Author: News Room

Silicon Valley Bank’s (SIVB VB ) sudden collapse and seizure by the FDIC on March 10 sent shockwaves through the financial markets and eroded confidence in other banks. While a thorough analysis shows U.S. banks to be solvent overall, the concern about banks has spread globally. The challenge of analyzing bank safety is that a severe loss of confidence can actually cause an otherwise functioning financial institution to collapse. Thus, it is crucial to monitor the health of the banks with as high-frequency data as possible. The most accessible and frequent data is bank stock prices. Bank stocks have been…

Today’s Social Security column addresses questions about whether filing dates can affect the application of COLAs to benefits, how public pensions can affect spousal benefits and submitting applications before benefits begin. Larry Kotlikoff is a Professor of Economics at Boston University and the founder and president of Economic Security Planning, Inc. Should My Husband Have Filed In January Or Earlier To Receive The COLA? My husband was receiving spousal benefits before he filed for his benefit at 70. He turned 70 in December of last year. Should he have filed for his retirement benefit to have begun in January 2023…

Late last year, Congress passed and President Biden signed SECURE 2.0 legislation as part of the Omnibus spending bill. Enactment of this legislation is a clear signal that policymakers understand the depths of the frightening retirement savings shortfall facing millions of Americans. The reasons are many for the nation’s retirement crisis – from rising costs to fewer pensions to longer life expectancy. Despite these challenges, one segment of the workforce has been on stable ground when it comes to retirement: the state and local government workforce. Today, the vast majority of state and local workers have a defined benefit (DB)…

Nothing drives up fear in the financial system like news of runs on banks. We had several large institutions go through a collapse in the last few weeks. Because of this, there has been renewed interest in understanding whether our individual deposits are safe. This is where it is important to understand how the FDIC works. While bank failures are rare and justifiably headline-grabbing, the scarcity of failures is due, in part, to the banking system being undergirded by the Federal Deposit Insurance Corporation or what is commonly known as the FDIC. The FDIC was established in 1933 to offer…

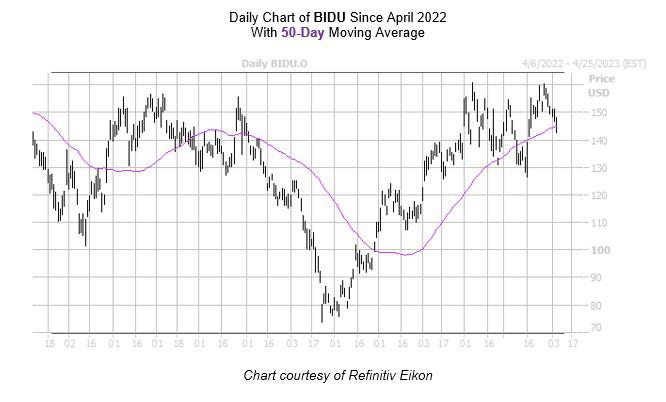

So far this year, China-based software concern Baidu (BIDU) twice conquered the $159 area – its highest level in more than 12 months – with the most recent trip up the charts taking place in late March. Following that peak, however, BIDU turned in five-straight losses, and was last seen on track for its sixth. Though the shares now sport a fractional year-over-year deficit, traders shouldn’t fret just yet, as they’re now trading near a trendline with historically bullish implications. Specifically, Baidu stock is within one standard deviation of its 50-day moving average. According to data from Schaeffer’s Senior Quantitative…

I hate to see folks trying to time this banking mess with regular stocks like JPMorgan Chase JPM & Co. (JPM). Especially when they can easily swap their big-bank stocks for “preferred” dividends yielding 8% and up! That’s a far sight better than the magic trick mainstream investors are attempting, as they try to dodge into big banks like JPM at just the right moment. Worse, JPM only yields 3% today. And you and I both know that markets can thrash around for weeks looking for a bottom. That’s why, instead of squinting at price charts, we’re calmly picking up…

In the $30 billion rescue attempt of First Republic on Friday, Too Big To Fail Banks led by J.P. Morgan Chase, Citi, and Bank of America BAC finally stepped up to help stave off a crisis. Days earlier, in the stunning government seizure of Silicon Valley Bank and crypto lender Signature Bank SBNY , the Fed, FDIC, and Treasury were the stars. But a separate cast of unsung heroes also was at work, and this shows what private enterprise can do. Soon after SVB’s shares took a tumble in the after hours market on Wednesday night, March 8, sending a…

Silicon Valley Bank had a rather spectacular collapse this week. The bank run was due to a drawdown in venture capital depositor funding, rising interest rates causing an asset/liability mismatch, and the firm’s sale of government bonds at an enormous loss to raise capital. Cutting right to my points — the three major misconceptions on Silicon Valley Bank that appeared repeatedly on social media this past week— 1) “This is 2008 all over again”. This statement is incorrect, but we are having some severe financial dislocations, probably brought on by the Fed keeping interest rates under the inflation rate for…

By Leika Kihara TOKYO (Reuters) -Japan’s new central bank chief will take baby steps in any shift away from the radical monetary experiment of his predecessor, if recent comments are any guide, but a deeper history of his thinking shows a taste for bolder action. Markets are rife with speculation that Kazuo Ueda, who becomes Bank of Japan (BOJ) governor on Sunday, will dismantle incumbent Haruhiko Kuroda’s massive stimulus programme that has drawn criticism for distorting market pricing and crushing bank profits. In a sign he will be in no rush to shift policy, Ueda told a parliamentary confirmation hearing…

By Ambar Warrick Investing.com– Most Asian currencies fell on Monday, while the dollar firmed as a rally in oil markets, following a surprise OPEC+ production cut, brewed concerns that inflation could remain buoyed by high fuel prices. A raft of weak Asian economic data also weighed, as a post-COVID rebound in China appeared to be running out of steam. The lost 0.3% after a private survey showed that the country’s barely expanded in March amid weakening output and demand. Softening growth in China bodes poorly for broader Asian markets, given their dependence on the country as a trading hub. On…

Subscribe to Updates

Get the latest financial, business, investing, and market news and updates, directly to your inbox.