Here at the Lab, we like utility companies, and our team recently upgraded Enel and E.ON. Today, we are back to comment on Engie (OTCPK:ENGIY). On the French player, we were in a Wait-and-See mode, and as reported in our last analysis, we were expecting a reassuring outlook and a simplified business model before changing our valuation. That said, before commenting on the company, we should take a step back and look at the sector.

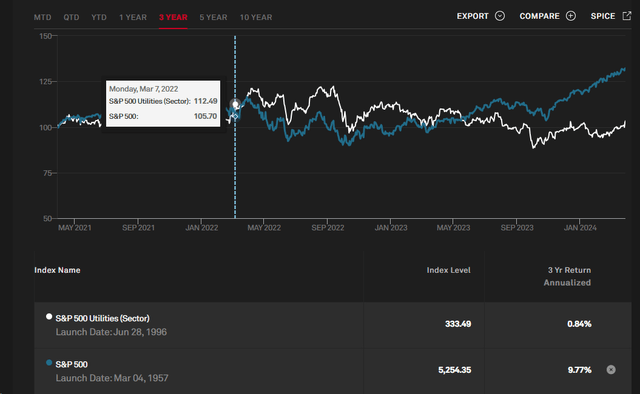

Looking at the utilities sector, it is evident that it has been underperforming the market since 2022 (Fig 1). Considering the ongoing Russia-Ukraine war and its repercussions on the energy price, we believe the sector could benefit from lower interest rates. Wall Street is awaiting communications from major central banks on the timing of first-rate cuts, which are expected to begin in June. While June might be a good time, nothing is set yet. ECB and FED argue that their decisions will depend on economic and inflation data. Given the sector’s weak growth and historically high and stable dividends, even if we are not forecasting a June cut, we believe integrated utility players will likely benefit from a decline in long-term rates. In addition, until very recently, utilities were considered akin to high-quality bonds. However, with electricity grids scaling to unprecedented levels, we see better growth in low-risk regulated assets than before. This was already evident in Engie Fiscal Year 2023 results.

S&P 500 Utilities Index Evolution

Source: S&P 500 Utilities – Fig 1

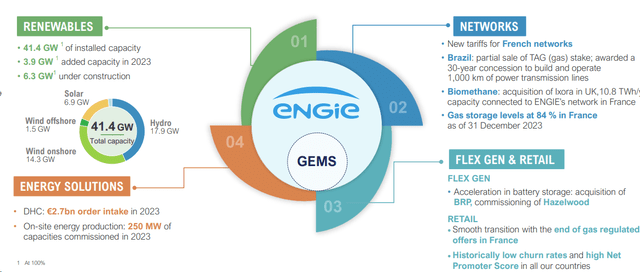

For our new readers, Engie SA is a France-based global energy player that operates through four divisions: renewables, networks, energy solutions, and flex gen & retail. In addition, Engie has nuclear operations in Belgium. Here at the Lab, we previously anticipated higher provisions for the nuclear asset life extension as well as its waste liabilities. However, we believe the company is now likely to substantially de-risk itself.

Engie 4 Core Segments

Source: Engie Fiscal Year 2023 results presentation – Fig 2

Why are we positive?

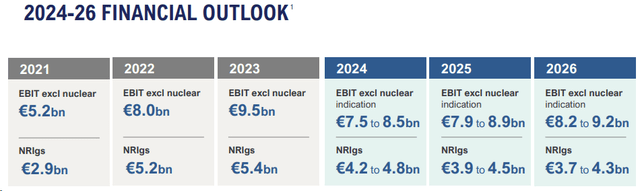

- With the Q4 and 2023 FY results, the company reassured investors with positive medium-term guidance (Fig 3). After checking Engie’s financials and forecasting lower power prices, we report that the company’s low-end outlook is still above consensus. Therefore, this might positively impact its stock price evolution;

- Engie has an attractive capital remuneration policy. In detail, the company’s board will propose a DPS of €1.43 per share. At the current market price, this represents a dividend yield of 9.2%. Engie has a shareholders remuneration set with a 65/75% payout ratio and a minimum dividend floor of €0.65 until 2026 (Fig 4). Therefore, in a depressed scenario, there is downside protection. As a reminder, the company goes ex-dividend on May 2nd. In our forecast, we anticipate a declining DPS set at €1.18, €1.16, and €1.17 for 2024-2025-2026;

-

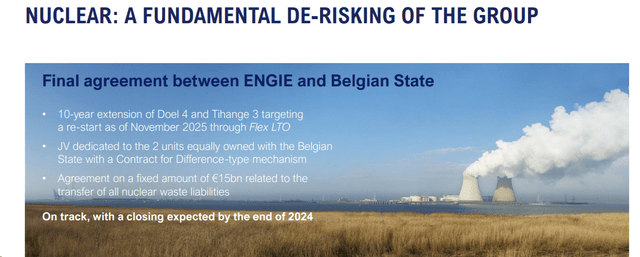

Engie signed a final agreement on the Belgian nuclear plan and fundamentally de-risked the Group portfolio (Fig 5). The company now expects a €0.2-0.4 billion core operating profit contribution from nuclear post 2026. This eliminated Engie’s longstanding uncertainty on nuclear waste liabilities. Here at the Lab, we believe this also simplified the group structure and removed another overhang;

-

Key to report is Engie’s structural growth expected in the upcoming years. We believe the market has overlooked the company’s EBIT growth. In our supportive forward view, Engie’s growth engines will be batteries and renewable energy development, which are very well supported by the company’s resilient earning generator, i.e., the network division. Looking back, we should report that the company delivered a core operating profit CAGR of 13% between 2021 and 2023. Even if we are forecasting a gradual deterioration of the group’s commodity-driven earnings, Engie’s new network core operating profit guidance supports our financial estimates;

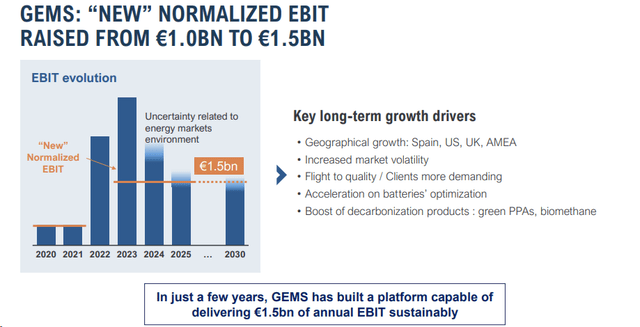

- Looking at the GEMS & Retail division (Fig 6), we believe the company forecasts cautious guidance. We have a different view supported by three key takeaways: 1) there is higher volatility post-COVID/Ukraine war on energy price; 2) we believe there are higher margins on battery storage assets; and 3) the retail division is more profitable due to higher demand for renewable electricity demand (from B2B clients);

- With commodity-driven profits normalizing and Engie’s nuclear EBITDA generation lowered, we expect Engie’s hard work to bear fruit. Here at the Lab, we project a declining EBITDA in our three-year visible period. In numbers, our 2024-2025-2026 EBITDA is set at €14.54, €14.46, and €14.14 billion, respectively. Following an aggressive CAPEX plan, our EBIT is forecasted at €9.07, €8.89, and €8.96 billion with an EPS of €1.81, €1.66, and €1.67;

- Besides, even if we are not speculating on portfolio rotation, we know disposal could play a crucial role in housekeeping. This also provides flexibility on the net debt profile. In our three-year visible period, we anticipated a financial leverage below 4x.

Engie 2024-2026 Outlook

Fig 3

Engie DPS Floor

Fig 4

Engie Nuclear Update

Fig 5

Engie GEMS new estimates

Fig 6

Valuation

We recently valued Enel, so we are taking advantage of our previous publication. Indeed, looking at the sector, the EU-integrated companies trade with a P/E and EV/EBITDA at 14.86x and >7x, respectively. In our 2024 numbers, Engie trades at a P/E of 8.56x with an EV/EBITDA of approximately 5.5x. At this stage, we see limited value granted by the market to Engie’s growth prospects. In addition, the networks/GEMS upgrades will likely allow the French player to weather lower energy prices more gracefully. French gas storage levels are pretty high, and the next 2024/2025 winter should be reasonably secure from a supply standpoint. More importantly, the overhang on Nuclear liabilities has been removed.

We see no reason why Engie should trade at a discount. That said, applying a 10x P/E due to a lower EPS evolution expected until 2026, we value Engie with a target price of €18.1 per share ($19.5 in ADR). This means a buy rating valuation with an expected total return of approximately 26% in one-year forward estimates.

Risks

Engie’s critical risks to our target price include a low and prolonged energy price environment, CAPEX delay with no growth in solar and wind net capacity additions, lower credit for battery and renewables growth beyond 2024, GEMS EBIT back to the pre-energy crisis level, and provisions in the retail division. Higher interest rates also negatively impact Engie.

Conclusion

We believe Engie is set to outperform the market in 2024. Our analysis is supported by 1) an attractive valuation, 2) earnings defensiveness driven by the network division, 3) lower risks on Nuclear, and 4) a simplified structure. Even if we are not speculating on rate cuts, the sector is sensitive to interest movements, and we believe we are at rate pick. Therefore, Engie is now a Mare Evidence Lab’s top pick.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here