Author: News Room

Our goal here at Credible Operations, Inc., NMLS Number 1681276, referred to as “Credible” below, is to give you the tools and confidence you need to improve your finances. Although we do promote products from our partner lenders who compensate us for our services, all opinions are our own. Rates for well-qualified borrowers using the Credible marketplace to refinance student loans fell this week for 10-year fixed-rate loans, and rose for 5-year variable-rate loans. For borrowers with credit scores of 720 or higher who used the Credible marketplace to select a lender during the week of April 3, 2023:Rates on…

Our goal here at Credible Operations, Inc., NMLS Number 1681276, referred to as “Credible” below, is to give you the tools and confidence you need to improve your finances. Although we do promote products from our partner lenders who compensate us for our services, all opinions are our own. Based on data compiled by Credible, mortgage rates for home purchases are mixed with two key terms rising and two falling since last Thursday. Rates last updated on April 10, 2023. These rates are based on the assumptions shown here. Actual rates may vary. Credible, a personal finance marketplace, has 5,000…

During the onset of the pandemic, the flexibility to work remotely coupled with record-low interest rates had many home buyers toying with the idea of moving to vacation home markets as shifting priorities and preferences altered where and how people wanted to live. Vacation home sales skyrocketed during the second half of 2020 and through 2021. Page views of for-sale listings soared in metro areas typically considered vacation destinations, such as the Jersey Shore area; Myrtle Beach, South Carolina; Key West, Florida; Lake Tahoe, Nevada; Cape Cod, Massachusetts; and Park City, Utah. Today, it’s a different story. A scarcity of…

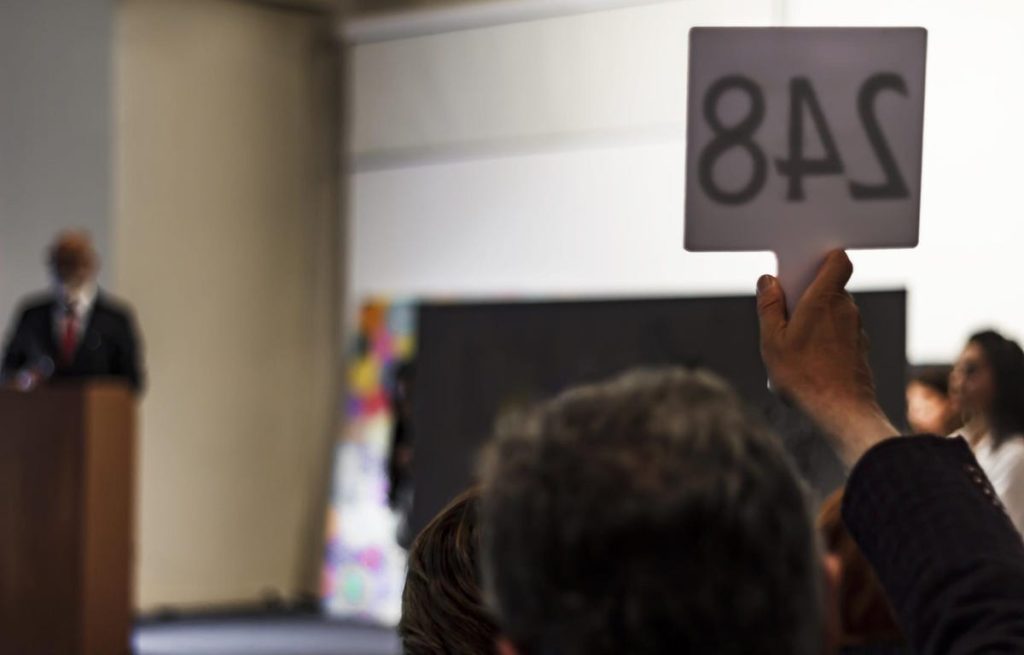

Artprice.com has released their report, “The Art Market in 2022” and, at 72 pages, it is a comprehensive look at the global art market, which is especially interesting to professional advisors to collectors of Art. For those who do not have the time to read through the report, here are some of the high points: THE GLOBAL ART MARKET: Despite a 19% contraction of the S&P 500 Index in 2022 and a generally precarious global context in terms of public health and energy costs, more than one million artworks appeared at auctions in 2022, of which almost two thirds (65%)…

The Biden administration has enacted sweeping student loan initiatives over the last two years, including a mass student loan forgiveness plan and multiple extensions of the ongoing student loan pause. But these plans are under attack in both Congress and the courts as challengers seek to halt this student debt relief. And the attacks are escalating. Here’s the latest. Republicans In Congress Will Try To Repeal Student Loan Forgiveness And Extension Of Student Loan Pause Congressional Republicans have introduced a resolution under the Congressional Review Act (CRA) to repeal President Biden’s student loan forgiveness initiative, which would cancel up to…

Topline A small grouping of mega-cap stocks are behind almost all of the S&P 500’s 2023 rally, as investors pile back into the stocks battered last year and shun smaller-cap stocks amid macroeconomic and banking uncertainty, though one analyst cautioned about what the concentrated rally means for the market’s broader health. Key Facts Silicon Valley titans Alphabet, Apple, Meta and Nvidia, Seattle’s Amazon and Microsoft and electric vehicle giant Tesla gained more than $2.1 trillion in market capitalization year-to-date through Thursday’s market close cumulatively, according to FactSet data. Incredibly, those seven stocks account for 88% of the S&P’s 2023 gains,…

TL;DR We’ve seen a ton of new employment data out this week, including the ADP private payrolls report, the broader unemployment report and new jobless claims numbers It is showing a trend of a weakening job market, which is good news for companies and investors who are hoping for some respite from rising interest rates Layoffs continue to be part of this trend, but they’ve spread beyond the high growth tech industry and are now hitting even ‘recession proof’ companies like McDonalds and Walmart Top weekly and monthly trades Subscribe to the Forbes AI newsletter to stay in the loop…

Unless you’ve been involved in a lawsuit, you may not know about structured settlements. You may have heard of them on late night TV. “It’s your money,” some TV ads will exclaim. “Cash in your structured settlement and use your money now!” These TV ads are from factoring companies that buy up lawsuit structured settlements, but how do you get one in the first place? If you are a successful plaintiff in a lawsuit, your contact with structure settlements may be personal. You may have received one, be evaluating one now, or have considered one but opted for cash. Even…

By Geoffrey Smith Investing.com — The world economy is facing its worst five years for growth in more than three decades, the International Monetary Fund warned on Thursday. Speaking ahead of the IMF’s spring meeting, managing director Kristalina Georgieva said that world gross domestic product growth is likely to average only 3.0% over the next five years. That’s the lowest since 1990, and well below the average of around 3.8% seen over the last two decades. In a briefing in Washington, D.C., Georgieva warned that the twin threats of deglobalization and geopolitical instability would act as a brake on growth…

By Peter Nurse Investing.com – The U.S. dollar drifted lower in early European trade Tuesday as returning confidence in the global banking sector weakened demand for this safe haven. At 04:00 ET (07:00 GMT), the , which tracks the greenback against a basket of six other currencies, traded 0.2% lower at 102.320. The banks index rose 3.1% on Monday, helped by the news that First Citizens BancShares (NASDAQ:) would acquire the deposits and loans of Silicon Valley Bank, which failed earlier this month, as well as reports from Bloomberg that U.S. authorities were considering more support for banks. Signs of…

Subscribe to Updates

Get the latest financial, business, investing, and market news and updates, directly to your inbox.