Oxford Industries (NYSE:OXM) is currently undervalued based on my discounted cash flow analysis and is strong relative to peers on multiple metrics at this time. However, I have concerns about its long-term growth prospects elucidated by trends in shifts in economic class in the US, OXM’s primary market. My analysis shows there is still a compelling buying opportunity here despite risks related to this and considerable liquidity weakness at the moment.

Operations & Market Trends

The company is internationally renowned as an apparel design, sourcing, and marketing company that owns a portfolio of successful brands. These include Tommy Bahama, Lilly Pulitzer, and Southern Tide. Its operations include retail stores, e-commerce, and wholesale.

Tommy Bahama focuses on island-inspired sportswear and accessories, Lilly Pulitzer offers dresses and accessories appealing to women, and Southern Tide has a focus on the Southern lifestyle with casual and classic styles. Oxford Industries has a worldwide network of suppliers and manufacturers to produce products across its range of brands.

OXM Brands (OXM December 2023 Presentation)

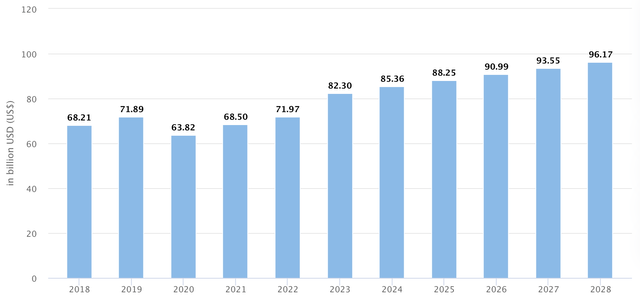

According to McKinsey’s “The State of Fashion 2024” report, the fashion industry worldwide is set to see top-line growth of around 3% this year. The luxury segment is forecasted to grow at around 4% globally; non-luxury segments in the US are expected to grow at around 1% due to the challenging economic environment at present.

Fashion market dynamics are shifting as they are being influenced by digital marketing trends, demand for personalization, and competition from smaller, more local brands offering competitive pricing. Dominant peers in luxury, including PVH Corp. (PVH), Kering SA (OTCPK:PPRUF) & LVMH (OTCPK:LVMHF), will be tailoring their strategies to these new expectations, but Oxford Industries may have a tougher time keeping up with the expensive transitions happening in larger conglomerates. OXM’s target market is more the middle class, and as discussed prior to my valuation commentary below, OXM may need to shift its target market more toward its larger luxury peers to maintain growth.

Luxury Apparel – Worldwide Revenue (Statista)

Financials

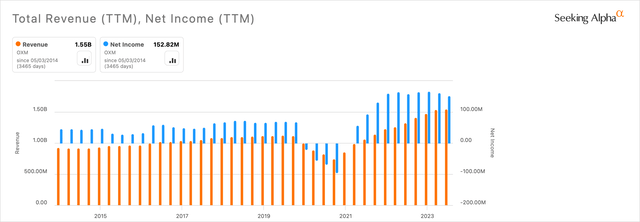

From my analysis of Oxford Industries’ financials, it looks considerably well-positioned and competitive, opening up a significant investment opportunity, in my opinion.

Author, Using Seeking Alpha

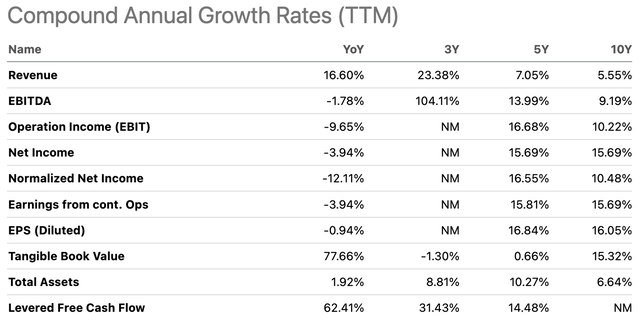

The firm’s YoY revenue growth is 16.6%, which is 263.42% higher than the sector median of 4.57%. Over the past five years, OXM has had an average revenue growth rate of 7.96%. Its forward EPS GAAP growth is 10.03%, 200.04% higher than the sector median of 3.34%.

One notable weakness financially is a low forward free cash flow per share growth rate of -5.09% compared to the sector median of 4.79%. However, it must be noted that its five-year average on the metric is a much stronger 5.71%.

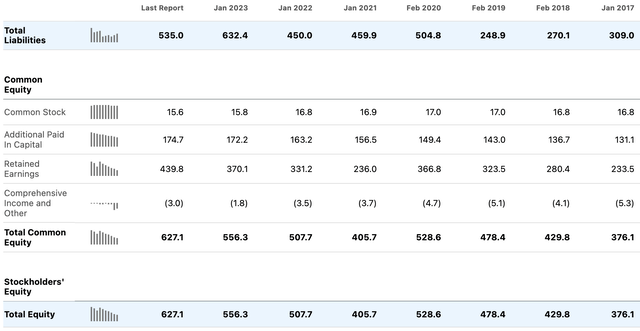

The balance sheet at the moment is also okay, with more total equity than total liabilities at an equity-to-asset ratio of 54%:

Seeking Alpha

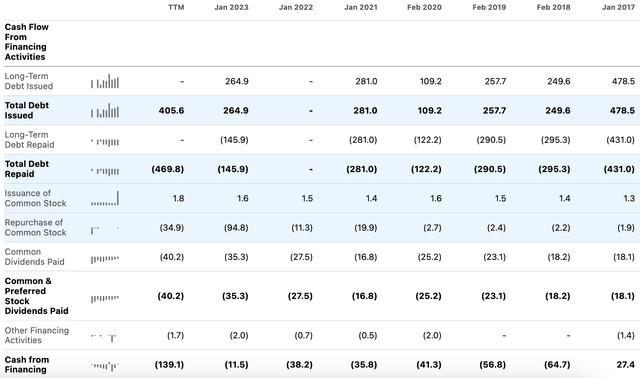

However, over the past three years, the company has reported a negative net change in cash. This is largely driven by high capex, total debt repaid, and repurchase of common stock over the period. It’s important to note that the firm has also been issuing a significant amount of debt over the past two years, although it has not issued nearly as much common stock as it has repurchased.

Seeking Alpha Seeking Alpha

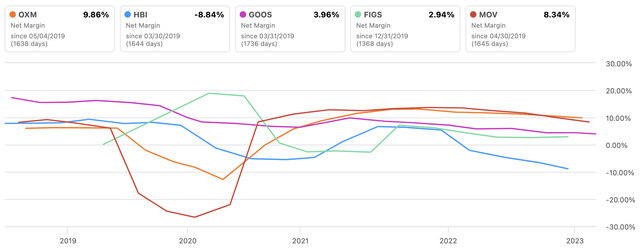

Let’s compare Oxford Industries to its major peers to gauge its profitability. Movado Group (MOV) falls just below OXM on net margin, with Canada Goose (GOOS) resting at a more common level for the industry:

Seeking Alpha

Growth Prospects & Further Market Trends

Oxford Industries seems to have very strong previous growth, but I am particularly interested in what the potential bottom-line growth for OXM could be over the next decade.

Seeking Alpha

Considering 16.05% diluted EPS growth as an annual average over the last 10 years, I think 10% growth is more likely considering the consensus understanding of a slowdown in growth for luxury apparel in the near future. As most of OXM’s revenue comes from the US, I am also considering the slowdown in middle-and-upper class growth over the next decade in the country.

61% of adults in 1971 lived in middle-income households in the US, compared to 51% in 2019, according to a report from Pew Research Center. However, there was a moderate increase from 14% to 20% of adults in the upper-income tier. This signals a less significant market over time for OXM, as it is tailored primarily to middle-class customers from my analysis. This is an issue I predict may continue to exacerbate as members of the middle class either shift into the lower or upper bands.

However, growth in the upper-middle class, as elucidated by the American Enterprise Institute, could mean that OXM simply will need to shift its target market as time progresses. As a technology investor, I also predict that the high adoption of autonomics in economies worldwide will further exacerbate income inequality in the short-to-medium term in favor of the upper classes until correct social structures are in place. If people are earning more, OXM can shift its audience, price points, and quality toward its new, more affluent target audience and, as such, could maintain 10% or so diluted EPS growth per year over the next 10 years. This allows for a conservative understanding that the enterprise has been around for quite some time but still has room to target affluent markets to come.

Here is some indication that the company may be willing to change and could be aware of the minor shift in its target market that could be beneficial for them:

We believe that by generating an emotional connection with our target consumer, lifestyle brands can command higher price points at retail, resulting in higher profits. We also believe a successful lifestyle brand can provide opportunities for branded retail operations as well as licensing ventures in product categories beyond our core apparel business. – SEC 10-K 2007

Additionally, the apparel retail market is evolving as a result of shifting shopping patterns and technological advances, with e-commerce playing an increasingly important role and bricks and mortar retail stores playing a different role in consumers’ journey to their ultimate purchase. The industry is also being impacted by the coming of age of the millennial generation whose values and approach to the marketplace are so different from past generations. We believe that our lifestyle brands are ideally suited to succeed and thrive in the long-term while managing the various challenges facing our industry. – SEC 10-K 2016

Other risks, many of which are beyond our ability to control or predict, could negatively impact our business and financial performance, including changes in social, political, labor, health and economic conditions. – SEC 10-K 2023

While I have not been able to locate an exact mention of the company facing risk from class shifts, it is implied in their writing that significant operational adaptations are going to have to take place to remain competitive and sustain growth. Whether my analyzed strategy is chosen or the firm moves forward with other tactics, the agile nature of their business is paramount to continued high results. The company is evidently aware of this.

Valuation

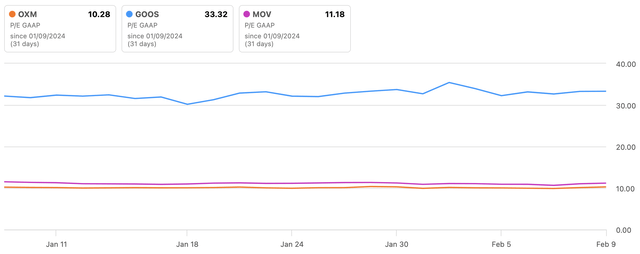

Oxford Industries has a good valuation at the moment, with a forward P/E GAAP ratio of 10.52, which is 37.69% lower than the sector median of 16.88. When we compare OXM to GOOS and MOV, it has the lowest valuation of the three based on present P/E GAAP ratios.

Author, Using Seeking Alpha

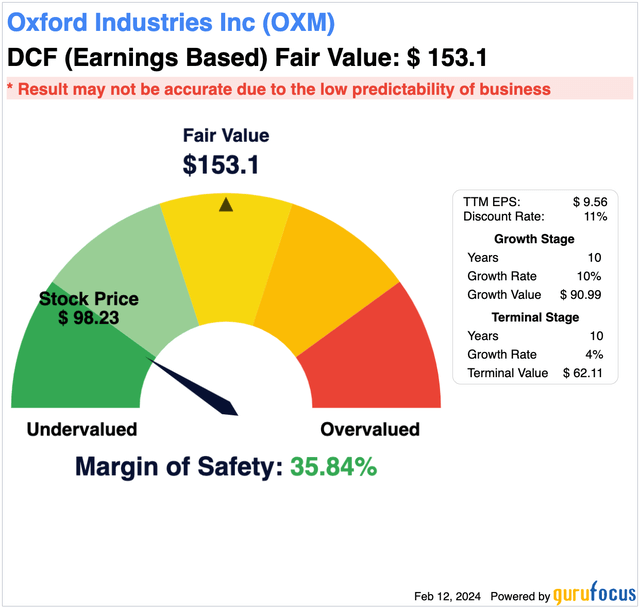

For my discounted cash flow analysis, I used my discussed-above 10% diluted EPS growth rate per year for the next 10 years, a 4% terminal-stage growth rate, and an 11% discount rate. This implies a fair value of around $153.10, a 35.84% margin of safety on a stock price of $98.23 at the time of this writing:

Author, Using GuruFocus

Risks

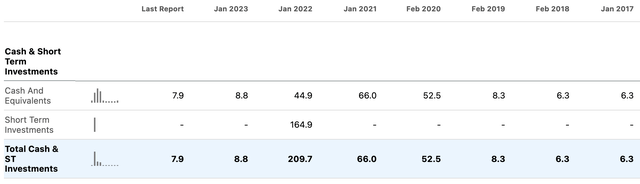

The greatest risk I am presenting at this time for an investment in OXM is its low liquidity, made clear by my cash flow statement discussion above, but also by its low level of cash and short-term investments at this time on the balance sheet. This could negatively affect the organization if it experiences any effects of macroeconomic recessions and means the company could use more internal efficiency to drive free cash flow and careful management of financing to improve its net change in cash moving forward.

Seeking Alpha

Additionally, its diluted EPS may not grow at 10% per year if it fails to adjust its target market in line with the general economic trends outlined above. This takes shrewd management, and while I am confident in the business, it still remains a risk and will take careful monitoring of pricing and marketing to see evidence of continued growth.

Conclusion

My analyst rating for OXM stock at this time is a Buy. While the balance sheet and cash flow statements could be improved, and there are risks related to long-term growth as a result of market shifts, the investment looks generally compelling. It has a significant margin of safety based on my DCF calculation and diversification amongst brands to provide security from specific company issues.

Read the full article here