Most of the panic from the mid-March bank runs seems to have dissipated. But, we caution, most of the real fallout lies ahead as banks move into restructure mode which will only serve to deepen the Recession.

There are still some “Nervous Nellies” on the Street when it comes to the Regional Banks. On Wednesday, the stock price of one of the major Regionals (WAL) got trashed simply because in a press release by the bank, the deposit data wasn’t detailed enough. Nerves calmed later in the day when the bank updated its press release. We don’t expect a repeat, as other Regionals now know what the market wants to see.

Jobs & the Labor Market

Good Friday was jobs data day, but also a market holiday. Thus, there was no real-time reaction to the jobs data. However, since the Payroll data, at +236k, was dead on the Street estimate (+238k), there should be little market reaction come Monday (April 10). Earlier in the week, ADP reported that their Survey indicated job growth of +145k; that was down -44% from their February +261k count. We also had a JOLTS report (Job Opening and Labor Turnover Survey). For the first time since May 2021, job openings are below 10 million, down by -1.3 million over the past two months. In addition, new hires in that report were at a 21-month low. Fed Chair Powell has referenced this report over the past few quarters as important in Fed deliberations about interest rates.

We did see the U3 (unemployment) rate drop by 0.1 percentage points back to 3.5% from February’s 3.6% level. Clearly, job growth is still showing up in the plus column, and this will keep the Fed in tightening mode for a little while longer. But, if we exclude the Covid lockdowns, March’s Payroll Survey showed the slowest growth pace since February 2020. If the slowdown trend continues, it won’t be long before we see job losses.

In other labor market data, average hours worked per week fell to 34.4 from 34.5 in February. Outside the Covid lockdown period, this was the lowest number of workweek hours since September 2019! Because of the cost of hiring and training, employers first reduce hours. Cutting heads comes next.

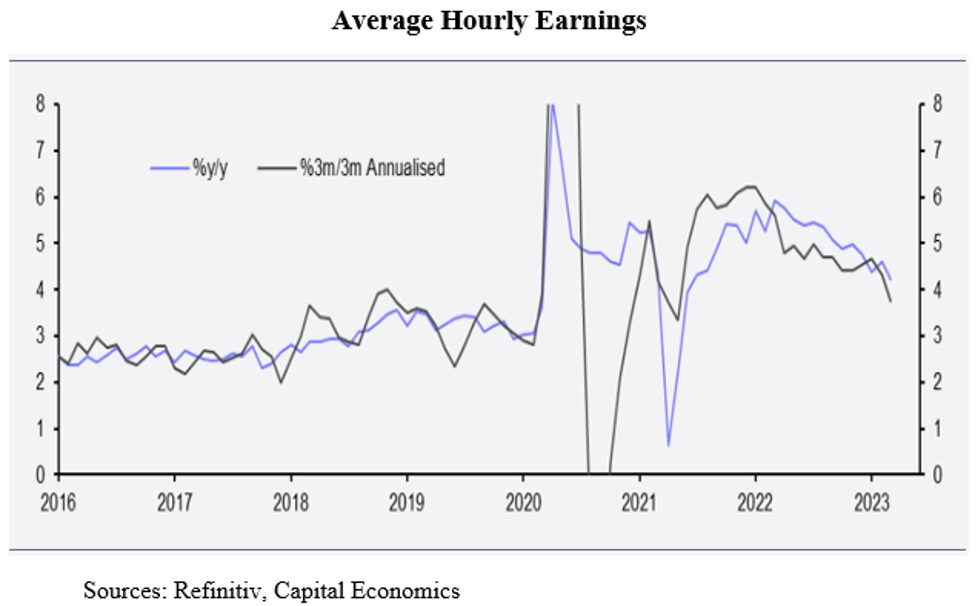

Hourly earnings rose +0.3% M/M in March and have risen 4.2% over the past year. That happens to be the slowest monthly increase since June 2021. The chart at the top of this blog shows that the annualized three-month trend is even lower (3.8%), which is very good news for the inflation scene and is pretty solid evidence that there is no 1970s style “wage-price spiral.”

Looking at the data by sector (see chart), note that the rise in jobs was from the usual suspects (leisure, health care, government). Note the fall in construction (-9k) and retail (-15k) jobs. Both of these are leading indicators of the economy’s direction. Financial activities showed up as -1k. That was prior to the SVB

VB

Growing Recession Evidence

We suspect that bond markets will be on hold for much of the rest of the month, waiting on the Fed’s next move (May 3rd). Although showing some softening, the jobs data didn’t come off as “recessionary.” And as a result, markets now believe that the Fed will raise rates 25 basis points at its May meeting, and that will be the end of the rate raising cycle.

That is our view too, not because we think it is good economic policy, but that is our reading of this FOMC. There is a preponderance of evidence that shows not only a weakening economy, but one now entering disinflation.

- The Payroll report showed a slight fall in manufacturing jobs. The Fed’s own Regional Bank Surveys confirm manufacturing weakness. The KC Fed’s Manufacturing Survey has been flat or negative since October; Dallas’ showed up negative in both February and March; Philly’s has been in contraction since September, and Richmond’s since June.

- The chart shows what’s been happening to manufacturing orders. It is pretty clear from this data that the goods sector has already fallen into Recession. Note from the jobs chart above that all the positive numbers are in service industries (except for the +3K in Mining).

- High interest rates have taken their toll on the housing industry. The chart below shows that mortgage refi activity is off about 75% from its peak while home purchase apps have fallen 50%. This, of course, occurs when demand falls (high/rising interest rates). As a result, falling home sales and falling prices aren’t shocking results.

- The Atlanta Fed, which had been forecasting +3.5% Q1 GDP through February, has now reduced that to +1.5% (as of April 5th) based on significantly slowing March data.

- On Wednesday, a CNBC headline read: Inventory Gluts Are Here To Stay. In a survey of warehouse managers, 36% said the high current level of inventories would return to “normal” in this year’s second half, while 51% said not until 2024! In the latest ISM Survey, 21% of respondents said inventories were too high. For context, in the 30-year history of this ISM survey, that number is at the high end.

- Reducing excess inventories normally means price cuts. So, at least for goods, disinflation appears to be the order of the day.

- U.S. auto sales fell -1.1% in March, -6.6% in February, and have been down in four of the last five months. Redbook is also reporting lower same store sales (-2% in the March 1-25 period).

- The chart below is the N.Y. Fed’s Global Supply Chain Pressure Index, now below zero and softer than at any time in the last five years except for a few months in 2019. We also note that in those Regional Fed Bank Surveys there is a significant softening in prices paid, prices received, supplier delivery delays, and order backlogs. Weakness in these indexes imply an approaching atmosphere of disinflation.

- For the first time in 11 years, home prices are falling. Rents, too. And there is a glut of new apartment units in the pipeline. As we have discussed in prior blogs, the CPI, which is heavily weighted toward rents, lags the real world by six to eight months. We expect to see significant downward rents in the CPI in this year’s second half. Deflation anyone?

- OPEC+ decided to reduce output by -1.2 million bpd starting in May. Some think this could be inflationary, but we think that the unfolding worldwide Recession will reduce demand by that much or more, and doubt that pump prices will rise much as a result.

- In order to survive the deposit runs in March, except for the money center banks, there has been significant borrowing from the Fed (more than $350 billion) at a near

near

just

Final Thoughts

The data point to a weakening economy and deflationary pressures. The bond market has already sensed this with yields falling over the past month. The 10-Year Treasury Note was 4.1% on March 1; it fell to 3.4% on April 6. The Fed is now at or near the end of its tightening cycle, and even a last gasp +25 basis point rate increase at the May 2-3 FOMC meeting won’t sway the bond vigilantes to push rates back up. The economic data is compelling.

(Joshua Barone and Eugene Hoover contributed to this blog)

Read the full article here