Author: News Room

This article was written byFollowBlackRock’s purpose is to help more and more people experience financial well-being. As a fiduciary to investors and a leading provider of financial technology, we help millions of people build savings that serve them throughout their lives by making investing easier and more affordable. Read the full article here

The description of facts here is based on a real case. We addressed a complex matter of drug addition in an elder, related financial ripoffs, and the effect of a broken healthcare system. Daughter Finds Dad In Distress Faithful daughter (FD) stepped in to rescue her aging father (AF) from an abusive situation at his home. He had not responded to her efforts to reach him. His wife, who seemed to have mental challenges of her own, was giving AF a long list of medications multiple times a day. She was seen verbally and emotionally abusing AF. Dad was a…

Stay informed with free updatesSimply sign up to the EU trade myFT Digest — delivered directly to your inbox.Brussels is investigating whether China provided unfair subsidies for a BYD electric car plant in Hungary, in a highly sensitive move to target the deepening economic ties between Beijing and Viktor Orbán. The European Commission is in the preliminary stages of a foreign subsidy probe into the BYD plant, two people familiar with the matter told the Financial Times, in a step that will further raise trade tensions with Beijing. If Brussels finds that the Chinese company has benefited from unfair state aid,…

I love helping my clients maximize their tax-free retirement income streams. Converting a traditional IRA account to a Roth IRA is a fabulous part of a proactive tax-planning strategy to reduce the tax drag on your retirement income. However, many people forget about state taxes when developing the optimal Roth conversion strategy for their personal financial and tax-minimization needs. Most people focus on federal tax rates when choosing how large a Roth conversion to do each year. Ignoring state taxes could leave you without enough cash on hand to pay the taxes due on the Roth conversion. It could cause…

Unlock the Editor’s Digest for freeRoula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.Investors have poured $22bn into short-term US government debt this year after concerns over Donald Trump’s economic and trade policies set off a race for haven assets and sent stocks tumbling. Net inflows into short-dated Treasury funds hit about $21.7bn between early January and March 14, according to EPFR data, setting the stage for the biggest quarterly flood into the vehicles in two years. Flows into long-term government bond funds were also positive for the quarter to date, but totalled a much…

This article was written byFollowFreelance Financial Writer | Investments | Markets | Personal Finance | RetirementI create written content used in various formats including articles, blogs, emails, and social media for financial advisors and investment firms in a cost-efficient way. My passion is putting a narrative to financial data. Working with teams that include senior editors, investment strategists, marketing managers, data analysts, and executives, I contribute ideas to help make content relevant, accessible, and measurable. Having expertise in thematic investing, market events, client education, and compelling investment outlooks, I relate to everyday investors in a pithy way. I enjoy analyzing…

“Recession Canceled: U.S. Industrial Production Jumps To Record High.” That was this morning’s headline in the Zero Hedge website. Too often overlooked, industrial production is a crucially important supply-side indicator of the health of the economy. The February index moved to 104.2, just barely topping the prior record registered during Donald Trump’s first term in late 2018. When you look under the hood of the production index, it’s even better. Manufacturing increased nine-tenths of 1% led by motor vehicles and parts which jumped an incredible 8.5% for the month. High tech output rose 1.4% in February and is now up…

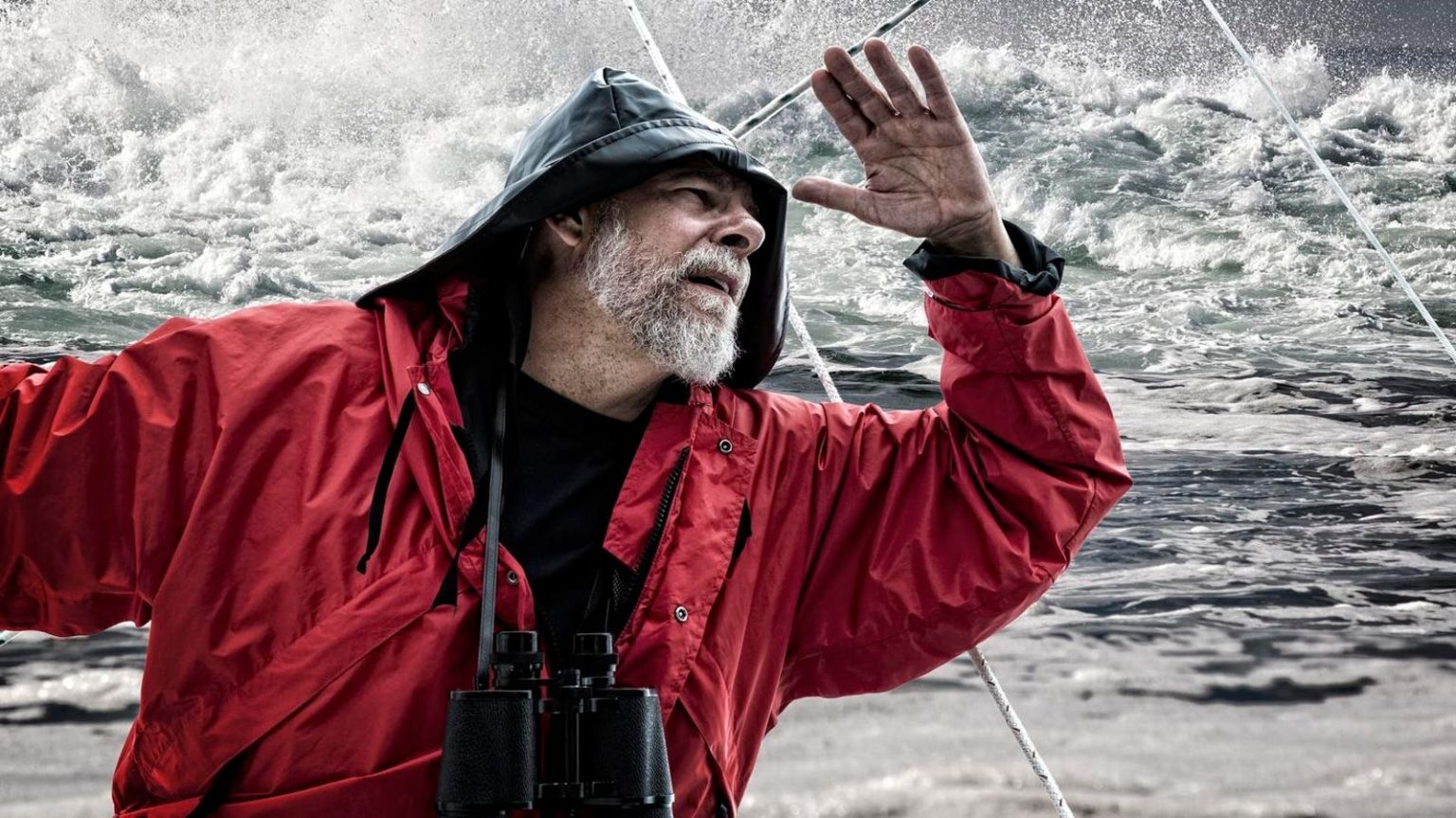

What’s it’s like to be retired when a recession hits? Every good ship’s captain knows how to ride out choppy waters. He’s got a tried-and-true rulebook. Maybe it’s not in writing. Maybe it’s just in his head. But he’s certain about Rule #1: See a storm on the horizon? Sail around it. Sometimes, though, you just can’t help but take on the rough seas. Sure, a safe harbor would be nice, but you’re a skilled helmsman. You can brave what’s coming. Years of experience have conditioned you to calmly pilot your craft, no matter what turbulence throws at you. If…

Israel has launched “extensive strikes” in Gaza, saying it was hitting Hamas targets as a two-month ceasefire collapsed amid persistent differences between the warring parties over extending the truce. Health authorities in the Hamas-controlled enclave said at least 240 people were killed in the air strikes early on Tuesday, which Israeli Prime Minister Benjamin Netanyahu’s office said were launched in response to the Palestinian militant group’s “repeated refusal to release our hostages” and rejection of mediators’ proposals in talks to prolong the ceasefire.“Israel will, from now on, act against Hamas with increasing military strength,” Netanyahu’s office said in a post…

This article was written byFollowFreelance Financial Writer | Investments | Markets | Personal Finance | RetirementI create written content used in various formats including articles, blogs, emails, and social media for financial advisors and investment firms in a cost-efficient way. My passion is putting a narrative to financial data. Working with teams that include senior editors, investment strategists, marketing managers, data analysts, and executives, I contribute ideas to help make content relevant, accessible, and measurable. Having expertise in thematic investing, market events, client education, and compelling investment outlooks, I relate to everyday investors in a pithy way. I enjoy analyzing…

Subscribe to Updates

Get the latest financial, business, investing, and market news and updates, directly to your inbox.