Introduction

Kyndryl is the product of a spin-out by IBM (IBM) in November 2021. IBM’s intent was to remove the declining part of their business so that they could focus on their growth drivers. The business that became Kyndryl was roughly 20% of IBM’s revenue, but less than 4% of IBM’s market cap at the time of the spin. Kyndryl’s financial profile featured declining revenue, low margins, and negative free cash flow – a combination not appreciated by IBM management or shareholders. In my article from November 23, 2021, we recommended purchase of the stock based on a risk-reward trade-off that was heavily tilted to the positive. Sentiment on the newly public shares was extremely negative, IBM’s remaining holdings were viewed as a significant overhang, and the valuation on future FCF appeared very attractive. The story has played out largely as expected, sentiment has improved somewhat, the stock has appreciated, and we now consider the risk-reward profile more balanced.

Brief Review of the Business of Kyndryl

Kyndryl provides IT infrastructure services. The company essentially manages the hardware, software, network, and security systems for large enterprises. Over time, large corporations and government entities have built complex technology environments that require lots of people. Kyndryl has roughly 80,000 employees across 60 countries serving over 4,000 customers today, including 75 of the Fortune 100. Although KD has only been a standalone public company for less than three years, this is a very established company.

Kyndryl has a large, albeit declining base of business. Their average customer relationship is roughly 10 years with an average contract of 3–5 years, and the separation from IBM opened up opportunities with other technology partners. For example, in February, Kyndryl announced that they are extending their current contract with Google Cloud. Still, the core business looks as much like a “melting ice cube” as a turnaround, in our view. The traditional enterprise systems, originally developed by the likes of IBM, Oracle, and SAP are being replaced by slick cloud-based systems developed by those same companies, in addition to Microsoft (MSFT), Salesforce (CRM), Workday (WDAY), and many others. Management of the newer cloud-based systems tends to be more streamlined, and is typically arranged by the developers themselves. KD addresses a market that has been in slow decline.

Results since the Spin

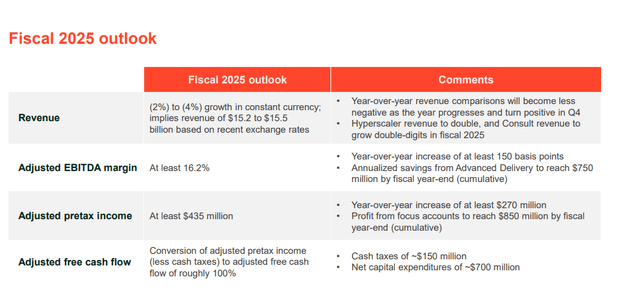

We believe management has actually done a good job thus far, and performance has generally been in-line with management’s initial plan. Revenues have declined from $18.3 billion in F2022 to $16.1 billion in F2024, and guidance calls for just over $15 billion for F2025. As anticipated, revenue has declined in each quarter for which standalone data exists.

The bigger driver to the Kyndryl story may be free cash flow generation. By shedding unprofitable business, focusing on higher margin accounts, and re-pricing certain accounts, KD is close to generating adequate FCF to pay down debt, although much further away from being in a position to do a meaningful stock repurchase and/or initiate a dividend. The company was actually close to generating positive FCF in F2024, with CF-Ops of around $450 million and net Capex around $513 million. When adjusting for cost items that Kyndryl expects to disappear over time, including Workforce Re-balancing ($176m), Transaction-related Payments ($106m), and Litigation ($61m), the company actually generated positive FCF of around $290 million, or more than $1.25/share. Importantly, the F2025 guidance calls for Adjusted FCF that appears roughly similar.

Kyndryl 10K

Risk-Reward Trade-off More Balanced Today

Management has largely delivered on their initial post-spin plan. The company has re-focused the company on higher value work and taken a hatchet to cost structure. However, there will be limits to what management can do with this business, in our view. For example, the higher margin consulting business (Consult) now represents 15% of business and is growing significantly. However, consulting is a very competitive space, and we suspect Kyndryl will struggle to hire/retain good talent at levels that allow that business to grow profitably long term. We have shifted to a more neutral stance to reflect the following concerns:

- Achieving and sustaining positive organic growth may be more challenging than the current trajectory indicates. The company expects to deliver its first quarter of positive revenue growth in Q4 of F2025. Even if that happens, it may be difficult to sustain. While Kyndryl participates in Cloud Computing environments, the migration from On Premise to Cloud does not play to their strengths, which was the reason IBM divested the business. We believe this trend is actually accelerating, in large part due to the AI capabilities that are rapidly being integrated into cloud computing and cloud storage environments.

- FCF in F2025 should be better than what the company expects, in our view. The company has spent more than two years rightsizing the organization, shedding and restructuring certain unprofitable accounts and signing higher margin deals. (Given the scale of the business and the length of certain contracts, it is understandable that there is more to be done.) This is also a business with heavy working capital requirements. With the steady revenue declines and focus on working capital cycle over the past two years, free cash flow should be better. If and when revenue begins to grow, it is likely that working capital becomes a drag on FCF.

- The quality of earnings (and actual FCF) should improve as the “temporary” costs decline. However, we believe the company will incur workforce re-balancing at some point, and workforce re-balancing is just part of the business. (We also believe litigation will remain part of this business, although maybe less than $60 million per year.)

- Companies with little or no growth should return capital to shareholders, and we don’t see that in the intermediate term. KD has almost $1.5 billion in net debt on the balance sheet, which is manageable given the reasonable maturity ladder on the facilities. However, the company will need to generate significant FCF to reduce that amount to where they can repurchase stock or pay a dividend. We do expect actual FCF generation in F2025 versus the actual cash burn (even giving credit for asset dispositions) of around $60 million in each of the past two years.

Valuation

We do not consider KD overvalued, but believe the upside from here is modest, at least for a while. With the LT growth outlook and current capital structure, we believe a reasonable P/FCF multiple is 10x (on clean FCF). We believe the company can generate $2-$3 per share in FCF in F2026, which has valuation about where it should be. Obviously, a lot of things can happen between now and then related to enterprise spending trends, financing costs, and company-specific moves.

Conclusion

KD has performed well since the initial drop following the spin. This was a classic deep value opportunity. However, the story has largely played out, and the risk/reward is more balanced than it had been. We are moving our rating to Hold and recommend that investors ring the register on this one.

Read the full article here