Thesis

The First Trust Global Tactical Commodity Strategy Fund (NASDAQ:FTGC) is a well-established commodity ETF with a sizable AUM and a long track record. Its low historical volatility can be also attractive for some.

But because of some other competing ETFs with better past performance and lower expense ratios, I don’t believe this is a good choice. If you are looking for exposure to the commodity markets, you might be interested in an ETF like the Invesco Optimum Yield Diversified Commodity Strategy No K-1 ETF (PDBC) or an ETN like the iPath Pure Beta Broad Commodity ETN (BCM), both of which are also discussed below.

What Does FTGC Do?

FTGC was issued by First Trust Advisors L.P. on 22 October 2013 as an actively managed commodity ETF. It currently manages about $2.96 billion.

The fund’s objective is to produce “attractive” risk-adjusted returns through exposure to commodity futures, commodity ETFs, and commodity swaps. Because it invests in these securities via its Cayman Islands wholly-owned subsidiary, it can allocate up to 25% of its total assets to those and it will invest the rest in fixed-income securities (sovereign debt obligations, repurchase agreements, ETFs, and money-market securities).

Such a structure allows the fund to be classified, and therefore taxed, as an equity ETF. It also won’t have to distribute a K-1 to shareholders, allowing them to avoid the tax complications that come with it.

Performance

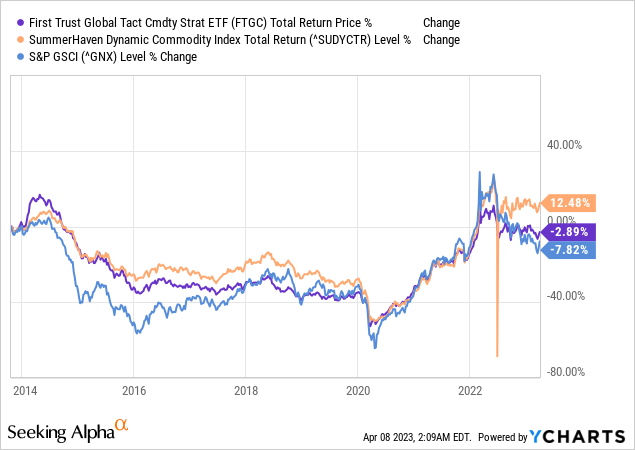

Among passive investors who allocate to commodities to a degree, index ETFs that offer exposure will be a good choice. The low fees and long track record of the index such a fund would track provide some kind of assurance you’ll get the exposure without the loss of capital. By default, you have low-cost and probably low-risk commodity options. For this reason, it’s a good idea to compare actively managed ETFs like FTGC to indices that competing ETFs track:

As you can see, FTGC has outperformed a relevant index and underperformed another. The discrepancy between the fund’s performance and that of the SummerHaven Dynamic Commodity Index TR is so wide that some time spent examining an ETF that tracks it is worth it. This is the United States Commodity Index Fund (USCI), which is used in the comparison below:

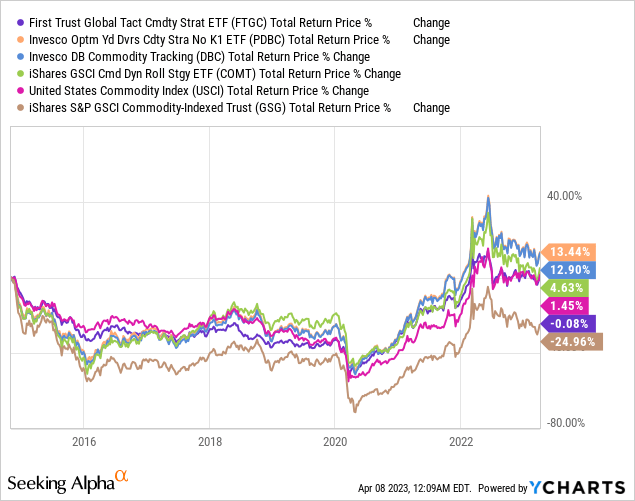

As expected, FTGC outperformed a competing ETF, the iShares S&P GSCI Commodity-Indexed Trust ETF (GSG) which tracked the S&P USCI index you saw above. But it underperformed four other commodity ETFs, including USCI I also mentioned above. The performance concerns the period since 11/07/2014, the launch date of the youngest ETF among the above, PDBC.

Now, FTGC might have underperformed those 4 ETFs but it has been the least volatile among them.

| Standard Deviation (%) | Correlation (SPY) | Beta (SPY) | |

| FTGC | 13.34 | 0.49 | 0.42 |

| PDBC | 17.66 | 0.46 | 0.52 |

| DBC | 18.05 | 0.46 | 0.52 |

| COMT | 18.41 | 0.48 | 0.56 |

| USCI | 15.52 | 0.41 | 0.41 |

That’s a relevant factor for a diversified portfolio. However, it had the highest correlation to the market, which is also relevant in this context. The next least volatile fund which also had the lowest correlation to the market among them was USCI.

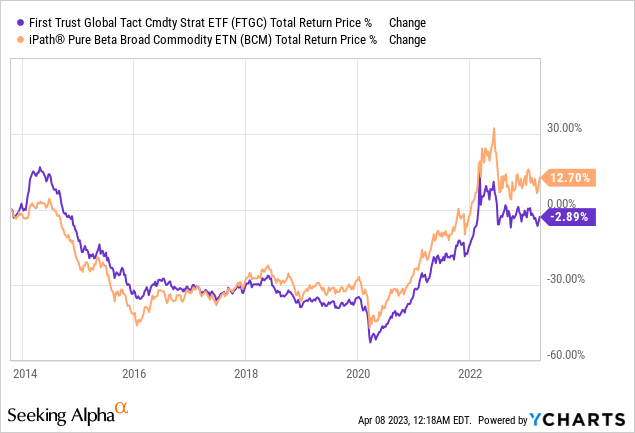

With that being said, in the next section, I will explain why I wouldn’t prefer USCI over FTGC. As for the rest of the ETFs, if you are interested in the best possible performance over the long term, PDBC’s historical performance seems attractive. However, there is a better option out there in the form of an ETN:

I wrote a post about BCM recently if you’re interested in learning more.

Fees

| Ticker | Expense Ratio | AUM | Inception Date |

| FTGC | 0.95% | $2.96B | 10/21/2013 |

| PDBC | 0.59% | $5.56B | 11/07/2014 |

| DBC | 0.85% | $2.20B | 02/03/2006 |

| COMT | 0.48% | $894.68M | 10/15/2014 |

| USCI | 1.01% | $201.00M | 08/10/2010 |

| GSG | 0.75% | $1.11B | 07/10/2006 |

With an expense ratio of 0.95%, FTGC is the most expensive ETF on the list above after USCI. Because it’s actively managed, this is not surprising, even though it has almost $3 billion under management. From the standpoint of what we know so far about it and USCI, the latter’s expense ratio of 1.01% may seem reasonable; especially given its smaller AUM size of about $200 million.

While this is true, I don’t think such high fees are justified for an index fund. Especially when it has underperformed so much the index it tracks (0.96% annualized return for the ETF and 2.46% for the index since its inception). For this reason, I would not select USCI over FTGC.

Now that we got this out of the way, I think that in comparison with PDBC and the iShares GSCI Commodity Dynamic Roll Strategy ETF (COMT), FTGC’s fees are higher than I feel comfortable with paying when there are other options. PDBC and COMT charge 0.48% and 0.59%, respectively. And while I do value FTGC’s historically lower volatility, the difference in cost is too wide for this factor to counterbalance it.

So, when it comes to fees, FTGC is not competitive enough.

Risks

Let us now take a look at some of the most relevant risks when it comes to investing in FTGC:

- Counterparty Risk: This is the danger that the other party in a future contract transaction becomes unable to fulfill its obligation. This is the most significant risk related to investing in commodity ETFs since they usually use futures contracts to get exposure to commodity prices.

- Commodity Risk: Through the futures contracts that the fund buys, it indirectly becomes subject to the risks that come with holding the underlying asset, such as market events, regulatory and political changes, as well as war.

- Credit Risk: FTGC is also exposed to credit risk because it invests the majority of its assets in fixed-income instruments.

For the full list of related risks, check the prospectus for FTGC.

Verdict

FTGC has accumulated a substantial size in AUM since it launched and apparently is the usual choice among investors. However, we have a couple of better options out there that make me unable to see any reason to invest in it.

Its performance has been underwhelming since it was launched when compared to other commodity ETFs. At the same time, its fees are higher than those other better-performing competing ETFs charge. For these reasons, I would either go with an ETF like PDBC or an ETN like BCM if I wanted long-term exposure to commodities.

But I’m interested in reading your thoughts too. Have you already invested in FTGC or considering it? What alternatives do you prefer? Let me know in the comments below. And consider following me as there are more to come. Thank you for reading.

Read the full article here