Author: News Room

California Democratic Rep. Ro Khanna is calling for California Democratic Sen. Dianne Feinstein to resign – a rare instance of a lawmaker urging a member of their own party to step down from Congress. “It’s time for @SenFeinstein to resign. We need to put the country ahead of personal loyalty. While she has had a lifetime of public service, it is obvious she can no longer fulfill her duties. Not speaking out undermines our credibility as elected representatives of the people,” Khanna said Wednesday on Twitter. The 89-year-old Feinstein announced in early March that she had been hospitalized and was…

SoftBank has moved to sell almost all of its remaining shareholding in Alibaba, limiting its exposure to China and raising cash as the market downturn pummels the value of its technology investments.The Japanese group, led by billionaire founder Masayoshi Son, has sold about $7.2bn worth of Alibaba shares this year through prepaid forward contracts, after a record $29bn selldown last year. The forward sales, revealed through a Financial Times analysis of regulatory filings sent by post to the US Securities and Exchange Commission, will eventually cut SoftBank’s stake in the $262bn Chinese ecommerce group to just 3.8 per cent.The contracts…

Company description Wingstop Inc. (NASDAQ:WING) franchises and operates restaurants, with its key product offering being wings sauced in its various flavors. As of December 2022, the company has 1,959 franchised and owned restaurants in 44 states and 7 countries worldwide. Share price Data by YCharts WING’s share price has had a monumental rise in the 7 years, gaining over 400% in its short history. This has been driven by substantial growth in the company’s brand and rapid expansion to meet ravenous demand. Unlike many of their US counterparts, the business moved early to expand its overseas presence and that is…

Watch full video on YouTube

Disclaimer: The text below is a press release that is not part of Cryptonews.com editorial content.Revuto, a crypto-based fintech company, has announced its plan to raise $1.75 million for 8% of the equity with a company valuation of $20 million by selling Ordinals on the Bitcoin network. The company offers an ecosystem of products that enables seamless transactions between crypto liquidity and real-world economic transactions. Revuto is designed to provide users with active subscription management using virtual debit cards.According to the Revuto team, the upcoming seed round aims to sell Ordinals exclusively for equity to retail investors who believe in the vision…

America’s largest bank is ending pandemic-era hybrid work for its senior staff. “Our leaders play a critical role in reinforcing our culture and running our businesses,” JPMorgan Chase told staff in a memo. “They have to be visible on the floor, they must meet with clients… and they should always be accessible for immediate feedback and impromptu meetings.” Wall Street giants like JPMorgan have been among the most vocal proponents of returning to a pre-pandemic office regimen. That was true even in the fall of 2020, before new Covid variants emerged and scuttled banks’ back-to-office plans. But as infection rates…

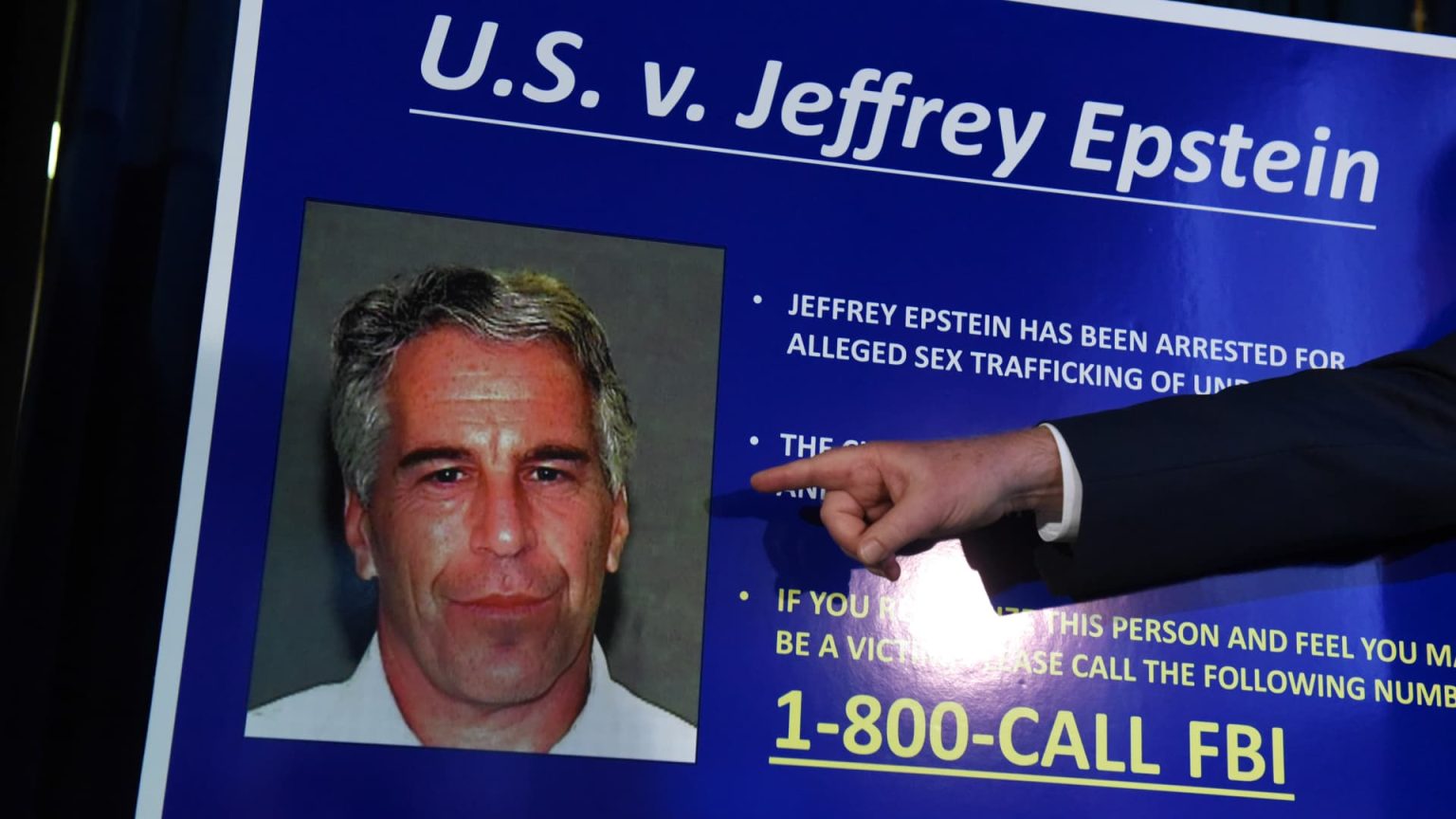

JPMorgan Chase was aware in 2006 of accusations that disgraced former financier Jeffrey Epstein paid to have underaged girls brought to his home, according to the latest allegations in a high-profile legal case.A filing released Wednesday as part of a lawsuit begun last year by the U.S. Virgin Islands contained fresh revelations about internal discussions at the biggest U.S. bank by assets tied to Epstein, who died by apparent suicide in 2019.Mary Callahan Erdoes, a veteran JPMorgan executive who became head of the bank’s giant asset and wealth management division in 2009, was recently interviewed under oath in the case.She…

A U.S. economist is making a significant prediction about a stock selloff stemming from banking sector concerns. During an appearance on “Mornings with Maria,” MacroMavens President Stephanie Pomboy sounded the alarm on the U.S. banking system, predicting a “credit bust” comparable to the Great Recession. “I think actually we’re overvalued by the standard stock market cap to GDP by $20 trillion. So that’s roughly a 50% haircut,” Pomboy explained. “And I think we’re at the beginning stages of a credit bust that I believe could look a lot like 2008, 2009 in magnitude.” Pomboy’s key point of concern surrounds companies not…

Nursing homes have been pressing for more money from the state and federal governments, by far their biggest payers. Now they are close to getting it, but the extra payments may come with costly new obligations, especially related to staffing. The federal government is about to increase Medicare payments for skilled nursing care and, at the same time, states are considering a new round of hikes in their Medicaid payments for long-term nursing home care. The price: Tough new requirements for facilities to hire more staff and work harder to keep care workers. More Money, More Rules The federal government…

UnitedHealth Group (NYSE: UNH) is scheduled to report its Q1 2023 results on Friday, April 14. We expect UnitedHealth to post revenue in line and earnings slightly above the street expectations. The company will likely continue to benefit from the increased contribution of the Optum Health business, while its health insurance business will likely benefit from increased memberships. Not only do we expect the company to navigate well over the latest quarter, our forecast indicates that UNH stock has more room for growth, as discussed below. Our interactive dashboard analysis of UnitedHealth’s Earnings Preview has additional details. (1) Revenues expected…

Subscribe to Updates

Get the latest financial, business, investing, and market news and updates, directly to your inbox.