ETF introduction

Vintage 2022 has not been one of the most memorable “crus” for German equities. The economic powerhouse behind Europe’s sprawling economy has found itself thrust into a range of economic headwinds, from a Ukraine war-induced inflationary spike, to domestic corporate scandals such as Wirecard, and even widespread EU arbitering between wealthier Northern European states and the poorer South.

Spreadsheet by ZMK Capital

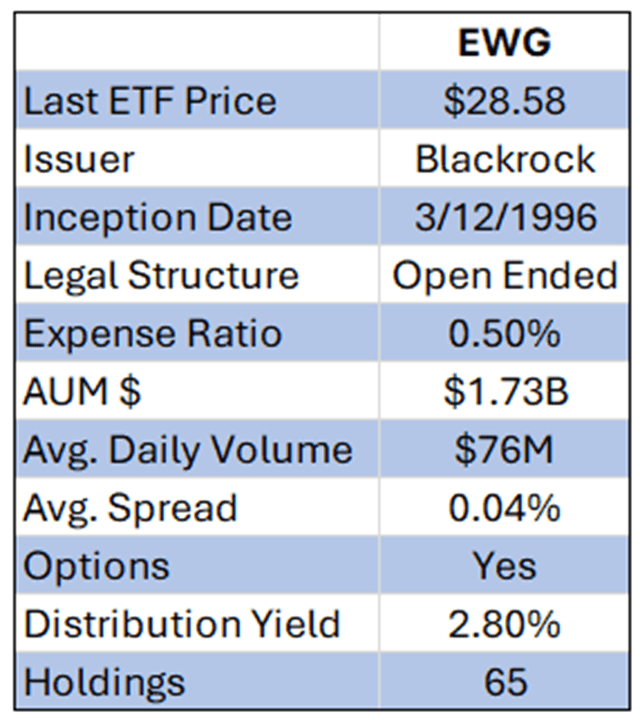

ETF overview (EWG)

You must feel sorry for Germany traditionally renown for using cheap Russian energy to industrialize high quality capital equipment and luxury goods to sell to the likes of China and the United States. With economic tides appearing to be turning, perhaps inflicting lasting economic change is on the cards for the $4.3T German economy.

So how is it possible to wager on a turnaround story or a lasting economic decline without taking direct positions in the country’s celebrated DAX30 – the 30 largest publicly traded German corporates?

Queue iShares MSCI Germany ETF (NYSEARCA:EWG), which is an exchange traded fund marketed by financial giant BlackRock Inc. By investing in public equity markets of Germany, the fund aims to provide concentrated exposure to large to mid-cap segments while omitting some smaller cap constituents representing a small part of the index.

With fund rebalancing occurring quarterly and underlying securities trading for the most part on the Frankfurt stock exchange, this is an ideal substitute for money managers unable to directly access the DAX30.

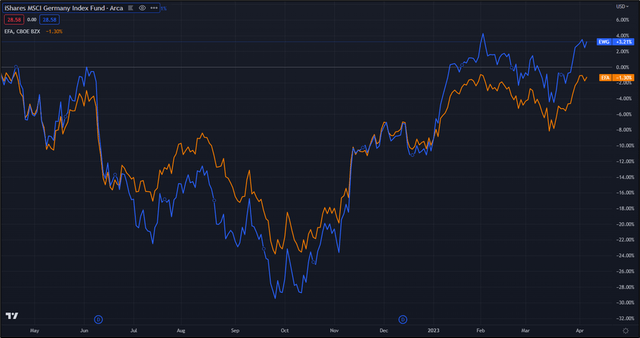

TradingView

EWG has shown a rebound lately with the stock gaining +3.21% over the past 12 months despite remaining relatively correlated with sister fund (EWA).

However, given the fact that many of the large caps included in this fund are also present in iShares MSCI Europe, Africa & Far East (EFA), the fund is not appropriate for investors seeking broad diversification across Europe. For investors looking for a concentrated long only wager on the German economy, EWG provides one of the best options.

ETF Structures & Key Components

EWG holds approximately $1.7B of assets under management, comprised of approximately 65 underlying German equities. The top 10 holdings make up roughly 55% of total fund assets emphasizing a relative degree of concentration.

Sector exposure accurately reflects the make-up of the German economy with a balanced mix of industrials (18.51%), financials (17.05%), consumer discretionary (15.83%), information technology (14.3%) and healthcare (11.48%).

Among the smallest sector exposures managed in the fund include real estate (1.43%), consumer staples (2.96%) and utilities (4.26%) Given the weaker weighting of more defensive sectors in the fund’s composition, EWG may not be the optimal choice during periods of heightened market volatility.

In terms of industry breakdown, the largest representation in the fund includes insurance (11.78%), automobiles (11.53%), software (10.26%) and industrial conglomerates (8.80%). Comparatively, on the other side of the spectrum, the most underrepresented industries include IT services (0.28%), consumer staples, distribution, and retail (0.30%) and interactive media and services (0.35%).

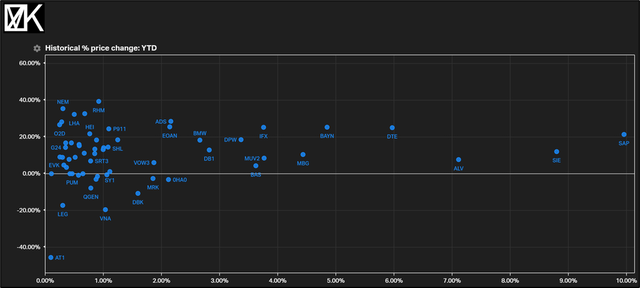

Year-to-date, the fund has delivered total returns of +13.64% underpinned by stellar performances delivered by software giant (SAP) (+200 bps), telecoms specialist Deutsche Telekom AG (OTCQX:DTEGY, OTCQX:DTEGF) (+136 bps), healthcare business Bayer (OTCPK:BAYZF, OTCPK:BAYRY) (+112 bps) and national industrial powerhouse Siemens (+108 bps).

Laggards have been in the real estate, utilities, and financials sectors, including Vonovia (VNA) (-29 bps), Deutsche Bank (DBK) (-22 bps) and Aroundtown (AT1) (-9 bps). Higher interest rates and the recent contagion in banking following the collapse of several regional US banks has weighed on the funds financial and real estate sectors.

Koyfin

Overall, most of the fund’s holdings have performed comparably well year-to-date.

German Macro-Economic Aspects

Last reported German GDP highlights signs of slowing with GDP growth registering -0.40%. At an annual growth rate level, the country has seen a decline from 1.4% to 0.9%. Despite the economy expanding 0.9% on a year-on-year basis, it has been the lowest reading in seven quarters of growth, auguring a gradual slowing of Europe’s economic engine.

Trading Economics

Long-run German GDP continue to maintain a positive upwards trend.

The gross domestic product in Germany was circa $4.25T in 2021, up from $3.88T during the pandemic, according to data from the World Bank – this represents almost 2% of total world economic output.

Unemployment in Germany edged up 5.6% in March 2023, the highest level since July with the lion’s share of the 2.54 million unemployed being in Bremen (10.4%) and Berlin (8.9%). The industrialized South holds lower unemployment rates with Bayern registering 3.3% and Baden-Wurttemberg 3.8%.

Trading Economics

A post Covid inflationary boom has significantly impacted the German economy.

German consumer price inflation has started to ease to +7.4% down from +8.7% during the previous quarter. This remains meaningfully above the +2.0% target rate set by the European Central Bank and has been driven predominantly by a progressive tapering of previously eyewatering energy prices, from +19.1% in February to the latest print of just +3.5%.

Trading Economics

Manufacturing PMIs pointed to a 9th straight monthly decline in factory activities.

German manufacturing PMIs continued to point to a ninth straight month of falling industrial activity, particularly important for the German economy. Low confidence among consumers has dragged on demand while rising borrowing costs and a desire to deplete inventories continues to impact factory output. Gradually declining prices have been positive but overall, the German industrial sector continues to regress.

Risk Factors

Any investor taking a wager on a German economic reprise via a holding in EWG is exposed to significant risk. The fund remains concentrated taking on specific Eurozone risks linked to inflation, monetary policy, and industrial policy.

The fund underweights more defensive economic sectors such as consumer staples, utilities and real estate implying a more aggressive bet on economic upside and discounting natural hedges inherent in these sectors. Germany’s exposure to the war in Ukraine must be mentioned too – the country, until recently, had strategized the development of its export focused industrial economy on cheap Russian energy.

The impact of the war is likely to bring lasting change to this policy and directly impact the German economy and holdings represented by EWG.

Key Takeaways

EWG is a German-focused ETF ideal for people looking for exposure to the German economy without necessarily having access to the DAX30 or European equity markets.

It represents some of the largest German equities and provides a concentrated bet on industrials, financials, consumer discretionary and information technology. Its sole focus on German equities implies high concentration risk and a requirement to understand country specific long-term macro-economic trends likely to shape future risk adjusted returns.

Read the full article here