Thesis

Petrobras (NYSE:PBR.A) (NYSE:PBR) appears to be the perfect name for an investor looking for cash flows with an attractive dividend policy and high margins, though risks remain thanks to the Brazilian state’s ownership of the company.

The preferred shares – PBR.A – are trading at a discount to the common shares – PBR – due to their lower liquidity and lack of voting rights, but this discount makes these shares the more attractive of the two.

All factors considered, the Petrobras preferred shares appear to be trading at around fair value, and as such rate as HOLD.

Author’s Representation

Company Overview

Petróleo Brasileiro S.A. (better known as Petrobras) is one of the world’s largest producers of oil and gas and one of the largest companies in Latin America. The company primarily deals in exploration & production, refining, energy generation, and energy trading.

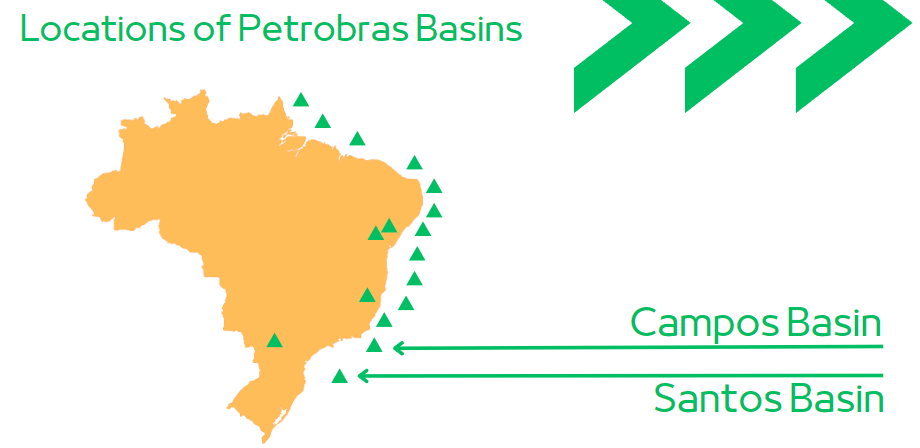

Petrobras operates and produces most of Brazil’s oil and gas and has very large reserves to support its production. These reserves are predominantly based off the coast of the southeastern end of Brazil in the Campos and Santos basins.

Author’s Representation

The company considers its business into three separate segments: Exploration & Production; Refining, Transport & Marketing; and Gas & Power.

In Brazil, the state is the owner of oil deposits. Companies are allowed to explore and extract these deposits as long as the state receives payment, typically in the form of royalties. The state carries out bidding rounds to offer the exploration rights to companies. Generally, firms will team up with other oil companies in consortia to bid for exploration blocks. These partnerships mean companies can bid for larger blocks and keep their exploration portfolios diversified by having interests in many exploration blocks rather than a few of them.

This diversification is important since blocks vary in how productive they are and having interests in a broad range of projects increases the chance of finding those which are most productive. In the oil exploration business, it’s important not to put all your exp(loration) in one basket.

For example, in 2022 Petrobras acquired rights to three further blocks across the Campos and Santos basins. Petrobras bid for these blocks in a consortium with other important oil companies: TotalEnergies, Petronas, and Qatar Petroleum. Petrobras owns 30% of the rights while the other three firms own 30%, 20%, and 20% respectively.

During 2022 Petrobras had 68 exploratory blocks covering close to 40,000 square kilometres in total area and drilled 7 new wells.

After the exploration stage comes the production stage. Once a block has been explored for oil and deemed viable from a commercial perspective, production can begin. This is when platform installation, drilling, and well completion begins. After this, oil can begin being extracted.

In 2022, the total production of oil and gas (including natural gas liquids) was 2,684 thousands of barrels of oil equivalent per day (mboed). This is a little lower than in previous years but production remains broadly stable and ahead of Petrobras’ production targets.

The company also operates most of the refineries in the country, with the majority of these operations based in the southeast, close to not only the two large Campos and Santos basins but also close to the country’s largest urban and industrial areas. Petrobras refines 70% of its total production itself across 11 refineries.

Most of Petrobras’ refining output is split across 6 different oil distillates which all serve different purposes and markets:

-

Diesel – predominantly used as fuel for vehicle engines;

-

Gasoline – predominantly used as fuel for vehicle engines;

-

Liquified Petroleum Gas (LPG) – predominantly used as fuel for heating appliances;

-

Jet Fuel – predominantly used as fuel for aircraft;

-

Fuel Oil – predominantly used as fuel for industrial purposes such as in metallurgy and electricity generation;

-

Naphtha – predominantly used as raw material in the petrochemical sector.

Petrobras is majority owned by the Brazilian state, with their ownership at just over 50% of the common shares, as such, the state plays a big role in the company and is a significant beneficiary. Not only does the state pick up tax revenue from Petrobras but also any dividends the company issues. For the next five years, the company intends to return between USD215 – 235 billion to the state, of which USD195 – 205 billion in taxes and between USD20 – 30 billion in dividends.

Latest Updates

Petrobras had a record year in 2022 when it comes to its financial performance. EBITDA, Operating Cash Flow, and Net Income were the highest in the company’s history. It was also a record year from an operating perspective with record levels of proved reserves which should help support future production.

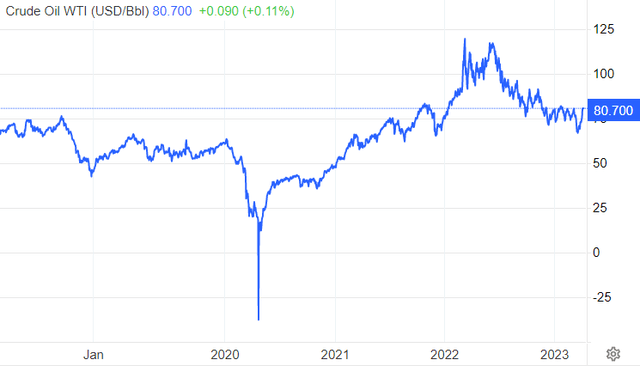

This is obviously not simply down to high production levels but also the historically high price of oil during 2022. Since the end of the COVID-19 pandemic, oil prices have steadily risen as economies have come back online from shutdowns. Then in early 2022 began the conflict in Ukraine, as a result of which many Western economies began to sanction Russia. With the supply of oil to Western economies being cut off, this reduced the overall oil supply, rapidly pushing up the price of oil. Interestingly, this Russian oil was still being supplied, however no longer to Western economies but to China, India, and Turkey at heavy discounts.

Crude Oil WTI Price Last 5 Years (Trading Economics)

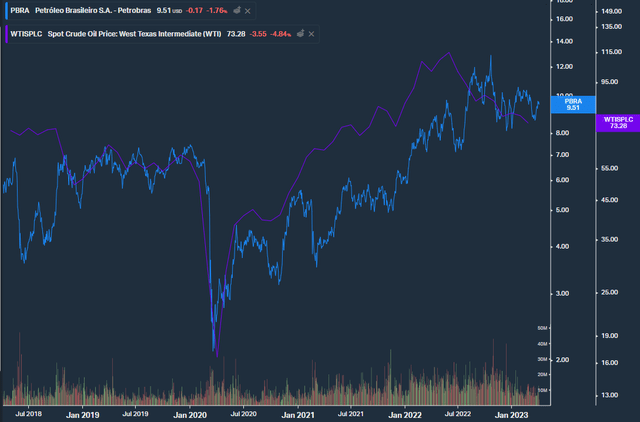

Petrobras’ future performance will unsurprisingly be heavily linked to oil prices, which will be important when considering a valuation of the shares. Petrobras shares have traded very closely to crude oil prices, and given how important oil prices are to profitability, is not really a surprise.

PBR.A Price vs WTI Oil Price (Koyfin)

The company has also recently issued its “Strategic Plan 2023-2027” where it describes its aims for the next 5 years. These include sound balance sheet management, steady shareholder returns, and maximising growth and value of its exploration portfolio. I will be referring back to the forecasts and budgets when running through the financials below.

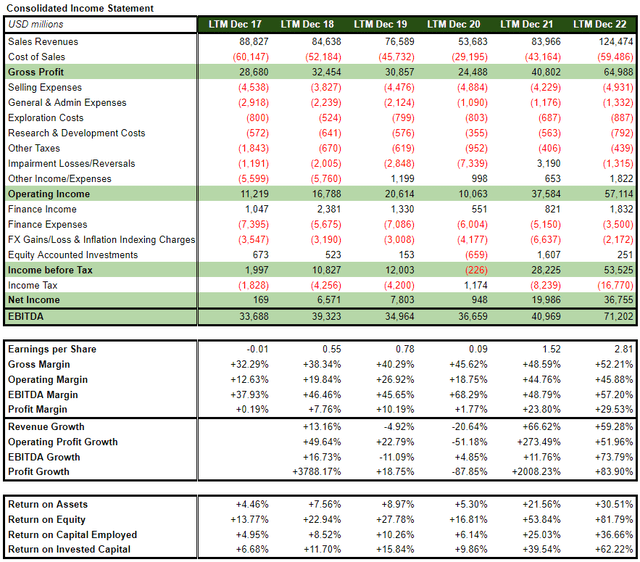

Income Statement

Looking at Petrobras’ Income Statements we can see how much the company has benefitted from elevated oil prices in the last twelve months, with a close to +60% rise in revenues. Additionally, margins are wider than they have been in recent history with Gross Margin at over 50% and Operating Margin at close to 45%, but interestingly even in environments where oil prices weren’t so strong, the company was able to operate with strong margins. In 2020 in particular when oil prices collapsed with the onset of the COVID-19 pandemic, Petrobras remained profitable and with healthy margins.

From a profitability and efficiency perspective, it was a record year for Petrobras with a Return on Equity of close to +82% and an impressive Return on Capital Employed of over +35%. What is again surprising, is the company’s ability to maintain high profitability indicators across the years, even when oil prices are depressed.

The impressive results even in low oil price environments are thanks to keeping production costs low.

Future exploration will be overwhelmingly budgeted towards pre-salt exploration, which are the older sediments of Earth under the sea off the southeastern coast of Brazil, in and around the Santos and Campos basins. These pre-salt fields have a much lower cost per barrel when it comes to production of USD4.2 per barrel equivalent, as compared to USD10.7 per barrel for the post-salt fields which are of younger sediment.

Author’s Compilation – Based on Data from Petrobras

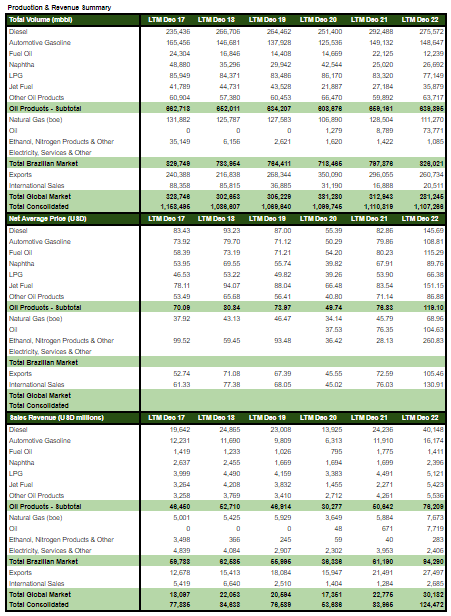

The details of how production translates into revenue can be found below.

Author’s Compilation – Based on Data from Petrobras

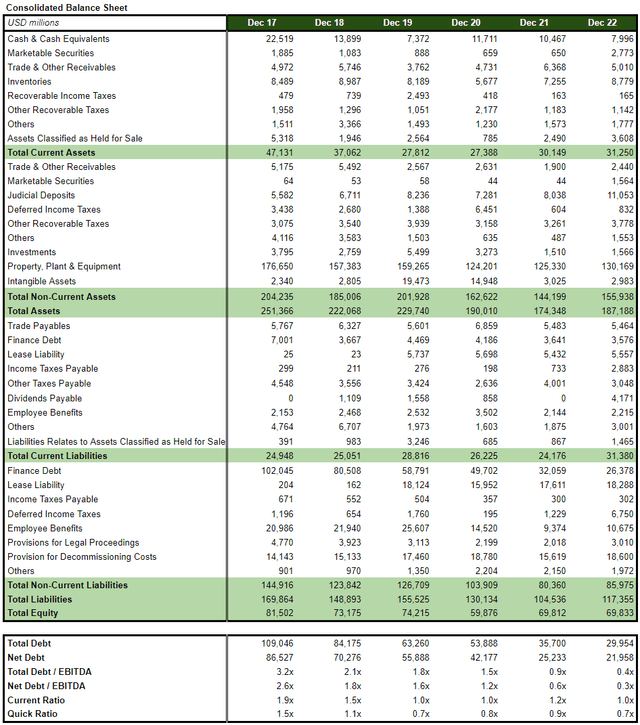

Balance Sheet

From a Balance sheet perspective, Petrobras is in a very healthy situation. Thanks to the recent impressive results and cash generation, the company has managed to reduce debt significantly with Net Leverage now at 0.3x EBITDA when it was over 2x only a few years ago.

Record levels of EBITDA have obviously helped to reduce leverage as a ratio to EBITDA, but also total gross debt in USD terms has fallen too. According to the Strategic Plan, gross debt (including leases) for the next few years is expected to be between USD50 – 65 billion. Given current gross debt levels are at around USD45 billion, we can expect Petrobras to take on a little more debt in the short to medium term.

Author’s Compilation – Based on Data from Petrobras

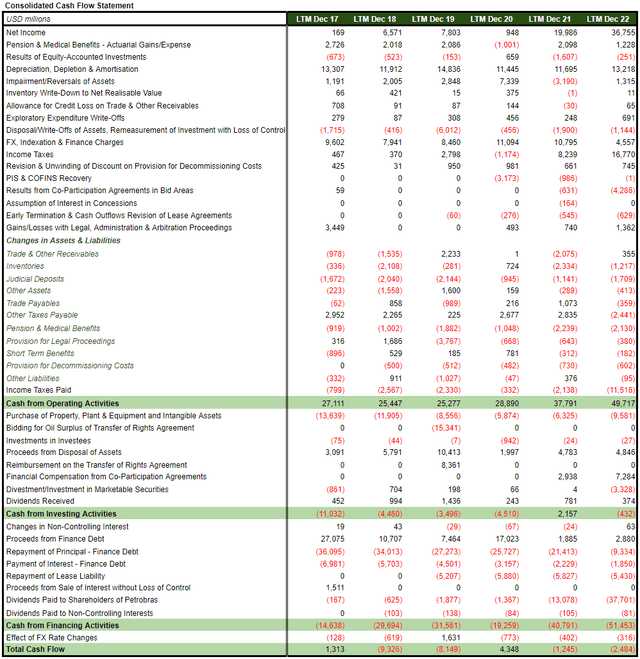

Cash Flow Statement

Capital Expenditure at Petrobras has been steady at between USD5 – 10 billion a year. This is going to rise going forward, with anticipated CAPEX over the next few years to total USD78 billion according to the Strategic Plan, with 83% of this to be for further oil exploration and production.

Dividends have risen steadily with increased profitability unsurprisingly. The company does have a dividend policy described in the latest Management Report, which is as follows:

- When the Brent price is above USD40 a barrel, the minimum total dividend will be USD4 billion;

- As long as total gross debt is less than USD65 billion, the dividend will be equal to 60% x (Cash from Operations – Acquisition of Assets).

Author’s Compilation – Based on Data from Petrobras

Valuation

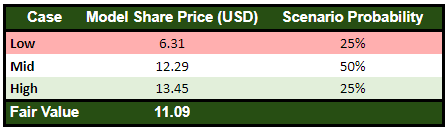

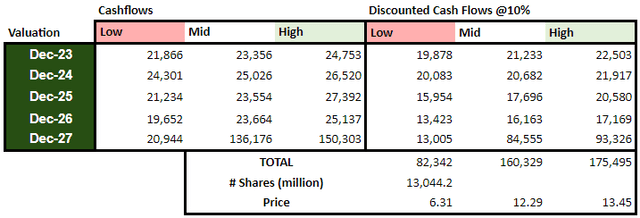

For the valuation, I will consider a low, mid, and high case for Petrobras. My assumptions are as follows.

Low Case

- Average Oil Price 2023 USD75, 2024 USD70, 2025 USD60, 2026 USD50, 2027 USD50;

- Gross Margins of 45% for 2023, 35% for 2024 and 2025, and 30% beyond;

- 5% production drop in 2023, then a 1% drop each year beyond that;

- CAPEX 10% more than according to Strategic Plan;

- Dividend policy maintained.

Mid Case

- Average Oil Price 2023 USD75, 2024 USD70, 2025 USD60, 2026 USD60, 2027 USD50;

- Gross Margins of 45% for 2023, 38% for 2024, and 35% beyond;

- 2% Production drop for 2023, 1% Production increase per year after;

- CAPEX maintained according to Strategic Plan;

- Dividend policy maintained.

High Case

- Average Oil Price 2023 USD85, 2024 USD80, 2025 USD80, 2026 USD70, 2027 USD70;

- Gross Margins of 50% for 2023 and 45% beyond;

- 3% production increase every year;

- CAPEX maintained according to Strategic Plan;

- Dividend policy maintained.

Obviously, the crude oil price will be key to any valuation of Petrobras. In my Mid Case, despite current oil dynamics, I will remain somewhat conservative.

I am of the opinion that thanks to the low levels of the US Strategic Petroleum Reserve (meaning the limited future potential for the Biden administration to sell some of the reserves into the market), OPEC+ recent production cuts, longer-term underinvestment in the oil sector, the reopening of the Chinese economy, and the extension of the Ukraine conflict, crude oil prices will be broadly supported despite slowing economics as a result of rising inflation and interest rates.

As such I would not expect huge swings in oil prices up and down from current levels without new catalysts. In the medium to longer term, oil prices should temper as the energy transition continues.

When it comes to margins, given Petrobras’ size and low-cost base, the company should be able to defend margins.

Below is the result of the valuation using a discounted cash flow model, given a five-year time horizon and a 10% discount rate. Again, I choose to remain conservative by using a high discount rate.

Author’s Representation Author’s Representation

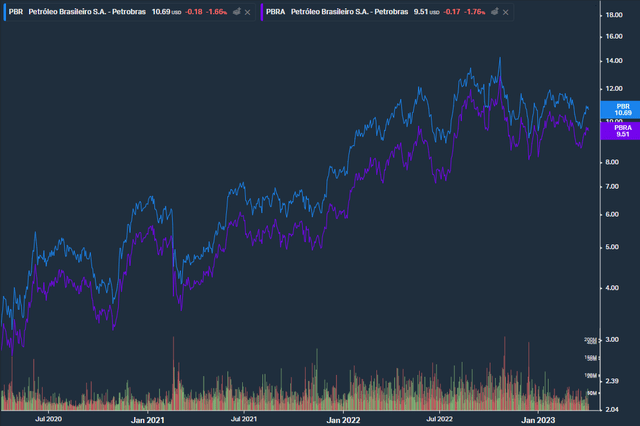

There are two Petrobras shares that are available: the common shares (PBR) and the preferred shares (PBR.A). The common shares come with voting rights and the preferred shares have none though the preferred shares do have dividend priority.

Currently, thanks to better liquidity and voting rights, the common shares trade at a premium to the preferred. Because of both the discount and the dividend priority, the preferred shares certainly look the most attractive of the two.

PBR and PBRA Share Price (Koyfin)

Risks

The biggest risk with Petrobras comes from its state ownership and the influence of the newly elected administration of Luiz Ignacio Lula da Silva (better known as Lula).

When Lula was previously president of Brazil, he chose to get involved with Petrobras’ pricing policy, in an attempt to keep prices down so as to benefit the people of Brazil. In the current inflationary environment, this could certainly happen again. Naturally, if lower prices are imposed on Petrobras, then that will significantly impact profitability.

The new administration has introduced federal taxes on gasoline and ethanol which the previous administration under Jair Bolsonaro had scrapped.

From my valuation, it is clear that downward pressure on oil prices will significantly impact the company from a profitability perspective, and as such is a significant risk to consider.

As part of his election campaign, Lula looked to use the company as a vehicle for development projects nationally, which would obviously impact Petrobras’ cash flow generation and push up leverage.

There is a similar trend in Colombia, where the new government is looking to use the state-owned oil company Ecopetrol to guide the energy transition away from fossil fuels. Ecopetrol has been expanding into renewables and energy transition, which as much lower-margin businesses than oil and gas.

Obviously, any measures that impact Petrobras’ profitability will impact the returns to the Brazilian state from tax receipts and dividends. If the administration chooses to employ measures that are too harsh, this will significantly impact Government revenue and the provision of public services. There is a fine balance the Lula administration needs to take.

Conclusion

Both the Petrobras common (PBR) and preferred shares (PBR.A) both seem to be trading at an attractive level, though when considering one against the other, the preferred shares offer better value thanks to their discount.

Although the potential upside with the stronger oil price environment and the very attractive dividend yield of 50-60% (depending on the common or preferred shares) there are certainly risks associated with the Lula administration and Petrobras’ state ownership.

As such, I believe current pricing levels offer fair value and rate Petrobras as a HOLD.

Read the full article here