Plug Power (NASDAQ:PLUG) as a pioneer in the global hydrogen industry, has focused on hydrogen fuel cell design, development, manufacturing and commercialization since 1997. The company is the largest integrated hydrogen fuel cell system manufacturer and the top hydrogen re-fueling company.

However, the company has always been linked with one word – bankruptcy. This is primarily because of the company’s cash position and financial health, given its aggressive expansion and acquisition strategy.

While the short-term concerns for its financial health have been partially removed, because of the extra funding secured from B Riley earlier this year, investors should not forget that the strategy of Plug Power has remain unchanged, which means that the company has not completed its capital-heavy development trajectory that will require more cash burn.

At the same time, according to the latest 2024 Q1 earnings results, the company’s sales significantly fell short of expectation while profitability has not improved. After the earnings of the first quarter in 2024 has been announced, the stock was down about 7% post-trading hours. Therefore, this is a dangerous investment opportunity to me, hence a Strong Sell rating.

Rapidly expanding in the value chain, almost too fast

Plug Power

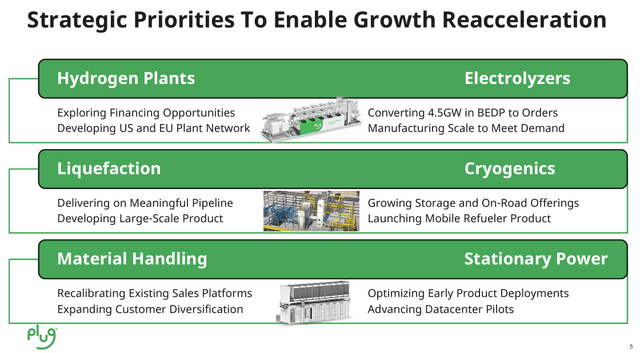

The company has started from manufacturing fuel cells, and through aggressive acquisition and expansion, the management has expressed that continuous expansion is how Plug Power keeps staying “at the forefront of delivering innovative and sustainable energy solutions.” In the quarter, the company has decided to further build 6 more hydrogen plants in the US, on top of the acquisition that the company has done before as shown below.

Global strategy of Plug Power

| Expanding hydrogen production: On top of the Georgia hydrogen plant milestone achieved in 2024 January, Plug kicked started its Tennessee hydrogen plant operation |

| Establishing hydrogen plants network: Establishing networks in the US and in Europe, including plants in Antwerp, Brussels, and Finland |

| Expanding electrolysis manufacturing network: Expanding the capacity of the plant in New York, which is a world-class fuel cell manufacturing |

| Entering road vehicle market: Partnering with Renault and establish a joint venture to manufacture trucks, while entering into aviation market |

| Establishing joint venture globally: Partnering and establishing joint venture partnerships with Renault in France, Acciona in Spain, and SK in South Korea |

However, in my opinion, this is a dangerous strategy since the global green hydrogen industry is still in its early development, and it is more a hype than a certain trend. This is exemplified by the fact that the only 1.3% of the green hydrogen offtake deals signed are binding, while others are all non-binding MOU or LOI. This has suggested that when Plug Power is broadening the business scope while not deepening its root, it will fall down easily, in my opinion. This leads us to examining the company’s financial health.

Short-term “going concerns” partially addressed by additional financing

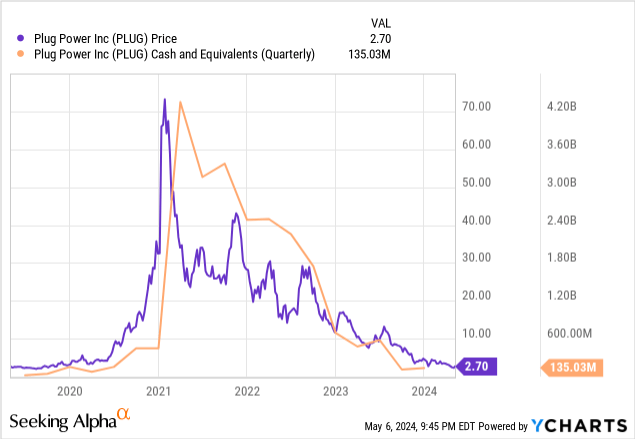

The company announced a net loss for 2023 at $1.4 billion, which is almost twice of the 2022 loss at $724 million. By the end of 2023, the company’s operating capital was $822 million, and unrestricted cash and cash equivalents dropped from $691 million from 2022 to only $135 million in 2023.

However, the company no longer faces an imminent risk of bankruptcy. In January, the company entered into a “Market Issue Sales Agreement” with B Riley that allows the firm to purchase an unlimited number of shares up to a maximum of $1 billion. Under the term, the company can sell share the B Riley “at the market” to further raise fund for the company’s strategic use. According to the management’s explanation to the SEC, this financing, alongside its cash position, can “at least sustain the company and its operations for more than 12 months”, which solved investors’ concerns.

First and foremost, our focus the last quarter was solving the going concern problem, which we have done – Plug Power CFO

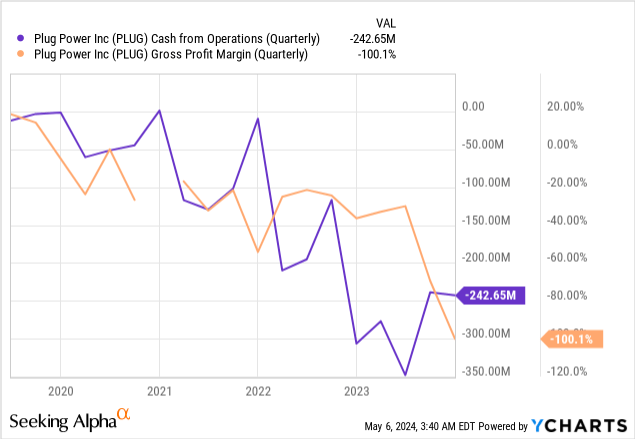

Although this, coupled with the CFO’s reassurance that “capex will come down tremendously”, may address the short-term bankruptcy concerns of investors with a shortage in cash last year, one should not be too optimistic about the company’s financial health, given the simultaneous drop in profit margin, as suggested in the chart above. For context, in 2023, the company’s profit margin for all of its products other than fuel cell system is negative. However, on the other hand, the company’s global expansion and investment plan has not stopped. In other words, the cash burn will not stop any time soon.

Sales, profitability and cash flow still at risk

Plug Power divided its business into four major segments: Sales of equipment, related infrastructure and other; Services performed on fuel cell systems and related infrastructure; Power purchase agreements; and Fuel delivered to customers and related equipment. Among the four pillars, the revenue from equipment and infrastructure sales accounts for 57.7% of the total revenue, while the service income had the smallest proportion.

According to the latest earnings announcement, the company’s sales has significantly declined to $120.3 million from $210.3 million in 2023, while analyst estimates of the sales this year are in the range of $150 – $210 million. This is a very disappointing result for investors, coupled with the net loss of $0.46 per share which is higher than the analysts expectations of $0.33.

While the company put the blame on “seasonality in our equipment sales and timing impacts from electrolyzer deployments”, this has completely wiped away most investors’ slight confidence gained by the extra financing secured earlier in the year. However, I have to emphasis that, the core of the company’s problem is how it manages its investment and sales, the cash position is merely a results. Burning $167 million this quarter in operations while merely having $172 million of cash, more dilutive financing can be expected.

Valuation

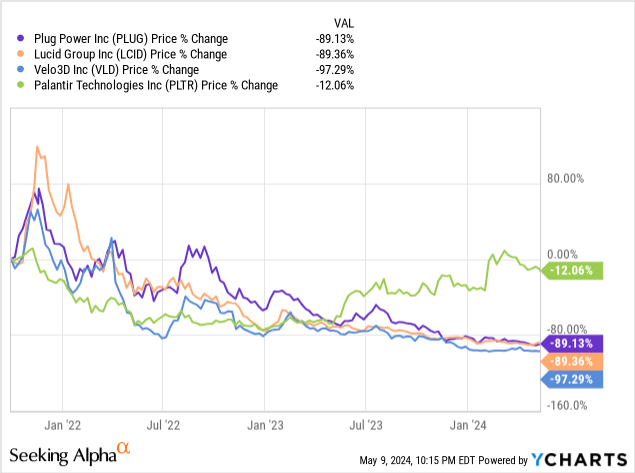

Like all pre-profit companies with financial distress, there is simply no valuation method suitable to give the share a fair price. Using a share price chart below to describe some of the distressed companies that I cover, they are all racing to the bottom with one exception – Palantir (PLTR) who has shown tremendous progress in profitability and cash flow. And only when Plug Power can do the same will its share price rise again.

But if you insist I give an estimate on the company’s share price, there is at least 25% room for decline in the coming three to six months with the following triggering events expected:

- Additional financing and action from B Riley, which will historically lead to a 20+% drop

- Actions to relieve the financial distress like selling off assets, laying off and cutting business units

- Potential de-listing risks if the share price is too low

- Downgrade by analysts

Investment risks

- Supply chain risks: The recent under-capacity of hydrogen has led to the high volatility of commodity prices and hydrogen production equipment supply. The company’s sourcing of equipment and raw materials may be disrupted or delayed, due to third-party suppliers’ manufacturing progress. This may affect the company’s production cost or ability to produce sufficient hydrogen

- Technology risks: The green hydrogen production technology is still in its infant stage, with production cost and time being unstable. This may affect the company’s ability to meet the downstream demand or its ability to expand the production. As such, longer breakeven period or cash burn is expected

- Exchange rate risks: The company’s hydrogen products and derivatives are being sold to foreign off-takers in the international market such as shipping lines and aviation, with costs being incurred in a certain countries. If the exchange rate fluctuates, or if the strong US dollar trend reverse, this may affect the company’s foreign business and profitability

Conclusion

In conclusion, although the additional funding has provided temporary relief for investors’ concerns and the company’s financial pressure, Plug Power’s underlying strategy in global expansion and vertical supply chain integration remains. Therefore, taking into account the company’s poor profitability and heavy cash burn, the company’s share price is unlikely to improve. For these reasons, a Strong Sell rating is assigned for this stock.

Read the full article here