Author: News Room

Disclaimer: The text below is a press release that is not part of Cryptonews.com editorial content.The Swords of Blood presale’s first stage is quickly approaching its conclusion. With higher prices incoming, this is your last chance to purchase the native token behind the platform – SWDTKN – at the lowest possible prices.Swords of Blood has created a blockchain-based AAA-quality hack-and-slash thriller, which is built on the framework of an award-winning title released in 2019. With immersive combat mechanics, stellar graphics, and a team filled with outstanding experience in the industry, Swords of Blood is already set up to become one of the…

India’s plans for a sharp increase in renewable capacity auctions will put “a lot of pressure” on the industry to scale up quickly, the head of one of the largest clean energy providers has said.India will start auctioning 50 gigawatts of solar and wind power capacity for the country’s electricity grid annually until 2028, more than doubling the current pace.Sumant Sinha, chief executive of ReNew, welcomed the proposal outlined by India’s renewable energy ministry. But he noted that renewable companies were already stretched trying to keep up with existing work. More bidding will “put a lot of pressure on people…

US fund managers are increasing investments in international stock markets after rising interest rates and fears of an economic slowdown brought an end to more than a decade of domestic dominance.US stocks have vastly outperformed most other developed and emerging markets since the financial crisis, but the trend began to reverse last year.The Europe-wide Stoxx 600 index has now posted stronger returns than Wall Street’s S&P 500 for four consecutive quarters, its longest period of outperformance since 2008. European stocks did decline in the middle of last year, but losses were milder than in the US, and asset managers that…

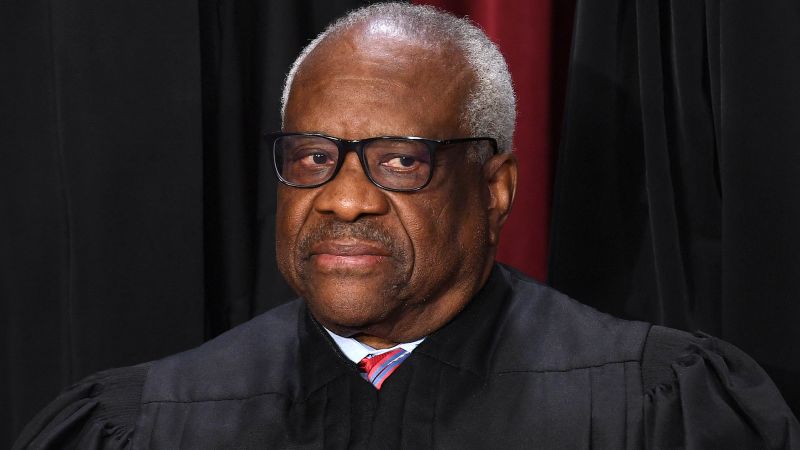

Justice Clarence Thomas said Friday that he did not disclose luxury travel paid for by a Republican donor because he was advised at the time that he did not have to report it. In a rare statement sent via the Supreme Court’s public information office, Thomas said that the trips he and his wife, conservative activist Ginni Thomas, took with the donor Harlan Crow and his wife – whom Thomas describes as among his family’s “dearest friends” – were the “sort of personal hospitality from close personal friends” that he was advised did not require disclosure. Thomas’ travel with the…

The State Department’s review of the US withdrawal from Afghanistan has far more findings in it than the document about the withdrawal that the White House released Thursday afternoon, according to a source familiar with the report. While the White House’s document focused on President Joe Biden having been “severely constrained” by the conditions created by former President Donald Trump, the State Department report has more than two dozen recommendations – some specifically related to how the department could have better prepared, including during the Biden administration, the source said. “The Biden administration inherited a deadline without a clear plan…

The federal appeals court in Washington, DC, has upheld the Justice Department’s use of a key criminal charge against hundreds of January 6 rioters, saying they can be charged with obstructing Congress. The appeals court said obstruction can include a “wide range of conduct” when a defendant has a corrupt intent and is targeting an official proceeding, such as the congressional certification of the presidential election on January 6, 2021. The major ruling affects more than 300 criminal cases brought in the wake of the Capitol riot. The Justice Department has used the charge – obstructing on official proceeding –…

Just days before his death on March 28 at the age of 71, Ryuichi Sakamoto used his final reserves of strength to fire off a letter to the governor of Tokyo.Japan’s most important postwar composer, a pioneer of electronic music and an exemplar of his nation’s creative prowess demanded a halt to the planned felling of hundreds of trees. It was the final stand of a man who had for decades — in life, music and collaboration — defied conformity.The threatened Jingu park sits beside the new National Stadium — the venue for the delayed and scandalised Tokyo 2020 Olympics,…

China has announced three days of military manoeuvres around Taiwan, in an apparent reaction to Taiwan president Tsai Ing-wen’s meeting with senior US lawmakers in California.The People’s Liberation Army will “conduct Taiwan encirclement combat readiness, patrol and joint sharp sword exercises” in the Taiwan Strait and waters and airspace north, south and east of Taiwan from Saturday until Monday, the PLA Eastern Theater Command said.The statement on Saturday morning came a day after Tsai returned from a 10-day trip that culminated with talks in California with House Speaker Kevin McCarthy, the most senior elected US official to meet a Taiwanese president…

Americans’ views of the economy are the best they’ve been in more than a year, according to a new CNN poll conducted by SSRS — but they’re still pretty bad, with 7 in 10 saying it’s in poor shape. Closer to home, 50% say their own financial situation is worse than it was a year ago. Read the full article here

Vice President Kamala Harris will travel to Nashville on Friday to advocate for gun control and meet with the two Black state lawmakers who were expelled from the General Assembly after they protested in favor of gun control on the state House floor. Read the full article here

Subscribe to Updates

Get the latest financial, business, investing, and market news and updates, directly to your inbox.