Finding quality companies to invest in rather than just niche or exciting stocks during the AI boom is incredibly important for protection from potential market speculation and a crash or correction that could occur. I believe only the best companies, with shrewd financial management but also great operational moats, will survive. ServiceNow (NYSE:NOW) seems to have all of the qualities I need to make a confident investment despite an already premium valuation.

Overview & Updates

ServiceNow is a leader in automated enterprise IT operations through cloud services. Its core areas of operation can be outlined as follows:

- IT Service Management (‘ITSM’): Automation and management of IT service processes. This transforms the impact, speed, and delivery of IT services.

- IT Operations Management (‘ITOM’): Provides visibility into infrastructure and applications, which helps IT to prevent outages and enhance performance.

- IT Business Management (‘ITBM’): IT operations are aligned with business needs, including portfolio planning and execution.

- Security Operations (‘SecOps’) and Governance, Risk, and Compliance (‘GRC’): Automates elements of the security process and improves infrastructure resilience through integrated risk management processes.

The company also has what it calls the Now Platform, which provides a suite of applications and a foundation for all ServiceNow products.

ServiceNow has collaborated with Amazon Web Services (AMZN), aiming to integrate its cloud capabilities on the ServiceNow platform to innovate in sectors including AI call centers, cloud transformation, automotive manufacturing, and supply chain management. It plans to make these offerings available to private-sector companies this year.

I believe that ServiceNow offers compelling products and services, and one of the core drivers of client acquisition and retention is the cost-benefit to users, who find they no longer have to go to multiple providers by what is provided on ServiceNow for an often lower cost with more reliability. This positions the company to continue to grow long-term, and it is further strengthened by growing trends in the adoption of enterprise AI. I believe there will be an exponential increase in the adoption of services like ServiceNow over the next few decades, and from my analysis, the company is well-positioned for long-term success in this trend.

Competition & Market Analysis

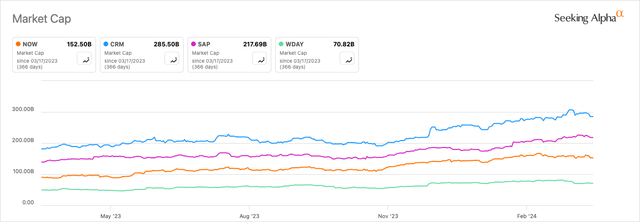

ServiceNow competes with a range of IT management and digital workflow providers, including IBM (IBM), CA Technologies from Broadcom (AVGO), Microsoft (MSFT), AWS, and Salesforce (CRM). However, due to the large differences in operations of these peers and significant variations in market cap, I have chosen instead a peer analysis of NOW, CRM, SAP (SAP), and Workday (WDAY):

Author, Using Seeking Alpha

The key competitive threats to NOW from each of these providers can be outlined as follows:

- Salesforce: Overlapping capabilities in customer service management and platform ecosystems. It is Salesforce’s Service Cloud, which directly competes with ServiceNow’s Customer Service Management offerings.

- SAP: SAP has ITSM solutions and Enterprise Resource Planning (‘ERP’) abilities that pose a threat to ServiceNow. With SAP’s recent transformation plan that I wrote about, it will begin to compete more aggressively in AI enterprise solutions.

- Workday: Workday is primarily focused on Human Capital Management (‘HCM’) and financial management, but its analytics and enterprise planning present an indirect threat to ServiceNow. This is particularly true as it relates to workflow automation and data-driven decision-making tools.

Of these competitors, I believe Salesforce is the most prominent threat, but it works in a slightly different area of expertise, more customer-focused than enterprise-focused, and hence, I believe NOW commands a dominant spot in a highly attractive niche. In terms of investment cases, both CRM and NOW have some of the most compelling future prospects I have seen as it relates to exposure to AI use in organizations.

There is a notable increase in enterprise spending on generative AI and automation in workplaces, and these are going to have significant accretive effects on ServiceNow. My own conservative forecast for a CAGR for the total AI market size is 30% for the next decade at the time of this writing, based on a consolidation of countless articles and research papers on the topic, including Bloomberg’s 42% AI market CAGR estimate over the next decade, which I have synthesized with other CAGR estimates including 15% over six years from Statista, and 37.3% over seven years from Grand View Research. ServiceNow is undeniably well-positioned for the benefit of this, with large saturation among Fortune 500 companies and recent wins in the public sector according to a report on Diginomica, including with the US Army, US Postal Service, and Australian Department of Defense. Additionally, CEO McDermott outlined private sector success in the latest earnings call:

Our large new logo count continued to accelerate in Q4. We had a record 10 new customers signing deals over $1 million in NNACV (Net New Annual Contract Value), including a $10 million win with a very large global financial services firm, which is our largest new customer logo in history. Global iconic brands such as Chipotle (CMG), Air France (OTCPK:AFRAF), TIAA, NTT (OTCPK:NTDTY), Data Group Corporation, and Busch (BUD) are digitally transforming with ServiceNow. – McDermott, Q4 Earnings Call

Key Financials

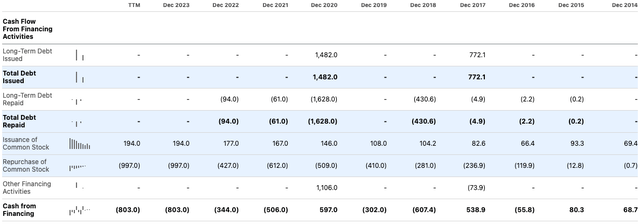

After reviewing ServiceNow’s financials, I can safely say that I like the way it manages its capital. For example, its equity-to-asset ratio of 0.44 is supported by the low frequency of issuance of long-term debt and a quick and stable repayment of such debt. Additionally, due to its well-managed and not overleveraged balance sheet, it has the ability to reasonably repurchase common stock, which it does so aggressively and has been doing for the past decade every year.

Seeking Alpha

We can compare its balance sheet on key metrics to the peers I have used in my competitive analysis. Please note that my cash-to-debt ratio is calculated as cash, cash equivalents, and marketable securities divided by short-term debt and lease obligations and long-term debt and lease obligations. My debt-to-equity ratios also include any short-term and long-term lease obligations for the debt calculation, and equity refers to the total stockholder’s equity.

- ServiceNow: Equity-to-asset ratio of 0.44, debt-to-equity ratio of 0.3, cash-to-debt ratio of 2.14.

- Salesforce: Equity-to-asset ratio of 0.6, debt-to-equity ratio of 0.21, cash-to-debt ratio of 1.13.

- SAP: Equity-to-asset ratio of 0.63, debt-to-equity ratio of 0.2, cash-to-debt ratio of 1.31.

- Workday: Equity-to-asset ratio of 0.49, debt-to-equity ratio of 0.41, cash-to-debt ratio of 2.37.

All of these firms have moderately good balance sheets for what’s normal in the industry and NOW has notably high cash on hand, with cash and equivalents at the time of this writing of $1,897 million and total cash and short-term investments of $4,877 million. ServiceNow’s balance sheet may not particularly stand out, but I can safely say that it is well-structured and relatively secure for future operational success. Perhaps it could bolster its equity-to-asset ratio above 0.5 by favoring long-term debt repayments to share repurchases at this time. However, a higher proportion of its total liabilities is unearned revenue, specifically $5,785 million of $9,759 million in total liabilities at the time of this writing, so I am not too concerned at all that the balance sheet is overleveraged.

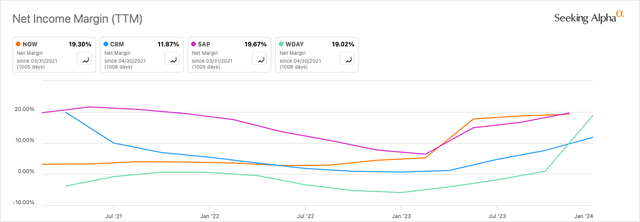

Recently, NOW also commands very high net margins when compared to its peers. For example, consider the following chart, which shows its net margin of 19.3%, second place only slightly to SAP:

Author, Using Seeking Alpha

Additionally, its five-year average YoY revenue growth of 23.82% is far higher than the sector median of 4.3%, but let’s compare this to the peers in my competitive analysis:

- Salesforce: Five-year average YoY revenue growth rate of 23.24%.

- SAP: Five-year average YoY revenue growth rate of 6.33%.

- Workday: Five-year average YoY revenue growth rate of 22.55%.

Evidently, the laggard here is SAP, but what is promising to see is that NOW has the highest five-year revenue growth average of all four peers. I believe from my peer analysis and deeper considerations operationally, it is fair to say that the firm is an elite investment choice for exposure to enterprise AI. It outperforms all of my peers when combining the three core elements of my financial analysis, namely financial health, profitability, and growth.

Value Analysis

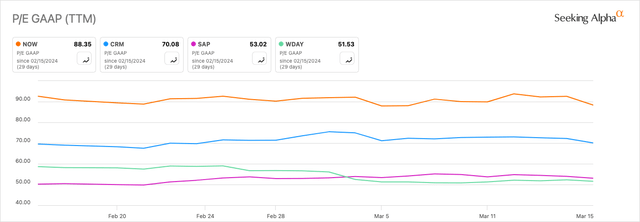

Over the past five years, ServiceNow has had an average P/E Non-GAAP ratio of 89.66. At the moment, its ratio is around 69, a -22.97% difference. I believe this signals an opportunity in and of itself.

We can also look at the stock relative to the peers I have used in my competitive analysis, where it does appear to be selling at a significant premium based on GAAP measures, even higher than CRM. However, we must bear in mind that earnings estimates for NOW are slightly higher than for CRM, so I believe that the market has priced both companies accordingly.

Author, Using Seeking Alpha

Considering investor sentiment may not rise to the levels it was at previously, ascertaining that the shares are 23% undervalued compared to previously does not capture the full picture. Instead, it provides a buffer to my true hypothesis that the stock is trading at fair value at this time and is priced according to valuations attributed to the sector and also its better results in comparison to peers. In this instance, the market looks to be efficient. What investors will be getting with an investment, therefore, is not good value but exceptional growth as a result of high forecasted market CAGRs and strong consensus analyst estimates for the firm’s growth.

Risk Analysis

Other than the risk of investing in the stock when it is priced for perfection, which is also an apt statement considering it is trading around all-time highs at the time of this writing, I believe investors should be cautious and ready to weather some short-to-medium term volatility as it relates to a sector correction in AI and technology stocks which could occur as investors become evermore drawn to investing in the technology over the next decade. I do not see it as unlikely for a significant market bubble and associated correction or crash to occur. Thankfully, I consider ServiceNow to be one of the undeniably best businesses to have a stake in that should easily outlast such correction. Nonetheless, the volatility associated with this would affect NOW shareholders for some time.

Additionally, we are at the advent of a very new era of technological advance. It remains to be seen how fast and who become some of the major players in this space. It will take a careful eye and acquisition strategy for NOW to remain dominant when other new upstarts with startling new technologies related to machine and deep learning could overtake and usurp NOW’s top spot in enterprise AI.

Conclusion

I feel very confident in this company, and I believe that it will do an exceptional job over the next decade to maintain its position at the forefront of enterprise AI solutions. However, the valuation is difficult to tolerate if investors are considering a high allocation, as some speculative market prices may occur that cause unwarranted volatility for NOW stock periodically. Therefore, I personally will be considering it for my portfolio at a balanced allocation alongside other industries that provide some protection from potential speculation in AI markets. My analyst rating for ServiceNow stock is a Buy.

Read the full article here