Why You Should Keep ASP Isotopes On Your Watchlist

ASP Isotopes Inc. (NASDAQ:ASPI) with a life history of fewer than three years, is a specialty materials company, that is seeking to build clout in the terrain of Isotopes, where the supply chain is inherently quite fragile, and provides budding players, the opportunity to make a mark.

For the uninitiated, Isotopes are atoms of the same chemical elements that have the same number of protons but different number of neutrons; for instance, take carbon which has three naturally occurring isotopes- Carbon-12, Carbon-13, and Carbon-14. All three of these isotopes will have the same number of protons but the first isotope has 6 neutrons, the second 7, and the third 8. Put another way, they all share the same chemical properties, but vary in mass and physical properties, and could have different end uses.

Jan 2024 Presentation

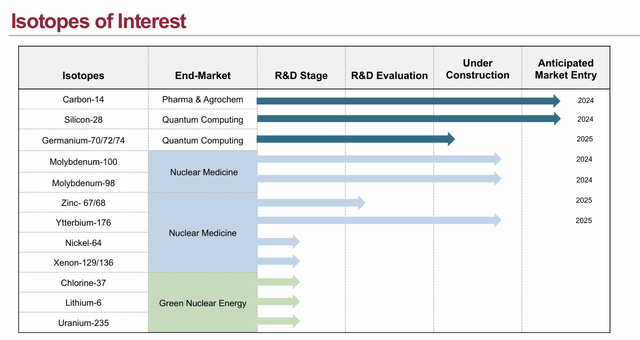

These Isotopes will be required in increasing frequency by a range of industries including nuclear medicine, healthcare, agrochemicals, quantum computing, space exploration, and nuclear energy. However, the bulk of the supply is currently controlled by the Russian state-owned- Rosatom State Nuclear Energy Corporation (believed to account for 85% of global production) leaving a massive gap in the Western world.

The supply side is not vast enough as it is difficult to find the appropriate tech to parse and separate these innately similar isotopes that only have minor weight differences. Besides the cost involved in setting up separation facilities can be quite prohibitive (the capital cost associated with a single gas centrifuge plant could be upward of $800m).

ASPI believed they have a more cost-competitive (less than $100m a plant) and effective alternative that can help separate isotopes of varying atomic mass and unique transition energies. Essentially, ASPI’s tech leverages the principles of quantum mechanics and lasers to carry out the separation process. What’s key is that, unlike a few alternative supply sources where isotopes are often procured as by-products of nuclear energy reactors, ASPI’s isotope enrichment plants produce and enrich isotopes organically with no waste.

Because of these benefits and its positioning in the Western world, ASPI has a large backlog of interest from customers for various isotopes, who are even prepared to fund ASPI’s future isotope enrichment facilities. This year, ASPI recently wrapped up the completion of its first manufacturing facility in South Africa (specializing in carbon-14) and is now on course to wrap up a multi-isotope enrichment facility by mid-2024 which could open up further commercial opportunities.

Financial Outlook and Valuations

Until Q4 of last year, ASPI wasn’t generating any revenue. Then in October 2023, it acquired a 51% stake in PET Labs Pharma, a radiopharma company that will give the former exposure to the downstream radio pharmacy market.

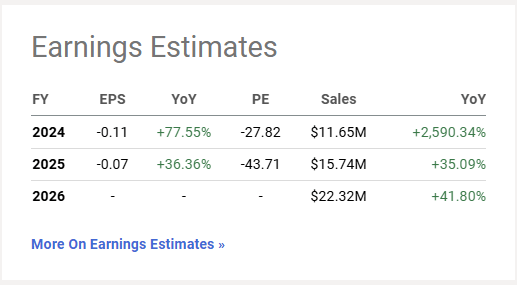

As a result of this acquisition, ASPI was able to notch up a small revenue figure of $0.43m last year (by way of sales of nuclear medical doses for South African-based PET scans), which has almost doubled to $0.84m in Q1-24 alone. This is expected to stimulate topline growth at a steady pace as demand for new PET radiopharmaceuticals is on the up, and there’s been a general shift to image-guided medical care.

Besides the nuclear medical dose opportunity, also note that in mid-2023 ASPI had signed a multi-year carbon-14 contract (carbon-14 has great utility in tracking drug molecules in a body because of harmless emissions of alpha particles with a minimum revenue commitment of $2.5m p.a. The first revenues linked to this contract is expected to come on board by mid-2024.

Then last year, ASPI had also locked in a supply agreement with a US customer to supply highly enriched metal, equating to sales of $9m p.a.

Essentially all these opportunities will see, ASPI’s topline growth surge by over 2000% this year. However, given the low base and just one quarter of revenue growth from last year, we don’t think investors should get carried away with the topline growth seen in FY24; rather a more appropriate gauge should be the revenue growth trajectory from FY24-FY26 which points to topline CAGR of 38%. There’s potential for these sales estimates to get adjusted to the upside, as management believes they can lock down even more isotope contracts within the 2025-2028 time frame.

Seeking Alpha

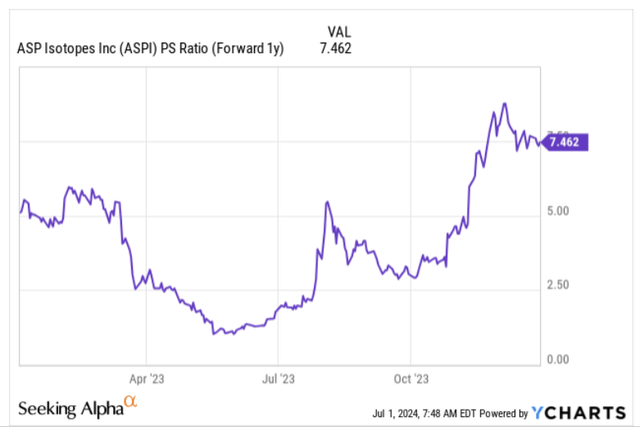

Regardless, for a business poised to generate at least 38% topline CAGR over the next two years, a price-to-sales multiple of 7.46x does not feel exorbitant.

YCharts

Key Risks

As you can imagine, the financial commitment towards developing complex tech like isotope enrichment won’t be light (CAPEX has been coming in at the +$1m mark last two quarters). In addition to that, this is a loss-making business (and is expected to bleed red next year as well) and continues to incur operating cash outflows to the tune of $2-$3m per quarter. Currently, it has less than $24m of cash on its balance sheet, which is largely the function of convertible notes issued to the tune of $20.5m (at a rate of 6% for the first year, and 8% thereafter). We’ve also seen the company receive around $5.5m in April by issuing shares linked to the exercise of warrants.

Despite tapping all these funding options, management has suggested that the liquidity won’t be sufficient to fund their operations for the next 12 months, so expect another round of common stock or other equity securities funding in the months ahead, which also raises the prospect of equity dilution risks further down the line.

Do consider that, ASPI still has a very underdeveloped management team, and it was only recently they appointed a new CFO (before that a certain individual held both the CFO and COO posts)

ASPI’s proprietary tech has been able to demonstrate success in enriching isotopes of low atomic mass, but there are still question marks over its ability to enrich heavier isotopes such as molybdenum or uranium. Thus, note that even though ASPI has talked up the scope of these isotopes in the medical industry or energy industry, it has yet to push for any regulatory approval of the same.

Closing Thoughts – Technical Considerations

ASPI’s stock made its debut on the bourses in November 2022, so with less than 20 months of price action, the monthly charts won’t provide great context.

On the smaller time frame- weekly charts though, it appears that the force has been with the bears since the second half of May, although the glass-half-full community may be inclined to think some respite is in store.

Essentially note that from July 2023, for close to a year, the stock had been trending up within a certain ascending channel. A couple of weeks back, we saw the ongoing bearish momentum push the price out of the channel. Now however, the stock has come to a terrain that had served as a brief consolidation zone in February, and as a source of support in April; so don’t be surprised if you see some of the selling momentum abate.

Investing

Having said that, we are still not overly enthusiastic to jump in as yet, as the positioning on the relative strength charts is still not ideal.

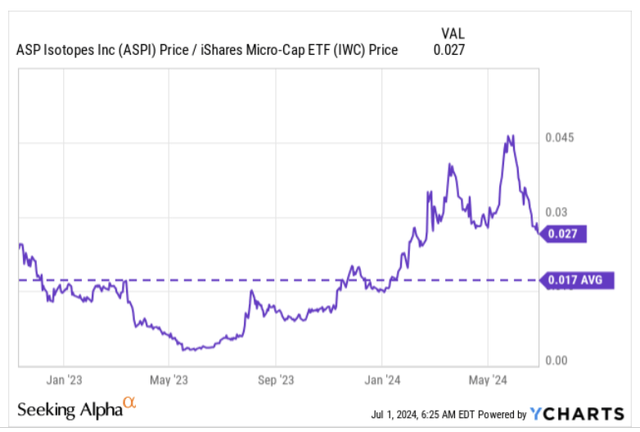

YCharts

The chart above suggests that within the broad micro-cap universe, ASPI’s relative strength still looks quite elevated, currently translating to a 59% premium over its long-term average. Until this ratio gets closer to the mean, we don’t feel, it would be the most opportune time to go long.

Read the full article here