What Happened Since the IT Outrage

CrowdStrike Holdings, Inc. (NASDAQ:CRWD) beat on both revenue and non-GAAP EPS estimates in Q2 FY2025, but forecasted a disappointing outlook. Although the company managed the crisis effectively, CRWD’s top priority is now to strengthen customer engagement. I believe some customers may hesitate to renew the Platform products in the near term, leading to a lower net revenue retention rate and impacting top-line growth. To preserve goodwill, CRWD has made concessions, such as offering discounts to certain customers, which could result in a significant slowdown in ARR growth in coming quarters.

Following the outage, I previously issued a hold rating on the stock due to the considerable uncertainty surrounding the company’s growth trajectory, as rebuilding its reputation will take time. The stock has recovered some losses from its August lows, indicating its valuation multiples getting more elevated.

Therefore, due to a disappointing forward revenue and EPS guidance, I’m reiterating my hold rating on CRWD, anticipating a significant growth slowdown in the coming quarters as it works to rebuild customer loyalty. Moreover, I’m cautiously optimistic about the company’s long-term leader in the core Endpoint market, as CRWD is likely to face increasing competition and potential market share loss following this incident.

Offering Concessions Will Impact Near-Term Growth

The company model

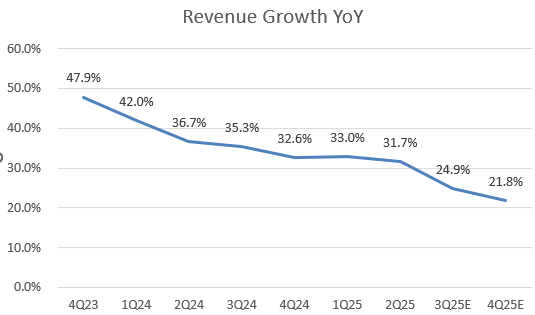

CRWD delivered better-than-expected 2Q results, with revenue growth still showing resiliency at 31.7% YoY. Since the outage occurred in July, I expect the financial impact to begin materializing in 3Q FY2025, as the management mentioned that this coming quarter will include an estimated $30 million additional cost from the concession package. Particularly, the midpoint of the company’s 3Q FY2025 and FY2025 guidance falls below market estimates, implying a YoY growth of 24.9% in 3Q and 21.8% in 4Q. The chart clearly shows that the growth trajectory is starting to decelerate significantly in 3Q.

The company model

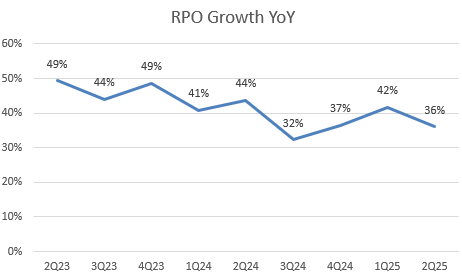

Moreover, the company’s key metrics, such as RPO, dollar-based net retention, and ARR will not fully reflect the negative impact of the recent outrage. However, we did observe some modest slowdown in 2Q, as its RPO grew 36% YoY, showing a sequential slowdown. The management indicated that the dollar-based churn was modestly lower on a YoY basis. ARR growth also experienced a 1% sequential decline.

During the 2Q FY2025 earnings call, the management discussed their customer commitment package to strengthen the customer retention and increase Falcon adoption. The concessions package will impact net new ARR and subscription revenue by around $60 million and professional service revenue by $5 million to $10 million in 2H FY2025. Therefore, I believe these key metrics are expected to see a significant deceleration in 3Q.

However, the management is confident that this package will enhance customer engagement, which will eventually create a higher platform adoption. I believe it’s too early to confirm this narrative given increasing competition in the cybersecurity industry, as we are seeing CRWD losing market share following the incident.

Expecting A Sharp Margin Decline

The company model

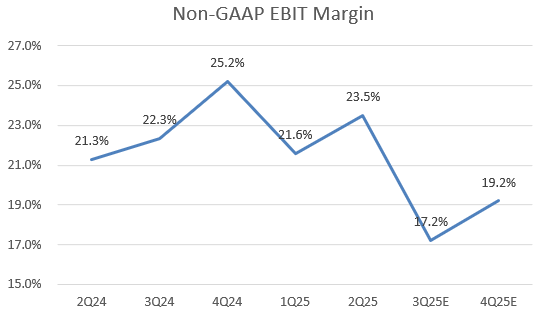

CRWD is also expected to experience a contraction in non-GAAP EBIT margin in 2H FY2025, as the company will incur additional G&A expenses following the outage. With a significant slowdown in revenue growth coinciding with a margin decline, the company has indicated a YoY decline in its non-GAAP EPS for 3Q. The midpoint of FY2025 guidance suggests a continued YoY decline in non-GAAP EPS in 4Q as well. I believe the street will likely revise its forward EPS consensus downward following this muted outlook. It’s possible that the forward 12-month EPS will be lower than its TTM basis, which would make the forward valuation multiple appear pricier.

Nevertheless, as the company continues to invest in R&D to support growth while focusing on customer retention, management anticipates a gradual improvement in EBIT margin in FY2026.

Gaining Market Shares from Other Cyber Players

Despite CRWD’s leading position in the Endpoint Security market, some analysts on the street believe that the company may face incremental market share loss in the near term, particularly to cybersecurity peers like SentinelOne (S) and Palo Alto Networks (PANW). Although these companies currently hold a smaller share of the market, they have been steadily gaining ground recently. Particularly, SentinelOne is expected to capture more bookings at CRWD’s expense. A recent survey indicated that SentinelOne’s results increased by 29% both sequentially and year-over-year, partly due to the company offering discounts to customers.

Earlier this week, SentinelOne delivered better-than-expected Q2 earnings and raised its forward revenue outlook. I believe that once a company’s reputation is damaged, it may take a long time to fully recover. As competitors may catch up and gain market share, we need to hear the management’s comments on the FY2026 outlook early next year to gain more color into the recovery process, particularly concerning net new ARR growth. Therefore, it’s premature to be bullish on the stock at this time, especially given its still elevated valuation.

Valuation

Seeking Alpha

CRWD’s valuation was expensive before the outrage but was supported by its strong growth momentum, with a +30% YoY revenue growth trend. Following the recent sharp pullback, I believe that some near-term growth headwinds have been priced in. Its EV/sales TTM is currently trading at 19.1x, despite below its 5-year average, still higher than PANW and S. In addition, its non-GAAP P/E fwd sits at 69x, more expensive than Nvidia’s (NVDA) 46x and PANW’s 55x. This indicates a lofty valuation and further downside potential for CRWD. However, management encouraged investors to look past the near-term growth slowdown. They stated that the “customer commitment package will drive even more Falcon utilization and platform value realization in both the short and long term.” Therefore, it’s prudent to stay on the sidelines at the moment.

Conclusion

In conclusion, although CRWD delivered better-than-expected Q2 results, this does not mitigate the significant near-term challenges posed by the recent IT outage. The disappointing forward guidance has raised concerns about potential slowdowns in key growth metrics such as ARR and RPO. Moreover, the company may face intensified competition and potential market share loss as rivals like S and PANW capitalize on the situation and boost their forward guidance for the upcoming quarters.

Given the likelihood of downward revisions to EPS estimates and CrowdStrike Holdings, Inc.’s still elevated valuation multiples, it’s premature to buy the dip. We need to hear an optimistic management’s commentary on the FY2026 outlook, particularly regarding net new ARR growth, before considering a more bullish view on CRWD.

Read the full article here