Author’s Note: All figures in Canadian currency unless otherwise noted.

Investment Overview

2022 marked the second worst year on record for the Canadian REIT sector with a 17% loss across the index. There are a few quality names that have been caught up in this slide. With units down almost 50% over the past 12 months, Allied Properties Real Estate Investment Trust (TSX:AP.UN:CA) is trading well below the REIT’s NAV of $38. This valuation has been hampered by high Debt/EBITDA levels. Allied Properties is poised for a significant deleveraging following the planned sale of its data center holdings.

It addition to its high quality properties and niche positioning in the office REIT space, Allied has one of the best distribution growth records in the Canadian REIT sector. Despite its poor valuation and leverage concerns, Allied just signaled its continued commitment to rewarding unit holders by increasing its distribution.

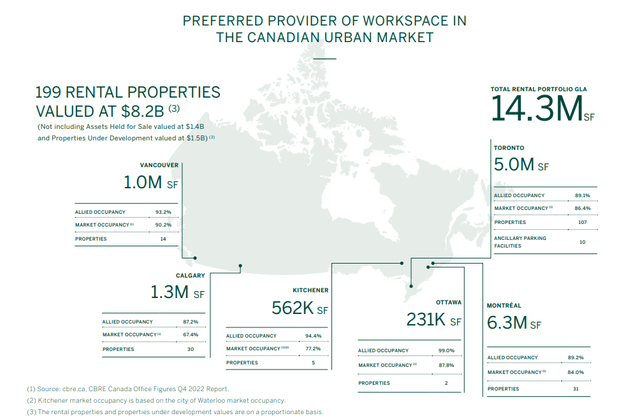

Allied Properties Assets (Allied Properties )

Company Profile

Allied Properties develops, owns and leases a portfolio of high quality office and retail properties in Canada’s urban cores. The REIT’s portfolio is characterized by a collection of niche class “I” work spaces. Picture trendy neighborhoods, with classic brick buildings featuring high ceilings, redone with glass and open concept floor plans:

Allied was known initially for its leading role in the emergence of Class I workspace, a format created through the adaptive re-use of light industrial structures in urban neighbourhoods. This format typically features high ceilings, abundant natural light, exposed structural frames, interior brick and hardwood floors.

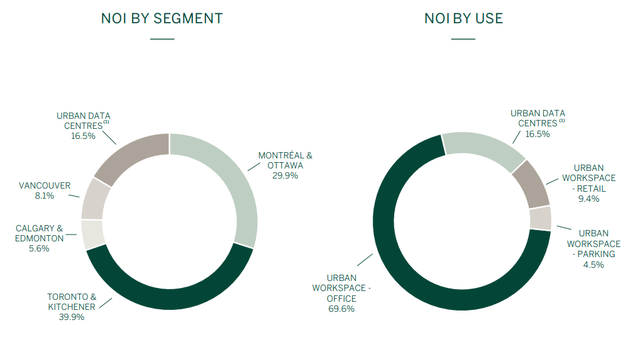

Allied Properties NOI By Segment (Allied Properties )

Allied’s property portfolio is 70% Office, 16% Data Centers, 9% Retail and 5% Parking. The REIT’s portfolio consists of 202 total properties including 183 rental properties, and 10 parking properties. The rental properties encompass a total of 14 million sq ft of GLA. Allied is currently developing nine properties, which are expected to add an additional 1.7 million sq ft of GLA. The REIT’s committed occupancy for Q4 2022 sat at 90.8%, a 10 bps improvement over the previous quarter and a 40 bps gain over Q4 2021.

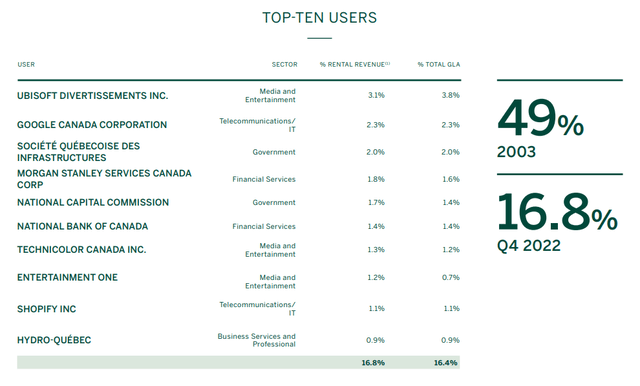

Allied Properties has a diversified tenant base that is largely focused on established finance and technology firms, as well as government agencies. The company’s largest tenants include Ubisoft Entertainment (OTCPK:UBSFY), Google (GOOG) (GOOGL), Morgan Stanley (MS) and National Bank (NA:CA). No single tenant accounts for more than 3.1% of revenue.

Allied Properties Top Ten Users (Allied Properties)

Allied is one of the few investment grade Office REITs in Canada with BBB Baa2 credit ratings from DBRS and Moody’s respectively. The REIT has traded around 10X FFO and 11X AFFO over the past few years with EBITDA/EV of 12X. With a market capitalization of $3.2B and enterprise value of $8.1B, the REIT trades on the Toronto Stock Exchange under the ticker “AP.UN” with daily average volume of 400K shares.

Challenging Office Fundamentals

According to a recent CBRE Group Inc. (CBRE) report, Canada’s overall national office vacancy rate increased to an all-time high of 17.7% in the first quarter of 2023. According to the report, ten of the last twelve quarters have produced “negative net absorption” with more office space put back on the market through vacancies, new inventory or subleases, than was leased to tenants.

Leasing activity has been bifurcated with newer, high quality properties with attractive amenities and good access, commanding higher lease prices, while older, un-renovated office property have been sitting vacant. This trend has been evident in some of Allied’s key markets including Toronto and Montreal which stood at 15.3% and 16.5% vacancy respectively. By contrast, Allied Properties has a little more than 9% vacancy across the portfolio reflecting the higher quality Class A office space in its portfolio.

Operating Results and Guidance

Given the challenging fundamentals for office leasing activity in 2022, Allied produced reasonable operating results. For the FY 2022, (excluding UDC’s) net rent per occupied square foot was $23.10, up 5.1% from 2021. SP NOI was up 0.2% YoY while occupancy stayed essentially flat. With 8.7% SP NOI in the UDC portfolio, these non-core assets helped to offset the primary office segment decline of 1.7%.

For 2023, Allied has introduced guidance of low-to-mid single digit % growth in SP NOI, FFOPU, and AFFOPU. This guidance implies AFFOPU in the range of $2.46-2.56. Allied has approximately $1.5B of development properties in its pipeline. The 2.8 million sq ft of GLA under development is anticipated to add $90.5M in annual NOI. This portfolio is 82% preleased. At 763,000 sq ft, the largest project under development is The Well, a joint venture with RioCan REIT (REI.UN:CA), which is 98% preleased.

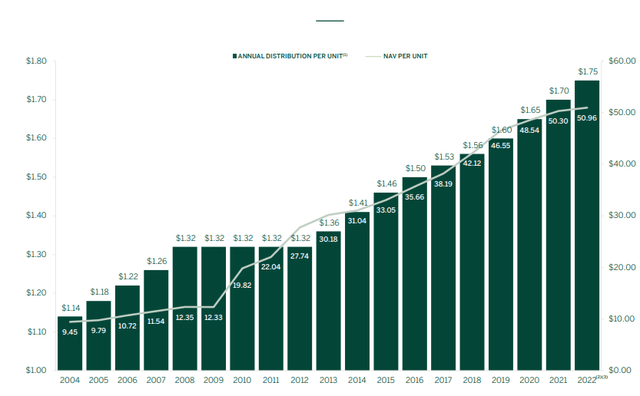

Returning Cash to Unit holders

Allied has increased its distribution per unit in 14 of the past 19 years. Distribution per unit growth has largely tracked NAV per unit since the REIT’s 2002 IPO. Allied has navigated both the 2008 Global Financial Crisis and the pandemic while maintaining its 19 year record of annual distribution payments. Following the REIT’s most recent annual increase of 2.9% in January 2023, Allied pays a monthly distribution of $0.15 monthly for an annualized payout of $1.80 per unit. This increase is in line with the REIT’s 10-year dividend CAGR of 2.8%.

Allied Properties Distribution History (Allied Properties )

This most recent distribution increase is notable as it signals that despite the uncertainty regarding the UDC transaction and the resulting overhang on the unit price, Allied is staying the course on its long term commitment to unit holders of modest but regular increases. Regular readers will know that my favorite measure of business stability is a long and consistent record of dividend increases. This demonstrates confidence from management in the company’s future profitability and steadily growing cash flow per share/unit.

At current unit prices, Allied is yielding 7.8%, well above the REIT’s long term average yield of approximately 4%. Allied has an AFFO payout ratio of 81% This compares to Dream Office REIT (D.UN:CA) and Slate Office REIT (SOT.UN:CA) with payout ratios of 105% and 107% respectively.

In addition to paying down debt, one of the possible uses of cash from a potential sale of Allied’s data centers is to repurchase units for cancellation. To that end, in February 2023, Allied launched a normal course issuer bid to purchase up to 12.58M of its 127.96M outstanding units. This significant volume represents approximately 10% of Allied’s public float. This action is a strong indication that the REIT sees its units as undervalued at current levels in my view.

Deleveraging The Balance Sheet

Following a busy period of acquisition and development activity financed in part by debt, Allied has seen its Debt/EBITDA ratio reach nearly 10X, above its target of 7-8X. Management expects that a sale of its Urban Data Centers properties, valued at approximately $1.3B would enable Allied to bring its leverage back in line with its target range.

The unencumbered UDC portfolio includes two freehold and one leasehold interest in Toronto. These network-dense, carrier-neutral sites are interconnected by high-count diverse fiber. The sale process was launched in February and is expected to unfold over a three to four month period. In addition to “supercharging” it’s balance sheet in an effort to avoid reliance on capital markets for funding, Allied sees the disposition as an opportunity to “reaffirm its commitment as an operator of distinctive urban workspace with low-cost capital”.

Proceeds from a sale will primarily be deployed to reduce debt and to finance development activity. Specifically, the company is considering paying off its $650M of unsecured term loans due in 2025 and 2026. The REIT could also use some of the proceeds to repurchase units under its NCIB. Following a number of acquisitions in 2022, Allied has indicated that it does not expect to make any significant acquisitions in 2023.

Risk Analysis

Allied has reasonable financial flexibility having finished 2022 with a D/GBV ratio of 36%. As of Q4 2022, Debt/GBV was up 130 bps QoQ, and 210 bps YoY, while net Debt/EBITDA was 9.8, up 0.2X QoQ, and up 0.4X YoY. As noted, Debt/EBITDA, should decline as NOI grows from the completion of properties currently under development and debt is reduced through the sale of the UDC portfolio. With $356M in available untapped liquidity, the company has a low liquidity ratio relative to its $4.15B in total debt.

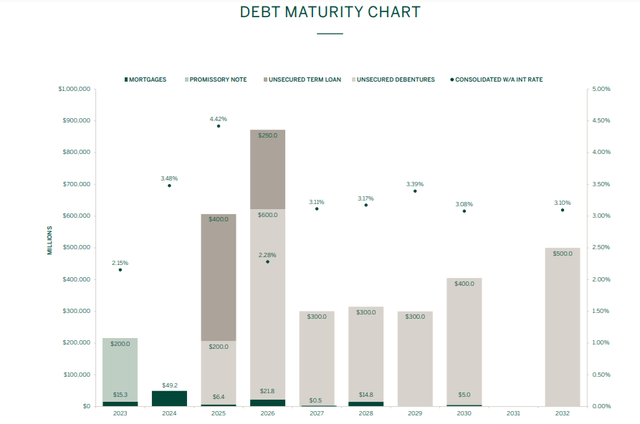

Allied Properties Debt Maturity Profile (Allied Properties)

Allied has a sound debt maturity profile with approximately 25% of debt coming due in the next 36 months with a WATM of 5.4 years. 89% of debt is fixed term with a WAIR of 3.1%. Relative to the Canadian REIT sector average of 3.5% Allied enjoys low cost of capital. Similarly, the REIT’s WATM of 5.4 years is attractive relative to the group average of 4.3 years.

Rising debt costs have pushed up cap rates across the sector. Despite a relatively low cost of current debt, Allied could face higher borrowing and development costs in the coming years. Medium term interest rates are an unknown that creates uncertainty across the sector.

Greater adoption of hybrid work arrangements could limit occupancy recovery for the Office REIT sector. Allied’s properties in the urban cores of Canada’s major commercial centers with their high ceilings and more open floor plans lend themselves well to be converted to flexible or shared work spaces. These spaces should prove more resilient than lower grade office property.

The REIT owns some great sites that tend to be characterized by low-rise buildings. Some densification projects will be capital intensive in order to unlock the value of the underlying properties. Allied will have a tension between pursuing intensification from its urban properties and maintaining its differentiating characteristics of unique office space. It would be difficult to intensify some sites containing older iconic properties.

Another near-term headwind for Allied Properties is the addition of new office inventory to the leasing market. For 2023, Altus Group Limited (OTCPK:ASGTF) forecasts new supply of approximately 8 million sq ft of new office space coming online, equating to another 1.5% of inventory. The majority of this is concentrated in the central business districts of Canada’s major cities. While this adds more supply at a time of high vacancies, it may not necessarily have a negative impact on pricing as there continues to be strong demand and pricing for new higher end real estate.

Investor Takeaways

Patient investors with some risk tolerance can exercise an opportunity to initiate or add to a position in Allied at these levels. The current discount to NAV should shrink should the REIT execute on its deleveraging plans through its planned UDC disposition. Beyond its short term debt, the REIT has a low cost of capital and a strong development pipeline. Allied Properties has a great portfolio of urban properties that the REIT can surface value in through future intensifications. In the meantime, the REIT’s attractive 7.8% distribution is well covered by AFFO.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here