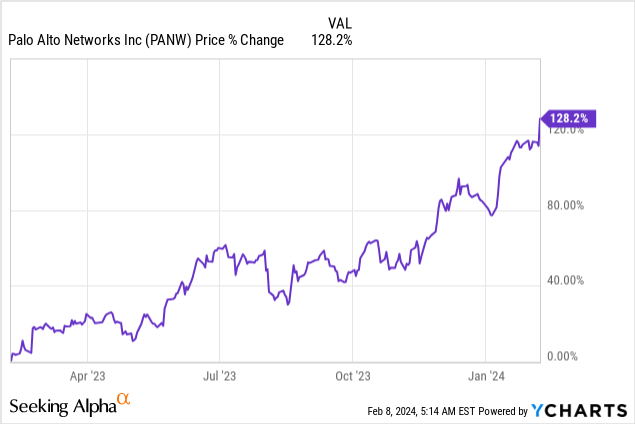

Palo Alto Networks, Inc. (NASDAQ:PANW) returned more than 128% in the past year owing to its ability to deliver revenue growth in the mid-20%s y/y each quarter with low volatility since FY2017. In a high interest rate environment, customers tend to be more cautious with commitments on future spends and likely prefer shorter duration contracts. PANW’s revenue/billings growth has largely ridden the uphill battle against surging interest rates fairly well. This was until FY1Q24 (year-end: July 31) when we saw the company report quarterly total billings having decreased q/q and a slightly lower y/y growth number.

We feel the recent rally was driven by improving market sentiment, particularly surrounding AI, which does increase cybersecurity demand, and the general expectation that the Fed will embark on a rate-cutting cycle before 2H24.

What makes us cautious is the high valuation the stock has garnered while future FCF visibility may be reduced, in addition to, the Fed which is signalling a pushback in rate cuts.

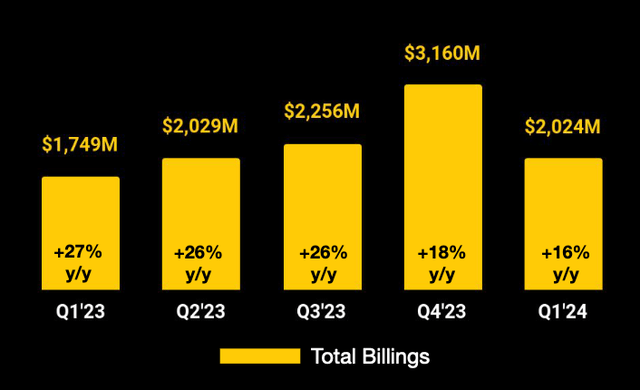

The billings miss

Total billings of $2,024M in FY1Q24 fell 36% q/q and its y/y growth number dropped down from 18% y/y a quarter ago to 16% y/y, which is the second consecutive quarter of lower y/y quarterly growth numbers. Management attributes the swing in billings to volatility in contract duration chosen by customers given the backdrop of higher interest rates. Customers are less likely to commit to long-term contracts (~3-year duration) without significant discounts which the company is not too willing to offer. So given the increased flexibility in payment terms, total billings will continue to fluctuate.

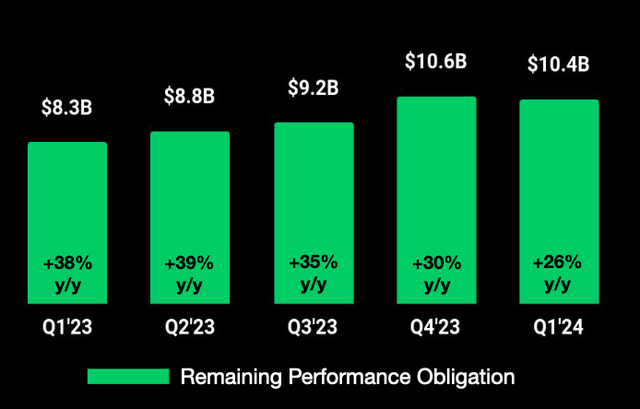

The management also cites RPO (remaining performance obligation) as a better metric during these periods. RPO grew 26% y/y during the most recent quarter but still registered a sequential decline of ~2% or 4% deceleration in y/y growth numbers. This trend does correlate with the slowdown in billings growth mentioned earlier.

Company Company

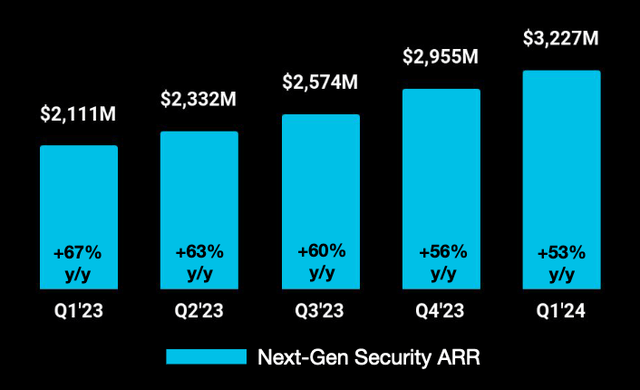

Next-gen security ARR beats expectations

The next-gen security (NGS) portfolio crossed the $3B ARR mark in the latest quarter, which implies a 53% y/y growth, beating market expectations for this segment by $100M. This y/y growth rate has been relatively steady, although it has naturally declined each quarter since FY1Q23.

NGS ARR sustaining a 50% growth rate at a $3B quarterly ARR run rate has been able to drive total revenue upside, more than offsetting deceleration in hardware and support sales.

We see the growth rate of NGS (>50%) slowly uplift the total subscription growth rate of about 25% y/y in FY1Q24 as customers migrate from classic applications like URL filtering to Advanced URLs in NGS over time. We estimate that NGS is about half of total subscription revenue currently.

Company

FY24E guidance interpretations open up debate

Overall, it is perplexing that the company has cut billings guidance while lifting operating margin guidance by only 1% and maintaining an unchanged FCF margin guidance in FY24E. It appears to imply that the management sees FCF visibility, but that is debatable among investors because the guided operating margin of ~26% in FY24E would imply a margin degradation from FY1Q24’s reported 28.2%.

Its peer, Fortinet, Inc. (FTNT), has also reported slower billings growth due to lower visibility among customers in a high interest rate environment. That said, PANW relies on improving operating leverage, partially offsetting slower cash collection due to lower billings. It also benefits from rising rates as its interest income has gone up, but this item is considered non-core.

We think a shorter contract, even if a few months shorter on average, can impact future revenue growth visibility despite certain beliefs holding that the customer ends up sticking to PANW but simply prefers deferred payments. We believe that this does open up opportunities for competitors to attempt to divert those customers.

Valuation

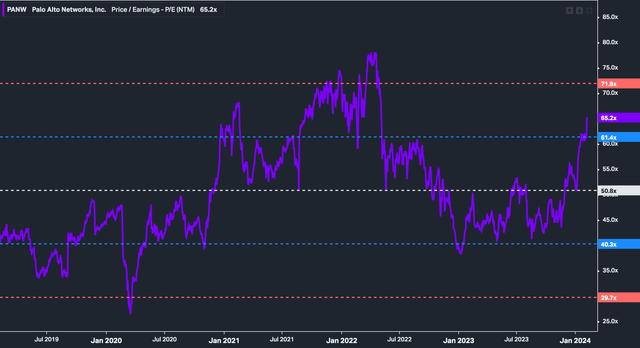

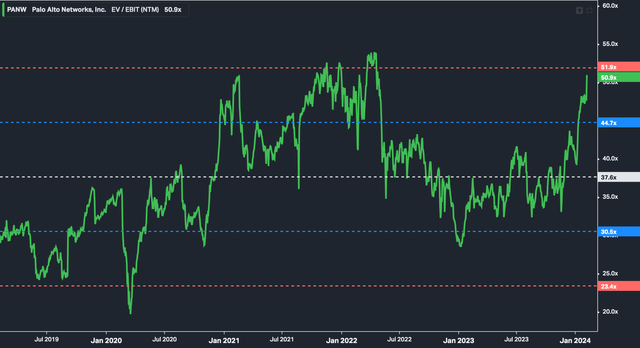

Given that expectations for total billings growth have been lowered to 16%-17% from 19%-20% but offset by improving operating leverage, we think EPS can still grow ahead of revenue at 22%-25% y/y. The market consensus for EPS growth in FY24E/FY25E is predicted to be 24%/17%. But at current prices, the stock trades at a forward P/E of 65 times or EV/EBIT of 51 times. Both metrics are well above their 5-year averages and nearing their highs in 2021 when interest rates were near zero.

PANW’s NGS portfolio is a major growth driver in the coming two years, but investors should take caution of the high valuation the stock trades at. We opine that a reduction in FCF visibility, even if it may disagree with the management’s view, should warrant a downward adjustment in multiples to reflect a higher possibility of customer churn or price discounting due to shorter contract terms.

Further, the market’s odds for a rate cut have recently been pushed back due to robust economic data in the U.S., while the Fed also appears to signal that they are in no rush to cut in their latest FOMC statement. Again, higher rates for a bit longer are unfavorable for PANW’s billings trend.

Himalayas Research, Koyfin Himalayas Research, Koyfin

Read the full article here