A leader is a dealer in hope.” -Napoleon Bonaparte.

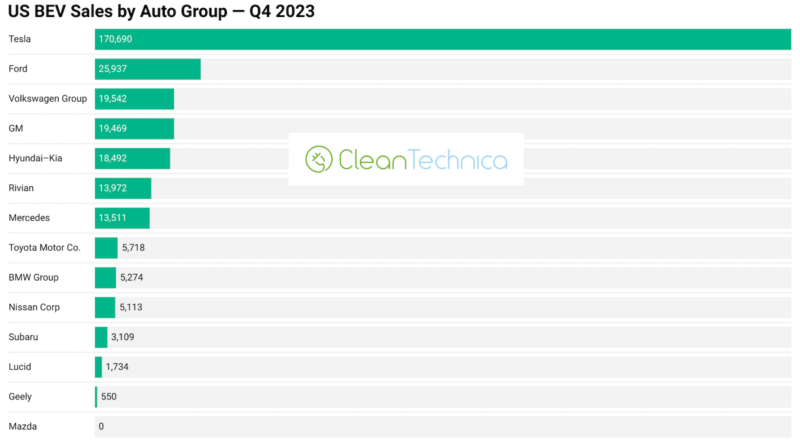

Tesla, Inc. (NASDAQ:TSLA) CEO Elon Musk has garnered much polarizing media attention lately, but Tesla’s stock is looking increasingly like a good buy from several vantage points. When we look at stocks with a financial aim in mind, it’s essential to disregard polarizing and emotional narratives as much as possible and to evaluate securities dispassionately. This is truly the essence of securities analysis. And all the polarizing headlines aside, the prolific electric vehicle (“EV”) automaker’s lead in the U.S. market is still dominant.

CleanTechnica

Positive or negative media frenzies are sometimes an opportunity to exploit the false beliefs of the crowd. The company’s CEO and the focus on Tesla in the headline cycle can sometimes create a distorted impression that shrewd investors can exploit. I think this is one such moment of opportunity.

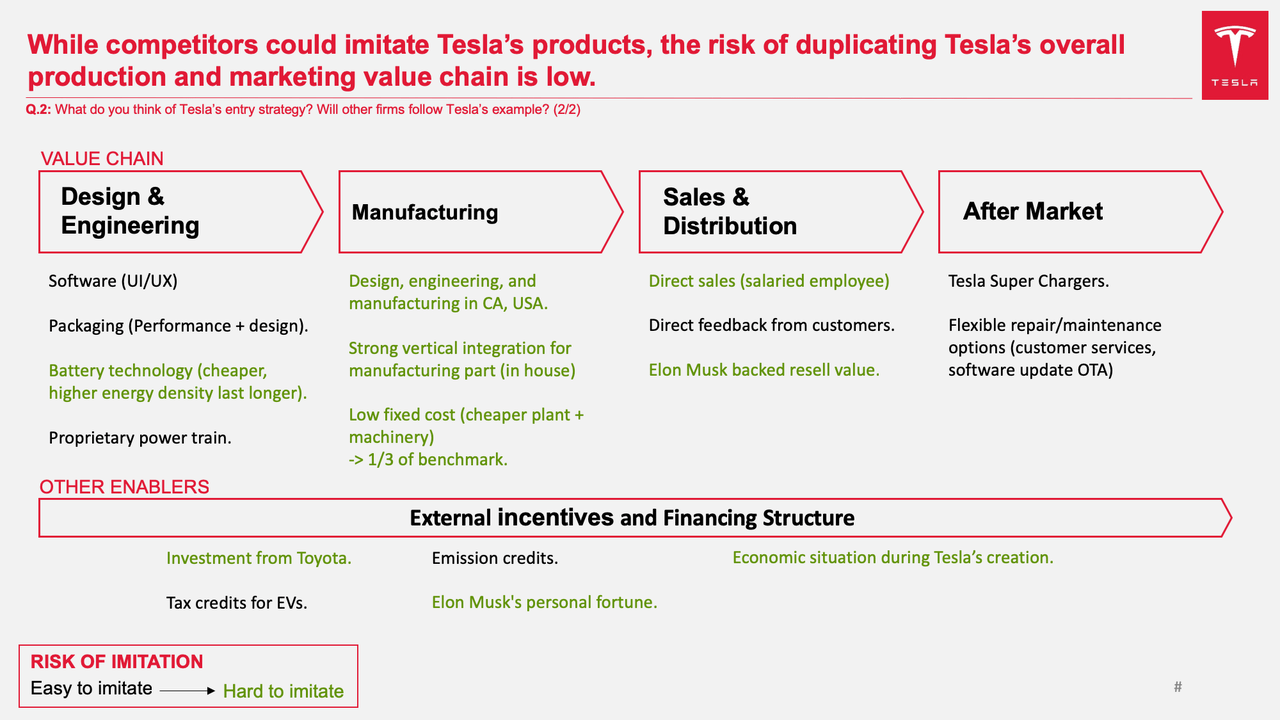

There are a lot of negative headlines that have nothing to do with the stock’s ability to generate free cash flow over the next decade, and there are a lot of positive data points coming out, like the company exceeding sales and maintaining a dominant market share like in the graphic above. I like that setup. Plus, Tesla’s competitive advantages are neither easily eroded nor copied.

LeonardTakada.com

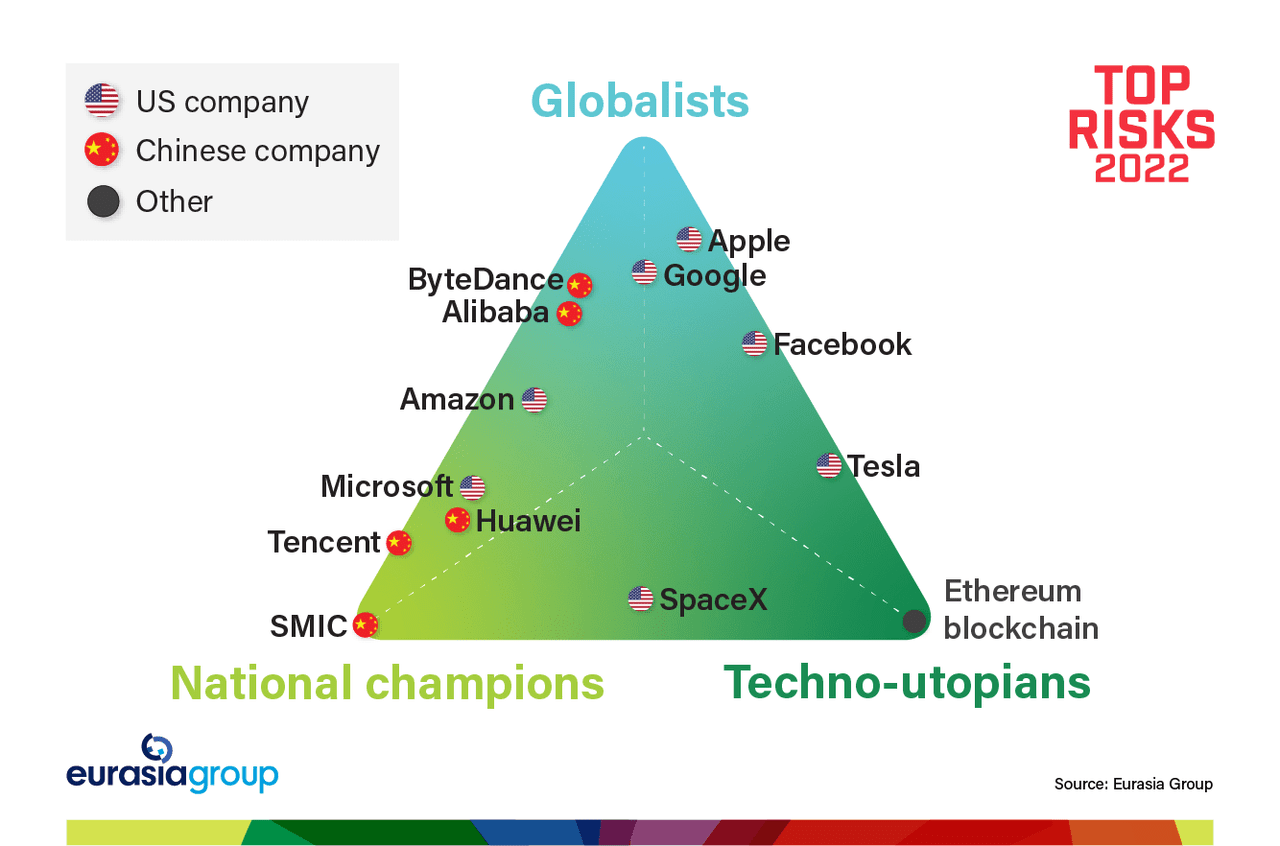

The other thing about Tesla that some may not realize is that it occupies its own unique lane within the Technology complex. In an insightful article by Eurasia Group’s Ian Bremmer, he labeled the firm as “Techno Utopian” instead of some of its more seasoned tech peers, as you can see below.

In contrast to the other two groups, this camp [Techno-Utopians] centers more on the personalities and ambitions of technology CEOs rather than the operations of the companies themselves. Whereas globalists want the state to leave them alone and maintain favorable conditions for global commerce, and national champions see an opportunity to get rich off the state, techno-utopians look to a future in which the nation-state paradigm that has dominated geopolitics since the seventeenth century has been replaced by something different altogether. – Ian Bremmer, “The Technopolar Moment: How Digital Powers Will Reshape the Global Order.”

Whereas Apple (AAPL) has a vested interest in a pre-COVID global economic order due to its presence in China, and Microsoft (MSFT) has become an arm of the United States government with regard to cyber security in a way, Tesla and some of the firms under techno-utopian umbrella take a more ambiguous approach to partnering with governments.

Instead, techno-utopians like Tesla see technology as a revolutionary force with a moral license and legitimacy on par with the state’s. This is a high-risk position sometimes, but it has attracted some of the cream of the crop of the world’s engineers.

Eurasia Group

I want to focus on Tesla’s future earning potential and valuation in this article. Regardless of polarizing issues in the headlines, I think this analysis will be more relevant to deciding whether or not there is still alpha in Tesla’s stock.

But it would be best if you viewed Tesla’s tendency to clash with the state and with authority as a feature, not a bug. It is by design, and Mr. Musk has documented his viewpoint that all rules are more like “suggestions.” However, some of this constant contradiction is part of Mr. Musk’s brand and perhaps even his connection with prospective consumers.

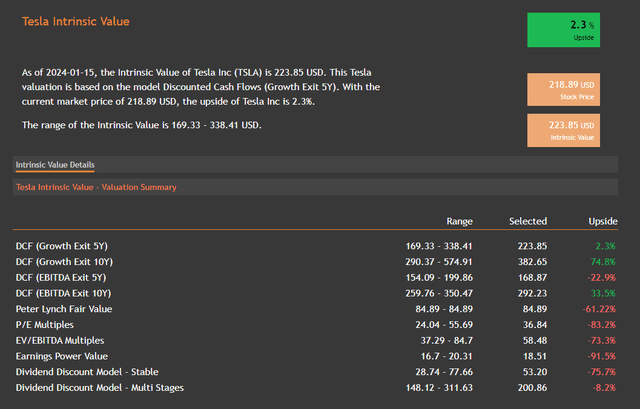

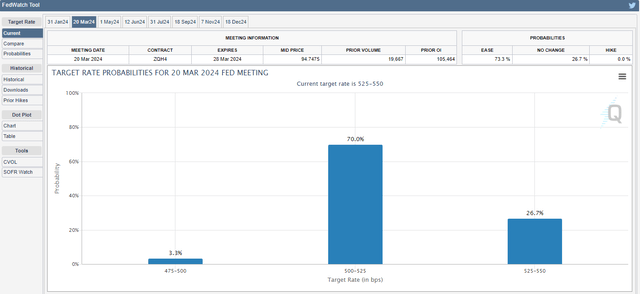

All this aside, my favorite valuation model suggests an upside in the stock, particularly given the likelihood of Fed cuts later in the year. Tesla is a member of the Magnificent Seven, and despite its drawdown over the past few months, it will still benefit significantly from falling rates, all else being equal.

ValueInvesting.IO

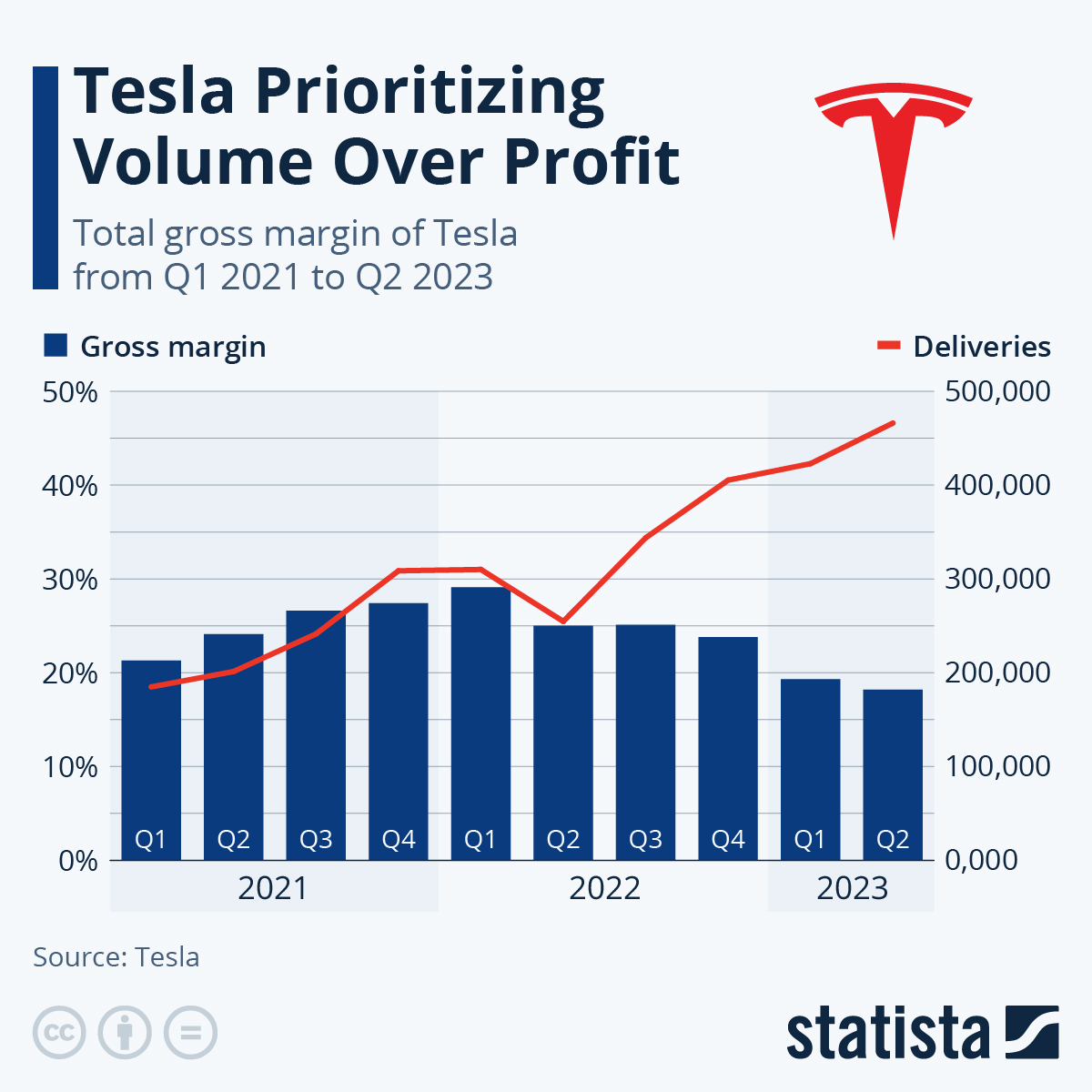

Furthermore, while Tesla’s price cut strategy has downsides and its fair share of detractors that make some compelling arguments, the second-order effect of this strategy, in addition to helping maintain market share, will also likely be increased resilience in an economic slowdown. It appears to have the desired effect of defending market share and increasing market penetration in critical groups of consumers, such as millennials.

Statista, Company Reports

This should help the stock’s valuation because bankruptcy during down cycles of demand is one of the main culprits of auto bankruptcy. I think the Cybertruck also establishes a credible beachhead in the lucrative Truck market that complements Tesla’s aging body types from a brand perspective. But the core of Tesla’s moat is in the physical world with manufacturing. The manufacturing excellence and innovation that the firm possesses lead me to believe that incremental outperformance is possible and can add up over time.

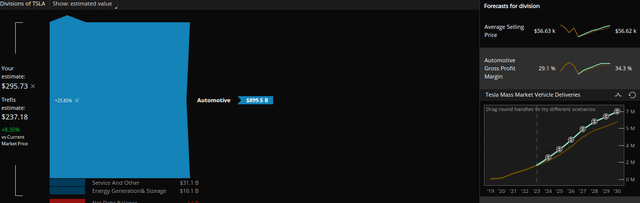

ThinkOrSwim

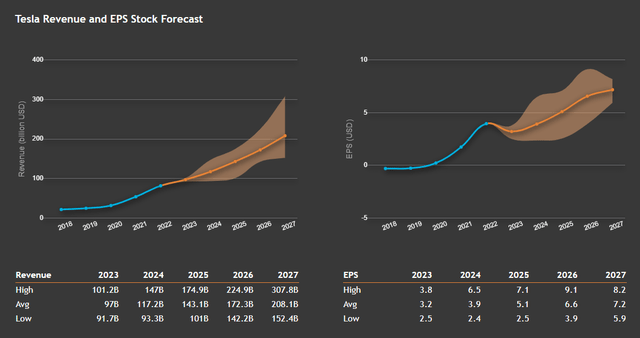

In my opinion, though, Tesla can potentially sell more cars than the consensus currently forecasts. This is because of their technological edge in certain areas that could redefine the competitive picture. It is not an out-of-bounds assumption that Tesla could produce 16% more cars in 2030 than anticipated. And by adding some incremental outperformance, the model gets an intrinsic value of around $296 compared to $237. This is congruent with the values suggested by discounted cash flows, or DCFs, with longer time horizons.

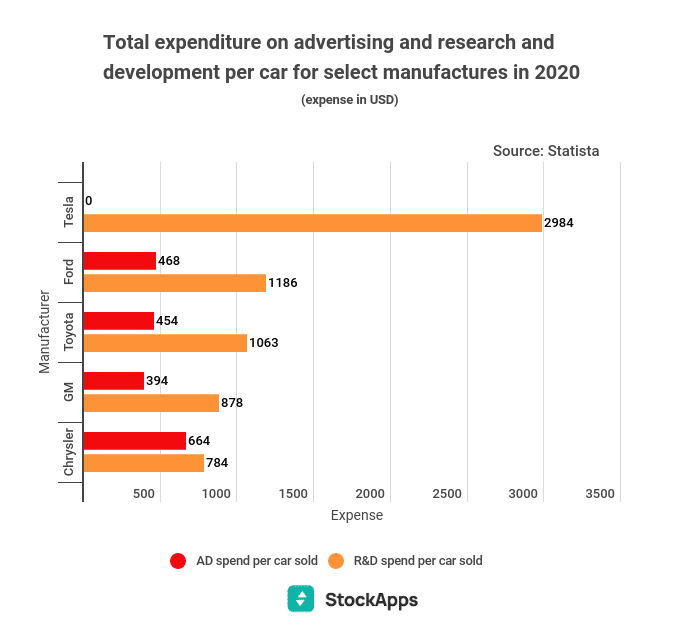

StockApps

I think that current trends and advantages in manufacturing could make the above scenario plausible. However, one of the great things about Tesla is that it has a ton of optionality, given its higher spending on the future than competitors and premier global talent. If they have an unanticipated development in autonomous driving, for instance, the firm could skyrocket in value quickly. Tesla’s R&D per car is three times that of the nearest competitor, and the firm has a demonstrated track record of delivering key promises and value to shareholders.

Holes in the Bear Case for Tesla

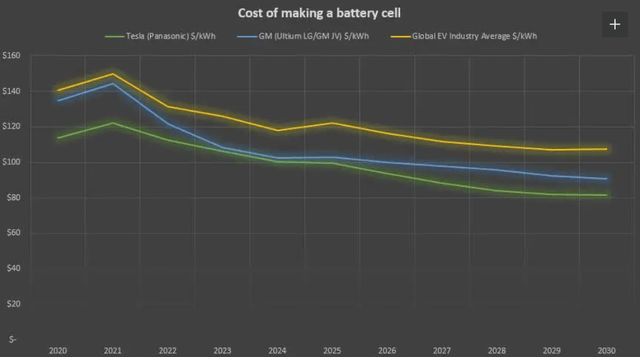

When stocks become as large as Tesla, they engender their economic gravity. There is never a shortage of uber-bearish or uber-bullish articles that can compellingly meet your confirmation bias. However, it looks to me like the bearish headlines are at an apogee and that the raw economic strength of the business and its brand remains intact and prodigious despite the firm’s polarizing founder. None of these headlines change that Tesla’s lower battery costs should lead to incremental gains that add up big over the length of a discounted cash flow model.

TheDriven.IO

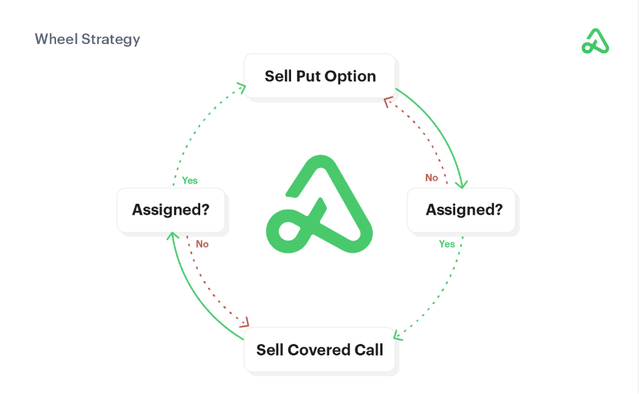

Nonetheless, the bear case points out some legitimate short-term drivers. And while I know many people are interested in short-term Tesla price action, I’d recommend owning the stock for the long term. If you want to get fancy, you can try some synthetic dividend strategies like I have proposed for Disney (DIS) and Berkshire Hathaway (BRK.B) for Tesla. Please also remember, folks, that while the term synthetic can connote inferiority in specific contexts, this is not the case for synthetic dividends.

You are getting an economic benefit in exchange for taking a measurable risk, but the company is not foregoing any capital to invest. Many conservative investors prefer to own Ford (F) because of the dividend, but with a well-executed derivative strategy, you can mimic it or even exceed it. The wheel strategy can also be effective for a stock with higher volatility, like Tesla.

OptionAlpha.com

There are few stocks with potentially more alpha in such a strategy, but it is also high risk given the volatility that can accompany the sky-high valuation. Let’s go through the bear case point by point and then round out with some positives that give me confidence in the ability of the stock to exceed future expectations.

But I digress. Let’s discuss the bear case and refute it point by point, given what we know about the stock and the benefit of the doubt that this firm deserves, given its prodigious past achievements. It’s very difficult for individual investors to do better than sell-side analysts at assessing the CAPEX plans of the Magnificent Seven, but we can assess management’s track record in delivering to shareholders. Here, Tesla is in the top weight class for sure. In this light, for long-term investors, I’d suggest that all short-term risks are either irrelevant or buying opportunities.

Margin Compression: Tesla’s strategy to defend market shares and enable more deliveries by reducing prices has been controversial on the Street. Let’s remember what Wall Street thought of Amazon (AMZN) pursuing a lower-margin strategy. Tesla’s focus on building long-term value is a positive attribute for long-term shareholders, in my opinion. Low prices to compete with the deluge of new EV models is a pretty aggressive competitive strategy that will help the firm defend its considerable popularity with millennials.

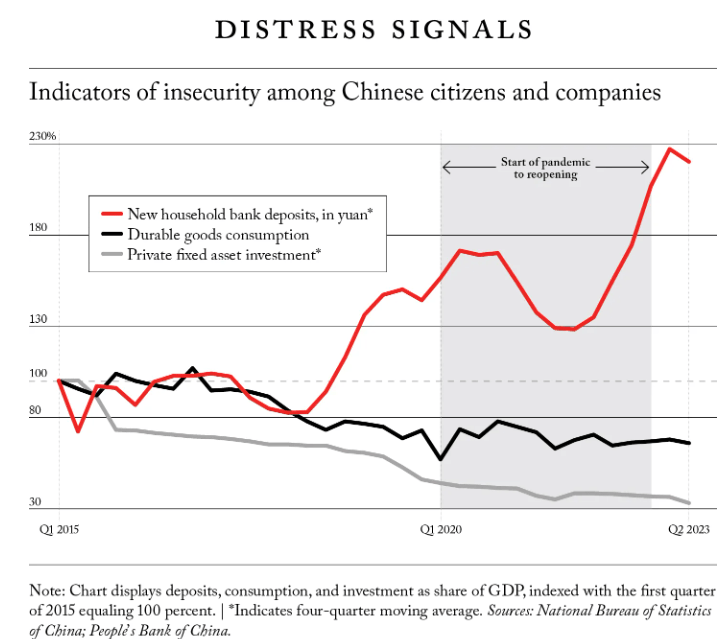

Geopolitical Concerns and BYD Overtaking Tesla in EV Sales: Tesla has focused on initially penetrating high-income markets on the coast in the U.S., and it has achieved a level of market penetration in critical geographies many never thought possible. However, the auto business is incredibly capital-intensive, and production interruptions can easily lead to bankruptcy or financial stress. However, China seems increasingly favorable toward economic detente given its increasingly tenuous domestic economic situation and the adverse response of its domestic consumers to the increasing authoritarianism of President Xi’s regime. Recent factory shutdowns due to recent Red Sea interruptions should be short-lived. The U.S. Navy and Air Force are pretty fearsome.

Foreign Affairs, Adam Posen

Hertz Concerns: Recently, Tesla got some negative press when it decided to sell much of its fleet of former rental Teslas. EVs are still in an early adopter phase, and the fact that Tesla’s models don’t make for good rental cars does not mean that consumers don’t like them. The evidence that consumers like them is more than substantial. Selling almost 2 million cars in a year is no small feat, and the momentum and dominant position Tesla has established should not be thought to be vulnerable to such an ephemeral news story as a poorly managed company not being able to properly distribute Tesla’s product within their business model, which consumers very well rate.

CME FedWatch Tool

High Rates and Valuation: Tesla is a richly valued stock by some measures, given its higher-than-average P/E ratio. However, I have also shown why several intrinsic value measures currently undervalue it. The pressure on the stock over history’s second most aggressive tightening Fed cycle should not be underestimated. And the market now expects that pressure to not only be alleviated but to start moving in the other direction. The market has priced some significant level of Fed cuts, and even if the Fed cuts less than currently expected, the change in the market’s reaction function to anticipating cuts is a decidedly more favorable environment for Tesla than what has been over the past year or two.

Risks and Where I Could Be Wrong

Tesla has taken significant risks in the techno-utopian lane that have thus far paid off, but that doesn’t mean such risks will always end up well for Tesla shareholders. Elon Musk is a man who wears many hats, and given his dispersed focus, it is natural to question whether or not he may neglect issues given the demands on his time and focus. Of course, when a company tends toward more autocratic governance, there can be risks with the “knowledge problem” and elevated founder risk. To be sure, Mr. Musk’s decision to wade into political debates could prove risky in an election year.

There is also a risk that the public appetite trends away from electric vehicles. However, I think Tesla is much more immune to this than their competitors, given their genre-defining products. While BYD Company (OTCPK:BYDDF) recently overtook Tesla in sales, I think Tesla’s lead in the more lucrative U.S. market is by far more critical. The mass market vehicle is coming from Tesla, and when it does, I suspect it will allow for current projections to be left by the wayside as too conservative. I also summarized other risks in the last section; any reversal upon the point-by-point refutations I gave could be a major risk for the stock.

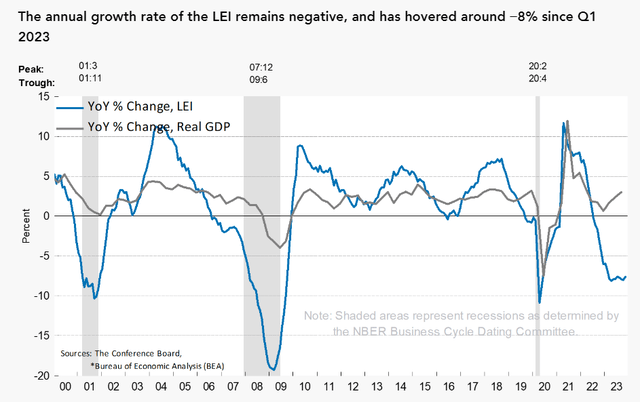

The Conference Board

Of course, in the event of a recession, Tesla is always vulnerable, being a capital-intensive auto company. Luckily, there’s increasing evidence that a soft landing is possible, and I think progress on inflation is good for any capital-intensive business. However, worsening the above risks could be a significant setback for the world’s most iconic EV manufacturer. Many indicators, like the Conference Board Leading Economic Indicators, suggest a recession is near. Mr. Musk has also been pessimistic about the economy on earnings calls lately.

Conclusion

Cars are the ultimate symbol of freedom, independence and individualism. They offer the freedom to ‘go anywhere,’ whenever it suits and with whom one chooses. – Sarah Redshaw.

Tesla has become a polarizing company, and it is easy to understand why Tesla shareholders can get frustrated from the time when looking solely through the lens of the stock they own. However, the type of growth ushered in by Mr. Musk doesn’t come often to public markets; when it does, it usually comes from someone who doesn’t tend to play nice with others. The following competitive advantages are hard to overlook, even given the intensity of negative media scrutiny.

ValueInvesting.IO

- Manufacturing advantages in terms of automation and the Gigapress.

- Repeated ability to create more free cash flow growth than competitors.

- Strong brand loyalty and awareness among key markets, like millennials.

- Strong consumer reviews and an innovative platform that can reduce costs in areas like auto insurance.

- Cybertruck appears to be a viable product for gaining a foothold in the lucrative truck/crossover market.

- Tesla has proven its ability to weather unprecedented global economic catastrophe, still meet key production targets and delivery goals, and maintain a thin spread between them.

- Tesla still has a dominant position in the U.S. EV market.

For the above reasons, I think Tesla will meet the high ends of forecasts or exceed them. These favorable factors and focus on long-term value creation through cycles make me like Tesla. There are a lot of hyperbolic positions on Tesla, but it’s a company that has delivered to shareholders. I also believe in owning both Ford and Tesla if you are a thematic investor in the Electric Vehicle revolution. Talk is cheap in the auto business, but producing millions of cars is not. Mr. Musk, despite his eccentricities, is still perfectly capable of inspiring the hopes of the market with regard to his Tesla vision.

Read the full article here