Bank of Hawaii (NYSE:BOH) was still very much in the grip of funding cost pressure when I last covered it in September, with additional headwinds from weak loan growth and its skew to relatively low-yield fixed-rate assets further pressuring revenue and earnings.

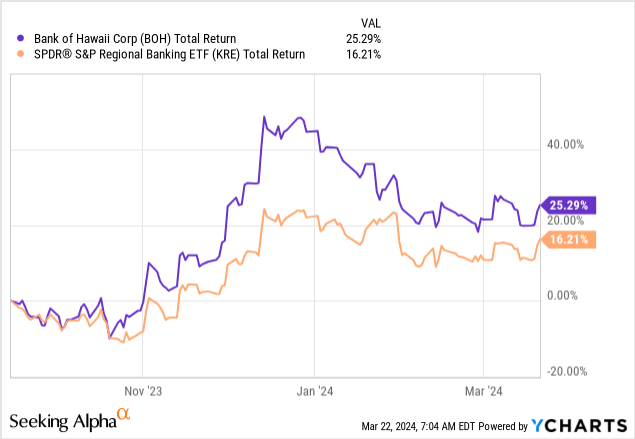

Although regional banks are not off to the best start in 2024, BOH has nonetheless done well in the interim period, registering around 9ppt of outperformance versus peers as these headwinds continue to ease.

Like its peer group, BOH faces particularly tough comps in the first half of the year as funding cost pressures had yet to fully work their way through the income statement at this point last year. With the earnings outlook looking soft this year as a result, I still think shareholders can afford to adopt a wait-and-see approach here for a few more quarters, and I keep my ‘Hold’ rating in place for now.

Top Line Pressure Now Easing

Bank of Hawaii and recently-covered peer First Hawaiian (FHB) each control around one-third of Hawaii’s ~$60b in statewide bank deposits. While that means BOH ultimately possesses one of the highest quality deposit franchises in the industry, pressure from both higher deposit costs and mix-shift to interest-bearing balances has nonetheless been a significant headwind to net interest margin (“NIM”).

Compounding matters is the composition of the bank’s earning assets. Firstly, around one-third of loans are residential mortgages, and many of these were fixed back when interest rates were very low. The average yield BOH earned on this section of the loan book was 3.60% last year, just 31bps higher than it earned in 2022. This has resulted in a relatively low cycle-to-date loan beta, limiting its ability to offset higher funding costs via loan repricing.

Secondly, BOH entered 2023 with around $5.4b in HTM investment securities on its balance sheet, accounting for around a quarter of earning assets. These were still only generating a yield of 1.79% as of last quarter – up just 5bps on the same period in 2022. Back then, the spread between the yield BOH earned on HTM securities and the rate it paid on total deposits was around 130bps. This had fallen to 10bps as of Q4 2023.

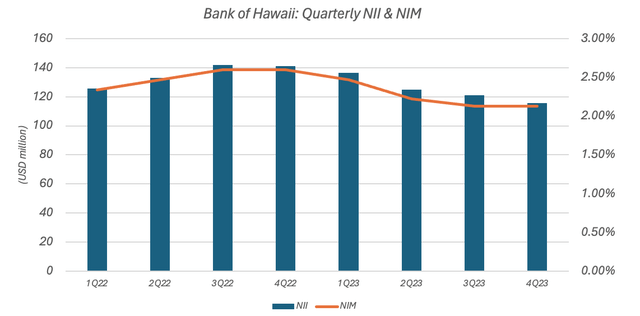

The above has led to a significant contraction in BOH’s NIM, and weak demand for credit means it has been unable to offset this with loan growth. While house prices have actually been relatively stable in Hawaii, transactions are down sharply – important given the composition of BOH’s loan book. As a result, total loans increased just 0.3% sequentially last quarter to $14b, ultimately resulting in weak net interest income alongside contracting NIM.

Data Source: Bank of Hawaii Quarterly Results Releases

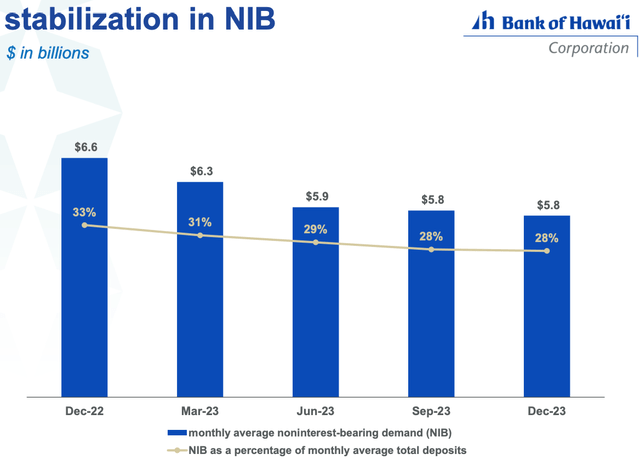

While the outlook for loan growth remains challenging, the good news for investors is that funding cost headwinds have now largely run their course now that the Fed is done hiking. In terms of mix-shift, non-interest-bearing deposit balances fell around 2.5% last quarter, an improvement on the ~3% sequential decline posted in Q3 and the ~6% sequential fall recorded in Q2. Management expressed confidence on the latest earnings call that NIB balances will now stabilize at the Q4 level of ~$5.7b.

Source: Bank of Hawaii Q4 2023 Results Presentation

Similarly, while interest-bearing deposit costs increased 35bps sequentially last quarter to 2.30%, this was a more modest pace of increase than in Q3 (up 41bps sequentially) and Q2 (47bps). As cost pressure moderates, higher yields from re-pricing earning assets will provide more support to NIM, as explained on the last call.

As a result of continued asset repricing, together with the peaking of our deposit beta, the margin is expected to increase by 2 basis points to 4 basis points in the first quarter of 2024.

Dean Shigemura, Bank of Hawaii Vice Chair & CFO, Q4 2023 Earnings Call

I would add that while the forward curve is pointing to around 80bps in rate cuts this year, a substantial portion of BOH’s earning assets can still reprice higher in a lower rate environment. It holds over $7.3b, or ~30% of earning assets, in AFS and HTM investment securities, and these earned just 2.45% blended for BOH last quarter. Even allowing maturities to sit as cash earning the effective Fed funds rate would provide a tailwind to revenue and margins. As a result, NII, NIM and indeed overall revenue should prove resilient from the Q4 base even with a modest decline in interest rates.

Not Much To Get Excited About Near-Term

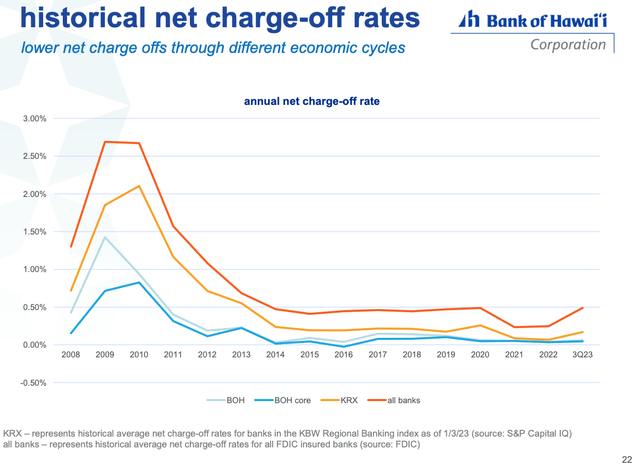

Credit quality remains very strong, with non-performing assets (~8bps last quarter) and net charge-offs (~5bps) still at historical lows. BOH has historically been well above-average in this regard, reflecting the composition of its loan book.

Source: Bank of Hawaii Q4 2023 Results Presentation

Ultimately, loan losses are a function of the number of defaults plus the expected loss on default. In terms of the latter, around 80% of BOH’s lending is backed by real estate, with a circa 54% weighted average loan-to-value ratio giving it a significant cushion to absorb bad debt.

Delinquencies also still appear to be benign. Past-due loans (i.e. 30+ days delinquent) were around 31bps relative to total loans at the end of Q4, 10bps higher than the year-prior period but off a very low base. Delinquencies are still comfortably below pre-COVID 2019 levels.

While the above remains supportive of earnings, I can’t say that there is much in the current valuation that would point to meaningful upside here. At $62 as I type, BOH stock trades for a little over 2x tangible book value per share. Last quarter, the bank reported EPS of $0.70, though this was quite a messy print due to the FDIC special assessment charge that affected all banks. Normalized earnings landed closer to $1 per share, mapping to a return on tangible common equity in the 13-14% range. While that’s not bad, it does make valuation multiple expansion a very tough sell from these levels, especially when certain regional banks like recently-covered Bank OZK (OZK) are trading for just above TBVPS on a mid-teens ROTCE profile.

It’s also difficult to see much near-term upside from earnings growth and the dividend. While earnings should be relatively stable against the Q4 2023 run rate, analysts aren’t really seeing much by way of growth out to 2025.

Similarly, BOH’s $0.70 per share quarterly dividend has been stuck at its current level for almost three years now, with the bank prudently opting to build capital in the light of significant unrealized losses in its securities portfolio. While the yield of 4.5% isn’t bad as such, larger peers like Citizens (CFG) and Regions (RF) offer similar yields on lower payout ratios, not to mention the competitive yields available in short-term risk-free alternatives. Like earnings growth, dividend growth is also going to be lackluster here in the near term.

Lacking significant upside drivers in terms of multiple expansion, earnings growth and dividend growth, prospective investors can afford to wait for a more constructive macro environment and valuation, and I keep my Hold rating in place.

Read the full article here