The Biden-Harris administration recently announced a finalized retirement rule that will help individuals save for retirement. The Retirement Security Rule updates the definition of fiduciary, a financial manager that follows a certain code of ethics.

The amended definition requires financial managers to have set policies that guide them in advising individuals. These policies instruct professionals to provide prudent, loyal and honest advice without hefty fees.

“America’s workers and their families rely on investment professionals for guidance as they save for retirement,” Acting Secretary for the U.S. Department of Labor, Julie Su said.

“This rule protects the retirement investors from improper investment recommendations and harmful conflicts of interest. Retirement investors can now trust that their investment advice provider is working in their best interest and helping to make unbiased decisions,” Su said.

The updated fiduciary definition takes effect on September 23, 2024. When finalized, the new rule also helps fiduciaries compete for business on a more even playing field. Instead of rewarding financial managers for recommending certain products, it rewards them for giving sound financial advice.

“These new rules update regulations created nearly a half-century ago that simply are not providing the protections America’s workers need and deserve for their retirement savings so that they can retire with dignity,” Lisa M. Gomez, Assistant Secretary for Employee Benefits Security said.

“The investment landscape has changed, the retirement landscape has changed, and it is critical that our regulations are responsive to those changes so that workers can reach the secure retirement that they work for decades to finally achieve,” Gomez said.

Saving for retirement is a lot easier if you’re not burdened with high debts. A personal loan can help you consolidate your debts into a more manageable payment. Use an online marketplace like Credible to make sure you’re getting the best rate and lender for your needs.

RETIRED AMERICANS WITH STUDENT LOAN DEBT RISK GARNISHMENT OF SOCIAL SECURITY BENEFITS

Many Americans over 50 have no retirement savings

Saving for retirement is a difficult accomplishment for many Americans struggling to meet their basic financial needs.

Nearly 20% of adults 50 and over have no retirement savings, an AARP survey found. Americans that have saved for retirement don’t believe they’ll have nearly enough to retire comfortably. About 61% are concerned they won’t be able to fully support themselves during retirement.

“Every adult in America deserves to retire with dignity and financial security. Yet far too many people lack access to retirement savings options and this, coupled with higher prices, is making it increasingly hard for people to choose when to retire,” Indira Venkateswaran, AARP’s senior vice president of research, said.

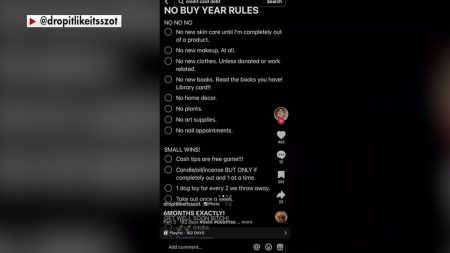

High debts and household expenses make it difficult for many workers to contribute to retirement plans on a regular basis.

“Everyday expenses continue to be the top barrier to saving more for retirement, and some older Americans say that they never expect to retire,” Venkateswaran said.

Credit card debt is a particularly high burden for many Americans. Nearly one-third of older adults carry a credit card balance of $10,000 or more. An additional 12% have $20,000 or more in debt.

Get rid of credit card debt with the help of a personal loan. Credible can help you find reputable personal loan lenders that provide timely funding. Visit Credible today to explore rates and loan terms.

CONSUMERS SPEND MORE THAN $1 TRILLION ON INTEREST PAYMENTS, LARGELY DUE TO INCREASING CREDIT CARD DEBT

Americans now believe they’ll need about $1.5 million to retire

The cost of retiring in America is growing. Many U.S. adults believe they’ll need at least $1.46 million to comfortably retire, a Northwestern Mutual study reported. This number is up 15% since last year when Americans thought they’d need about $1.27 million.

Younger generations, namely Gen Z and Millennials, will require even more for retirement than their parents. The study found that these generations will likely need $1.6 million to retire.

Compared to what Americans need versus how much they’ve actually saved for retirement, the outlook is grim for many. The average amount workers have saved for retirement dropped to $88,400 from $89,300 last year.

“In 2023, the soaring cost of eggs in the grocery store symbolized inflation in America. In 2024, it’s nest eggs,” Aditi Javeri Gokhale, the chief strategy officer at Northwestern Mutual, said.

“People’s ‘magic number’ to retire comfortably has exploded to an all-time high, and the gap between their goals and progress has never been wider. Inflation is expanding our expectations for retirement savings and putting the pressure on to plan and stay disciplined,” Gokhale said.

Gen Zers are preparing more for retirement than most other generations. The average American doesn’t start saving for retirement until 31, but many Gen Zers start as early as 22.

Take care of your debt, so you can contribute more to your retirement accounts. When it comes to personal loan shopping, Credible can do the heavy lifting for you. You can easily view multiple lenders, rates, and terms in one spot.

HIGH DEBT IS CAUSING MORE CONSUMERS TO LIVE PAYCHECK-TO-PAYCHECK

Have a finance-related question, but don’t know who to ask? Email The Credible Money Expert at [email protected] and your question might be answered by Credible in our Money Expert column.

Read the full article here