Broadcom Inc. (NASDAQ:AVGO) reported their Q1 FY24 result on March 7th after market close. I introduced my “Sell” thesis indicating their infrastructure software lacks high-quality assets in my introductory article. While their artificial intelligence (“AI”) semiconductor business is experiencing robust growth, the company carries numerous legacy businesses. Broadcom Inc. stock is overvalued, and I maintain my “Sell” rating with a fair value of $1,146 per share.

AI Growth Offset by Weak Chip Sales in Enterprises and Telco

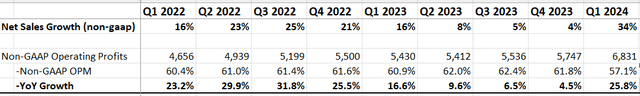

Excluding the contribution from VMWare, Broadcom grew their revenue by 11% in Q1 FY24. The total operating profits was up 25.8% year-over-year, as shown in the table below. The primary growth came from their infrastructure software segment, while their semiconductor business only grew 4% year-over-year.

Broadcom Quarterly Results

I understand investors are highly optimistic about their AI-related business. However, it is important to note that AI chips only account for less than 20% of group revenue; therefore, Broadcom’s growth is still primarily driven by their infrastructure software and other semiconductor business at present. Due to their robust AI business growth in the quarter, they raised their networking revenue guidance to 35% year-over-year growth in FY24, compared to the prior guidance of 30%. As indicated in the earnings call, the networking business represents 45% of their semiconductor segment, and the strong demand is being propelled by two hyperscale customers.

Broadcom continues to experience the downturn of their wireless, broadband and sever storage businesses. As a result, the whole semiconductor segment only grew 4% in the quarter.

Broadcom’s AI business has the potential to sustain rapid growth in the upcoming years, in my view.

Broadcom’s Tomahawk 5 is quite powerful with most advanced 51.2 Tbps shared-buffer technology, making it well-suited for hyperscale and cloud customers in the data center operations. Nvidia (NVDA) Spectrum-4 is adopting a similar ASIC architecture, supporting 51.2 Tbps switching and routing. Both companies’ ethernet switching could link multiple GPU together in the data center to facilitate large language model machine learning tasks. Given the rising AI and GPU demands, Broadcom’s AI business could be poised to grow rapidly in the near future.

Broadcom’s wireless, broadband and sever storage businesses are weak due to the end-market cyclicality, and Cisco (CSCO) also pointed out the end-market weakness during their Q2 FY24 earnings call. Given the context, the weakness is quite understandable.

Legacy Infrastructure Software

In my introductory article, I expressed my concerns regarding their legacy infrastructure software business. A large part of CA business is still in the legacy mainframe market, where is facing structural decline when major workflows are migrating to the cloud. Regarding their Symantec business, it was once a dominant player in the antivirus market for the on-premise IT networks. However, in the era of cloud computing, their competitive advantages have begun to erode, and emerging players including CrowdStrike (CRWD) and Palo Alto Networks (PANW) are rapidly gaining market shares.

Their recent acquisition, VMware, has a run rate of around $11-$12 billion, accounting for 22% of group revenue. There are some key differences between VMware and their existing infrastructure software businesses. VMware has more than 300,000 customers as disclosed in the earnings call, while Broadcom was targeting the top 1,000 large enterprises in the past. Consequently, Broadcom has to adjust their go-to-market strategy and salesforce structure to integrate VMware’s business in the near future. I acknowledge that it is too early to judge whether VMware could be successful within Broadcom’s umbrella.

Guidance Maintained

Broadcom maintains their prior guidance of $50 billion in revenue and $30 billion in adjusted EBITDA. The semiconductor business is expected to achieve mid-to-high single digit revenue growth in FY24, and AI would continue its growth momentum to reach $10 billion in revenue, representing 25% of full-year’s semiconductor revenue.

Assuming 40% increase in AI business, and mid-single-digit decline in broadband, wireless and storage, the semiconductor segment would grow by 6.25% in FY24 considering the revenue mix. Excluding VMware, I assume their legacy infrastructure software will grow by 6% year-over-year, consistent with their historical average. With VMware’s run rate estimated at around $11-12 billion, their total revenue is projected to be approximately $50 billion in FY24. Consequently, their guidance appears to be achievable.

Valuation Update

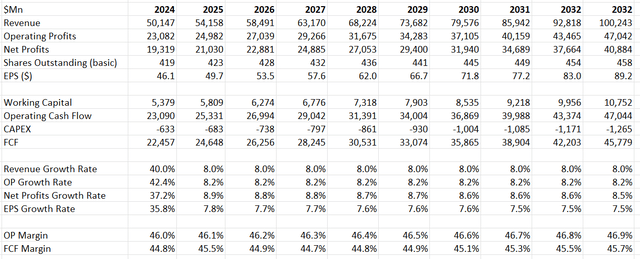

Compared to the previous version, the biggest change in the model is the normalized revenue growth assumption. Given their strong AI semiconductor growth, I increased the revenue growth assumption to 8%. Assuming a 20% growth in AI chips, this would attribute 5% to total revenue growth. I anticipate the remaining businesses to grow at low-single-digit in the future, contributing around 3% to total revenue growth. Summing these contributions, I estimate 8% normalized revenue growth for Broadcom.

The operating expenses is calculated to grow by 7.8% per year in the model, generating some operating leverage and resulting 10bps annual margin expansion. Broadcom has $11.9 billion in cash and $75.9 billion in debts. The total present value of future FCFF is calculated to be $450 billion, and the fair value is estimated to be $1,146 per share adjusted for the net debt balance and equity investments. The current enterprise value is trading at 23x forward EBITDA, not a cheap multiple, especially given the presence of numerous legacy businesses within the company.

Broadcom DCF – Author’s Calculation

Other Issues

In February 2024, VMware announced to divest their end-user computing division to KKR, and the transaction is expected to be finalized by the end of 2024, subject to regulatory approvals. The business will be classified as discontinued operations; however, the actual financial impact is immaterial.

In the past, Broadcom decided to divest their Carbon Black business. In the Q1 FY24 earnings call, their management changed their mind and announced to merge Carbon Black with Symantec. Their management stated the merge would attribute more value to shareholders. However, the true reason behind this decision is unknown.

Conclusion

I appreciate Broadcom’s AI-related semi business; however, it only represents 20% of group revenue at present. The company’s growth is largely driven by other segments. Their stock price is overvalued, and I maintain my “Sell” rating with a fair value of $1,146 per share.

Read the full article here