Investment thesis:

Warner Bros. Discovery (NASDAQ:WBD) reported 1Q24 earnings earlier this month. I’m initiating the stock with a buy rating based on two factors I see playing out simultaneously: 1. Consistent debt reduction, and 2. Improving profitability in Warner Bros Discovery’s Direct-To-Consumer or DTC segment is an impressive milestone, considering others in the streaming peer group, e.g., Disney (DIS) and Paramount (PARA), struggle to achieve that. I attribute the former to management’s disciplined execution on debt since the merger in 2022 and the latter to the booming Max business.

The company reported revenue of $9.9 billion for the quarter, a decrease of 7% year over year, missing the consensus of $10.2 billion, but showed a contracting net loss at $966 million (40 cents EPS) compared to $1.07 billion (44 cents EPS) from a year ago quarter, missing consensus of 59 cents. The company also recorded an operating loss of $267 million, compared to $557 million from a year ago quarter. The stock is down over 7.9% over the past month, showing shaky investor sentiment in the stock. Warner Bros Discovery’s reputation since the merger has been one heavily weighed down by debt and a lack of competitive edge in the streaming wars, but I think we’re at a turnaround moment for Warner Bros Discovery in 2024.

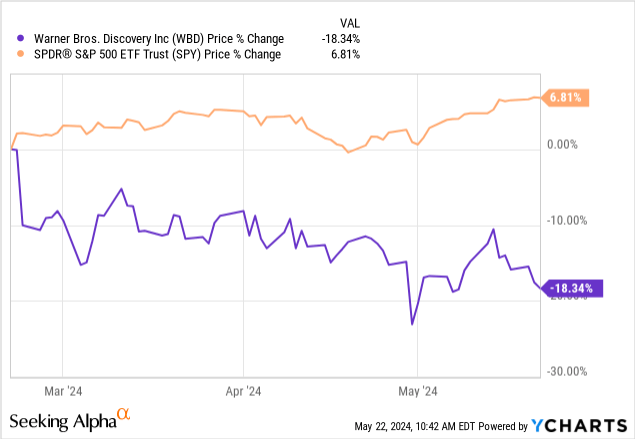

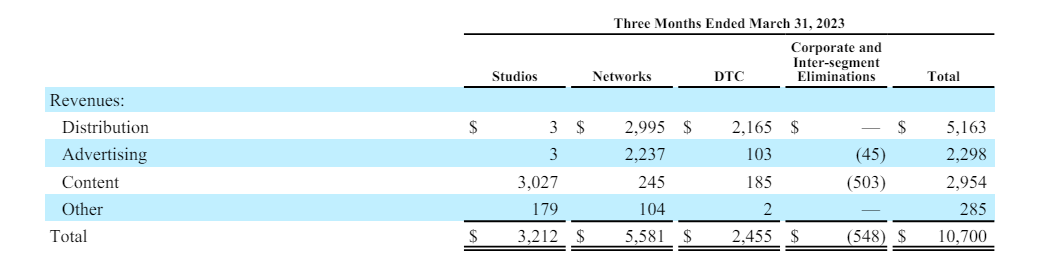

I see more upside ahead after the miss on top and bottom lines this quarter, as I think the market’s subtle reaction to the miss shows the worst has already been priced in, and Wall Street’s expectations have reset. The graph below shows Warner Bros Discovery underperforming the S&P500 by 25% over the last three months.

YCharts

On the six-month chart, Warner Bros Discovery is also underperforming the S&P500. The S&P500 is up ~17%, while the stock is down ~26%.

YCharts

I see a window for longer-term investors to jump into the stock at current levels as it trades very close to its 52-week low; it’s trading at $7.8 now, near its 52-week low of $7.3. I think the stock will see a material recovery in the 2HFY24.

Warner Bros Discovery Value Proposition

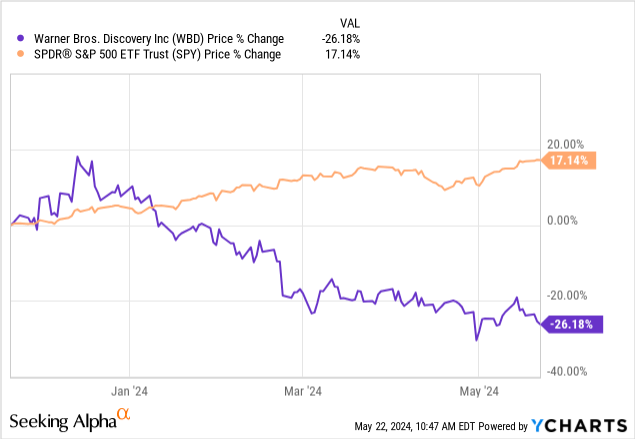

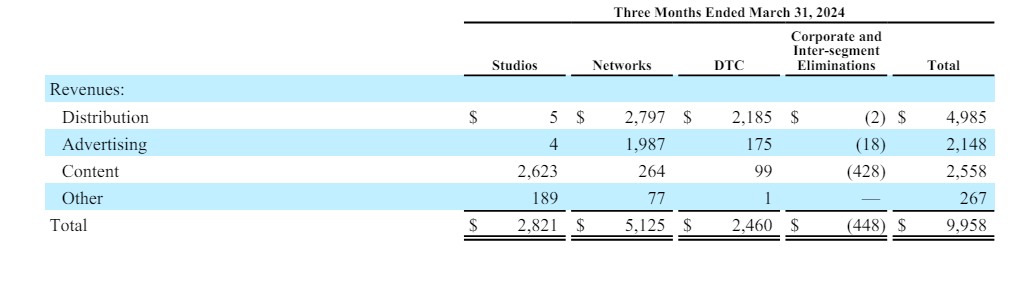

Warner Bros Discovery has three segments under its entertainment business: studios, networks, and DTC. All of these saw revenue decline year-over-year during 1Q24, except for DTC. The following chart shows the segment results for a year ago quarter, comparing revenues in the Studios, Networks, and DTC segments with the company’s most recent quarter results.

Warner Bros Discovery 10Q

This chart from the most results reflects a year-over-year decline in all segments, except for DTC, which showed a slight improvement.

Warner Bros Discovery 10Q

I’m always positive about the diversification strategy. My philosophy is that entertainment companies are often better positioned when they have more than one leg to stand on, or in other words, multiple revenue streams. Having said this, I do expect the next leg of growth supporting outperformance to come primarily from Warner Bros Discovery’s Max business.

DTC growth: near-term catalyst

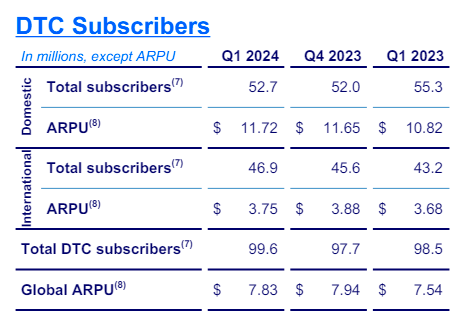

DTC is a subscription-based service that includes HBO Max, DC Universe, and Discovery+. I’m focused on DTC growth; in my opinion, it’s the most promising near-term catalyst for Warner Bros Discovery. The company improved significantly on the direct-to-consumer streaming subscribers during 1Q24, increasing the total to 99.6 million, an impressive increase of 2 million global subscribers. DTC revenue increased slightly to $2.460 million compared to $2.455 million in a year-ago quarter. This segment also recorded a $36 million increase in adjusted EBITDA at $86 million, compared to $50 million year-over-year. I’m also more optimistic about DTC profitability improving once macro uncertainty eases into 2025.

Another positive, in my opinion, is management’s go-to-market strategy for Max using bundles and packages of Max with other services in the market. The company revealed earlier in the month that it would bundle its streaming services with Disney’s services, making Max, Disney+, and Hulu a package and offering it as a “callback to the traditional pay TV package,” according to CNBC. I’m most curious about how pricing will look as a tool to better gauge how this will impact top-line growth, but prices have yet to be disclosed. Management called the pricing “attractive,” and I believe that if properly set up, the price could determine the success of the partnership. I see this joint effort by both companies as a profitability enhancer in FY2024. Management shares this sentiment as CEO David Zaslav mentioned in the earnings call that the overlap of these three services is looking promising in terms of driving subscriber growth for all three offerings, increasing retention, and lowering churn, which is a “killer in this business.” The graph below shows DTC’s total subscribers domestically and internationally, with a slight hit on the domestic front this quarter caused by seasonality. The bundling strategy should help boost subscriber numbers and ARUP by the end of FY2024.

Warner Bros Discovery 1Q24

I am also keeping an eye on the company’s advertising tier after this quarter’s results, but I don’t see it positively impacting top-line growth too much in the near-term. In my opinion, Max can be credited with the rise of ad revenue by 70% year-over-year this quarter due to engagement on the site in the U.S. due to the B/R Sports launch in late 2023.

Financial health:

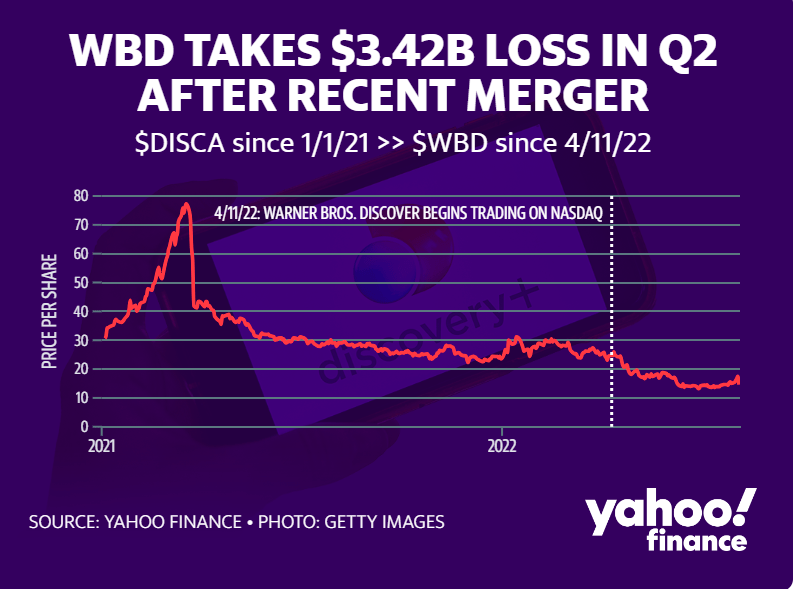

Part of my positive sentiment on the stock is based on management’s discipline in reducing debt and improving financial health. After the company went public in April 2022, combining AT&T’s WarnerMedia with Discovery, there became a massive amount of debt, as shown below. This quarter confirmed my belief that this debt will be a temporary headwind as management reported 1. increased cash flow and 2. consistent debt repayment.

Yahoo Finance 2022

The company generated $585 million in operating cash flow and free cash flow of $390 million, compared to a negative $930 million from a year ago quarter. Even looking at a year ago quarter, free cash flow increased to about $7 billion, over $6 billion of which was allocated to repaying debt, as shown in the table below.

|

Quarter |

1Q23 |

2Q23 |

3Q23 |

4Q23 |

1Q24 |

|

Debt repaid |

$60 million |

$1.65 billion |

$2.48 billion |

$1.13 billion |

$1.12 billion |

|

Total remaining |

$49.21 billion |

$47.56 billion |

$45.08 billion |

$43.95 billion |

$42.84 billion |

I recognize management’s efforts to pay the debt, as I see an upward trend dating back four quarters. Debt is decreasing substantially, and I don’t think it will be a problem for much longer.

Valuation says buy on weakness

In my opinion, the stock’s valuation makes it more attractive. I consider Warner Bros Discovery a value stock at current levels, according to data from Refinitiv shown in the table below. The stock is trading at an EV/Sales ratio for CY2024 of 1.5, while the peer group trades higher, with an average peer group ratio of 8.5. I think mid-to-long term investors are well positioned to buy the stock on weakness.

Image created by The Techie with data from Refinitiv

What could go wrong?

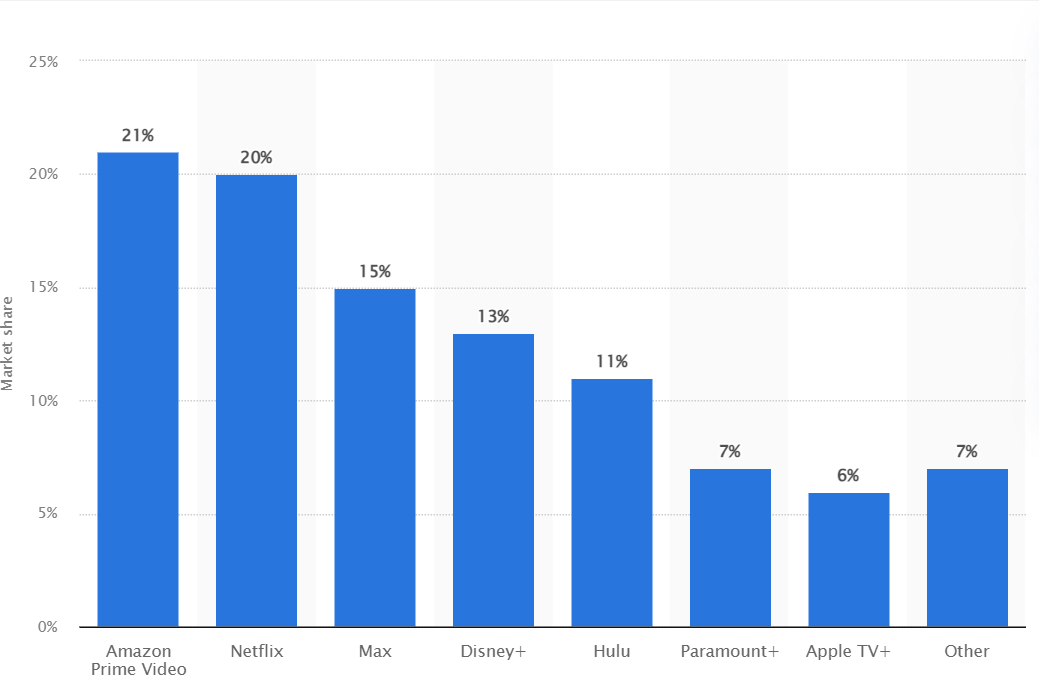

The streaming industry is an increasingly competitive field, and Warner Bros Discovery is competing with companies with a wider customer base and larger market share. The following chart shows the top streaming company market share as of 2023.

Statista 2023

Warner Bros Discovery will need to bring its A-game to keep up with the peer group because the company doesn’t have any unique competitive advantage, particularly in the streaming business. This is what I think they’re doing with the bundling strategy; in my opinion, management is well aware of the lack of competitive edge when it comes to the streaming industry, and that’s why the company is placing so much emphasis on the bundle strategy, first with Disney and soon with Paramount. They’re prioritizing monetization over differentiating the service, which, I believe, is a smart move to boost near- to midterm growth.

What’s next?

The stock is down ~67% since going public in mid-2022, and in my opinion, there isn’t much downside risk left in the near term, as the negatives have mostly been priced into the stock and outlook. I think investors should start to consider a long-term position in Warner Bros Discovery at current levels to ride the upward trend of Max monetization.

The stock is trading near its all-time low. I think Warner Bros Discovery is a well-run company with undiscovered potential in the streaming business and improving financial health. I’m watching bundle and package pricing heading into 2H24, as well as operating net loss. I would advise investors to jump in on the $7.40s range.

Read the full article here