Stay informed with free updates

Simply sign up to the World myFT Digest — delivered directly to your inbox.

Hello and welcome to the working week.

Get out your glad rags because it’s time for the rich and powerful to show off in front of the cameras. Yes, New York is hosting the annual Met Gala and the theme is Sleeping Beauties: Reawakening Fashion. Will Elon Musk turn up again looking like an awkward teenager in his white tie and tails? For more details, read the excellent Fashion Matters newsletter. FT subscribers can sign up here.

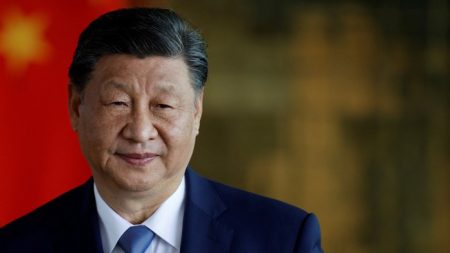

China’s President Xi Jinping may well be hoping that a bit of French fashion chic will rub off on him as he arrives in Paris for the first of several European state visits this week. Monday will be the key meeting with both French President Emmanuel Macron and European Commission head Ursula von der Leyen. Xi will then travel to Serbia and Hungary.

This week’s newsworthy rate setters are the Bank of England and, to a lesser extent, the Reserve Bank of Australia. Neither is expected to move rates, but watch out for signals that cuts are coming soon. UK watchers will be looking out for the first stab at first-quarter GDP numbers on Friday, expected to confirm the general perception of an economy at best only able to produce sluggish growth. Elsewhere, China looks to trade and Germany to factory orders.

It’s a delayed start to the week for the financial markets in London, Tokyo and Seoul due to the May Day and Children’s Day public holidays, but still a fairly busy week for corporate news. Media is a strong theme for this week’s results, with Disney, Fox, Warner Bros Discovery and (big for the UK) ITV all reporting. Also, on Tuesday, BP reports first-quarter numbers, with analysts expecting strong growth in gas trading but weaker fuel margins. Will there be any more changes to the senior management team in the wake of the Bernard Looney scandal?

One more thing . . .

This is a bumper week for British anniversaries. Monday not only marks a year since King Charles III was crowned at Westminster Abbey (and he now has a pretty scroll to prove it), but is the 30th anniversary of the Channel Tunnel’s formal opening and the 70th of Roger Bannister breaking the four-minute mile.

Before the week is out, it will also be another significant anniversary (at least to me): my birth. This will be celebrated by my finally getting to see Nye at London’s National Theatre (as endorsed by my employer) with supper at the (equally eagerly anticipated) theatre restaurant Lasdun. If you don’t believe me on that last point, read this persuasive review from the world’s most eloquent food critic (IMHO) Tim Hayward.

How do you intend to spend the week ahead, and what are your priorities? Email me at [email protected] or, if you are reading this from your inbox, hit reply.

Key economic and company reports

Here is a more complete list of what to expect in terms of company reports and economic data this week.

Monday

-

China, EU, France, Germany, India: Caixin/HCOB/HSBC April services purchasing managers’ survey (PMI) data

-

Japan/South Korea: Children’s Day. Financial markets closed

-

UK/Ireland: May Day bank holiday. Financial markets closed

-

Results: BioNTech Q1, Tyson Foods Q2, Westpac HY

Tuesday

-

Apple hosts a product launch event called Let Loose with the usual secrecy around the device being unveiled, though many expect a new iPad tablet

-

Australia: Reserve Bank of Australia monetary policy decision

-

Germany: March industrial orders and foreign trade figures

-

Japan: April services PMI data

-

UK: BRC-KPMG Retail Sales Monitor and Halifax House Price index

-

Results: Adecco Q1, ANZ HY, Bouygues Q1, BP Q1, Deutsche Post Q1, Electronic Arts Q4, Geberit Q1, Heidelberg Materials Q1, IAC Q1, Infineon Technologies Q2, IWG Q1, Kenvue Q1, Lyft Q1, Nintendo FY, Reddit Q1, Ricoh FY, Saudi Aramco Q1, UBS Q1, UniCredit Q1, Walt Disney Co Q2

Wednesday

-

US Federal Reserve’s Exploring Careers in Economics event in Washington. Speakers include Fed board vice-chair Philip Jefferson

-

Brazil: Banco Central do Brasil Monetary Policy Committee (Copom) rate-setting decision announced

-

Germany: March industrial production

-

Results: Ahold Delhaize Q1, Airbnb Q1, Alliance Pharma FY, Alstom FY, Anheuser-Busch InBev Q1, Bertelsmann Q1, Boohoo FY, BMW Q1, Continental Q1, Fox Corp Q3, Henkel Q1, Itochu FY, Match Q1, OSB Q1 trading update, Puma Q1, Renishaw trading update, Skanska Q1, Toyota FY, Tripadvisor Q1, Uber Q1, Wetherspoon trading update

Thursday

-

China: April trade balance figures

-

Russia: Victory Day. Financial markets closed

-

UK: Bank of England’s Monetary Policy Committee rate-setting decision. Later, the bank will host a virtual Q&A with its chief economist Huw Pill on its latest Monetary Policy Report. Register here. Also, Rics Residential Market Survey and REC-KPMG Jobs Report

-

Results: 3i FY, Asahi Kasei FY, Balfour Beatty AGM trading update, Enel Q1, Ferrovial Q1, ITV Q1 trading update, Nikon FY, Nippon Steel FY, Nissan FY, Panasonic FY, Telefónica Q1, Warner Bros Discovery Q1, Wood Q1 trading update and AGM

Friday

-

Indonesia: Ascension of Jesus Christ holiday. Financial markets closed

-

Eurozone: European Central Bank publishes its last monetary policy meeting minutes

-

Japan: March trade balance figures

-

UK: preliminary Q1 GDP estimate

-

US: University of Michigan May consumer sentiment survey

-

Results: CRH Q1, Honda FY, KDDI FY, IAG Q1, Iveco Q1, Mazda FY, NTT FY, Tata Motors FY

World events

Finally, here is a rundown of other events and milestones this week.

Monday

-

Chad: presidential election first round, with a run-off vote on June 22 if required, the result of constitutional changes approved in a referendum last year

-

France: Chinese President Xi Jinping travels to Paris where he will meet French President Emmanuel Macron and European Commission head Ursula von der Leyen for a state visit

-

Israel: Holocaust Martyrs’ and Heroes’ Remembrance Day aka Yom HaShoah.

-

Panama: winner in the presidential election expected to be announced, after one of the most unusual campaigns since democracy was restored after a US invasion in 1989

-

UK: deadline for candidates to register in the Scottish National party’s leadership contest following the chaotic departure of Humza Yousaf

-

US: 108th annual Pulitzer Prize winners and nominated finalists announced online for prizes in journalism, drama, letters and music. Separately, the Costume Institute Benefit, aka the Met Gala, is held in New York. Here are what attendees wore last year to the fashion industry’s big night out

Tuesday

Wednesday

-

North Macedonia: parliamentary elections and presidential election run-off

-

UK: Prince Harry attends the Invictus Games 10th anniversary service at St Paul’s Cathedral in London

Thursday

-

EU: Europe Day, marking the 1960 declaration issued by Robert Schuman proposing a European continent united in solidarity

-

Russia: military parade in Red Square, Moscow, to mark the second world war victory day

-

UK: City of London Corporation’s Easter Banquet for the Diplomatic Corps, with a speech by foreign secretary Lord David Cameron

Friday

-

Iran: parliamentary election run-off

-

UK: Christopher Berry and Christopher Cash appear in court in London accused of spying for China

Saturday

-

Sweden: Eurovision Song Contest, hosted by last year’s winning nation

-

US: Republican presidential candidate Donald Trump stages a campaign rally in Wildwood, New Jersey

Sunday

-

Lithuania: presidential election

-

Spain: Catalonia regional parliamentary elections

-

UK: Bafta TV Awards held at London’s Royal Festival Hall

Read the full article here