We previously covered Shopify (NYSE:SHOP) in November 2023, discussing its excellent FQ3’23 results, with the robust consumer spending contributing to its expanded GMVs and GPVs.

With multiple e-commerce and online payment platforms still highly resilient despite the uncertain macroeconomic outlook, it was unsurprising that the SHOP stock had also rallied over optimistically and forward valuations inflated, resulting in our reiterated Hold rating then.

In this article, we shall discuss why we are finally re-rating the SHOP stock as a Buy, since it is apparent that its profitable growth trend and growing leadership in the US e-commerce SaaS market may never come cheap after all.

Combined with the management’s promising Free Cash Flow guidance, we believe that the SaaS company has finally turned the corner, with minimal cash burn and healthier balance sheet ahead.

We’ve Underestimated SHOP’s SaaS Investment Thesis – Upgrade To A Buy

For now, SHOP has reported a top/ bottom line beat in its FQ4’23 earnings call, with revenues of $2.14B (+25.1% QoQ/ +23.6% YoY) and adj EPS of $0.24 (+71.4% QoQ/ +1300% YoY).

Much of its tailwinds are attributed growing Gross Merchandise Volume of $75.1B (+33.6% QoQ/ +23.1% YoY) and Gross Payment Volume of $45.1B (+37.5% QoQ/ +31.8% YoY), as more merchants/ buyers increasingly adopt its payment platform at 60% (+6 points QoQ/ +4 YoY).

SHOP’s price hikes have also worked as intended with Subscription Solutions revenue expanding to $525M (+8% QoQ/ +31.1% YoY) and Monthly Recurring Revenue to $149M (+5.6% QoQ/ +36% YoY) by the latest quarter.

The increased penetration of Shopify Payments and growing GMW have also contributed to its growing Merchant Solutions revenue of $1.6B (+33.3% QoQ/ +23% YoY).

As a result of the sustained tailwinds, it is unsurprising that SHOP has reported expanding gross margins of 49.5% (-3.1 points QoQ/ +3.5 YoY).

This uptrend is significantly aided by the optimized operating expenses and sale of its logistic segment, triggering the SaaS company’s positive operating margins of 13.8% (+0.7 points QoQ/ +17.8 YoY) for the second consecutive quarter.

The SHOP management has made great use of the elevated interest environment to earn $272M in annualized interest income (+7.9% QoQ/ +71.8% YoY) in FQ4’23 as well, naturally contributing to the expanding Free Cash Flow generation of $446M (+61.5% QoQ/ +395% YoY).

Lastly, SHOP has also offered a promising FQ1’24 guidance, with revenues growth at “mid-to-high-twenties” on a YoY basis, gross margins of approximately 51% (+1.5 points QoQ/ +3.5 YoY), and Free Cash Flow margins in the “high-single digits.”

These imply that the SaaS company has finally turned the corner, with a sustainable growth trend and no further cash burn moving forward.

At the same time, SHOP has guided “sequential improvement in its Free Cash Flow generation every quarter throughout the year,” implying that the net cash on balance sheet may continue to grow from current levels of $4.09B (+2.2% QoQ/ -1.9% YoY).

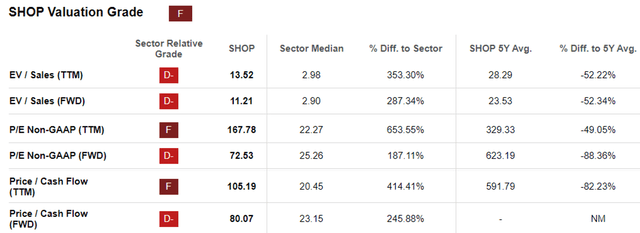

SHOP Valuations

Seeking Alpha

Assuming that the SHOP management is able to deliver as promised, we can understand why the market has awarded SHOP with the premium profitable growth valuations at FWD P/E of 72.53x and FWD Price/ Cash Flow of 105.19x.

While moderated from the 1Y mean of 328.87x/ 111x, the wide gap compared to the sector median of 25.26x/ 23.15x can not be denied indeed.

Even if we are to compare SHOP’s FWD P/E valuations to other e-commerce stocks, such as Amazon (AMZN) at 40.22x & MercadoLibre (MELI) at 73.98x, and e-commerce SaaS peers, Wix.com (WIX) at 30.26x & Squarespace (SQSP) at 41.55x, it is apparent that the former’s profitable growth trend has been handsomely awarded.

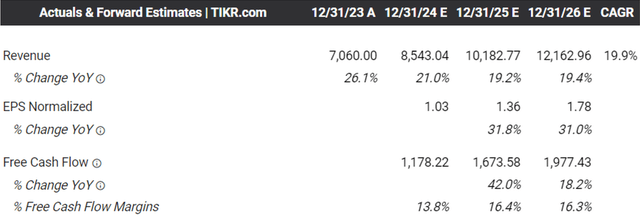

The Consensus Forward Estimates

Tikr Terminal

Unsurprisingly, thanks to the management’s promising guidance, the consensus have also moderately raised their forward estimates, with SHOP expected to generate an expanded top/ bottom line CAGR of +19.9%/ +57% through FY2026.

This is compared to the previous estimates of +19.3%/ +35% and historical top-line growth of +51.3% between FY2016 and FY2023, respectively.

If anything, the global retail market size is expected to grow from $26.4T in 2021 to $32.8T in 2026 at a CAGR of +4.4%, with the retail e-commerce market size projected to accelerate from $5.78T in 2023 to $8.03T in 2027, expanding at a nearly doubled CAGR of +8.57%.

With SHOP offering complete omnichannel offerings in both front-end/ back-end and across different platform sizes/ price points, we believe that its prospects are significantly aided by the robust discretionary spending and growing e-commerce sales, as similarly reported by AMZN and Costco (COST) in recent months.

However, investors must also size their portfolios accordingly, with the stock market already entering extreme greed levels, with any miss in SHOP’s future earnings and deceleration in growth likely to trigger painful corrections and downgrades ahead.

So, Is SHOP Stock A Buy, Sell, or Hold?

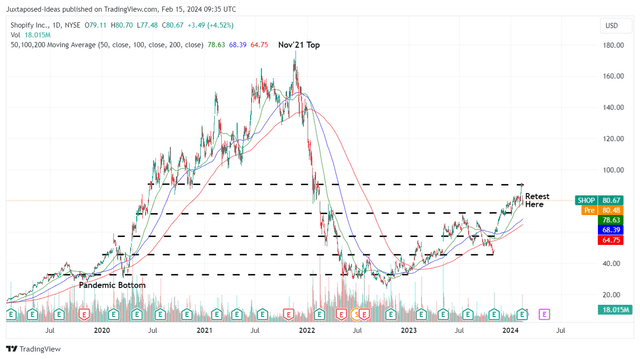

SHOP 5Y Stock Price

Trading View

For now, as per most tech stocks, SHOP has rapidly climbed out of the October 2022 bottom while outperforming the SPY’s 1Y performance of +20.82% with +65.48% rally.

With the market unfortunately over-reacting to its supposedly “narrow FQ4’23 earnings beat,” the stock has also returned part of its recent gains, while retesting its previous 2020 support levels of $80s.

Despite the correction, SHOP appears to be trading way above our fair value estimate of $33.30 with a notable premium of +142.2%, based on the FWD P/E of 72.53x and the FY2023 adj EPS of $0.46.

On the other hand, based on the consensus FY2026 adj EPS estimates of $1.78, there seems to be a more than excellent upside potential of +60% to our long-term price target of $129.10. Naturally, this is assuming that the stock is able to sustain its premium valuations moving forward.

Author’s Historical Rating For SHOP

Seeking Alpha

While we have yet to jump on the SHOP train, it is also apparent that we have been very wrong since our last Buy rating in March 2023, with us missing out on the stock’s doubling thus far.

It is apparent that SHOP’s leadership in the US Headless Commerce SaaS market with 20.64% in market share as of January 14, 2024 (+0.66 points QoQ) may never come cheap after all, especially since the country’s e-commerce revenue of $727.2B in 2023 is second only to China at $1.3T.

This also exemplifies how the management’s R&D efforts have succeeded extremely well in ensuring the platform’s growing relevance, despite the multiple price hikes thus far.

As a result of the attractive long-term risk/ reward ratio and the additional tailwinds from the price hike for the Plus plans and Shopify Payments from February 2024 onwards, we are cautiously re-rating the SHOP stock as a Buy.

Bottom fishing investors may consider waiting for a moderate pullback, preferably at its previous trading range of between $65 and $70s for an improved margin of safety.

Moving forward, we believe that the SHOP stock may slowly grow into premium valuations, for so long that it continues to deliver high growth, expanding profit margins, and increased market share.

Read the full article here