Author: News Room

(Reuters) – Japan’s new central bank governor Kazuo Ueda assumed office this week, succeeding Haruhiko Kuroda, and delivered his first press conference in the role on Monday, along with his two deputies, Shinichi Uchida and Ryozo Himino. Following are excerpts from the news conference, which was conducted in Japanese, as translated by Reuters: BOJ GOVERNOR UEDA ON FINANCIAL STABILITY “Achieving financial system stability is a big responsibility for the BOJ. As the environment surrounding Japan’s banking system becomes more severe, it’s extremely important to ensure Japan’s financial intermediation is functioning smoothly.” IMPACT OF THE U.S., EUROPEAN BANKING CRISIS ON JAPAN…

By Pavel Polityuk KYIV (Reuters) – Protests by European farmers are political and shipments of Ukrainian grain are not reducing the profitability of their business, Ukrainian food producers’ union UAC said on Wednesday. Logistical bottlenecks have kept large quantities of Ukrainian grains, which are cheaper than those produced in the European Union, in Central European states, reducing prices and sales for farmers there who have staged protests. Poland last week said it would temporarily halt Ukrainian grain imports after farmers’ protests led Poland’s agriculture minister to resign, but transit would still be allowed. “The political nature of the European farmers’…

© Bloomberg. The Tyson Foods Inc. logo is seen on a box arranged for a photograph in Tiskilwa, Illinois, U.S., on Monday, Aug. 6, 2018. The largest U.S. meat company posted better-than-expected fiscal third-quarter earnings as beef demand rose and cattle costs fell, Tyson said Monday in a statement. Photographer: Daniel Acker/Bloomberg (Bloomberg) — Workers at a Tyson Foods Inc (NYSE:). poultry plant in Van Buren, Arkansas, are striking to demand better conditions as labor at the facility grows tight before a scheduled closure in May. Since Tyson announced it would shutter the under-performing plant, many employees have left. That’s…

The Biden Administration is advancing the toughest-ever proposed limits on tailpipe emissions from cars, SUVs, vans and pickup trucks, an expected move that brought cheers from environmental policy-setters and prompted others to warn vehicle prices would rise in response. The proposal announced Wednesday from the Environmental Protection Agency increasingly raises restrictions each year on tailpipe emissions of carbon dioxide, smog-forming nitrogen oxide and other pollution from vehicles for model years 2027 through 2032…. Read the full article here

Quick facts about the gas guzzler tax: If you haven’t researched current models, shopped for new vehicles, or even dreamed about a high-performance car, you may have only a casual familiarity with what is known as the gas guzzler tax. It’s an excise tax the government assesses automakers for cars that don’t meet a minimum designated mileage number. For most offending models, the carmakers pass the tax along to the consumer. You will find it on the Monroney Label (window price sticker) on the glass of new cars. Our… Read the full article here

Michael Jordan stays on top. The shoes Jordan wore during Game 2 of the 1998 NBA Finals, his last season with the Chicago Bulls, sold at a Sotheby’s auction on Tuesday for $2.2 million including fees, a record price for any pair of sneakers, ever. The previous record price for a pair of shoes was for $1.8 million. Those shoes were a prototype… Read the full article here

U.S. stock indexes finished mostly lower after trading in a narrow range on Tuesday as investors awaited key inflation data that could determine whether the Federal Reserve will once again raise interest rates at its meeting in May. The Dow Jones Industrial Average advanced 98 points, or 0.3%, to end at 33,685, while the S&P 500 ended nearly flat and the Nasdaq Composite shed 0.4%. The March CPI reading from the Bureau of Labor Statistics, is expected to show a 5.1% rise from a year earlier, slowing from a 6% year-over-year rise in the previous month, according to a survey…

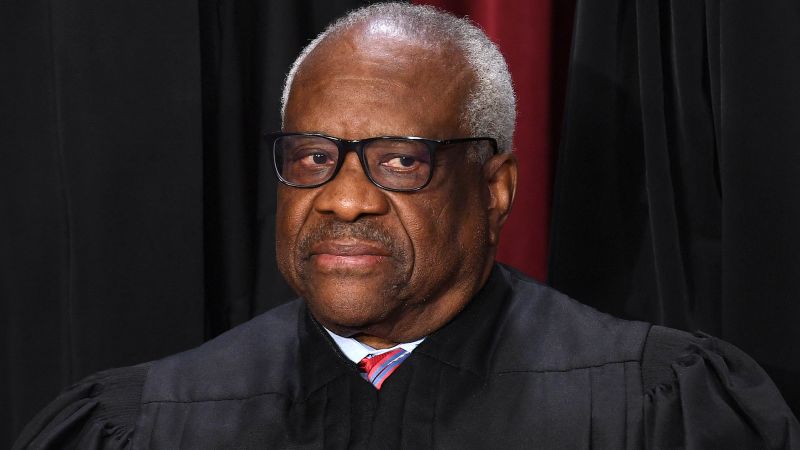

The recent revelations of lavish gifts and travel that a Republican megadonor showered on Justice Clarence Thomas reflect a larger Supreme Court culture of nondisclosure, little explanation, and no comment. The justices have provided less and less information regarding travel and gifts on their annual financial disclosure forms over the years. Earlier in the 2000s, for example, Thomas listed some private-plane travel similar in nature to some of the trips he later withheld which were detailed in a ProPublica report last week. In a brief statement responding to the story of his relationship with billionaire real estate magnate Harlan Crow,…

Joe Biden will discuss Northern Ireland’s economic potential with Rishi Sunak in Belfast on Wednesday, but the US president’s short trip highlighted the fact that the UK prime minister’s new Brexit deal has failed to end the region’s political logjam.The meeting between the two leaders, to mark the 25th anniversary of the Good Friday Agreement, takes place just months after the UK and EU clinched the so-called Windsor framework, a deal on post-Brexit trading arrangements in Northern Ireland.The Good Friday Agreement ended three decades of conflict in Northern Ireland and established a power-sharing executive. But the region’s biggest unionist party…

Subscribe to Updates

Get the latest financial, business, investing, and market news and updates, directly to your inbox.