In May, I upgraded my rating for Triumph Group (NYSE:TGI) stock to buy on a more manageable debt profile. However, I did point out that the company needs a solid free cash flow conversion, and even in that case, refinancing some of its debt would be required. In this report, I will be discussing the most recent results, provide a risk assessment and update my price target and rating for the stock.

Aerospace Supply Chain And Production Rates Limit Growth For Triumph Group

Triumph Group

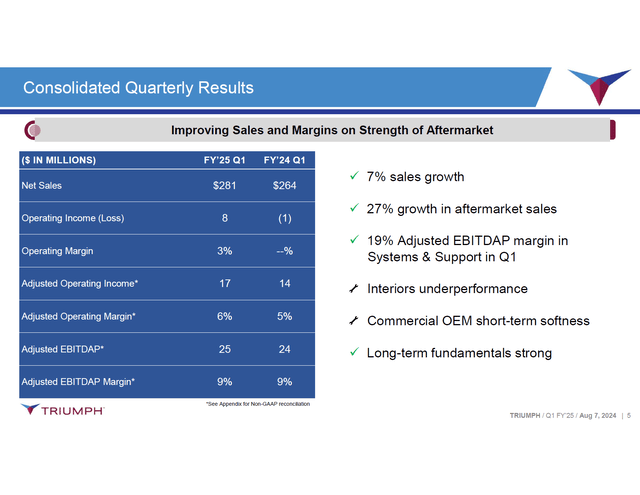

Q1 2025 sales grew 7% with operating income up $9 million to $8 million and up $3 million to $17 million on an adjusted basis. Adjusted EBITDAP increased $1 million to $25 million on stable margins. OEM Commercial sales increased $2 million to $119 million or 42% of revenues, where higher Boeing 787 volumes were offset by lower Boeing 737 MAX output. MRO Commercial sales grew $15 million to $50 million, or 18% of revenues, on higher spare parts demand. Triumph Group wants to focus more on proprietary parts, and that part of the business saw sales increase from $3 million to $5 million. In the military markets, which represents 37% of revenues (with the other 3% being non-aviation revenues), OEM revenues declined $4 million on lower V-22 activity while higher spare parts demands drove MRO revenues up by $4 million. So, from revenue perspective, that was a stable business.

It was not a bad quarter for Triumph Group, but the revenues do show the business sensitivity of production rates. The Boeing 787 volumes are being offset by the lower output on the Boeing 737 program, and there is a continued increase in working capital as production rate increases are planned and the aerospace supply chain remains tight.

With the OEM pressures, we see that aftermarket revenues account for 27% of the revenues but generate 73% of the profits. Aftermarket sales generally come with very appealing margins, but I believe that in the current environment with aerospace supply chain challenges and aircraft programs being at production levels significantly below historical levels, it also reflects the rate sensitivity of the OEM business.

During the quarter, another $120 million in debt was retired, but the company still has $959 million in debt and $821 million in net debt while it burned through $113 million in cash. Around $2 million is related to interest payments on extinguished debt, while there was a $5 million tax item related to the divestiture of its Products business. The use of cash also reflects higher working capital in preparation for higher production rates on key commercial airplane programs and is expected to unwind in the second half of the year, but it once again shows the sensitivity to the production rates.

Triumph Group Free Cash Flow Guidance Is Underwhelming

Triumph Group

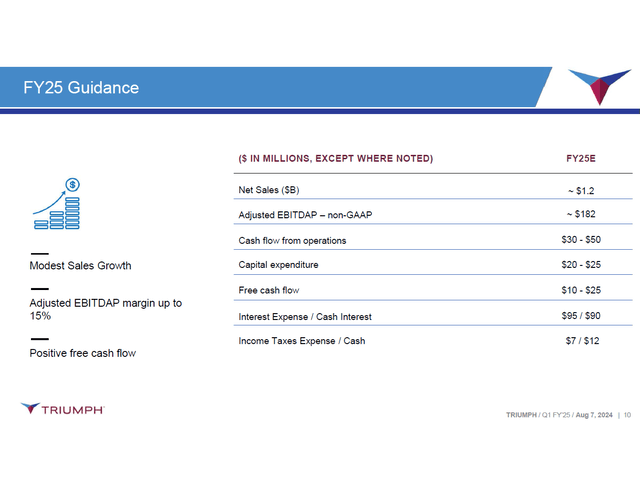

For 2025, the company expects sales of $1.2 billion, which is in line with last year and what I am paying more attention to is the free cash flow guide. With a guidance for $10 million to $25 million, we can say that it is not going to do much in meaningfully reducing debt. Previously, the consensus FCF for 2025 was $55.8 million and even at those levels and with early redemption of portions of debt to lower interest costs, Triumph Group would not be able to eliminate the debt and would require refinancing or capital raises. The guide for 2025 points at a significantly lower FCF trajectory for 2025 and the years ahead driven by production planning and aerospace supply chain issues and only increases the likelihood of capital raises or refinancing.

The only good thing is that the debt reductions helped Triumph Group get a higher credit rating, which could help them refinance the debt at lower interest rates eventually.

What Are The Risks And Opportunities For Triumph Group?

The risks for Triumph Group seem to be rather clear. The financial performance, which already wasn’t great, is highly dependent on the production rate planning of OEMs. Currently, that element together with aerospace supply chain challenges is pressuring the business while planned ramp ups are increasing working capital. So, that is both a pressure and an opportunity, but for Triumph Group the prospect of higher production rates is not a “nice to have” but a necessity. In the MRO market, Dreamliners will start reaching the age for a landing gear overhaul, which, I believe, will provide solid growth opportunities for the aftermarket segment.

For shareholders, the risk remains the debt maturity profile of Triumph Group. While I do believe that the company could refinance debt, in earlier stages the company has already shown willingness to dilute shareholders by issuing warrants which ended up diluting shareholders by around 18% after warrant exercise.

Triumph Group Stock Downgraded To Hold

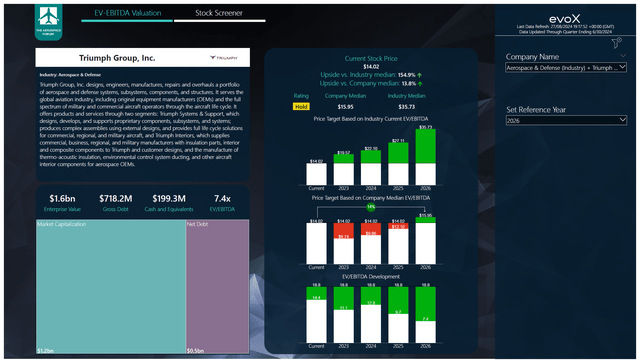

The Aerospace Forum

To determine multi-year price targets The Aerospace Forum has developed a stock screener which uses a combination of analyst consensus on EBITDA, CapEx and free cash flow along with the most recent balance sheet data, cash flow statements and my assumptions on debt repayment, share repurchases and dividends. Each quarter, we revisit those assumptions and update accordingly and if need be, we supplement our own estimates if key items such as for example acquisitions are not reflected in estimates yet. The estimates are not bases on any guidance provided by the companies we cover, but by a strong combination of consensus and my own estimates.

To service its debt, Triumph Group needs a strong ramp up in profitability and free cash flow conversion. Unfortunately, that is not the case. Between FY24 and FY26 the EBITDA estimate has come up 8% to $393.10 million, while free cash flow generation is suffering a one-year slip in the ram up resulting in a 50% cut to the FCF estimates. I currently anticipate that the company will have around $200 million in cash and $718.2 million in debt by the end of FY26. If we add expected FY27 cash generation to the cash balance, we would get to somewhere around $280 million and if we keep a cash-on-hand requirement of $150 million, that could possibly reduce the debt by $130 million to around $590 million. Effectively, this means that with the cash flow generation, Triumph Group will most definitely not be able to reduce debt and its options to service the debt are either dilution, which I don’t think is the most straightforward step, or refinancing the debt. The good thing is that with a better credit rating and expected interest rate reductions, refinancing could happen at attractive terms, but all in all, we see that Triumph Group has a significant debt load without that debt having generated strong operational value for the company. As a result, I am downgrading the stock to hold with a $15.95 price target.

Conclusion: Triumph Group Is Set For A Slow Recovery

Looking at the most recent results for Triumph Group, we see that the sales growth is limited due to supply chain issues and pressures on production rates for commercial airplanes. That trickles through in the working capital requirements and free cash flow generation. Effectively, we are seeing a one-year delay on the free cash flow ramp up and with debt maturing in 2028, the cash generation will not be sufficient, which will likely force the company to refinance debt. While that is not a huge concern, the fact that the company earlier elected to dilute shareholders might be a bigger concern, as well as the challenges faced in getting the company to achieve better FCF conversion rate. I do believe the stock has upside, but weighing all risks, the risk-reward profile is not attractive and a downgrade to Hold seems to be fair.

Why Our Triumph Group Analysis Matters To You As An Investor?

Triumph Group is one of over 100 names that I cover, which benefits from a thorough qualitative and quantitative analytical process. With that analytical rigor, we analyze each and every company in our coverage portfolio and instead of comparing names, we developed an analytical model that uses a wide array of input variables to provide every name with a valuation and multi-year stock price target cadence based on an EV/EBITDA valuation against the company’s median EV/EBITDA multiple and the peer group multiple. Apart from a multi-year price target based on these multiples, we also score each stock with a rating system. By doing so, the names in our coverage benefit from a unified approach towards determining ratings and calculating stock price targets, supplemented with qualitative analysis.

Read the full article here