Introduction

QuinStreet (NASDAQ: QNST) is in a precarious situation for both the company and the stock. As it currently makes a growing loss and declining revenues, it is bizarre to find that the company is trading higher than it was when it had better fundamentals and some flattened growth year-over-year.

Company Profile

QuinStreet is a marketing company that targets the financial space and home services. While they have a few products, notably their customer acquisition (or performance marketing) services and QuinStreet Rating Platform (QRP). However, since their most recent 10-K filing places more emphasis on their marketing business and it is the only business that gives them significant revenues, it is the only side of their business that I’m gonna talk about at the moment.

So, what does their performance marketing product do? It usually works in the same vein as advertising through different channels, including channels that the company owns. The idea seems to be that their clients only pay for the actions that the clients want, which is why QuinStreet labels it as “customer acquisition” on their website. What actions can apply? It can be as simple as a customer clicking through the links or advertisements that they post, or as difficult as getting a customer to purchase a product. While I’d expect a handsome premium in comparison to a metric like cost per thousand impressions (CPM), it would still provide some value depending on the customer and the product they purchase.

Since we’re talking about financial services, here’s what their webpage displays as niches they can handle for their marketing services:

Scope of Service (QuinStreet)

Considering that we’re talking about mostly big transactions, it is fair to assume that this premium would be a reasonable price to pay for most companies delegating their marketing efforts to QuinStreet. If, as an example, one customer pays around $350 annually for their insurance policy and it cost the company around $30 to acquire that customer, then it would be better than, say, paying $40 for a marketing campaign of Google (NASDAQ: GOOGL) or Facebook (NASDAQ: META) to have no customers.

The business model, in my opinion, has some good long-term potential when the market is filled with many willing consumers looking for services or products in this space. However, as my main divestment or short thesis implies, something is rather strange with the company.

What’s Amiss

There have been a few problems I’ve noticed with the company, some of which are rather apparent: growth is between slowing down and declining, profitability is borderline non-existent, and the stock itself is still pricing in growing revenues, which may be a problem on the investor side as analysts seem to be rather optimistic about the stock. Let’s take each one on.

Bad Business Economics

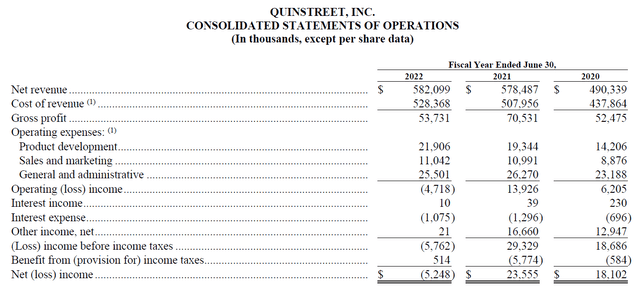

As we’ll see below, there’s a major problem with their business model that I see based on what’s shown on their 10-K filing.

QuinStreet

Already it is clear to see that the business runs on thin gross margins here. That’s honestly bad as a business, in my opinion, considering that it leaves very little space for further investment into the business.

However, if we look more closely, the cost of revenue seems to be rising regardless if there’s any growth or not. Why is this so?

I’m generally interpreting that their business is one where they buy ad space from other companies and display ads and other content on their own media spaces and only charging their customers for any qualified interaction as listed below:

- Clicks

- Leads

- Calls

- Applications

- Customers

Only one of them imply what I mentioned above, which is to actually purchase or utilize a product. The rest depend heavily on extra work on the company trying to market themselves, such as convincing a customer about a product through a sales team, properly routing them to the correct product and the biggest weakness of advertising that I see: hoping the customer takes an action that creates revenue.

If companies are not very convinced that this marketing model works or consumers are less willing to engage in new products and services, then overall it would be reasonable that the cost of sales – advertising expenses – increase regardless of revenue growth.

Alternatively, companies may not be as willing to spend as much, as seen in the overall advertising market, indicating that companies seek to cut costs in the advertising department. Considering the downturn we’re in, it’s pretty clear that profitability is king while growth takes a back seat. Because of this, apart from layoffs, an easy area to cut costs in would be sales and marketing.

Due to these reasons, I believe their business model depends heavily on the “grow at all costs” narrative that has become less prevalent in recent months. This is further confirmed by their revenue growth, or lack thereof.

Busted Growth

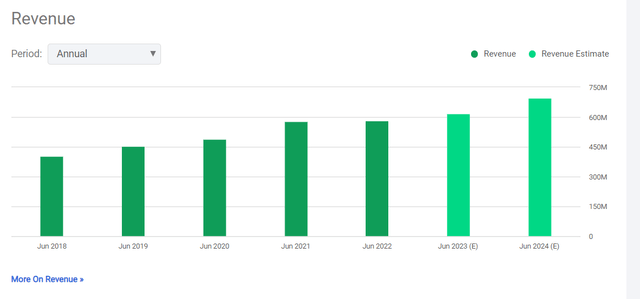

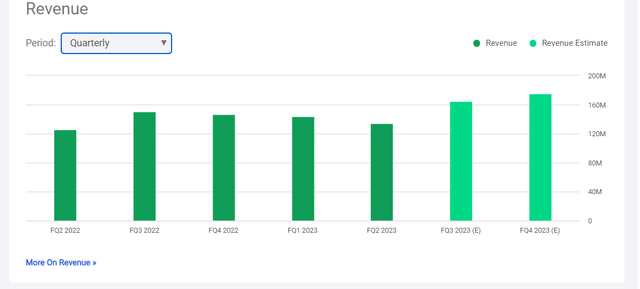

To continue with this part, here’s the recent revenue growth and annual revenue growth as displayed on Seeking Alpha.

Seeking Alpha Seeking Alpha

Starting with the annual perspective, QuinStreet does earn some points for growing their business almost 50% from 2018 to 2021, and even achieving net profitability in some of these years as seen both in their historic financials and even the recent income statement they issued back in June 2022. However, like mentioned earlier, their business model is essentially “growth at all costs” due to their thin gross margins, which is a very dangerous game to play. With their stagnating growth on an annual basis, their costs might as well have caught up and dug the company a nice hole to rest on for this downturn.

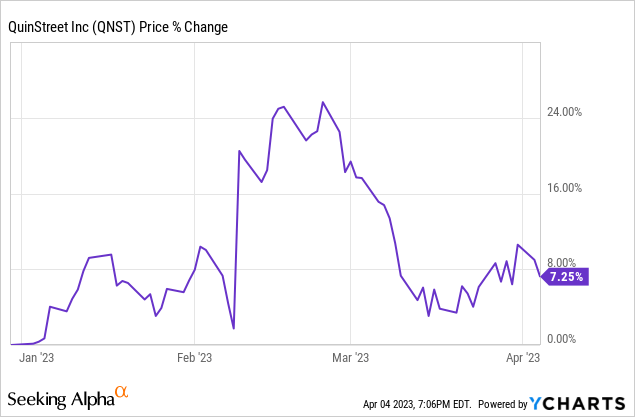

But, things get worse when we start to talk about recent quarters, as shown in the second figure. The company’s revenues have peaked around Q3 of Fiscal 2022 and have consistently declined since then. Considering companies like Unity (NYSE: U) and Snap (NYSE: SNAP) have each crashed in 2022 because of the advertising slowdown, it’s a miracle the company is still trading 7% higher than the beginning of 2023, let alone its choppy, yet impressive performance after May 2022.

So, what is the reason why QuinStreet stock has bat a blind eye to weakening fundamentals? Here’s why:

Analysts Too Optimistic

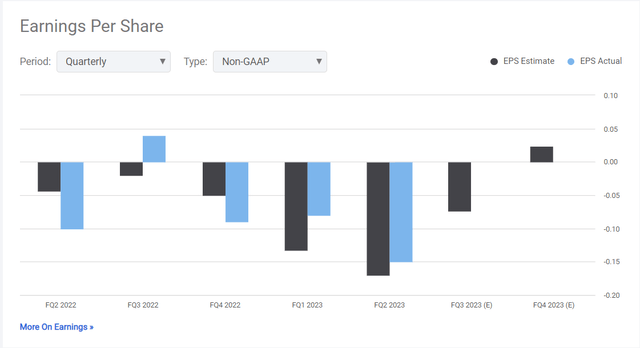

I believe that analysts and investors here are not considering the weakening fundamentals and economic backdrop enough for this company. This is very well reflected by the forecasts shown on the revenue side of fundamentals as well as the EPS side of fundamentals as shown below.

Seeking Alpha

Considering analysts expect the company to return back to growth and record revenues again by next quarter, I believe that investors may be in for a surprise if the company disappoints with another revenue decline or stagnation.

This is the primary basis of shorting the stock or cashing in gains, considering that the risks played here echo songs of GitLab’s (NASDAQ: GTLB) massive 32% crash.

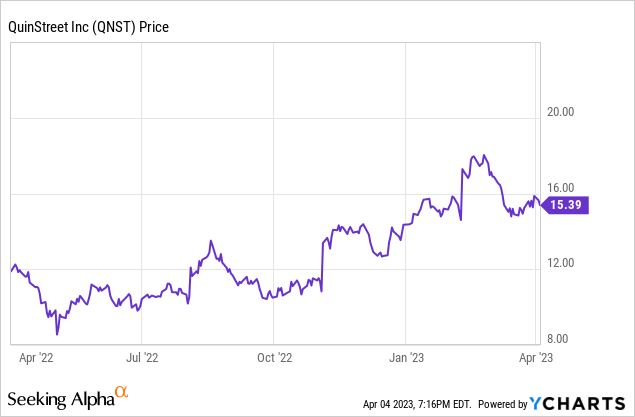

However, investors who shorted QuinStreet back in May when the company currently has its 52-week low will definitely testify that betting against the stock is a fool’s errand, as can be seen below. Only way to get a profit by shorting was to trade the tops, which is often driven by a mix of fundamentals and investor sentiment.

This is why I’ll begin talking about some risks I can see to this thesis.

Risks

As shown earlier, bullish investors can be very stubborn and do massive strides in pushing a stock price higher, which currently, the short side seems to not be very convinced about piling in just yet as indexes start to tout their bull market victory as they achieve major milestones with what could seem to be “improving fundamentals.”

This in itself can keep a stock up for a while and throw a short seller’s plans to the recycle bin since shorting often seems to have a time limit, as is the case with options and regular shorting.

What about selling and taking profits (or cutting losses)? Well, it’s fair to do this for those who are more comfortable just taking their wins or losses and putting that money elsewhere, but keep in mind that in the above possibility, there’s going to be some profits left on the table by doing this.

Now, on the fundamental side, I’d like to turn over to the company’s asset sheet for another point. The income statement I showed earlier will help reinforce that point.

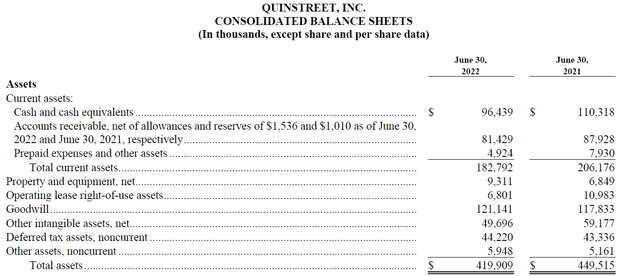

Assets (QuinStreet)

If you noticed the very low operating expenses, you might notice too the little tangible long-term assets that are needed for their daily operations. With property and equipment valued at $9 million and leased assets worth almost $7 million, there may be a clear reason why there are few operating expenses.

This is what I’d call an asset-light business, which is essentially how QuinStreet was able to claw a few profitable years during their lifetime. Because there are so very few operating assets needed, the expenses accrued to maintain those assets also become just as small.

This means that their main concern should then be other areas within product development, sales and marketing and general administrative expenses that don’t concern their operating assets, which would then make it easier for the company to become profitable again.

The key driver, however, will be revenue growth. If analysts are right and QuinStreet does turn itself around next quarter with record revenues, expect the stock to not go down unless there’s another catalyst such as guidance.

Valuation

With this in mind, how should the company be valued? As a shortcut, I’ll use this table I built to provide an easy and clear view of the fundamental metrics in the trailing twelve months (ttm).

| Revenue | $574.8M |

| Gross Profit | $53.73M |

| EBITDA | ($4.22M) |

| Net Income | ($15.21M) |

| Diluted EPS | ($0.28) |

Already there are a few major problems and some that have been mentioned before: no net earnings, no usable EPS and not even a positive EBITDA margin.

Their most usable metric is revenue, but as we take Equity and Free Cash Flows into consideration, what would they amount to in calculation?

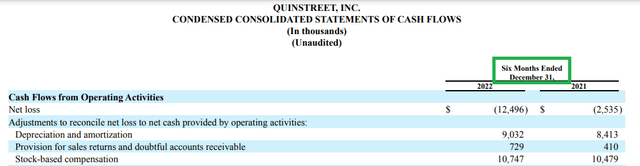

Using the usual Operating Income – Tax Expense + Cash Provided by (used in) investing activities formula, even cash flow remains rather useless. However, it is possible to add Depreciation, Amortization (Dep/Amo) and stock compensation expenses into the mix, primarily to remove this from the overall calculation of Operating Income. In order to fetch this data, the 10-Q filing for Q2 of 2023 will be utilized for the calculation. Keep in mind that most quarterly filings provide data for their fiscal year in question as well as their current quarter with only one exception, as shown below.

QuinStreet

Cash flow statements, like the one we’ll use to assist in our calculation, do not include results for the fiscal year, and as such would make it difficult to find a ttm calculation. As such, any result that comes from calculating the company’s free cash flow using data from their 6 months ended December 31st will be multiplied by two as a placeholder for their ttm Free Cash Flow. This allows investors a speculative snapshot of what their fiscal year could look like should performance repeat in the future.

With the current formula in place, what do we get?

(Operating Income + Dep/Amo Expenses + Stock Compensation – Tax Expense + Investing Cash Flows(burn)) * 2 = 597k * 2 = 1194k

Even with the modifications I made, QuinStreet struggles to have any positive Free Cash Flow, and so I will not use it for the calculation.

What about their equity? According to their 2nd Quarter 10-Q, their total assets are about $392 million while their total liabilities amount to $112 million, allowing for a positive equity of $280 million. Considering there’s 53.8 million shares issued and outstanding, this would provide a valuation of around $5.20 per share, and so the company stock might find itself in a reasonable price at that point should equity not continue declining.

However, the company is in negative growth for almost a year now and is missing a good chunk of its valuation metrics. Revenues ttm are the only useful metric and stand at around $574.8 million, or as calculated on a per-share basis, $10.68 per share.

That may be another reason to justify a premium on the stock, considering that a 4x revenue valuation would put the fair value all the way up to $42.72 per share. However, revenues are on the decline and profitability is an issue, so I have to value more modestly this time down to 2x revenues, so just $21.36 per share.

Combine revenues with equity at an even 50/50 split, we have a price target of $13.28. I believe this is a rather fair price for the stock, and could even consider buying below $12 or $11.

But as the company is, I’d rather avoid this company for the time being as well, considering that the current closing price as of writing in April 4th of 2023 stands at $15.40 per share, a 16% premium compared to my estimate of fair value.

Due to these reasons I will initiate a price target of $13 per share.

Conclusion

QuinStreet is a rather interesting company with a peculiar offering that allows companies to pay exclusively for people that engage with advertisements shown on the internet. While their offering does provide value to customers, it hasn’t been working out very well for the company as the business model demands revenue growth or going bust at the most extreme.

I believe some analysts and investors are downplaying the risks of such a premium on declining earnings, considering that the company’s stock had a nice and choppy run up from $9 to as high as $18 on February 24. With such a pricey stock, investors run the risk of a major correction, which is something the company stock has done time and time before.

Cashing out on gains or cutting losses for those who entered above this price would be appropriate, then just re-enter at a lower price. Your own due diligence and some technical analysis is definitely necessary, as per the usual, since you know your situation best and I’m not in any position to offer financial advice.

I initiate QNST stock with a Sell rating and an implied change to Hold should the company crash below $13, which is the price target I will provide for the time being.

Read the full article here