Food prices at the grocery store are rising, interest rates are increasing and inflation remains high. Most American households are facing tough decisions and must re-prioritize spending. In addition to cutting expenses, it’s very important to continue to save where you can, so that you can create an emergency savings fund for expected emergencies like a job loss, a sudden car repair or an unexpected medical emergency.

We’ve asked two money experts for tips on how to try to save $100 a week and put that in your savings account.

Monitor your spending carefully

Mark Hamrick, senior economic analyst and the Washington bureau chief of Bankrate.com says the first place to begin is to monitor the money that’s coming out of your bank account reflecting how money is being spent.

“Look at necessary vs. discretionary,” he says. “Can spending be reduced in either category or both?”

Typically, discretionary spending is where most people have greater flexibility, he says. Categories that can easily get out of line include food (dining out, take-out and even certain grocery purchases) and travel and entertainment including bars, concerts and sports events.

“The latter two have become increasingly expensive,” Hamrick tells FOX Business.

WHY IT’S IMPORTANT TO START A RETIREMENT PLAN IN YOUR 20S

If concerts are your thing, Hamrick suggests seeing lower-cost, less famous artists playing at smaller venues.

“Stadium and arena-sized concerts are killers on cost,” he says.

Audit your subscriptions

Hamrick advises that you do an audit of the subscriptions you have whether written publications, audio/music and video streaming.

“These have become ubiquitous in recent years, and it is easy to lose track of them,” he says.

Negotiate with your tech carriers

Many providers of cell phone, Internet and cable TV services will bargain on price, especially if you call to tell them you are considering canceling, says Hamrick. If you do that, he cautions, have a plan B or backup provider that you can say has a promotional offer that’s very appealing.

“I recently dumped my cable TV service in favor of streaming and saved more than $100 a month,” says Hamrick.

WHAT IS ‘CASH STUFFING’ AND HOW DOES IT WORK?

Vacation in the United States

Hamrick says while there’s no shortage of folks flying across the Atlantic to visit Europe, smaller trips closer to home and avoiding the increased cost of airfares can be immensely enjoyable as well.

“Most of us had to avoid travel during the pandemic, and there’s an inclination to try to make up for lost time,” Hamrick tells FOX Business. “That means there are plenty of nearby, regional or U.S. destinations that deserve a look and could be worthy of an automobile trip.”

Plan more meals at home

Cooking at home can be a money-saver.

“Restaurants and ready-to-cook options are more expensive than using raw ingredients,” says Hamrick. “Doing meal prep on a Sunday for the coming work week saves time and money.”

CLICK HERE TO GET THE FOX BUSINESS APP

Kimberly Palmer, personal finance expert at NerdWallet, also recommends cutting back on food spending by planning out meals for the week and looking for ways to repurpose leftovers into new meals.

“You can also take advantage of available coupons by signing up for your store’s loyalty programs and using apps like Flipp,” she says.

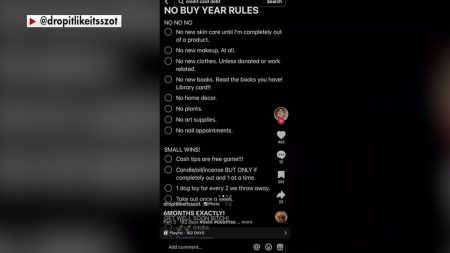

Take notice of impulse online shopping

Consider whether you really need that item you’re looking at online.

“Wait before making online purchases,” Palmer tells FOX Business. “Before making an online purchase, put the item in your cart and wait at least 24 hours. In some cases, you might decide you no longer need it.”

Read the full article here