Introduction

As it has been a while since I discussed KBC Group (OTCPK:KBCSF) (OTCPK:KBCSY), the recent publication of the full-year results for 2023 is a good moment to check up on the performance of the Belgian bank/insurance company.

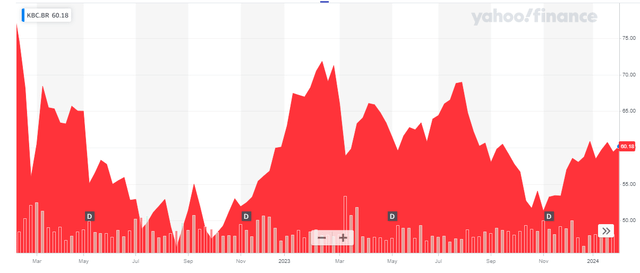

Yahoo Finance

KBC Group has its primary listing in Belgium where the company is trading with KBC as its ticker symbol. The Brussels listing has an average volume of 625,000 shares per day (for a monetary value of approximately 36M EUR), making it the most liquid listing and I would strongly recommend to use the Euronext Brussels listing to trade in the company’s stock. As KBC Group reports its financial results in Euro and has its primary listing in the same currency, I will use the EUR as base currency throughout this article.

The bank’s website contains a ‘download only’ links, but you can find all the relevant information I will be referring to here.

Despite the turmoil, KBC posted a decent set of results in Q4

The financial sector hasn’t had an easy 2023 but fortunately most European banks were not hit by the fallout caused by the issues in the US banking sector. I also like the model of offering banking services and insurance services under one roof as cross-selling of products can be quite profitable.

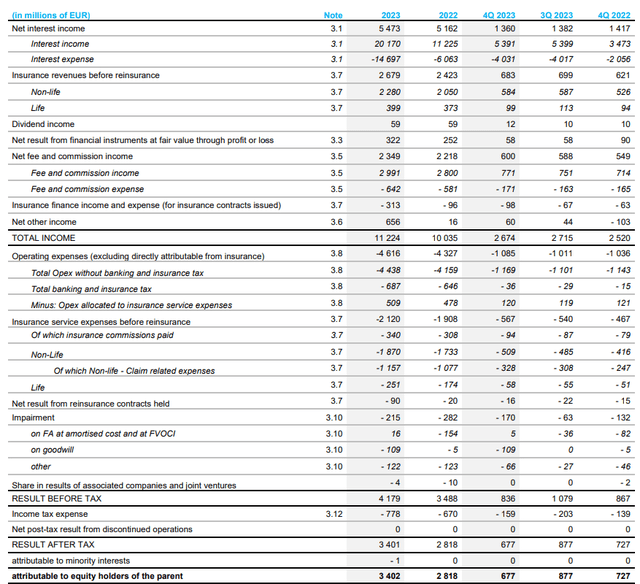

But of course, the main focus has been on the evolution of the net interest income. And KBC Group has actually done a pretty good job in protecting its net interest margin. While the pressure increased towards the end of the year, the FY 2023 results indicate a nice 6% increase in the net interest income, which jumped to 5.47B EUR.

KBC Investor Relations

Looking at the other elements that make up the 2023 results, we see the total insurance revenue increased to 2.68B EUR while the expenses related to the insurance activities were just 2.12B EUR resulting in a positive contribution of approximately 560M EUR. The income statement above also clearly shows the bank has its loan loss provisions under control. While it recorded a 215M EUR impairment charge, in excess of half that charge was related to the impairment of goodwill on the balance sheet. The ‘other impairment’ charges were mainly related to intangible fixed assets.

The strong credit risk environment was boosted by a 155M EUR release of previously recorded provisions for geopolitical and emerging risks and that release fully compensated for the 139M EUR recorded loan loss provisions during FY 2023 and that’s why the income statement above shows a provision release of 16M EUR on financial assets. While we shouldn’t bank on this happening again in the future (the loan loss provisions will normalize), it did not have a major impact on the bank’s reported net income as the other impairment charges were higher than usual which means the total impairment charge was just 67M EUR lower than in the previous year.

The net income generated during 2023 was 3.4B EUR which works out to an EPS of 8.04 EUR per share. KBC Group is proposing to pay a dividend of 4.15 EUR per share (subject to the standard dividend tax in Belgium of 30%).

Looking forward to the 2024 performance

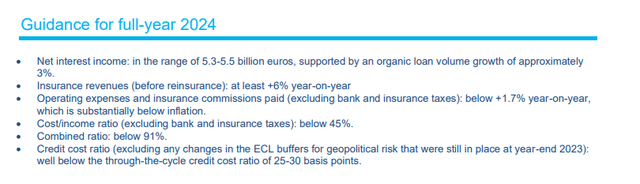

The bank has also provided an initial guidance for 2024. It expects a net interest income of 5.3-5.5B EUR and the midpoint of this guidance represents a small 1.5% decrease compared to the FY 2023 net interest income. However, the anticipated insurance revenue will likely offset the impact of the lower net interest income.

KBC Investor Relations

The loan loss provisions should remain very low: as you can see above, KBC Group is guiding for a credit cost ratio ‘well below’ the through-the-cycle cost ratio of 25-30 bp. With a total amount of 306B EUR in financial assets on the balance sheet, assuming a 15 bp credit cost ratio would result in total impairment charges of 450M EUR. I think 15 bp is pretty conservative considering the bank’s recent credit cost ratios for the period 2020-2023 were respectively 0.60%, -0.18% (a net release), 0.08% and 0.00% in 2023. Odds are KBC can keep the credit cost ratio below 10 bp in which case there should be no noticeable impact on the bank’s earnings assuming no other goodwill or intangible asset impairments are necessary.

This indicates we can expect the bank’s earnings to remain relatively stable in 2024. However, if I’m applying the higher credit cost ratio, I anticipate a small earnings decrease towards 7.75-7.85 EUR per share. A lower credit cost ratio would obviously boost the earnings result.

Investment thesis

I currently have no direct position in KBC Group but I have a rather substantial long position in a mono-holding whose only asset is a stake in KBC Group, so I indirectly have exposure. Trading at just over 60 EUR per share, KBC Group is not expensive at all as the stock is trading at approximately 7.5 times the 2023 earnings and at less than 8 times my anticipated 2024 net income. The dividend yield of almost 7% is appealing as well and given the low payout ratio of around 50%, that dividend is sustainable, even if the EPS would show a slight decrease in 2024.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here