Introduction

First Guaranty Bancshares, Inc. (NASDAQ:FGBI) is a small regional bank that has taken its share of hits related to the deposit struggles and higher interest rates facing its industry. Last year, I analyzed the bank and discussed why I would not be taking a position in either the common or preferred shares. After three quarters of new data, I revisited the bank’s financials, and determined that the situation had improved enough to take a small position in the preferred shares, but I am still avoiding the First Guaranty Bancshares common shares despite their trading near a 52-week low.

First Guaranty Bancshares Financial Performance

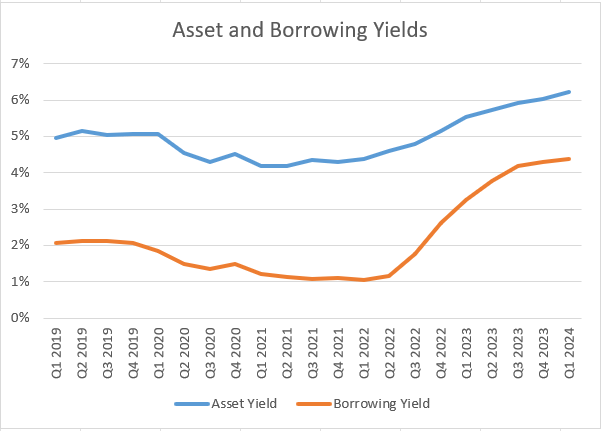

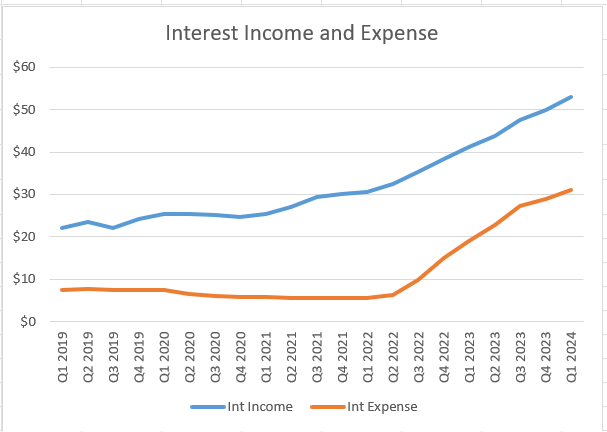

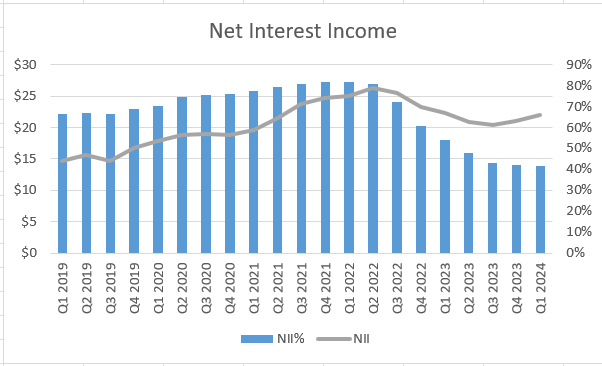

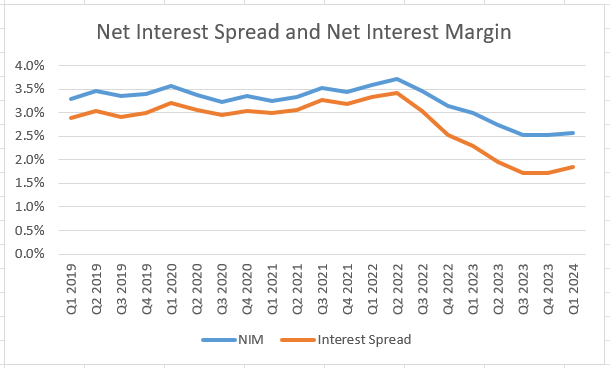

When interest rates rose in late 2022 and into 2023, First Guaranty Bancshares got squeezed a bit harder than many of its peers. The borrowing yields on its liabilities rose faster than the bank was able to raise the asset yields on its loans. As a result, interest expenses rose at a higher rate than interest income. Net interest income (interest income less interest expenses) dropped rather dramatically.

Fortunately, the bank has managed to grow net interest income over the last two quarters and stabilize its net interest spread and net interest margin.

Bank Financials Bank Financials Bank Financials Bank Financials

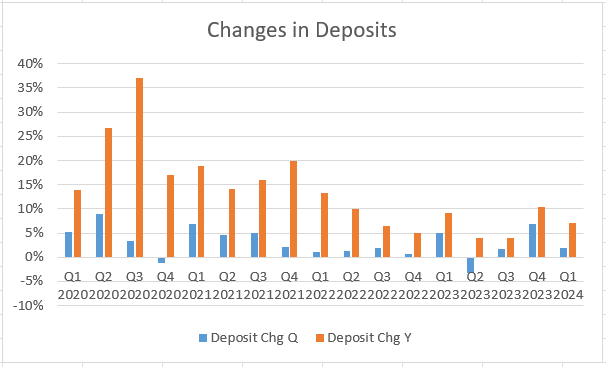

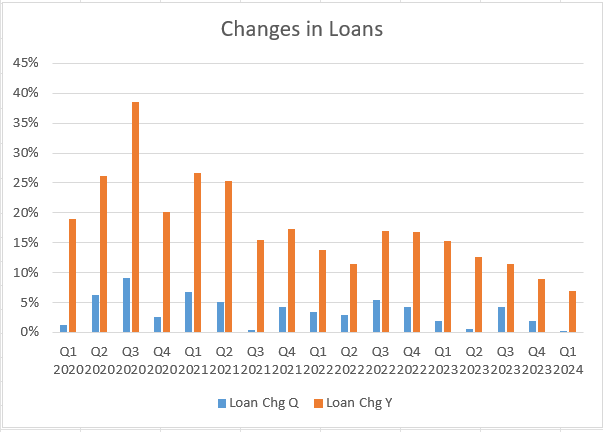

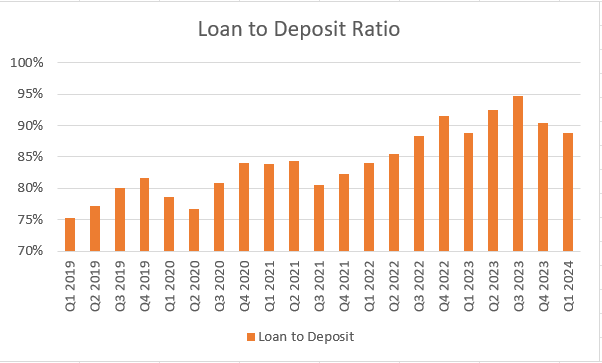

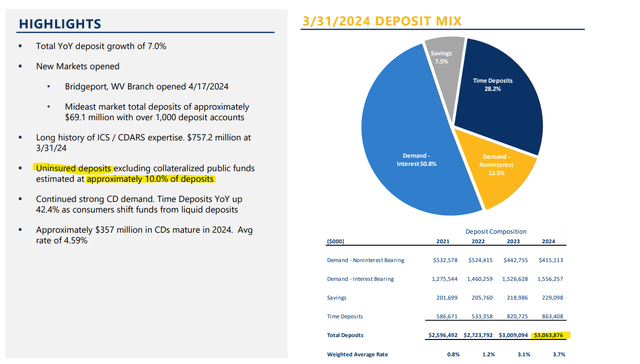

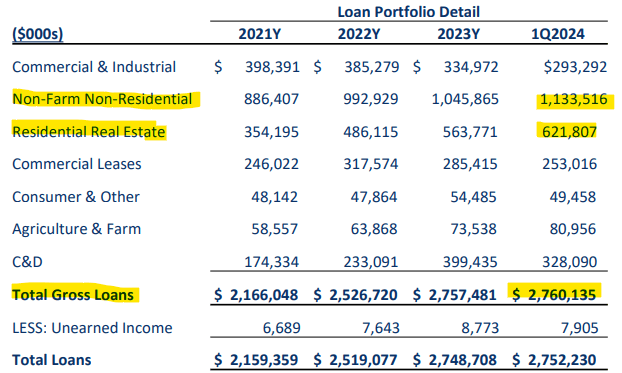

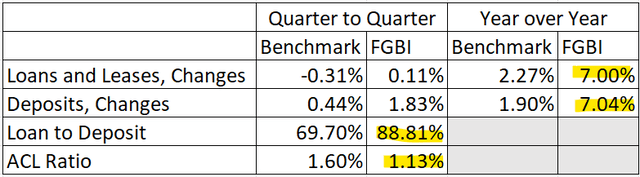

First Guaranty Bancshares has made progress beyond earnings. Back in September, I noted the concerning decline in the bank’s deposits. Since then, the bank has managed to grow deposits for three consecutive quarters, with year-over-year deposit growth now at 7%. Loan growth has eased off some, with first quarter loan growth near flat and year-over-year loan growth at 7%. Getting loan and deposit growth to match for a bank this small is important, because it brings the loan-to-deposit ratio under control.

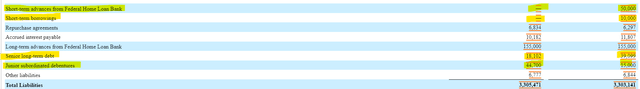

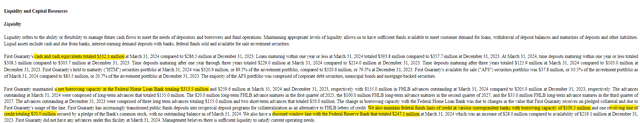

While the loan-to-deposit ratio is above the benchmark, it has declined to under 90% and signals less of a need for additional financing beyond deposits to fuel loan demand. First Guaranty was also able to pay off $60 million in short-term borrowings in the first quarter, thanks to the improvement in deposit growth.

Bank Financials Bank Financials Bank Financials SEC 10-Q

While many banks are grappling with the risks associated with uninsured deposits, First Guaranty Bancshares does not have to worry about this issue. Only 10% of the bank’s deposits, or approximately $300 million are uninsured. From a liquidity perspective, First Guaranty has uninsured deposits covered with cash on hand of over $330 million. Should they need additional access to funds, they have over $650 million in liquidity available through the Federal Home Loan Bank and Federal Reserve. Because of this coverage, I consider the bank’s uninsured deposits to be a strength for the preferred share thesis.

Earnings Presentation SEC 10-Q

Risks to First Guaranty Bancshares

First Guaranty Bancshares is one of the higher risk income securities in my portfolio. The risks to the bank will mainly affect the common shares, but investors should be mindful that if things get bad enough, there may be some price volatility in the preferred stock as well. When it comes to risks, I will be carefully monitoring the bank’s loan composition and performance.

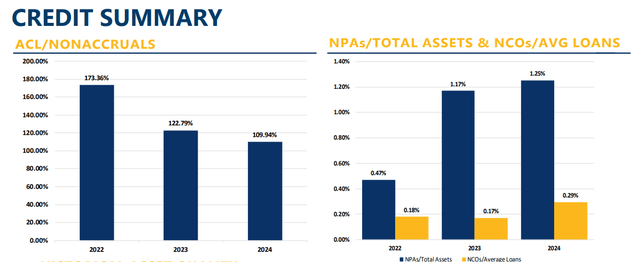

The concentration of the bank’s loans (more than 40%) is designated as “non-farm non-residential” which is code for commercial real estate. These loans are currently under scrutiny and could threaten the bank’s earnings in future quarters. The trend is already beginning to become concerning. The coverage of the allowance for credit losses against non-accrual loans has fallen from 173% in 2022 to 110%. Non-performing assets as a percentage of total assets are also rising. It also does not help that the bank’s allowance for credit losses is under 1.2% of gross loans, which is 40 basis points below the industry average.

Earnings Presentation Earnings Presentation Bank Financials & Federal Reserve Report on Commercial Banks

Conclusion

First Guaranty Bancshares, Inc. has made meaningful gains regarding deposit growth and short-term borrowing. As a result, the bank has been able to stabilize its net interest margin and net interest income. I’m comfortable enough to take an entry position into the bank’s 8.8% yielding preferred shares, but I’m still not sold on the common shares. The bank’s loan concentration in commercial real estate combined with its eroding performance and low allowance for credit losses places a great deal of risk onto common shareholders, but I see the threat to preferred shares as marginal.

Read the full article here