The reason that Vital Energy (NYSE:VTLE) got a lot of the acquired acreage in the first place is that much of the acreage is smaller amounts that do not appeal to the larger companies because such size “does not move the needle.” Additionally, the operators had such high costs (as much as $60 breakeven per BOE) that the acreage probably did not appeal to a lot of buyers. Therefore, there was reduced competition for the acreage, even though the location was better than what the company already had.

The last article looked hard at profitability and the effect of that profitability on the debt. But this provoked a lot of questions about how a company that reported a first quarter loss was going to do what management stated. Lost in the question was the consideration that five acquisitions and two add-on acquisitions (on the same terms) for small owners in the same properties would come with a material amount of one-time costs. The company has now roughly doubled its size in terms of quarterly production. That will take some organizing. But then, where are all those great profits coming from? It’s hard for readers to see profits when they are seeing a loss. Therefore, this article will attempt to explain that in some detail.

A good management can take acreage like the company required and get the maximum returns from it given a little bit of time. Now, maybe the breakeven point will not be as good as an Exxon Mobil (XOM) or an Occidental Petroleum (OXY). But there’s often a whole lot of possibilities between a small operator and one of those big companies. Many smaller companies like this one can make a living by being a low-cost operator for their size. Low-cost for Vital is often not the same as low-cost for Occidental Petroleum.

As these companies grow production, they gain the ability to bid for better acreage. But the key is to avoid the larger company competition. Among the large companies, Diamondback Energy (FANG) headed to the Midland Basin early before that basin attracted a lot of attention. By the time the industry overall went in that direction, Diamondback had already made several acquisitions, probably at better prices than is the case now that everyone “knows” the Midland Basin is the place to be.

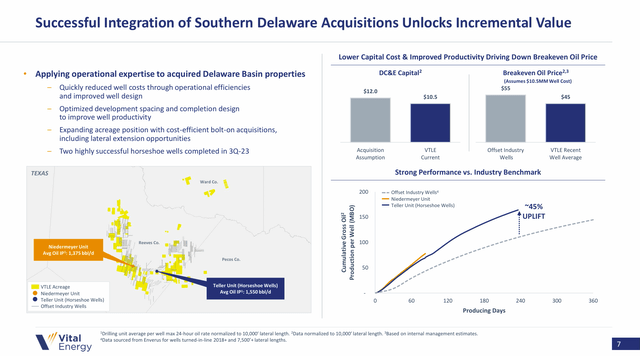

Delaware Basin Acquisitions

One example of this is the Delaware Basin acquisitions.

https://seekingalpha.com/article/4700746-vital-energy-going-west-for-more-oil (Vital Energy First Quarter 2024, Earnings Conference Call Slides)

One thing to note is that the emphasis is on oil production. The reason is that smaller operators often have to pay to have natural gas transported anywhere. Therefore, oil production is the basis for drilling these wells and anything else is “icing on the cake” as there’s a lot of excess other products in the Permian. This makes it hard for those other products to gain any value for the smaller operator.

Vital Energy most likely inherited that issue. Because production headed past 100,000 BOED the company may be in a position to negotiate better pricing for those products over time. But there will not likely be an instant “cure” for the situation.

That makes the 150,000 barrels of oil cumulative production (as shown above) important, as that production likely pays for the well (give or take). I’m using very round numbers before everyone tells me specifics. When you’re not a big oil company, a fast payback is essential because any production after that essentially adds to cash flow with only the usual production costs subtracted out. Essentially, the equipment is now paid for regardless of the accounting. That’s a huge deal during a cyclical downturn.

But the thing to notice is that the breakeven price dropped $10 (as shown above) just by applying what management already knew. As management learns more about the acreage, that breakeven is likely to drop further for new wells. In the meantime, that WTI $45 breakeven price is not bad. In fact, it could be about as good as one can get for a company of this size, and it’s certainly far better than the legacy acreage when natural gas prices are depressed.

It’s a similar story with Upton County, where management got the breakeven point for new wells down to $45 WTI as well. With oil prices where they are, management has plenty of time to improve that figure. New wells will take some time to become significant profit contributors and drop the company’s breakeven point. But this already looks like a darn good start.

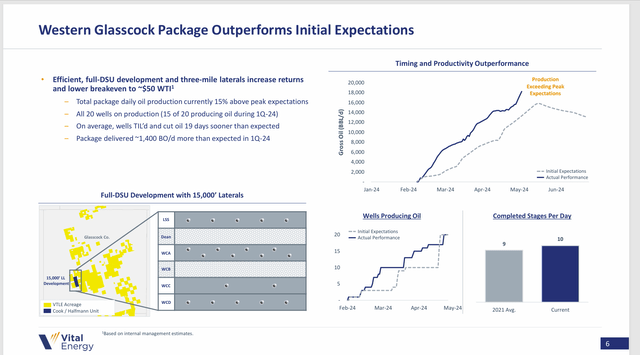

Western Glasscock

This acreage was acquired because its cash flowed better than the legacy acreage in Eastern Glasscock. However, it also produced a fair amount of natural gas. Therefore, as natural gas prices declined, then a higher oil price was needed for the wells to breakeven. This was one acquisition that needed to wait for a natural gas pricing recovery.

Unfortunately, the plans here did not “pan out” as planned. Now, however, technology advances may have brought this acreage back into consideration even with very low natural gas prices.

Vital Energy Performance Improvement Of Western Glasscock County Wells (Vital Energy First Quarter 2024, Earnings Conference Call Slides)

Even with the reported improvement, the profitability of these wells likely lags the latest acquisitions. It also shows why management has not acquired more acreage in this area (at least for the time being).

Long-time readers may remember that these wells produced at least 40% oil, which was a good 15% or so better than what was happening on the legacy acreage. Then the price of natural gas tanked.

Now, evidently technology has changed enough that it was time to try to improve the profitability of this area. That breakeven price of $50 WTI is probably marginal at best. However, it’s likely good enough that management will learn from the experience and come back with improvements to get that price still lower.

On the graph above, the key is the peak production would appear to now average 800 BOD (roughly) and it may hit 1,000 BOD. If the wells can stay at that level long enough for the company to produce about 80,000 barrels of oil, say in 90 to 120 days, then even the sharp decline curve of first year production may allow for a profitable idea.

This area would also benefit from the recovery of natural gas prices, as that would decrease the price of oil needed for breakeven as well. Since there’s a lot of export capacity coming online, the time spent now on optimizing wells may be time well spent.

Summary

Vital Energy purchased some property in good locations from some higher cost and likely smaller operators. The property was purchased with the idea that future wells drilled would be far more cost effective. This cost-effectiveness would increase as the company learned more about the acreage characteristics and as technology improvements continue to sweep the industry.

This property is expected to compete for capital dollars right away at the expense of the legacy acreage. Therefore, production from the legacy acreage is no longer expected to be a significant profit contributor. The production from the new acreage not only has a greater percentage of oil production, but the wells could potentially have larger absolute production also to make them more profitable than the legacy acreage.

The higher cost of the inherited production will gradually lose its significance as the company drills new wells to replace the declining production from wells already drilled. This is a process that could be material in the beginning, given the cost savings shown above (so far). But it will likely slow as the company has more wells that are more efficient on production.

The last article noted that Occidental has far better costs. But a company this size will likely be outbid for that kind of acreage. It’s very rare that a smaller company gets big company results without taking some risks to be first before the rest of the industry notices the profitability of an area.

Management has noted several times the success of the latest acquisitions has enabled the company to raise its goals on the quality of future acreage acquisitions. That means that the corporate breakeven will likely decline through the acquisition of still better acreage.

This company remains a strong buy as management has made darn good progress increasing cash flow and free cash flow from what it inherited. It looks like management is going for still more improvement. That bodes well for future stock price appreciation. Shareholders have yet to benefit from the transition to a more functional industry model that meets both debt market and stock market requirements. But that should soon change.

Risks

A sustained and severe commodity price downturn could change the outlook for this company.

If technology changes stop tomorrow, some of the benefits anticipated for the acquired acreage may not happen.

Any acquisition can fail to meet management expectations for improvement. Right now, this company appears to be off to a good start. But in the volatile oil and gas industry, that can change with little or no notice.

Fast growth through a large number of acquisitions can be risky all by itself, as quality control is usually the first thing to slip if problems appear. This management has minimized that risk through its experience. Even so, the number of acquisitions made in the past fiscal year likely would require some time before another acquisition is made just to establish the benefits.

Read the full article here