Introduction

I have been a shareholder of the preferred shares of Seapeak (NYSE:SEAL.PA) (NYSE:SEAL.PB) for several years now. Teekay LNG Partners, the original issuer of the preferred shares, was taken private by Stonepeak, a private equity firm. While I’m usually very cautious when I see a PE firm taking the reins at a company and don’t exercise their right to call the preferred shares, pretty much every single decision made by Stonepeak appears to be in the interest of Seapeak LLC. And much to my surprise, preferred shareholders are now in a better spot than (ever) before as the private equity group has contributed more capital. Common equity even, which ranks junior to the preferred shares. All relevant information I will refer to in this article can be found here. For the background of the preferred shares, you could perhaps read this older article on the Seapeak preferred shares.

The full-year results show an excellent preferred dividend coverage level

Before discussing the improved asset coverage ratio, I obviously also wanted to take some time to see how well the preferred dividends are covered.

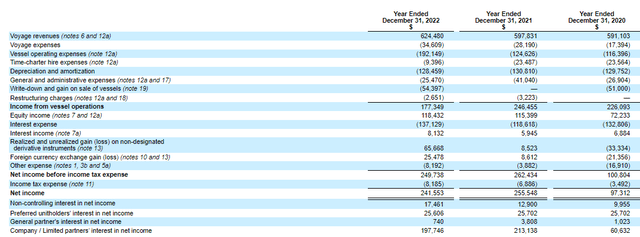

The total revenue of Seapeak in 2022 was just over $624M, which is a 5% increase compared to FY 2021. This does not mean Seapeak was able to convert the higher revenue into a higher net income as the operating expenses increased quite dramatically.

Seapeak Investor Relations

This wasn’t a major issue and although the income from vessel operations appears to be pretty disappointing at $177.3M which is more than a third below the 2021 result, keep in mind the 2022 result does include a $54.4M write-down on the fair value of its vessels. On an adjusted basis, the operating income would have been $232M which is just a little bit lower than in 2021 despite the higher operating expenses on the back of higher oil and fuel prices.

Seapeak also recorded a $118M income from equity investees and its net finance expense was pretty low. While the company paid in excess of $137M in interest expenses, it also recorded a $66M gain on derivatives (as it hedged a portion of its interest rate risk) and it reported a $25.5M FX gain as well. The combination of all these elements resulted in a pre-tax income of $250M and a net income of $242M. Keep in mind that although there was a gain on the derivative assets, there also was the substantial impairment charge so the net amount of non-recurring items boosted the pre-tax income by just $35M which means it was not very relevant in the greater scheme of things.

Net income was $241.6M and the net income attributable to Seapeak after deducting the $17.5M in net income attributable to non-controlling interests was $224M. And as you can see in the income statement above the preferred shareholders were owed just $25.6M which means Seapeak needed just 11% of its attributable net income to cover the preferred dividends. That’s very decent and it means the coverage ratio of the preferred dividend is almost 900%. A very comfortable situation to be in.

The asset coverage level increased

The main risk when a private equity group takes a company private is that they call the shots and could just add a lot of debt on the balance sheet and use the proceeds from issuing debt to pay extraordinary dividends to themselves. “Optimizing” or “rightsizing” a balance sheet with just one objective: Making sure the private equity group does well.

This means that in most situations the interests of the preferred shareholders and the private equity owner of a group are not aligned. Stonepeak, however, had a reputation of being honest and upfront and seeing how the PE group hasn’t tried to pull a fast one on the Seapeak group, I’m increasingly confident Stonepeak just wants to do the right thing (and seeing Seapeak continuing to file financial statements with the SEC is a very important element here).

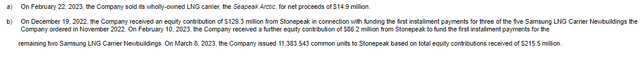

There was one element in Q4 2022 which has convinced me even more that this is indeed the case. Footnote 21 is the very last footnote in the SEC filing but it confirms that after investing $129M in common equity in December 2022, Stonepeak made an additional contribution of approximately $86M. This means the private equity group is adding more common equity to the balance sheet, which ranks junior to the preferred equity.

Seapeak Investor Relations

This means preferred shareholders are in an even better position than a year ago. As of the end of 2022, the total amount of preferred equity was $282M on a total of $2.28B in equity on the balance sheet. This means that about $2B of the equity was ranked junior to the preferred shares for an asset coverage ratio of in excess of 800%. The additional cash injection of almost $90M in Q1 2023 will only have increased this ratio. It makes the preferred shares safer and it emphasizes again Stonepeak appears to really want to do things right.

Interestingly, Seapeak has started to repurchase some of its preferred shares on the open market. Smart, as it can set its own pace while scooping up the preferred shares at a discount to their principal value of $25/share. According to the footnotes, Seapeak repurchased just over 38,000 Series A and just under 73,000 Series B preferred shares for a total of 110,000 shares which will save the company about $250,000 in preferred dividend payments on an annual basis.

Investment thesis

Of course, the repurchase of about 1% of the preferred share count could be seen as negligible. But it does show the company is still interested in buying back its shares at a discount to the market price, and as both (SEAL.PA) and (SEAL.PB) are still trading at a discount to their principal values, I expect Seapeak to continue to repurchase the preferred shares on the open market.

I have a long position in both series of Seapeak’s preferred shares and I would be interested in adding to this position at a discount to principal and only as long as Stonepeak, the private equity partner, does the right thing.

Read the full article here