struggling to return to a path of high growth: the revenue in 2022 was at the exact same level as the 2015 revenue ($1.49 billion). It’s in this context that Matt Goldberg stepped in as CEO to try and turn around this travel gem back to a path of high growth. The medium-term to long-term narrative may be different and could make today’s entry price (roughly $20 per share) an attractive opportunity for the next 3 to 5 years.

Investment Thesis – The Resurgence of a Company and its (Cheap) Stock

Is 2024 the year for a resurgence of this tech company? I do see enormous upside with limited downside for the stock, but the investors buying into it will have to be patient – really patient. I rate the stock as a Strong Buy that could materialize in a solid return in the next 3 to 5 years. Indeed, with the recent change in management with a new CEO replacing the former co-founder CEO and the improved financial performance, the company seems to be back on double digits’ growth in revenue and in EBITDA.

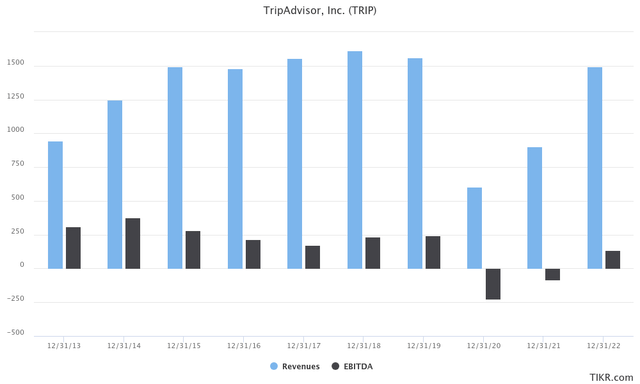

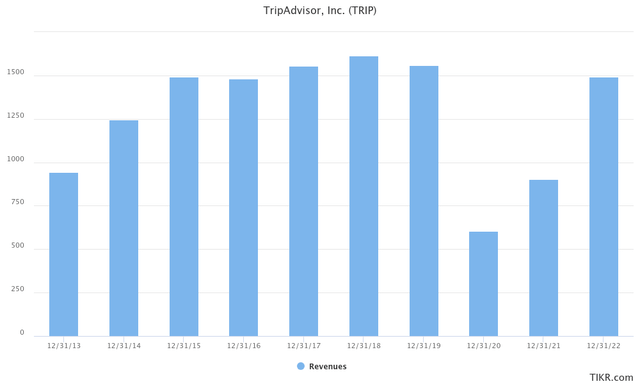

Indeed, Revenue Growth Has Stalled

Tripadvisor was on a path of double digits’ growth until the end of 2015, when essentially the company reached the glass ceiling of the segments it operates in.

www.tikr.com

EBITDA has struggled to show any growth trend since 2014, and it has been declining ever since. The way I see it, the large amount of layoffs induced by the covid market environment in 2020 (25% of the staff was cut that year alone) could cure an inert EBITDA growth and boost the stock valuation.

www.tikr.com

When I look at the last quarters, the company is looking increasingly attractive with an EBITDA growth trend seeming to emerge, especially since the arrival of the new CEO in Q1 of 2022 (more on that later in this article).

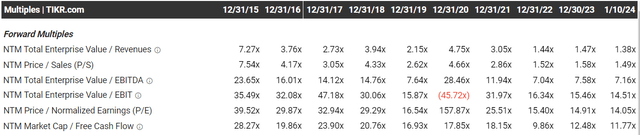

Valuation & Estimates Show The Stock Is Really Cheap Now

From the valuation perspective, I believe we are right in the sweet spot. The valuation is well below historical levels, discounted for the last few years of covid-related drop in revenue, and it has not captured yet the recent quarters’ growth despite showing signs of pick-up (the stock price increased by +17% in the last 6 months).

www.tikr.com

By practically every forward-looking metric, the stock is a strong buy now. It even got more attractive after the first trading days of the year due to an overall tech-led drop of a couple of percent. Comparing with

Booking Holdings Inc. (BKNG) using Seeking Alpha’s comparison tool, a much larger competitor that has already had its own efficiency turnaround a few years back, Tripadvisor is trading at a significant discount. Where Tripadvisor trades at a forward 7.16x EV/EBITDA, Booking Holdings is trading at a forward 17.34x. Additionally, based on the median observed in the worldwide software sector, stocks were trading in 2023 at around 15.88x. If Tripadvisor is able to convince the markets that it is on a turnaround track, the stock could trade at around $40-50 in 2-3 years time in line with the market multiples above – if EBITDA’s double digits’ growth is confirmed and the company reinvents itself into an innovative software company, which was what the company was about when it was founded in 2000 with the rise of the internet.

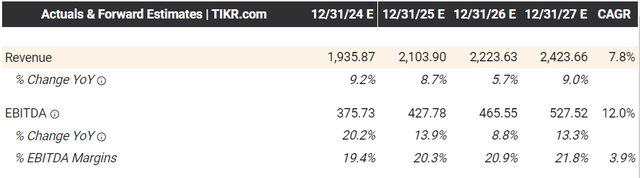

Another reason I believe we are today in the sweet spot is because the investors, perhaps still shaken from the covid crash, have not taken yet into account the cheap valuation in relation to the estimated revenue growth and, perhaps more interestingly, the EBITDA growth outperforming revenue growth.

www.tikr.com

This outperformance of EBITDA in relation to revenue growth could indicate the company is on track to increased efficiency, and without doubt it has something to do with the new senior management changes.

The time gap between past financials, future estimates and delayed market reaction is exactly where the alpha resides. That’s for me reason enough to buy the stock now and to hold it for 3 to 5 years.

New Management, New Hope?

In my opinion, Management lead by the co-founder Stephen Kaufer got too comfortable in the old ways (he declared “we got too comfortable” already in 2014) and has failed to realise that a company has to reinvent itself and innovate when revenue growth stalls (unless it’s due to the macro environment). The latest covid debacle with 900 layoffs in 2020, the 2020 sale of several Tripadvisor-held brands to Hopjump and the restrictions from the Chinese government on the app have all led investors to panic, and the stock price reached an all-time low in 2023.

And yet, I think the stock is a buy. The change in senior management with Matt Goldberg as CEO since 2022 is what the company needed already since 2016. Matt Goldberg is an exotic pick in the sense that he has not built his career in Tripadvisor, and his experience is for the most part in segments such as advertisement (The Trade Desk (TTD)) and online shopping (Qurate (QRTEA)). And these experiences from the CEO could help Tripadvisor to tap untapped revenue growth pockets. It is no coincidence that the company has shown an average YoY growth of 42% per quarter since the arrival of the new CEO, albeit it may be powered by a catch-up effect on the covid years’ drop. Interestingly, the layoffs in 2020 could be beneficial as the company is essentially forced back into efficiency without the new CEO needing to do the worst part of the role. Time will tell if the company is back on track to a double digits’ growth.

Risk Factors And What Could Make It Lose My Strong Buy Rating

The main risks I see that could make me reassess the Strong Buy Rating is artificial intelligence (AI) and the new CEO’s performance over time. As shown in this article published on Seeking Alpha, AI could be an enormous enhancer for online travel companies to tap new sources of revenue by integrating the technology in improving the travel booking experience, making it a much smoother process for the consumer, and in targeting ads in a better manner. Should Tripadvisor fail to integrate the new AI advancements in its ecosystem, it could cause it to lag behind its main competitors for a while longer. Additionally, if the new CEO fails to convince existing investors that Tripadvisor is back to growth and not only catching up from the covid period, the markets could give up on the stock. The next couple of quarters will be decisive to demonstrate that the uptrend is indeed real.

Bottom Line

After complicated years due to covid and an old management team led by the co-founder since 2000, Tripadvisor had lacked innovation and efficiency. Revenue had stalled and EBITDA had turned negative.

But with the new CEO since early 2022, a growth trend seems to emerge, and a return to double digits revenue and earnings growth seems in the cards for the next couple of years.

The valuation has not yet reflected the turnaround, and the markets have yet to pick up on this opportunity. The stars are now in alignment for the stock to outperform the market.

The stock is definitely an attractive play in a portfolio that wants to have increased exposure in both the travel and the tech sectors, and it is suitable for both growth and value investors at this point in time.

Read the full article here