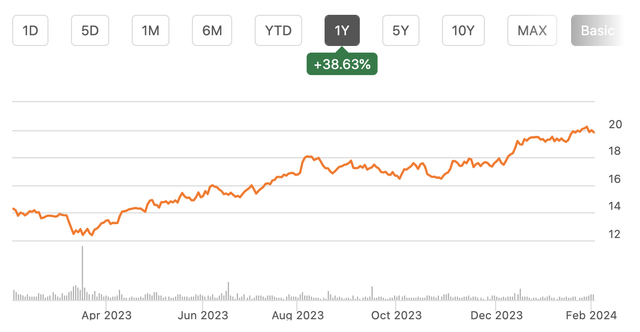

Shares of MGIC Investment Corporation (NYSE:MTG) have been a strong performer over the past year, rising by nearly 39%, as the housing market has proven to be resilient to significantly higher interest rates. Shares have also returned about 14% since I recommended buying the stock in October. With rises sharing near my $20-22 price target, now is an opportune time to revisit MTG, and I am downgrading it to a hold.

Seeking Alpha

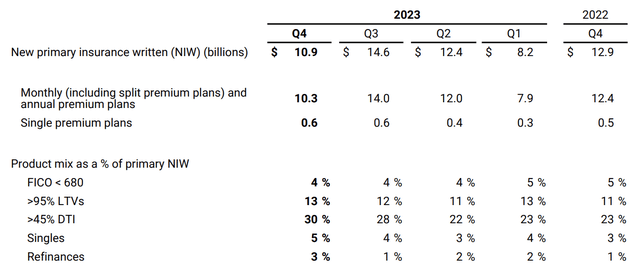

In the company’s fourth quarter, MGIC earned $0.67, which beat estimates by $0.09; this was up about 5% from last year.. For the full year, MTG generated adjusted earnings of $2.53. The company wrote $10.9 billion of new policies in Q4, down from $12.9 billion last year, and as a result, net premiums earned declined to $226.4 million from $244.1 million. Insurance in force has fallen by $2 billion over the past year to $293.5 billion. The rise in interest rates has caused a decline in home purchasing transactions, which has simply limited how many policies MTG can write.

We have seen some degradation in the credit quality of new insurance purchasers, but overall, credit quality of borrowers is quite strong. 43% of its insurance is to borrowers with FICO scores above 760; over 85% are 700+. MTG is primarily providing mortgage insurance to prime, not subprime, borrowers. While many credit quality metrics are broadly stable, we have seen a steady increase in consumers’ debt-to-income (DTI). As high home prices and elevated mortgage rates have combined to reduce home affordability, this is requiring borrowers to stretch a bit more to buy the home they want. Indeed, the average loan size is $257.5k, up from $250.2k last year.

MGIC

Now, importantly, employment remains buoyant, as evidenced by another strong jobs report this week. As long as people stay employed, mortgage delinquencies should remain relatively low. Moreover, real wages are rising, and given mortgage payments are largely fixed, this allows borrowers to grow into mortgage payments. The path of interest rates is also uncertain, but it seems that Federal Reserve rate cuts are more a question of “when” than “if,” which may create the opportunity for recent borrowers to refinance their mortgage, lower their monthly payment and improve their DTI metric.

For MTG to lose money on an insurance policy, it first needs the borrower to default on the mortgage, and it then needs the house to be sold for less than the guaranteed mortgage value. With a strong labor market, delinquencies are quite low. Just about 1.1% of loans have been delinquent over 90 days, a fairly low level that was essentially stable over the past quarter. With a soft landing appearing likely, I would not expect to see a material increase in delinquencies.

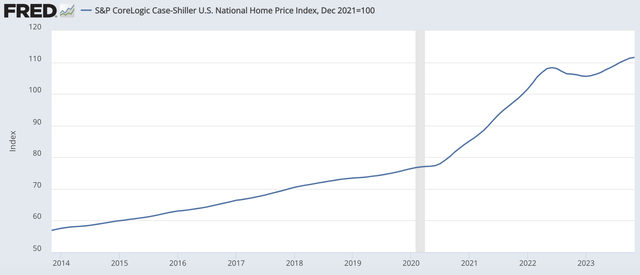

What continues to help MGIC substantially is that home prices have stayed elevated, reducing the potential losses on its policies, even in the event of a default. While Fannie Mae and Freddie Mac will guarantee a mortgage up to 80% of the home value (hence the standard 20% down payment); for borrowers who elect to make a smaller down payment, MGIC will insure the balance. With each monthly payment, as some principal is paid down, MGIC’s potential losses fall. Additionally, if home prices stay at or above that initial purchase price, a distressed borrower can sell their house and pay down the mortgage, meaning MGIC faces no loss.

This is what has been happening for the past three years, and it continues, albeit at a slowing pace. It had negative $9 million in losses (or a net $9 million in recoveries), down from $31 million in net negative losses last year, but still an absolutely pristine result. It is highly unusual for insurers to have negative net losses, but this has been the case as MTG has continued to have favorable revisions to reserves, as delinquencies have been low and severity of loss has been very low.

There were $51 million of current period losses in Q4 and $60 million of favorable prior period developments. This favorable prior development is down from $77 million a year ago. Because of these favorable developments, MGIC has $505 million in loss reserves, down from $558 million a year ago and $884 million in 2021. As reserves have continued to fall, there is simply less potential for negative net losses.

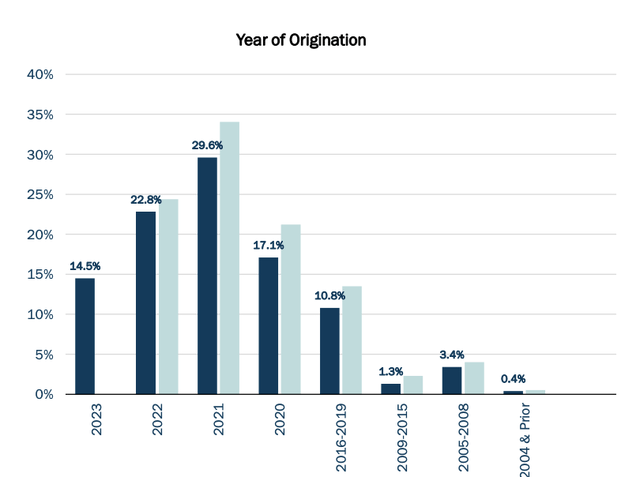

In my view, as first expressed in October, this ongoing decline in reserves is justified. Because mortgages often last 30 years, MGIC’s insurance exposure is fairly long-dated. As you can see below, 2023 originations are just 15% of the business, and nearly 2/3 of all policies were written during 2021 or earlier. On this large chunk of the business, MTG is very likely to suffer minimal, if any, losses, given ongoing principal payments and the rise in home prices.

MGIC

As you can see below, home prices are up over 10% from the end of 2021 and more than 35% from 2020. If home prices stay at current levels, individuals with MGIC insurance from 2021 or earlier likely have significant positive equity in their homes, meaning that even in a foreclosure, the home would be sold for more than the remaining mortgage balance, insulating MGIC from losses. This is why it has been able to release reserves consistently and generate such strong earnings.

St. Louis Federal Reserve

Additionally, with each month that goes on without housing rolling over, this legacy book of business just becomes higher quality as more principal payments are made. Now, of course, more recent vintages were struck nearer current housing levels and would be more quickly susceptible to downturns. As I wrote in my last article, I am bullish on housing longer-term given the significant undersupply of houses relative to population growth. I view the fact housing has held up so well despite higher rates as further evidence of this supply/demand mismatch.

Plus, if the Fed does cut rates and mortgage rates fall, we could see more demand for housing, pushing prices up again, and only making losses more remote. Now, lower rates are not a total win for MTG because it has $364 million of cash and an investment portfolio of $5.7 billion. Thanks to higher rates, it generated $57.8 million of investment income in Q4 from $46.4 million a year ago.

The book yield on its investment portfolio rose to 3.7%, up 20bp sequentially and 70bp from last year. Because this yield is still below market levels, the book yield should continue to rise but at a slower pace in 2024. The Fed would likely have to cut rates by over 150bp for MGIC to see reinvestment yields below today’s book yield. As such, I would view modestly lower rates as a net positive, as the benefit to potential insured losses outweighs slower growth in investment income.

Thanks to its strong results, the holding company’s liquidity rose to $918 million from $647 million as the insurance entity paid a $300 million dividend to the holdco. For the full year, it made $600 million of dividends to the holdco from $800 million in 2022. The holdco is the entity that pays the dividend and buys back stock. In Q4, it bought back 7 million shares, and it bought back another 1.8 million shares in January. As a result, its share count is down about 7% from last year. MTG has about $600 million in capital surplus and will have about $250 million of reserve releases in 2024, which rises past $500 million in 2025, based on the cadence of when it wrote policies. Combined with ~$240 million of investment income, this should support ongoing dividends of about $600 million to the parent, enough to buy back ~7% of shares per year on top of its 2.3% dividend yield.

MTG ended Q4 with tangible book value per share of $19.77, excluding AOCI. Shares are essentially exactly at 1.0x tangible book value. Now, the company is unlikely to see any material net losses on its insurance portfolio near term, given the labor market and home price dynamics. If we excluded reserves, book value would be closer to $22. Of course, there will eventually be some losses, on more recent vintages in all likelihood, and so shares are unlikely to get much past this level in my view. I believe my prior price target of $20-22.50 remains the fair value of the company, as it should trade somewhat about tangible book value, given the lower present value of its likely insured losses while recognizing there will be some losses eventually.

Bottom Line

While MTG remains very well positioned, it is now within 5-10% of its fair value, meaning the recent rally in shares has closed most of the value opportunity here. With shares not over-priced, there is no rush to sell shares in this strong company. However, there is no longer sufficient upside to buy more shares or open a position. As such, I am moving MTG to a hold. Most of the money has been made here, and investors should consider beginning to rotate out of MTG into companies they believe have more upside.

Read the full article here