The Hoya Capital High Dividend Yield ETF (NYSEARCA:RIET) is a high-yield REIT index ETF, investing in common and preferred REIT stock, as well as mREITs. RIET offers investors a strong, fully covered 9.9% yield, with the potential for some dividend growth. The fund is a buy, although it is a relatively risky investment, and might not be appropriate for more conservative investors.

RIET – Basics

- Investment Manager: Hoya Capital

- Underlying Index: Hoya Capital High Dividend Yield Index

- Expense Ratio: 0.50%

- Dividend Yield: 9.92%

- Total Returns 1Y: -23.7%

RIET – Overview

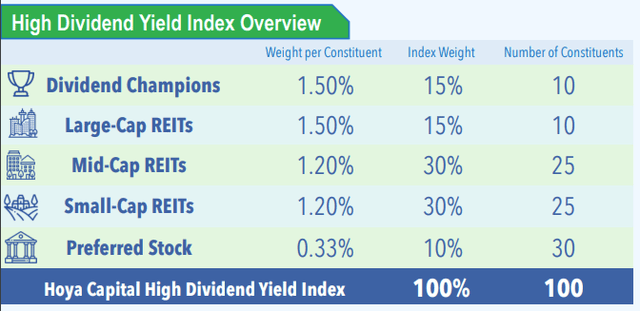

RIET is a REIT index ETF, tracking the Hoya Capital High Dividend Yield Index. The index has many moving parts. Simplifying things a ton, we can say that the index invests in 100 high-yield REITs, including common and preferred stocks, as well as mREITs. There are sub-asset class, sector, and size caps / floors to ensure diversification. Preferred have weights of 0.33%, other asset class weights of 1.2% – 1.5%.

RIET’s simplified investment methodology is as follows.

RIET RIET

RIET’s investment methodology is a bit unnecessarily complex. As an example, the fund considers leverage ratios for its Dividend Champions, 15% of its portfolio, but not for the other segments. Would be simpler, and cleaner, to simply exclude REITs with excessive leverage across the entire fund, not just a part of it. Excluding them from a portion of the fund seems self-defeating too, as they could simply pop up somewhere else. In any case, these are small issues all things considered, in my opinion at least.

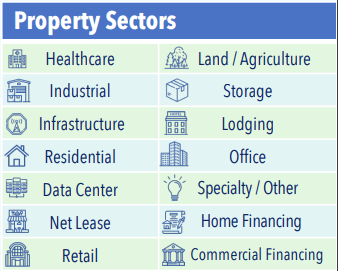

RIET’s weight caps and floors ensure a reasonably well-diversified portfolio, with the fund investing in 100 securities from all relevant property sectors.

RIET

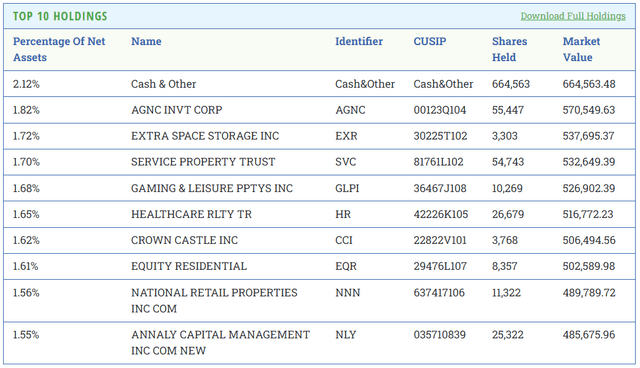

Concentration is quite low too, with the fund’s top ten holdings accounting for 17.0% of its portfolio.

RIET

RIET invests in mREITs, which are heavily leveraged mortgage plays. mREITs are incredibly risky investments, with unsafe dividends, and prone to experiencing significant, sometimes irrecoverable, losses. I believe that overweighting mREITs is unwise, and prefer funds that do not do so. RIET itself does not seem to overweight mREITs, with these accounting for something like 10.0% – 25.0% of the fund’s holdings, from what I’ve seen. RIET has industry caps and floors, so outsized investments in any specific REIT segment, including mREITs, are very unlikely to happen.

Malls and offices are seeing declining occupancy rates, leading to significant trouble in these sectors. RIET does not seem to be overweight either of these sectors, which seems important under present conditions.

In general terms, RIET’s underlying index seems adequate enough. The complexity is not excessive or risky, and neither are the fund’s mREIT investments, or mall and office exposure.

RIET – Dividend Analysis

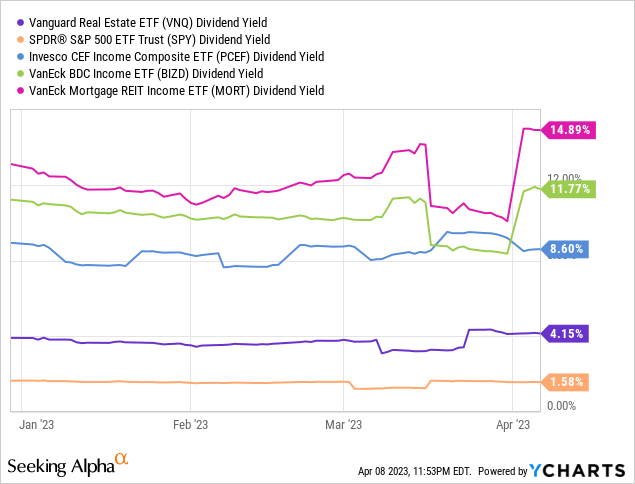

RIET’s most significant benefit is the fund’s 9.9% dividend yield. It is an incredibly strong yield on an absolute basis, and significantly higher than that of the average REIT or equity fund. The yield is comparable, perhaps a bit lower, to that of the highest-yielding asset classes in the industry, including BDCs, CEFs, and mREITs.

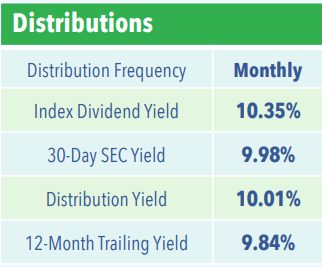

RIET’s dividends are fully covered by underlying generation of income, as evidenced by the fund’s 10.0% SEC yield. SEC yields measure (short-term) income, and can be used to gauge a fund’s actual income, disregarding capital gains, ROC distributions, and similar. Figures below are for 1Q2023.

RIET

RIET’s overall dividend growth track-record is decent enough, with fund dividends growing by 2.4% this past January, and remaining constant before that. Fund was created in late 2021, so that nets out to dividend CAGR of about 2.0% since inception. Although said track-record is too short to be all that meaningful, results are promising so far.

RIET’s strong, fully covered, growing 9.9% forward dividend yield is a significant benefit for the fund and its shareholders, and the fund’s core investment thesis.

RIET – Quick Cap Rates Analysis

In a recent article on real estate cap rates and the Vanguard Real Estate ETF (VNQ), I showed that U.S. real estate does not currently offer compelling yields to investors. VNQ yields 4.2%, a tad lower than current t-bill rates, and at much greater risk and volatility. As real estate yields are low, investors expect lower real estate prices in the coming months. RIET, and the fund’s underlying holdings, yield quite a bit more than 4.2%, so are less impacted by these issues. Investor demand for RIETs yielding 9.9% is not significantly impacted by t-bill rates in the 4.0% – 5.0% range, for obvious reasons.

In my opinion, RIET’s strong 9.9% yield should help sustain asset prices moving forward, even if interest rates continue to increase, benefitting the fund and its investors.

RIET – Performance Analysis

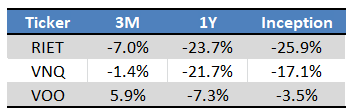

RIET’s overall performance track-record is below-average, at best. RIET has moderately underperformed broader REIT indexes, and significantly underperformed U.S. equities, since inception in late 2021. Performance has somewhat improved these past few months, although the fund continues to underperform. As the fund’s performance track-record is quite short, and owing to recent improvements in performance, I don’t find these issues to be all that significant, but the overall situation remains broadly negative.

Seeking Alpha – Chart by Author

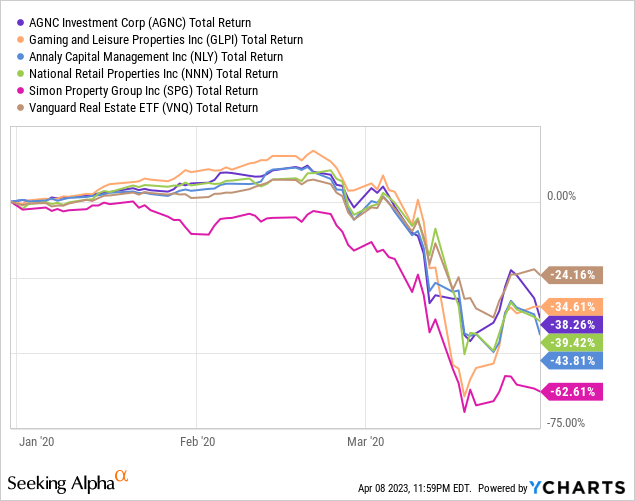

RIET’s underlying holdings, especially its mREITs, are riskier than average, so investors should expect above-average losses during downturns, recessions, and bear markets. Fund performance is consistent with expectations, as RIET has suffered above-average losses these past few months. RIET’s largest holdings also suffered above-average losses during 1Q2020, the onset of the coronavirus pandemic.

Risk and underperformance are a terrible combination, but RIET’s performance track-record is quite short, so I’m willing to overlook these issues. The fact that fundamentals have been quite good, as dividends have grown and are fully covered, is relevant too. Markets are sometimes wrong, sometimes overreact, but as long as fundamentals remain strong then so should long-term performance. As RIET is an income vehicle, long-term returns are mostly dependent on dividends, and these remain strong, and growing.

Conclusion

RIET is a high yield REIT index ETF. RIET’s strong 9.9% dividend yield makes the fund a buy.

Read the full article here