Introduction

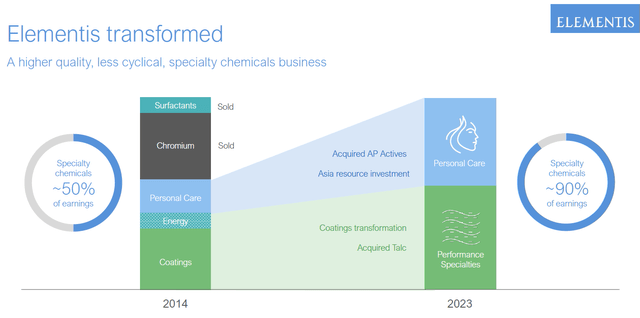

Elementis (OTCPK:ELMTY) (OTCPK:EMNSF) is a specialty chemicals company with a worldwide presence. The company had to reinvent itself in the past few years and is now predominantly focusing on personal healthcare and coatings. The company supplies rheology modifiers and hectorite applications as it operates the world’s only high-grade hectorite mine (which has a remaining mine life of approximately 50 years). Hectorite is for instance used in antiperspirant aerosols.

Elementis Investor Relations

As you can see above, the company is now fully focusing on its specialty chemicals business after selling the chromium division in the first quarter of last year for $139M in cash.

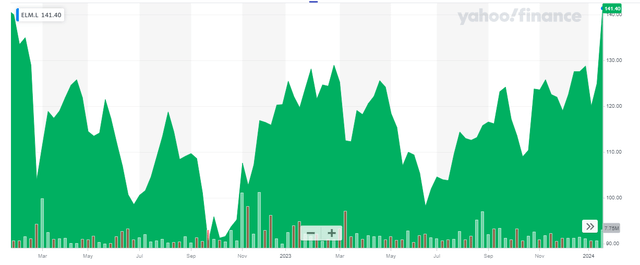

Yahoo Finance

Elementis has its primary listing on the London Stock Exchange where the company is trading with ELM as its ticker symbol. The average daily volume in London is almost 1 million shares. As Elementis currently has 585 million shares outstanding, its market capitalization is approximately 825M GBP. That’s approximately $1.05B at the current GBP/USD exchange rate.

Elementis’ free cash flow profile is pretty strong

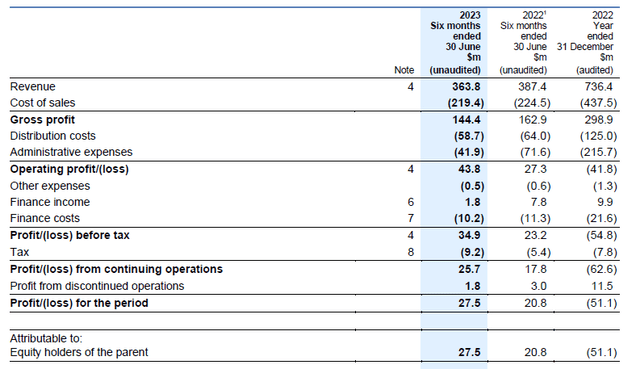

While the company will release its full-year financial results in March, Elementis has already published a trading update which comes in handy to finetune my expectations based on the detailed H1 results. As such, I think it makes sense to first look back at the H1 results before jumping to the full-year expectations and the outlook for 2026 as provided by the company on its most recent capital markets day.

The total revenue in the first half of 2023 was just under $364M. And although this resulted in a decrease of the gross profit by in excess of 10%, the operating profit actually increased by more than 50% thanks to a substantial reduction in its distribution and G&A expense. The company posted an operating profit of just under $44M which resulted in a pre-tax profit of almost $35M during the first half of 2023.

Elementis Investor Relations

After paying the relevant taxes and deducting the portion of the net profit that is attributable to the discontinued operations, the net income was $25.7M (the discontinued operations added $1.8M in net income), resulting in an EPS of $0.044. That’s approximately 3.5 pence per share.

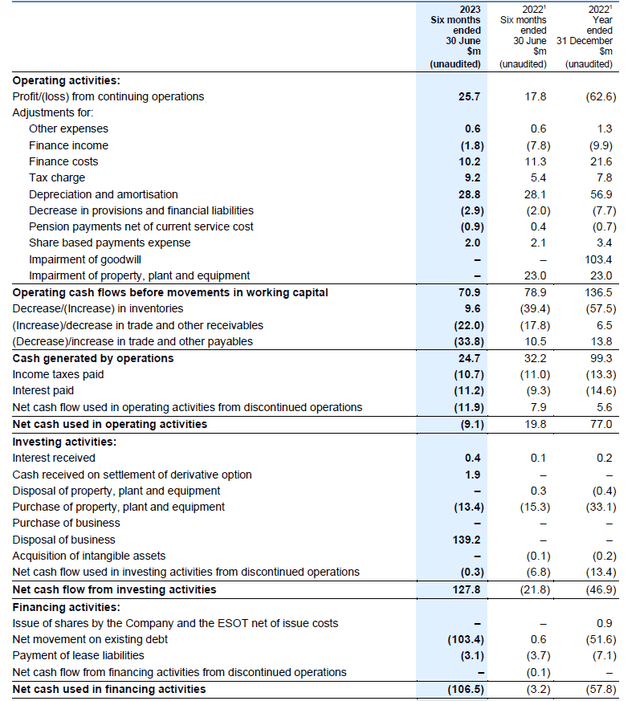

In my previous articles on Elementis I always looked at the company as a cash flow story, and that still is my approach right now. The image below shows the H1 cash flow statement wherein the company reported an operating cash flow before changes in the working capital position of almost $71M. After deducting the $22M in taxes and interest payments and the $3M in lease payments, the underlying operating cash flow was $46M.

Elementis Investor Relations

The image above shows the company spent approximately $13M on capital expenditures, resulting in an underlying free cash flow result of $33M. As there are 585M shares outstanding, the net free cash flow per share was approximately $0.056 or 4.4 pence per share. A strong result compared to the reported net income. That’s mainly caused by the difference between the depreciation and amortization expenses ($29M) and the capex + lease payments ($16.5M). Unfortunately the investments in the working capital position were a drain on the cash position but this should be reversed in the second semester.

Earlier this month, the company released a trading update and thanks to a strong final quarter, the company now expects to report an operating profit of $102-104M on an adjusted basis. The midpoint of that guidance represents a 2.5% increase compared to the adjusted operating profit reported in 2022.

This allows me to calculate the free cash flow for 2023. We know the company will generate approximately $2.5M in additional operating profit but it will also have to make higher interest payments which will likely come in $5M higher than in 2022. Additionally, the capex will be around $40M which is also slightly higher than the $33M it spent in 2022.

The net profit will likely come in at $60-62M. Meanwhile the total depreciation and amortization expenses will exceed $55M while the total capex + lease payments will be just around $45M. This means the free cash flow result will likely be around $10M higher and could very well come in at $70M in 2023. That’s approximately $0.12 per share, which is the equivalent of 9.4 pence.

And as we should see a working capital release during the second semester, the net debt will likely decrease. Elementis has guided for a net debt of $201M which represents “approximately” 1.5 times EBITDA. All these elements make the company’s ambition to restart dividend payments more credible.

The recent capital markets day provided more details on Elementis’ long-term plans

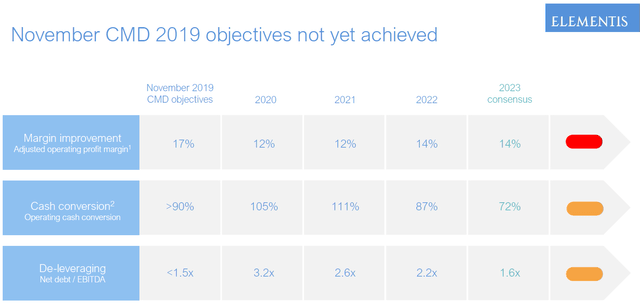

I like capital markets days as they generally provide excellent insights in the way a company’s management team thinks. In Elementis’ case, it wanted to provide an update as we are now reaching the end of the period that was the highlight of the 2019 capital markets day. Unfortunately the company has only met one of the objectives. The image below predates the Q4 trading update and while the debt ratio is “orange,” it now sounds like that target will be met. The three targets unfortunately were too optimistic.

Elementis Investor Relations

This doesn’t really mean we should have no confidence in the new guidance. After all, Elementis was dealt an unfair hand as shortly after its capital markets day the world changed when the COVID pandemic had a massive impact on the world economy. And as the pandemic was directly followed by an inflationary period, I am willing to cut the company some slack.

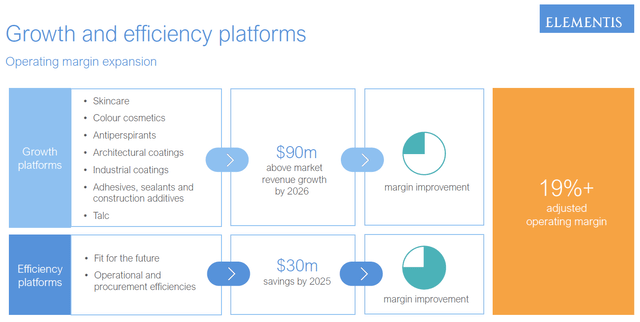

Elementis has identified the potential to increase its revenue by $90M above market growth by 2026. This would result in a full-year revenue of $800M (again, this excludes the impact from other growth initiatives). More importantly, Elementis aims to achieve an operating margin of 19%. This implies an operating profit of $152M which is approximately 50% higher than the operating profit generated in 2023.

Elementis Investor Relations

If I would now assume the interest expenses remain unchanged (I actually expect them to decrease as the company will deploy some of its free cash flow to further reduce the net debt level on the balance sheet), the pre-tax profit would be $132M resulting in a net profit of $98M or $0.17 per share. And as you know, the sustaining capex is slightly lower than the depreciation and amortization expenses so the underlying free cash flow will be approximately 10% higher on a sustaining basis. That would represent $0.185 per share or 14.5 pence. As there’s no real reason for Elementis to continue to reduce its debt (maintaining the current net debt level would result in a leverage ratio of just 1), there’s plenty of cash available for Elementis to complete a buyback and/or restart the dividend payments.

Investment thesis

At the current share price of 141 pence, Elementis is trading at a $1.05B market cap and an enterprise value of $1.25B (assuming a year-end net debt of around $200M). This indicates the current EV/EBITDA multiple is 8 while the company has set its sights on 2026 where the EBITDA should be around $205M. Even if we would assume the company won’t pay down a single dollar in debt, the enterprise value of $1.25B compares quite favorable to the anticipated EBITDA.

While I was writing this article, the company received a letter from Franklin Mutual Advisers urging the Elementis to consider selling the company. While that’s not a central thesis for this article nor my investment policy, it’s an interesting nudge from a large shareholder.

I have a small position in Elementis and was looking to increase this in the 120 pence range before the shareholder letter pushed the share price higher. The share price may come down in the next few days and weeks.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here