The Company And Its Financials

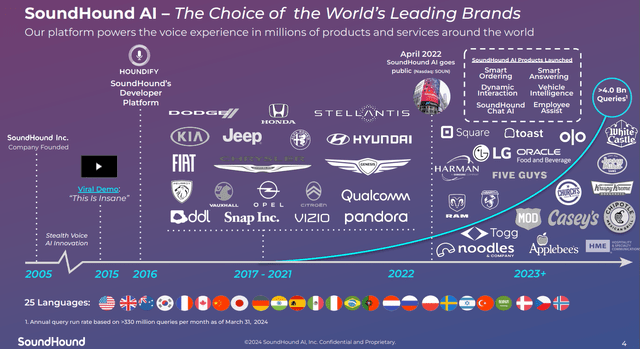

According to Seeking Alpha’s description, SoundHound AI, Inc. (NASDAQ:SOUN), a California-based $1.67-billion market cap firm, develops voice AI solutions for various industries including automotive, TV, IoT, and customer service. Their products include the Houndify platform, which offers tools for building voice assistants, and SoundHound Chat AI, which integrates real-time data like weather and sports. They also provide SoundHound Smart Answering for custom AI-powered voice assistance, CaiNET and CaiLAN software for improved query handling, and solutions like Dynamic Interaction, Smart Ordering, and Employee Assist. Below you can see how the company has developed from its foundation in 2005 until today (charts taken from the last IR presentation):

SOUN’s IR materials

I immediately have a question about the long period of more than 10 years that has passed since the company was founded in 2005 and the first product was created. After that, it took SOUN another 5-6 years to generate its first real sales and win its first few clients (mainly from the automotive sector). Now that the entire market has recognized the importance of voice AI in manufacturing, the company’s sales are growing exponentially as it expands its reach to other end markets.

In other words, either the product the company is developing is so sophisticated and unique that it takes so much time to develop, or the management is simply ineffective and SOUN is only saved by the hype surrounding AI. Or maybe it’s both – let’s assess.

But first off, I suggest reviewing how efficiently the company has grown in recent periods.

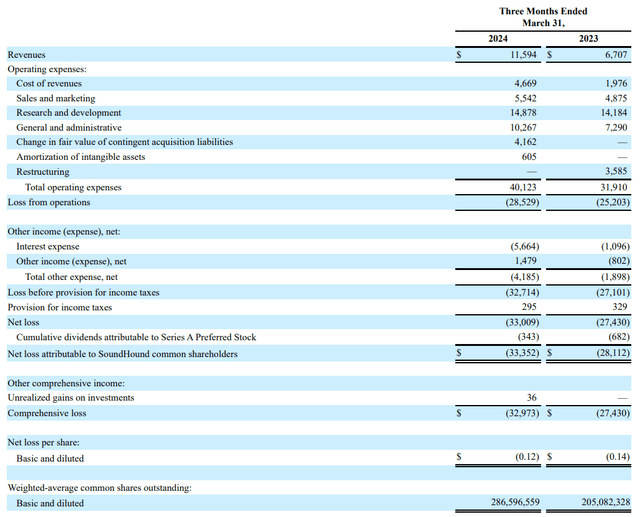

Upon reviewing the latest 10-Q filing for Q1 FY2024, I saw that the company’s revenue grew by a robust 72% YoY. However, what stood out even more was the more than twofold increase in COGS during the same period, while R&D and SG&A expenses saw minimal increases of 4.9% and 13.7% year-over-year, respectively. This disproportionate growth in COGS might be attributed to the “disease of scaling.” As the company expands to new locations, COGS tends to rise significantly due to the increased effort required to establish and optimize operations on-site, as these costs typically fall under COGS. Perhaps SOUN will have fewer problems with this in the future, but today the company is increasing its costs more than its revenues: hence Q1 FY2024 operating loss was ~$28.5 million, which is ~$3.3 million worse than 2023.

SOUN’s 10-Q filing

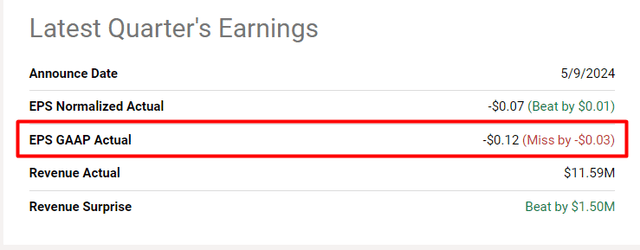

SOUN’s diluted earnings per share amounted to negative $0.12 – this is clearly not the development of events that the market was counting on, as we can see from the negative GAAP earnings surprise:

Seeking Alpha, SOUN, the author’s notes

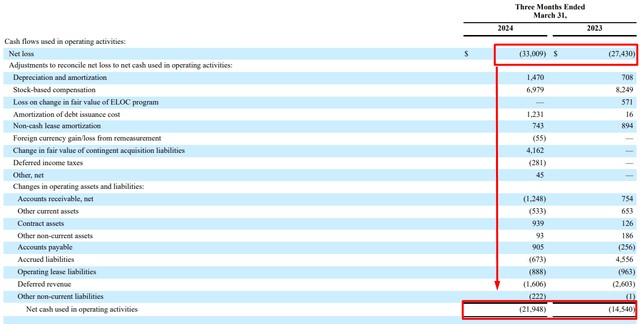

The increase in SOUN’s net loss led to the fact that operating cash flow also fell significantly – by almost $22 million, almost twice as much as the company’s revenue in the first quarter. At the same time, SOUN’s cash on hand has increased significantly (from $46.5 million in Q1 FY2023 to $226 million), as the CEO said during the last earnings call. That’s true, but this increase comes mainly from proceeds from the issuance of Class A common stock – I don’t see anything special in terms of the quality of operating activities. By quality, I mean at least a hint that SOUN is trying to control its costs and working capital while growing the top line, which I can’t yet see. Yes, this is definitely very important – raising additional cash, enough for about 2 years at current operating costs, gives the company room to breathe and scale further. But unless something fundamental changes, I expect SOUN will have to raise additional capital in the market and dilute current investors to sustain its growth – no talk of cost optimization yet. This is a risk that cannot be ignored.

SOUN’s 10-Q filing, the author’s notes

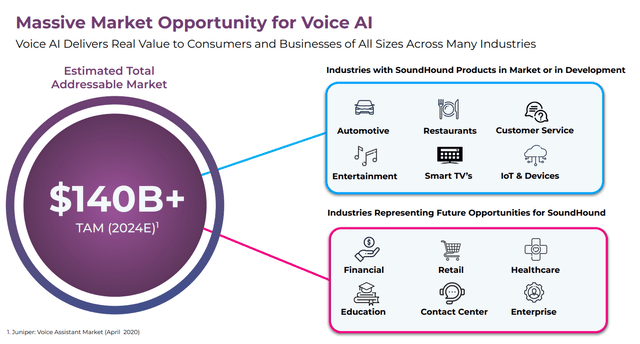

I’m not ignoring the fact that SoundHound’s addressable market is growing like crazy. According to Speechify, this market is estimated to reach a value of ~$26.79 billion during the forecast period from 2023 to 2028, with a CAGR of 17.2%. The entire AI industry, including the speech market, is forecast to be worth more than $190 billion by 2025. Obviously, management is targeting the second of the two figures (i.e. $190 billion), but adjusting it to the region in which the company is present.

SOUN’s IR materials

We estimate our pillar two total addressable market to be over $100 billion with over 1 million restaurants and approximately 30 million businesses in North America alone that we can offer our solutions to. And with dozens of languages we already provide to our pillar one customers, we plan to also go international in pillar two.

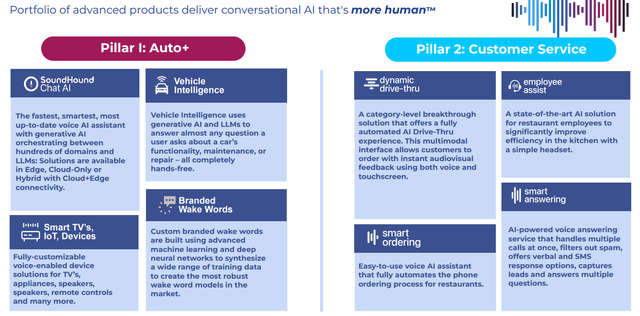

What pillars does the management talk about? The company categorizes its products and services into two Pillars. Pillar 1 is all about “Auto services”: driving assistance, also smart TVs, home devices, and more. Pillar 2 focuses on “Customer Service”, primarily targeting restaurants, food delivery clients, call centers, and similar end markets.

SOUN’s IR materials

Going back to my question at the beginning, although SoundHound has been in business for a very long time and offers a complex product, the company has struggled to turn a profit for many years. Until the recent hype around AI, the company was unable to sell its product effectively. In my opinion, the niche market in which the company operates is very large indeed, and SoundHound has the potential because of being a pioneer in this market. SOUN seems to have made significant progress recently and now that its products and services are being monetized, I believe it’ll be able to actively increase its sales in the coming years. This is good news and a competitive advantage for SoundHound over its younger peers who may not have as much experience and numerous patents (according to SOUN’s investor presentation, the company has more than 270 patents: 155+ granted, 115+ pending). SoundHound’s business structure and division by type of service offered seems to me to be well positioned to adapt to changing market needs. On the other hand, I’m concerned that SoundHound wasn’t able to market its products and services before the AI hype. This raises a question that I can’t answer: How consistent will the company’s offerings be for future customers? Can it retain its customer base as competition in the Voice AI niche grows? Only time will answer these questions, but these questions definitely introduce some level of risk for investors. What further confuses me is the competition from major players like Amazon (AMZN), Google (GOOG), and Apple (AAPL), who already have voice assistants. This represents significant competition for SoundHound, especially if these tech giants decide to make more aggressive attempts to monetize their innovations on this front (outside their ecosystems).

Although SoundHound has done a good job of attracting new customers in recent months (which has cost it a pretty penny), I see SOUN’s market size and current valuation as the main problems investors could face.

SoundHound’s Valuation Is The Problem

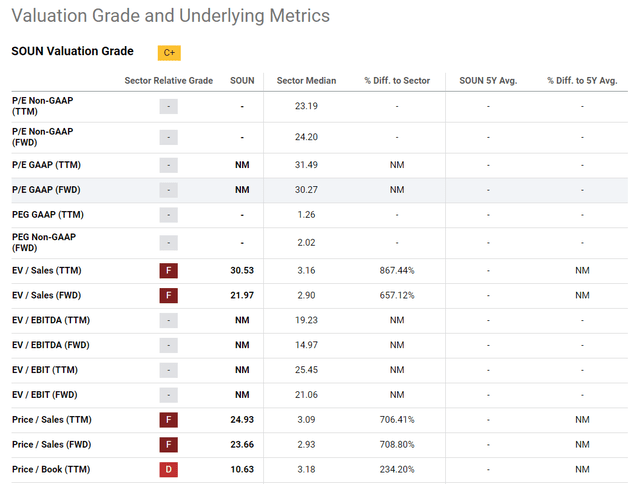

Let’s assume that management’s estimate of the potential size of the addressable market is that it will be $100 billion dollars in a few years. However, the company is already worth about 1.67% of that market, even though it has only made $50.8 million in TTM sales so far – a drop in the ocean, in my opinion. But that’s not the problem I see today.

What confuses me is the valuation. On a TTM basis, the price-to-sales ratio is one of the few metrics we have available to analyze today – it’s 32.9x (market cap to TTM sales), which is insanely high since we’re talking sales, not earnings. However, on a FWD basis, we have a figure of around 23.6x for FY2024 and 16x for FY2025 if today’s consensus is correct.

Seeking Alpha

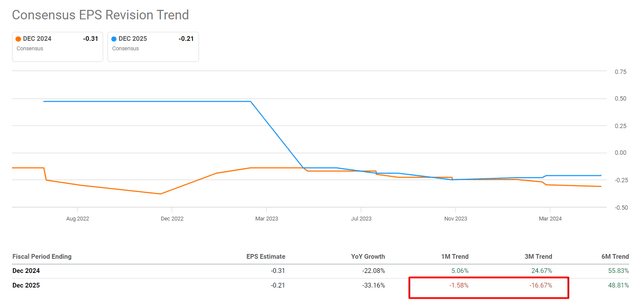

The market expects SOUN’s revenue to grow by 53.74% in FY2024 and by 46.55% in FY2025, YoY, respectively. At the same time, the consensus expects SOUN’s earnings per share to improve from -$0.31 in FY2024 to -$0.21 in FY2025 (a 47% improvement). I believe that SOUN’s earnings momentum is not sufficient on its way to breakeven: While the company continues to generate a heavy loss, I believe sooner or later it will have to dilute shareholders or raise debt, which in turn will put additional pressure on earnings and delay breakeven.

I also don’t like that SOUN was subject to a series of EPS revisions after the Q1 FY2024 report – in the last 3 months the size of the forecast FY2025 EPS has been reduced by more than 16%, which only confirms that the risk I described above is actually closer than many optimistic buyers think.

SOUN’s EPS revisions, the author’s notes

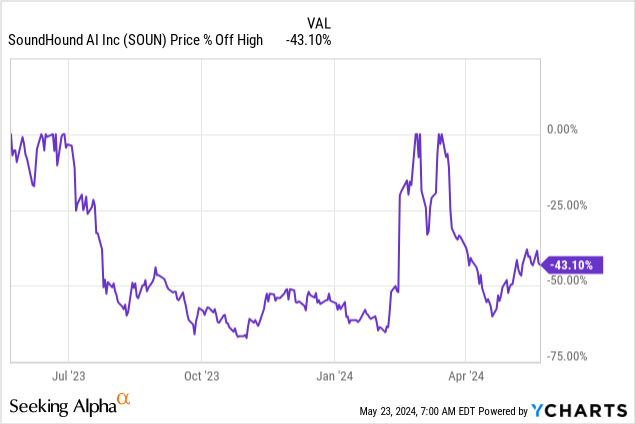

These revisions certainly explain what has happened to the stock in recent weeks – it has fallen by 43%:

Given the high volatility, I would not be surprised if we see renewed attempts to buy on this dip. However, the next leg up will not make the company more attractive; on the contrary, it will exacerbate the risks I write about in today’s article.

Summary Conclusion

If we take everything I have written about above together, a rather interesting picture emerges.

First, while the company is growing very fast, its COGS growth is far outpacing its revenue growth rate, which is not a good sign of quality. In my opinion, the risk of future dilution is on the horizon, and so far few people are paying attention to it.

Secondly, the valuation of the company seems to be very high. The point here is not that the company is trading at 32x its TTM sales, but that this multiple is expected to fall to just 16x by the end of FY2025. By comparison, even during the boom of technology companies in 2020-2021, the median valuation multiple in M&A deals grew only slightly from 5.8x to 6.4x, according to Aventis Advisors. In my opinion, the multiple contractions priced in today are too modest, so SOUN is really overvalued even considering its implied sales growth projections. In the valuation section above, I didn’t mention specific numbers where I see a fair valuation for SoundHound – it’s pretty hard to do for a growth stock. However, based on basic logic and M&A deals history from 2020-2021, I believe the company’s P/S shouldn’t fall to 16x, as predicted by some Wall Street analysts, but rather to around 10x, which itself would carry a premium for superior growth rates. In this case, we could see an overvaluation of at least 37.5%, based on my calculations.

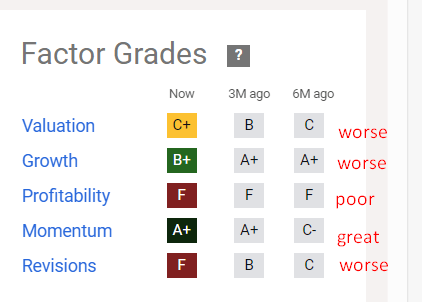

Third, a series of recent negative EPS revisions raises a number of questions about how realistic the early break-even is. Seeking Alpha’s Quant Grades describe all 3 of these points as succinctly and colorfully as possible:

Seeking Alpha, the author’s notes

Why then do I rate SOUN as a “Hold”?

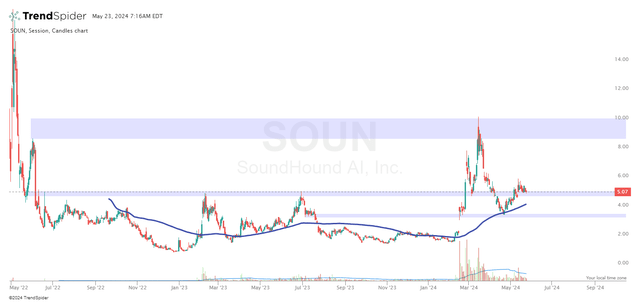

My uncertainty stems from chart analysis. As mentioned above, the stock is down about 43% from its local highs, creating favorable conditions for those looking to buy it on a dip. Currently, SoundHound stock is holding confidently above its 100-day moving average. Just recently, the price broke through a strong resistance level and settled above it, indicating further growth potential in the short term. Of course, this upward momentum, driven by the market’s fear of missing out on gains, could only make SoundHound more expensive and unstable as an investment in the long run. But anyway, this poses a risk to short sellers and leads me to maintain a ‘Hold’ rating on the stock today.

TrendSpider Software, the author’s notes

Thanks for reading!

Read the full article here