There are some excellent opportunities among high yield preferreds with the potential to capture stable double-digit yields. We are also seeing capital gains potential with some trading at steep discounts to par value despite a high chance of redemption at par in the next few years. In response to this opportunity, we have been posting our research such as our recent piece on Chimera Investment Corporation preferreds (CIM).

There are, however, quite a few traps in the area as well so I want to shed equal light on the risks. One must tread carefully and fully research each company to differentiate the good from the bad. This article will discuss the concepts behind the ways in which high yield preferreds can be dangerous as well as point out some specific issues that are dangerous today.

Mechanics of getting paid by preferreds and what can go wrong

There are three ways in which an investor in a preferred gets paid:

- Dividends.

- Liquidation preference.

- Redemption.

Like any other fixed income instrument, preferreds pay a contractually obligated sum designated by the coupon. Also similar to bonds, preferreds are entitled to their liquidation preference (face value) in the event the company is sold or liquidated.

There are two aspects that make preferreds as an asset class slightly riskier than bonds:

- Preferreds sit below debt but above the common in the capital stack so in the event of liquidation, debt gets paid before the preferreds.

- Failure to pay a preferred dividend does not trigger an event of default as failure to pay interest would with a bond. This makes it a lower priority for the company.

As a tradeoff for these weaknesses, preferreds usually offer higher yields than bonds. The spread between the yield of a preferred and that of a bond should be proportional to how much incremental risk preferred holders are taking on. In theory, the preferred of a well-managed company with a strong balance sheet should trade at a very small spread to bonds while the preferred of a company with weak cashflows, too high of leverage, or other substantial risk should trade at a significant spread.

The market usually understands that there should be a spread between preferreds and debt, but it is often wrong to ascribe the magnitude of that spread. Herein lies both the danger and the opportunity.

By examining the fundamentals of the underlying company, its capital stack, and its management, we can get a sense of what yield a preferred should trade at relative to where it is actually trading. Among other things, key pieces of information for a preferred are:

- Equity cushion.

- Business volatility.

- Premium to par.

- Bad actor risk.

Below we will explore specific preferreds that we believe are dangerous.

Not enough cushion

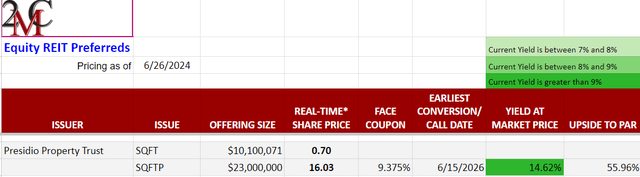

Presidio Property Trust, Inc. (SQFT) has a preferred, SQFTP that looks quite enticing at first glance with a current yield of 14.62% and a whopping 56% upside to par.

Portfolio Income Solutions

This preferred might be a trap, however, as it has very little equity underneath. The market cap of the common is only $10 million against $23 million of preferred and $98.5 million mortgage debt as of 3/31/24.

Given these ratios, it would only take a few percentage points of decline in asset value to wipe out the common entirely and then the preferred starts to feel the burden of declines.

It is possible that there is some sort of turnaround play here, but that would require a differentiated thesis with specific reasons why one believes SQFT will improve. Buying SQFTP for its income seems like a highly risky endeavor to me.

It is easy to see that a microcap like SQFT is too small to provide a cushion of safety for the preferred, but it can happen in larger companies as well. The key is the ratio between common, preferred, and debt.

This ratio should also be considered in the context of the business. Perhaps a high ratio of preferred to common is fine if the underlying business is quite stable, but we would want a much bigger equity cushion for volatile businesses.

Business volatility risk

The volatility of a business is not necessarily bad for common equity investors as they benefit from upswings just as much as they could be hurt by downswings.

As fixed income investments, preferreds are capped in their upside due to being redeemable at par value either presently or in the not-too-distant future. Volatility retains the risk side without the upside making it a clear overall negative. Thus, preferreds of companies in inherently volatile sectors should trade at higher yields.

Hotels are one such volatile sector. They can make great sums of money during event-driven surges or periods of economic strength inducing more travel, but they also have stretches of operating losses.

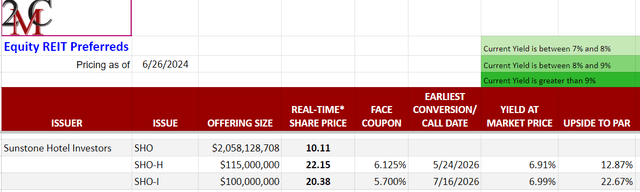

I think the market often misunderstands the concept that preferreds don’t participate in extreme upside and as such tends to overvalue preferreds of strong yet highly cyclical companies. Sunstone Hotel Investors, Inc. (SHO) is a well-managed and relatively successful hotel REIT but the preferreds are not attractive at current pricing.

Portfolio Income Solutions

A 6.9% yield would be appropriate for a non-cyclical company of similar size and earnings power. At that yield, it simply isn’t properly compensating investors for the extra cyclical risk they are taking on.

Recall that during the pandemic hotels had a long period of losses with many billions of dollars lost. Similar, although less severe losses happened after the 9/11 terrorist attacks, the Great Financial Crisis, and even the dot-com bust to a lesser extent.

Terrible events happen to hotel profitability seemingly multiple times each decade. If you are going to take on that risk, at least get compensated for it.

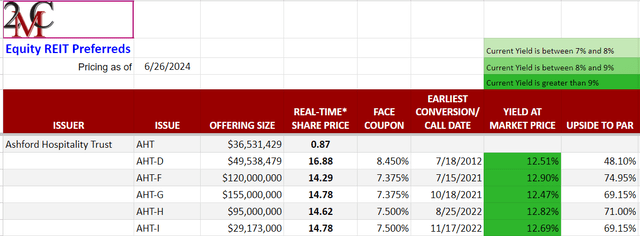

Ashford Hospitality Trust, Inc. (AHT) preferreds appear to compensate for extra risk with yields in the 12% range, but in addition to the cyclical risk of the industry, they have too small of an equity cushion as well.

Portfolio Income Solutions

With the $36 million market cap common dwarfed in size by the outstanding preferred issues, the company is just a sneeze away from the liquidation preference of the preferreds becoming impaired.

Always be cautious when reaching for yield, but particularly in high leverage situations in volatile sectors.

Bad actor risk

One of the most difficult risks to avoid is that associated with bad actors. It won’t be discernible in financial statements or analysis of the underlying business.

Management teams are humans and sometimes humans make bad choices that can harm investors. It is difficult to warn about future bad actor risk because I don’t know which company will try to pull a fast one, but we can examine historical cases to see what sort of things can happen.

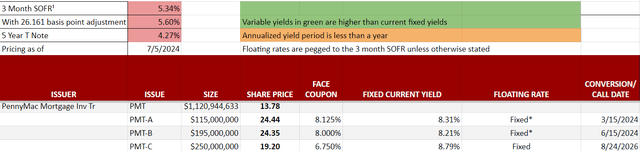

PennyMac Mortgage Investment Trust (PMT) has fixed to floating preferreds that were supposed to convert to floating on the dates listed below.

Portfolio Income Solutions

At the time of conversion to floating rate, PMT announced that they were not going to honor the floating rate and instead keep it at the original fixed rate.

The prices of these preferreds dropped materially. They have since recovered as many believe there will be legal or other actions that could force the company to pay the proper floating rate.

If floating as originally intended, the yields would be significantly higher.

Another way management can harm the value of a preferred is to remove assets from underneath them.

Cedar Preferred C and B were fairly well-protected preferreds fundamentally, as Cedar had a nice portfolio of shopping centers with a value that was clearly much larger than the debt plus preferreds.

In structuring the sale of Cedar to Wheeler Real Estate Investment Trust, Inc. (WHLR), however, the preferreds were transferred to WHLR in such a way that they are now tied to a much smaller pool of assets. As such, they became fundamentally riskier and have traded down materially to reflect the higher risk. We wrote more in-depth about what happened here.

There is no way to fully protect one’s portfolio against bad actors. It can happen to common, preferreds, or even debt. I find the best mitigation strategies to be knowing the management teams of companies and diversification.

Danger in preferreds of stable and highly profitable companies

Even when a preferred is associated with a great company that has low debt, high cashflows, and a stable business, the market price can be its own danger.

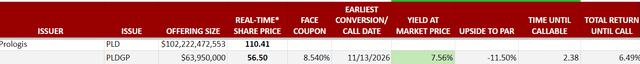

It is difficult to find a company that is more capable of supporting its preferreds than Prologis, Inc. (PLD). With $103B of common equity cushion and a strong growing business, Prologis, Inc. 8.54% PFD SR Q (OTCQB:PLDGP) is at minimal risk of going unpaid. Given the underlying strength, it should trade at a very small spread over debt.

Its current yield is 7.56% which, on a nominal basis, is easily high enough.

Portfolio Income Solutions

pricing as of 6/26/24.

However, the market seems to be focused only on the current yield and has forgotten about redemption risk.

Prologis has access to cheaper capital than its 8.54% coupon preferred so it will almost certainly redeem the preferred as soon as possible which is 11/13/26. With a par value of $50, investors are likely to get redeemed at $50 in 2.38 years which would incur a capital loss of $6.50 from today’s price.

This capital loss would eat up a significant amount of the dividend received over that time frame taking total return until redemption to about 6.5%. Over the course of 2.38 years that is an annual yield of about 2.7%

PLD is a great company, but there is no way its preferred should trade at a yield to maturity well below that of treasuries.

Putting it together

REIT preferreds have historically had fairly low default rates and have generally been a solid source of stable high yield. In today’s environment, high interest rates are causing many of these issues to trade at particularly high yields and nice discounts to par making it broadly opportunistic.

As always, we advocate for wise single-issue selection, even when an area is broadly strong. There are both excellent opportunities and some traps. Hopefully, this article helps shed some light on how to differentiate between the two.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here