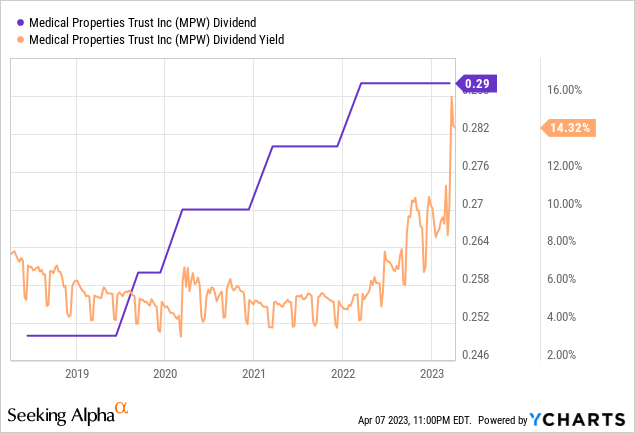

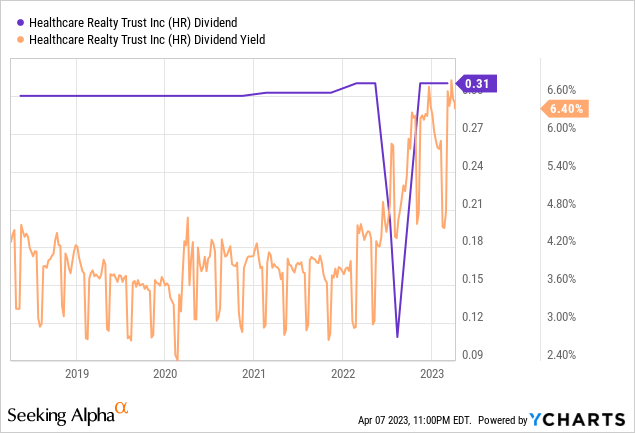

Healthcare spending is set for material growth with the US alone set to see healthcare spending rise by 8% of GDP from 2018 through 2040. Both Medical Properties Trust (NYSE:MPW) and Healthcare Realty Trust (NYSE:HR) form two REITs in the space that whilst having some similarities offer investors highly divergent total return profiles as we see through the end of the current monetary tightening cycle. Medical Properties last declared a quarterly cash dividend payout of $0.29 per share, in line with its prior payout and a 14.3% forward yield. Healthcare Realty’s last quarterly dividend payment was $0.31 per share, also in line with its prior payment and meant a 6.4% forward dividend yield.

Crucially, the 790 basis points dividend difference has been built on what’s been a marked discombobulation of Medical Properties over the years since the pandemic with tenant issues aggregated with the rapid rise in the Fed funds rate and back-to-back short reports. Healthcare Realty sports a short interest of 3.72% with its commons down 27% over the last year following its merger with Healthcare Trust of America. The $7.4 billion REIT has struggled to realize the synergies from its merger and last reported fiscal 2022 fourth-quarter earnings which saw dual misses.

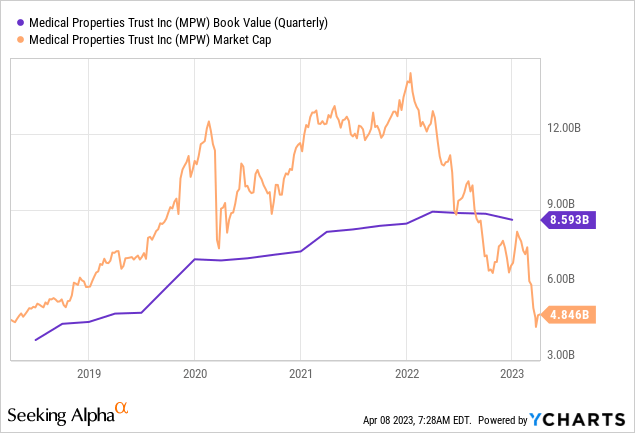

Medical Properties has a short interest that’s 5.6x larger at 20.73% with a market cap of $4.85 billion, down 62% over the last year. This has come against a dividend payout schedule that’s been broadly stable and has grown by a 3.71% 3-year compound annual growth rate. This is versus a 3-year CAGR of 0.83% for its peer group. Healthcare Realty’s quarterly payment has been broadly flat over the same time frame, albeit with disruptions to the timing of payout on the back of the merger which skewed its payout trendline. The REIT’s one-time special dividend payment of $4.82 following the completion of its merger has again skewed its dividend CAGR numbers but its quarterly payout was $0.315 per share in the first quarter of 2020.

Property Portfolios

Medical Properties has grown its dividend by a greater number through the pandemic years and the Birmingham, Alabama-based REIT fundamentally represents a distinct paradigm of risk beyond what’s offered by Healthcare Realty. To be clear here, Medical Properties faced a recent short call that stipulated that its fair value is $3 per share. This would imply a 63% fall from the current level. It’s currently pursuing litigation against these claims with every other week seemingly seeing more bears spring up. This isn’t a sleep-well-at-night REIT and Healthcare Realty is the obvious choice in regard to stability.

Nashville, Tennessee-based Healthcare Realty went public in 1993 and mainly owns medical office buildings adjacent to hospitals. This REIT owned 721 properties in 35 states totaling roughly 42 million square feet as of the end of its fiscal 2022 fourth quarter. Healthcare Realty differs from Medical Properties in that it has refined its portfolio predominantly towards multi-tenant, on-campus medical office buildings. It also has a US-only focus with Dallas, Seattle, and Los Angeles forming its three largest markets with a combined 20.2% of its medical office building portfolio.

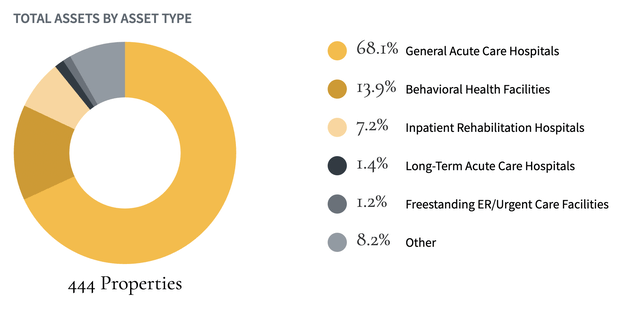

Medical Properties focuses on acute care facilities let out on triple net leases. This REIT held 444 properties across ten countries with 44,000 licensed beds as of the end of its fourth quarter. The US and UK formed the two largest markets at a combined 81.9% of total assets with Australia, Switzerland, and Germany forming the next three largest geographies. However, the REIT has recently divested $803 million worth of property in Australia.

Medical Properties Trust

Medical Properties’ two largest tenants Steward and Prospect Medical are currently amidst a level of financial distress with Standard & Poor recently downgrading Medical Properties’ credit rating to junk at BB, around two levels below investment grade on the back of Steward’s headwinds. However, and perhaps one of the key mistakes investors make when buying REITs, Medical Properties is not a private equity fund. Hence, its tenants simply have to meet the full terms of their lease whilst remaining a going concern. Earnings of underlying tenants facing volatility are irrelevant if they can continue to meet rents. The stock market will of course discount REITs with a broadly unstable tenant base but it’s the income that matters here.

Book Value, FFO, And Payout Ratio

Medical Properties’ dividend has been on an upward trend since the first and last cut made during the 2008 financial crisis. That’s nearly 15 years of stable and uninterrupted dividends, an impressive record that’s lost on the bears and could very well be maintained in spite of the Steward issues. The REIT could very well cut its currently large payout but even a $0.08 per share reduction in the payout would still see its dividend yield maintained at double digits.

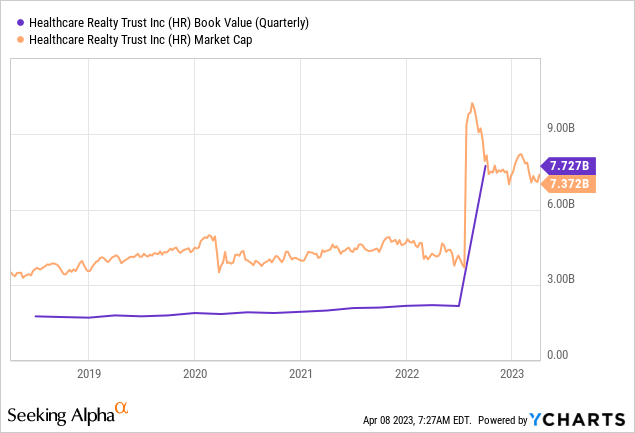

Healthcare Realty’s book value stood at $7.49 billion as of the end of its fiscal 2022 fourth quarter. This was around $19.89 per share and was down sequentially from $20.30 per share in the third quarter but grew from $14.52 per share in the year-ago comp. The REIT reported revenue of $338.06 million for its fourth quarter, this was up 72.7% over the year-ago period and was a miss by $5.94 million on consensus estimates. FFO came in at $0.42, a beat by $0.02 on consensus estimates and increased by 7.7% sequentially from $0.39 in the third quarter. Critically, Healthcare Realty is essentially trading near parity with its book value with its commons currently swapping hands for $19.37 per share.

Medical Properties’ book value as of the end of the fourth quarter was $8.6 billion, around $14.38 per share. This was down sequentially from $14.74 per share in the third quarter but was a growth of 1.7% from $14.14 per share the year-ago comp. Hence, Medical Properties is trading at a material discount to its book value with its stock price currently at $8.10 per share. This discount still stands at 34.5% using the lower tangible book value (“TBV”) per share of $12.36 which strips out intangibles. TBV will be more relevant here with the REIT set to report a $300 million write-down of intangible assets tied to a deal to lease five Utah hospitals currently let to Steward to a higher credit quality tenant. This will be a non-cash expense so will have no impact on the FFO.

Medical Properties last reported fourth-quarter revenue of $380.48 million, a 7% decline from the year-ago quarter but a beat by $7.49 million on consensus estimates. FFO per share during the fourth quarter was $0.43, in line with consensus but down from $0.45 in the third quarter and a $0.04 per share fall from $0.47 in the year-ago period. The REIT provided guidance for FFO per share to be between $1.50 to $1.65 for 2023, lower than analyst consensus of $1.75 but enough to cover what would be total dividends of $1.16 through 2023.

Healthcare Realty’s last declared quarterly dividend formed a healthy 73.8% payout ratio against its FFO for the fourth quarter. This compares to a 67.4% payout ratio for Medical Properties. Hence, I’m in Medical Properties Trust at around $8 per share and will likely increase this position by at least 2x in the coming months. The intention of this position wasn’t to get involved in one of the most contentious battleground REITs since the pandemic but to add healthcare exposure to my fledging income portfolio that’s primarily concentrated on apartment REITs and distressed preferred stock. There will be more volatility ahead for Medical Properties on the back of its fiscal 2023 first-quarter earnings, but its dividend history has to be commended here and could very well be maintained.

Read the full article here