Banking is a very good business if you don’t do anything dumb. – Warren Buffett

To My Partners and Friends:

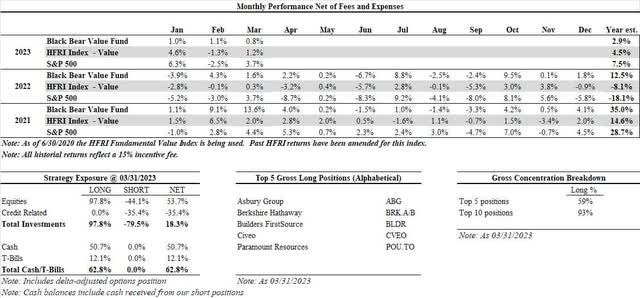

- Black Bear Value Fund, LP (the “Fund”) returned +0.8% in March and +2.9% YTD.

- The S&P 500 returned +3.7% in March and +7.5% YTD.

- The HFRI Index returned +1.2% in March and +4.5% YTD.

- We do not seek to mimic the returns of the S&P 500 and there will be variances in our performance.

| Note: Additional historical performance can be found on our tear-sheet. |

Our concentrated investments in energy have been a drag on our YTD performance. As you are aware, the Partnership is not managed with the short-term in mind, and presuming our thesis remains intact, we use shorttermism to our benefit by purchasing more of the businesses we like. As discussed below, Paramount Resources, a Canadian energy company, joins Civeo in our top 5. Our main themes of investment on the long side are fairly concentrated within the energy space, homebuilding, auto dealerships and general industrials. We underwrite our investments presuming an eventual weakening economy so if/when it strikes, we can take advantage of others’ short-term fear.

A large bifurcation still exists between the businesses we own and the businesses we are short. In other words, good businesses still seem VERY cheap given macro-worries and lousy businesses seem extremely expensive as remaining hangers on hope for a return to easy money and low interest rates.

Shorting Silicon Valley Bank/Equity Short Discussion

We have been short Silicon Valley Bank since 2022. I do not typically name our shorts unless we have fully exited and do not plan on re-shorting but given the bank’s demise it seems safe to discuss.

A bank run and the rapid disintegration of the business was considered a super low (sub 5%) outcome that was not central to our thesis. SIVB was symptomatic of a general theme in our short book…low rates created perverse behavior whose outcomes were hard to predict. While the mark-to-market on their securities book looked ominous, my timelier worry was the low-cost nature of their deposits and whether the money was sticky (i.e., wouldn’t move to another bank). When rates are low nobody cares what they earn on their money. A large portion of their capital was effectively free. As rates moved up it seemed likely that they would have to raise their funding costs to keep customers. The path I thought this would take was lower earnings for many years due to higher interest costs….and likely a dilutive equity raise to fix the hole from their securities.

As witnessed, leverage can accelerate loss recognition and given the ability to instantaneously redeem capital (aka withdrawing deposits) things got bad very quickly. The notion that short-sellers created or exacerbated the bank’s issues is both disingenuous and false. It’s troubling that podcast hosts and others with high listenership/viewership/readership spread misleading untruths knowing full well they are just trying to excite the audience.

Silicon Valley Bank went out of business because too many depositors tried to withdraw their money at the same time. While there are many VC companies, there are not that many VC allocators. A handful of VC allocators told their companies to get their money while they could, leading to a bank run and the banks’ demise. I am not here to judge that advice but only to objectively point out what happened. We can all learn more by being truthful and avoid problems in the future. Blaming a short seller on the bank run does not create a teachable moment.

Our short book thematically rhymes with SIVB. Several industries have relied on low-cost funding in order to fund the growth of customers, properties, employees etc. They include but are not limited to real estate development companies, data centers, online retailers, financial service providers etc. The bill for this will come due at various points in the coming months and years. As evidenced by SIVB it’s hard to predict the specific catalyst which spooks the market. Always keep in mind that debt (even cheap debt) eventually has to be repaid…

As a reminder we do NOT take large concentrated short positions as the risk-reward does not work in our favor.

Top 5 Businesses We Own

Asbury Group (ABG)

Asbury Group operates auto dealerships across the United States. While much attention is paid to the number of cars sold, the strength of the model comes from the back of the house in parts and services where more than 50% of the profits come from. We are exiting a period of high margins on new and used car sales. Shortages of inventory have allowed dealers to make record profits when selling a car. As inventories normalize and interest rates rise, I fully expect the dealers to make less profit (called the GPU) when selling a car. Car prices cannot go up ad-infinitum and at some point, there will be buyer pushback.

Less discussed is while profits per car are at all-time highs, the volumes sold have mirrored prior recessions. My expectation is that dealers will likely make less per car but will mitigate some of that pressure by selling more cars, especially used vehicles, as prices drop.

When an auto dealer sells a car to a consumer, they capture both the trade-in (inventory to sell) and the relationship for parts and services. It is a razor-razorblade model in a highly fragmented industry (many dealerships are owned privately by families). The large dealer groups have transitioned to an omni-channel model where much of the selling/pre-buy activity can be done online reducing the need for headcount and making the transaction smoother for their customers. The lower operating costs of the business are not appreciated by the market. They are appreciated by us and the management teams as most dealers, including ABG, have been buying in lots of stock with their free-cash flow.

ABG should be able to earn $25-$35 in free-cash flow per share in a “normal” year. At quarter-end pricing that implies a 12-17% annual yield.

Below is the rough Berkshire on-a-napkin valuation. Again, this is a rough exercise.

- Cash of ~$79,000 per class A Share o Down/Base/Up marks cash at book value to an 11% premium or $87,000

- Investments based on December prices ~$252,000 per class A share o Presume a range of stock prices that result in:

-

- Down = $225,000 per class A share (-11%- assumes portfolio is overpriced)

- Base = $294,000 per class A share (+17%)

- Up = $382,000 per class A share (+51%)

- Operating businesses that should generate ~$18,000 of pre-tax income per Class A share

-

- Down = 9x = $168,000 per share – equates to ~8% FCF yield

- Base = 11x = $205,000 – equates to ~7% FCF yield

- Up = 12.5x = $233,000 – equates to ~6% FCF yield

- Overall (vs. $469,000 at quarter end) o Down = $480,000 (+2%) o Base = $586,000 (+25%)

o Up = $702,000 (50% underpriced)

We added a short of Apple vs. the Berkshire position. Apple has become a large part of the BRK business and wanted to limit our exposure to that investment as it seems expensive.

Going forward I expect Berkshire to compound at above average returns from this price.

Builders FirstSource (BLDR)

BLDR is a manufacturer and supplier of building materials with a focus on residential construction. Historically this business was cyclical with minimal pricing power as the primary products sold were lumber and other non-value-add housing materials. Since the GFC, BLDR has focused on growing their value-add business that is now 40%+ of the topline. The company has modest leverage and has been using their abundant free-cash-flow to buy in over 30% of the stock in the last 18 months.

While mortgage rates are higher, they are not unusual versus history. The low rates of the last 5-10 years are the outlier. We have a structural shortage of housing in the USA. With existing homeowners locked into lowrate mortgages, the aspiring homeowner may increasingly need to find a home from a homebuilder. The next 6-12 months could be rocky as people adjust to the increase in pricing and rates. Eventually the housing market should adjust to the new normal (or rates could go down).

Normalized free-cash-flow per share looks to be in the range of $8-$12 per year. At quarter end pricing of ~$89 that implies a free-cash-flow yield of 9-13%. If we owned this business privately and someone offered us a this annual cash-flow yield, we would be jumping at it!

Civeo (CVEO) / Paramount Resources (POU:CA)

We have a large investment across the energy & commodity spaces. The thesis is simple…we haven’t developed enough energy or commodity resources to satisfy the near- and medium-term needs of the world as well as provide for a renewable/less-carbon intensive future.

Civeo is a workforce housing company (mining and energy sector) for those who are living/working away from home in more remote locations. They provide lodging, food services, housekeeping and property maintenance in Canada, Australia and the United States.

CVEO went through a brutal stretch during COVID yet still generated the equivalent of 12% of its market-cap in cash in a lousy year. In the coming years this business could be worth 2-3x where it’s priced now as more development is needed in their end markets. It’s hard to predict any given year of this business but they should be able to earn $3-$5 in cash in most years which equates to 15-24% free cash flow yield.

Paramount is an ENP (exploration and production) in the energy space. It has no debt and ~$660MM in cash/securities (15% of the mkt cap). Management is fully aligned with us as they own 47% of the Company.

Over the next 2 years the company should generate ~9-10% in annual free-cash flow presuming fairly bearish energy prices. I tend to believe this is on the lower end as China reopens and the lack of worldwide energy developments becomes more pronounced.

Tax Discussion

K-1’s were sent out last month and are available on your investor portal. Long-term gains were 95%+ of our realized gains for the year.

Upcoming Presentation in Omaha

I was flattered to be invited as a guest speaker at BTIG’s Value-Investing Event in Omaha during the

Berkshire Hathaway annual meeting. Don’t worry!!! You don’t have to choose between me and Charlie/Warren as the event is Friday at 2PM at the Hilton Omaha. If you are in town and would like to attend, please reach out. There are some other fund managers speaking as well.

My daughter Zoey is a special presenter who is accompanying me to Omaha. She had business cards made up so if you see her, she would be thrilled to hand one out (she’s 8). Just don’t tell her I told you!

Thank you for your trust and support.

Adam Schwartz, Black Bear Value Partners, LP

Read the full article here